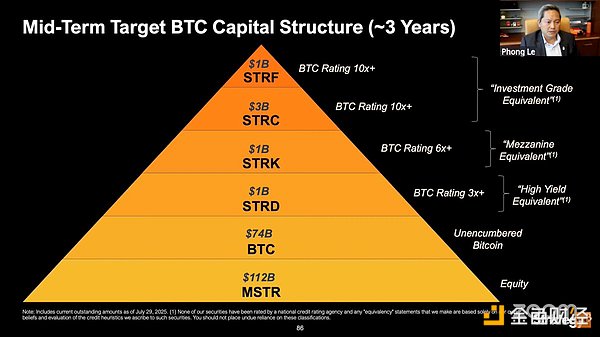

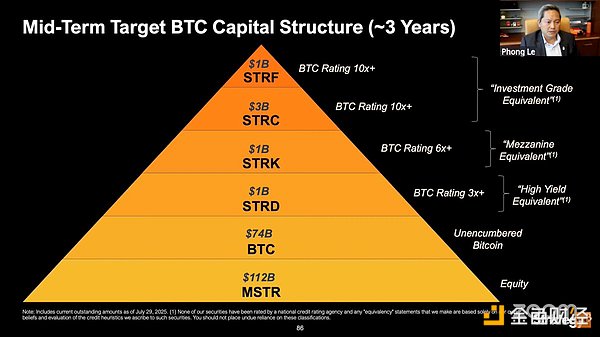

Source: TokenInsight, Compiled by Shaw Jinse Finance. Abstract: A multi-tiered capital structure serves the Bitcoin acquisition strategy: Strategy (formerly MicroStrategy) has established a multi-tiered capital structure consisting of common stock, convertible bonds, and a variety of preferred stocks (such as STRK, STRF, STRD, and STRC) to fund large-scale Bitcoin holdings. Different tiers offer varying risk and returns, catering to diverse investor needs. Design and Positioning of STRC: The newly launched STRC (Stretch) is a stable Bitcoin-backed preferred stock offering an annualized yield of approximately 9% and monthly dividends. The stock maintains its price close to its $100 par value through flexible adjustments to its dividend rate and redemption mechanism. Located in the middle of the capital structure, it offers lower volatility than higher-risk preferred stock while offering higher yields than traditional cash equivalents. It's suitable for investors seeking stable returns while also wanting to indirectly participate in Bitcoin price fluctuations. Dividend and Interest Funding and Potential Risks: The company plans to fund preferred stock dividends and debt interest payments through cash flow from its software business, new bond or convertible bond issuances, and at-the-market (ATM) common stock offerings. While this model is sustainable during periods of market optimism, tightening capital markets or a significant decline in stock prices could limit financing capabilities and potentially pressure dividend payments. Strategy (formerly MicroStrategy) has carefully crafted a unique capital structure that blends various debt and equity instruments to fund its operations and, most notably, its Bitcoin acquisition. Simply put, a capital structure refers to the mix of debt and equity a company uses to finance its growth. Strategy's case is particularly compelling because it introduces a variety of innovative financial instruments, including common stock, preferred stocks like STRK and STRF, convertible bonds, and now, the newly launched STRC.

The newly launched STRC (Stretch) is particularly noteworthy. STRC is promoted as a "stable" Bitcoin-backed stock that aims to mimic the stability of U.S. Treasuries, providing a low-volatility, cash-like yield layer within Strategy's BTC credit stack.

This article will break down these layers in simple terms, explaining what STRK, STRF, and STRC are and how they work.

Capital Structure Basics

Imagine a company's financials as a layered cake or pyramid. Each layer represents a different type of capital, each with its own risks and rewards:

Senior Debt (Loans/Bonds) —This is the topmost layer of debt (think first class on an airplane or the first slice of cake). Debt investors (like bondholders) have priority. They lend money to the company and expect to receive interest. If the company goes bankrupt, these creditors must be repaid before shareholders receive any proceeds. Debt is generally less risky (asset-secured or preferred debt) but offers a fixed and limited return (interest).

Preferred Stock (Preferred Equity) —Preferred stocks sit between debt and common stock in the capital structure. Preferred stocks act like a hybrid: they typically pay a fixed dividend (similar to interest) and are paid before common stock, but they typically do not have voting rights. To use an analogy, preferred stock investors are like a "priority" boarding group—less preferred than first class (debt), but they board ahead of economy class (common equity). Preferred stock offers more predictable returns (fixed dividends) and tends to be more stable in price than common stock, but it generally offers less upside if the company's value soars. Importantly, if the company is liquidated, preferred stockholders are entitled to receive their funds (the highest amount) before common shareholders. Common Stock (Equity)—This is the bottom tier of the pie (or the last to board). Common stockholders are the owners of the company. After all other obligations have been met, they receive the remaining shares. This represents the highest risk (common stockholders typically receive nothing in the event of bankruptcy) but also the highest potential returns (if the company thrives, the common stock price can soar with no upper limit). Common stockholders typically have voting rights and benefit the most from long-term growth, but they have the last claim on assets or cash flow.

In summary, the capital structure is layered: Debt> Preferred Stock> Common Stock (in order of priority). Each layer has a different risk/return profile, suitable for different investors. Now, let's look at how Strategy uses these elements to construct its capital structure.

Overview of Strategy's Overall Capital Structure

Strategy has carefully designed a multi-tiered capital structure to support its strategy of increasing its Bitcoin holdings. As of 2025, the company's capital structure will consist of:

Common Stock - Strategy's common stock trades on the Nasdaq under the symbol MSTR. These common shares are intended for shareholders who wish to directly participate in the company's destiny (and own Bitcoin). Preferred Stock – Multiple series of perpetual preferred stock with creative nicknames: STRK (“Strike”) – 8.00% Series A Perpetual Preferred Stock issued in early 2025. STRF (“Strife”) – 10.00% Series A Perpetual Preferred Stock issued in March 2025. STRC (“Stretch”) – An instrument with an annual yield of 9%. STRC offers a stable, low volatility, cash-like investment option.

STRD ("Stride") – High-yield subordinated preferred stock with a higher risk and reward profile compared to other series. STRD is designed for investors seeking higher returns with a higher risk profile.

Convertible Notes – These debt instruments can be converted into common stock if Strategy's stock price reaches certain levels. Strategy has issued several convertible notes, notably 0% convertible notes maturing in the next few years (2027, 2028, 2030, etc.), with the goal of raising billions of dollars to purchase Bitcoin.

Source: Strategy

Each tier can be thought of as a different way for investors to bet on Bitcoin in a way that suits them:

Common Shares (MSTR) – for investors who want the most upside (or downside) to the price of Bitcoin, as the value of the shares is largely driven by the value of Strategy’s Bitcoin holdings. Preferred Stock (e.g., STRK, STRF) – For investors who want income (yield) and some stability, effectively receiving a fixed return without the full volatility of owning Bitcoin directly. Convertible Bonds – For investors who want the security of a bond (a priority claim and a promise of repayment) with the option of a Bitcoin upside call (conversion to stock if the stock soars). STRC: A Stable, Cash-Like Layer in Strategy's Capital Structure STRC, or "Stretch," is the latest innovation in Strategy's capital structure. A floating-rate, perpetual preferred stock, STRC offers investors a stable, high-yield investment opportunity backed by Bitcoin. This instrument functions like a cash equivalent, offering low volatility and regular monthly dividends while still allowing investors to invest in Bitcoin's performance.

Preferred stock is a special type of stock that has a fixed dividend and is preferred over common stock in receiving dividends or assets, but generally has no voting rights. Strategy's preferred stocks are "perpetual," meaning they have no maturity date (the company has no obligation to repay the principal; it pays dividends indefinitely unless the shares are redeemed).

Key Features of STRC

Yield and Dividends: STRC offers an annual dividend yield of approximately 9%, paid monthly. The dividend rate adjusts monthly, aiming to maintain the share price near its $100 price tag. This makes STRC an attractive option for income-conscious investors seeking a stable cash flow without the volatility associated with holding Bitcoin directly. Price Stabilization Mechanism: Monthly Rate Adjustment: To maintain price stability, Strategy reserves the right to adjust the dividend rate monthly to ensure the STRC price remains near $100. If the price falls below par, Strategy will increase the dividend; if the price rises, Strategy will reduce the dividend and issue additional shares to bring the price back to the target level. Issuer Call Option: If STRC trades significantly above its par value, the Strategy can redeem the shares at $101, plus accrued dividends, providing an additional mechanism to maintain price stability within the target range. STRC in the Capital Structure Within the Strategy's multi-tiered capital structure, STRC sits in the middle tier. It is senior to STRD ("Stride") and STRK ("Strike"), but junior to STRF ("Strife") and corporate debt. This positioning makes it a more stable and less volatile alternative to higher-risk preferred stocks, while still offering a higher yield than traditional cash-equivalent instruments.

STRC is designed for a variety of investor types:

Credit investors seeking low-volatility, short-term instruments that correlate with Bitcoin's upward trend.

Cash managers who want predictable, stable returns without being exposed to Bitcoin's full volatility.

Institutions and allocators who are not yet willing to hold raw Bitcoin but want exposure to its price movements in a stable, cash-like instrument.

How will Strategy fund dividends and interest?

It's worth reiterating the company's debt repayment plan. Strategy has publicly stated that it will pay preferred stock dividends and any debt interest from a variety of sources: operating cash flow (from its software business, which contributes millions of dollars in revenue), proceeds from new or convertible debt, and proceeds from at-the-market (ATM) common stock sales. From 2023 to 2025, the company actively pursued an ATM equity program, selling small amounts of MSTR stock to the market—for example, it raised $500 million from a 2023 sale and was authorized to sell up to an additional $3.57 billion of common stock in early 2025. This represents a significant amount of capital: by gradually issuing new common stock (especially when the stock price is high), they can raise cash to pay dividends. Furthermore, the introduction of new preferred stock series (such as STRD "Stride") is explicitly intended to raise capital, in part to cover the dividends of STRF and STRK. This looks like paying off one credit card with another—in a sense, a refinancing plan. It works as long as there are new investors willing to come in (and Bitcoin remains strong). If capital markets freeze or stock prices plummet, it will become much more difficult for Strategy to raise new funds, and this is where the pressure will show.

Weatherly

Weatherly