Original author: Rapolas

"Recommendation: This article shows the future potential of the Gravity chain to be launched by Galxe from the perspective of the metaphor of chain as city, and analyzes the concept of the rise and existing problems of "chain abstraction". Galxe has a unique position in the ecosystem. They distribute resources by gathering upstream and downstream. Its growth history has obvious convergence with the original Cex. But in the future, under the competitive landscape of parallel EVM chain VS non-EVM parallel chain, what height will Gravity lead users to? It is inevitable to make people curious and continue to examine! Do you copy this homework?"

How much chain abstraction do we really need?

Overinvestment in crypto infrastructure. The long feedback cycle of infrastructure allows the lack of product-market fit (PMF) in this space to be concealed for a long time, much longer than consumer crypto applications.

The lack of infrastructure establishment at the protocol level has led to venture capital capturing excess value in numerous infrastructure and middleware projects. Layer 1 (L1) creates huge value by leveraging the unlimited total addressable market (TAM). Infrastructure projects then want to get as close to the valuation of L1 as possible because they have their own network consensus, block production, etc.

This is also one of the reasons why the crypto infrastructure space is so full of meme culture. Everyone knows the strategy that works, and what you’ll get if you follow it:

Claim that you’re scaling the blockchain;

Raise too much money from VCs;

Announce “partnerships” with other infrastructure projects before your chain goes live;

Release a testnet (which may crash) and then hype some crazy metrics;

Drop a token in the $1 billion to $10 billion market cap range.

The Rise of Chain Abstraction

Recently, we’ve observed attempts to further obfuscate step 1. Instead of claiming to scale the blockchain, they’ve moved to chain abstraction. This sounds like the ultimate holy grail of infrastructure, the cherry on top, the end of the game.

Every infrastructure founder has a natural desire to build a chain. Some are afraid to admit it.

The question is: if there are no users, who are we providing abstractions for? Chain abstraction is VC’s solution to the chain split problem that was originally caused by VC’s relentless investment. Without a product, chain abstraction is not a real solution to a real problem. It doesn’t even bring consumers a significant change and solution to a new problem like Ford or the iPhone did (both of which were qualitative leaps compared to the previous consumer experience).

Consider that every infrastructure project was created as a response to the previous solution:

L1 doesn’t scale, so we created Rollups;

Rollups fragment liquidity, so we built cross-chain bridges;

There are too many cross-chain bridges, so we aggregate them;

There are too many aggregators, so we built intent;

Intent is hard to explain, so we built an intent interpretation layer;

… Do you think it will stop here?

UX and Chain Abstraction Challenges

Chain abstraction may bring some kind of centralized tradeoff, as a stack is only as decentralized as its weakest link. Abstraction requires coordination around state proofs, solver execution, block confirmations, and cross-chain transaction guarantees, so consensus must be reached on this. There is always another faster/cheaper/newer buzzword chain abstraction solution that is better than the current one in the capital markets. Founders and VCs will create new rules of the game, but play the same way they always have, to win the same rewards.

Building infrastructure is often a response to poor UX, because high fees and slow settlements are part of the UX problem. But when adoption fails to meet expectations, poor crypto UX becomes an easy excuse to pass the buck. Criticizing UX requires little effort, so everyone is doing it. Whenever a crypto cycle turns to apathy, people blame it on bad products, forgetting that these products were so exciting in the first place that they took us to the top of the market.

In the past, we talked about crypto super apps that started with products rather than infrastructure. Whether it's Uniswap, Metamask, Magic Eden, StepN, Blur/Blast, dYdX, or Hypeliquid, it's clear that the idea of web3 is being turned on its head. Instead of collaborating on a composable stack, each party builds its own tech stack based on its own incentives. That's okay.

But it also means that chains will be abstracted by those who don't call themselves chain abstractions; instead, it will be those who build the most popular applications in crypto.

Most Popular App in the SpaceGalxe

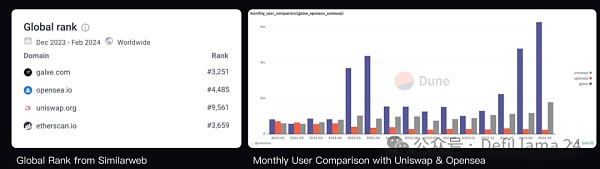

Galxe (formerly Project Galaxy) is the most widely adopted web3 app by a wide margin. It has more web traffic than Uniswap, Opensea, or Etherscan. Over 20 million unique addresses interact with Galxe. Over 1 million unique visitors use the Galxe website every day.

Before you dismiss this traction as a bot airdrop extravaganza, consider that every on-chain use case is dominated by bots. The majority of token trading is done by bots. Crypto games are also played by bots, as they are still primarily driven by financial incentives. NFT market making is also done by bots. AI agents (smarter bots) are starting to participate in the on-chain economy. Even our social finance darlings rely heavily on bots, making social finance even less social. Crypto is about incentives and resource coordination, and so far, bots have proven to be excellent target users for harvesting on-chain incentives. The future, proxy DAOs and UBI, are already closer than we thought.

But it doesn’t matter whether the user is a bot (it’s worth noting that Galxe’s 1 million daily active users are actual website visitors, not bots); what matters is how much economic activity there is, and the value that can be captured as a protocol or application.

Galxe found its entry point in airdrop distributions. But it has come a long way since then, by building identity layers including Galxe Passport (identity) and Galxe Score (reputation).

The most successful businesses are those that create new bundles or unbundles for everyone. Galxe has aggregated the supply side of projects looking to build communities and distribute their tokens, and the demand side of users looking for opportunities to earn tokens. What was previously the core business of centralized exchanges has now become a larger market by enabling projects to build communities before the Token Generation Event (TGE).

We have seen countless early attempts to build platforms that monetize identity or data, but they always failed because they did not start with a product that people want to use (most users don't care who owns their data). Galxe has built a unique use case and provides a strong enough financial incentive for people to reveal their identity. Such data will become valuable in ways we have not yet foreseen, especially if policymakers sincerely try to consumerize cryptocurrencies.

Almost 1 million people have already created a Galxe passport with their real life identity.

Aggregating users allows for the construction of not only a valuable identity layer, but also consumer type products that otherwise would not have been successful as standalone ideas. This includes the Galxe mobile app, money transfer and spending, AI-assisted trading products, research centers, and more. Galxe has become the first stop for many new users in the crypto space.

The question now is: How many valuable products can Galxe build so that these users never have to leave its ecosystem?

Galxe spans 34 different chains. That’s probably more than any cross-chain bridge or centralized exchange could ever integrate. With Galxe’s Smart Balance feature, users can deposit funds into a single vault and use the balance to pay Galxe smart contract transaction fees on multiple chains, without the need for bridging. Soon, Smart Balances will be upgraded to Smart Savings, enabling users to earn yield on deposited assets.

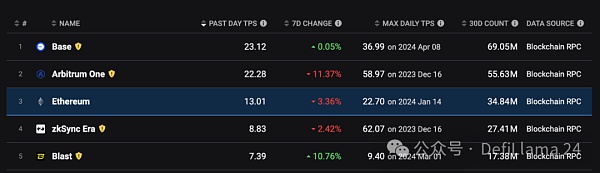

Many people don’t know that Galxe has been abstracting chains and accounts while people look elsewhere. After the just announced launch of Galxe’s Gravity chain, it will become the largest blockchain by transaction activity, with a monthly transaction volume of approximately $100 million.

Aggregating user identities, their transactions, and controlling block space is a combined strategy for abstracting chains. To us, it seems that only a few crypto companies - Galxe, Coinbase, and perhaps TON - are fully capable of making consumer-friendly chain abstraction a reality. While they are approaching it from different angles, the desired outcome, blockchain onboarding combined with identity, looks the same to us. Coinbase's Galxe's end game has been revealed We don't know who needs to hear this, but rebranding in crypto is always optimistic. There's no better ticker than $G.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Clement

Clement Coindesk

Coindesk Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph