Author: Jesse Coghlan, CoinTelegraph; Compiled by Wuzhu, Golden Finance

A bill that clarifies the role of the U.S. securities and commodities regulator in regulating cryptocurrencies is heading for an unknown future before it reaches U.S. President Biden's desk.

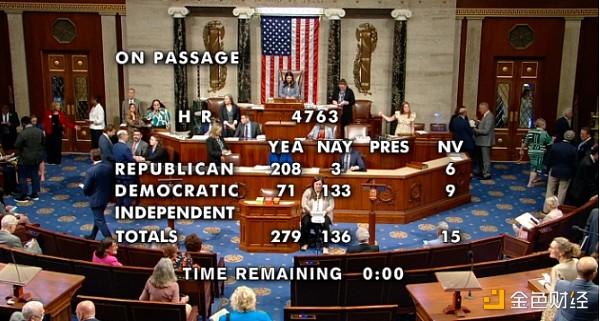

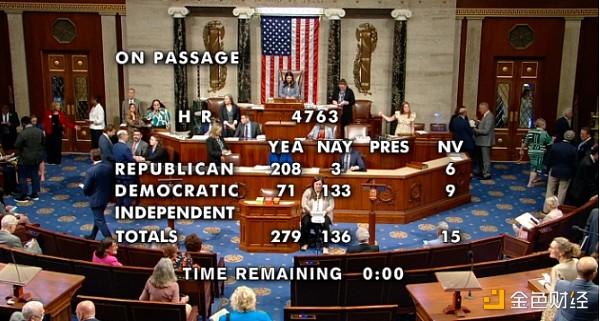

The Republican-led Financial Innovation and Technology Act for the 21st Century (FIT21) (H.R. 4763) was passed by the House of Representatives on May 22 with 71 Democrats, 208 Republicans, and 136 against.

Its future in the Senate is unclear, as there is no companion bill and it is against Elizabeth Warren, one of the country's biggest cryptocurrency critics. However, the same Senate passed a resolution last week calling for the repeal of regulations that restrict banks and cryptocurrency companies from doing business.

Final House vote on FIT21. Source: U.S. House of Representatives

It could be months before the 100-member Senate considers FIT21 — there is no time limit on when senators must act.

Even if they do, the bill will likely be assigned to a committee for possible rounds of review, hearings, and if it passes, a majority (51 senators) would have to vote in favor for it to pass.

Parts of FIT21 are subject to change, and members of the House and Senate will meet to iron out any differences in their respective versions of the bill. The bill will then return to the House and Senate for final approval.

President Biden will have 10 days to sign or veto FIT21. However, his administration expressed opposition to the bill's passage on May 22 but did not say he would veto it.

Even if Biden vetoes FIT21, both chambers of Congress could pass it with at least a two-thirds majority, overturning his decision.

Industry cheers passage

SEC Chairman Gary Gensler publicly opposed FIT21 on May 22, saying it created a "new regulatory gap" and threatened the stability of capital markets. Many saw its passage in the House of Representatives as an early victory for cryptocurrencies.

Coinbase CEO Brian Armstrong described the bill's passage and the support of 71 Democrats as a "comprehensive victory" and a victory for "clear rules for cryptocurrencies."

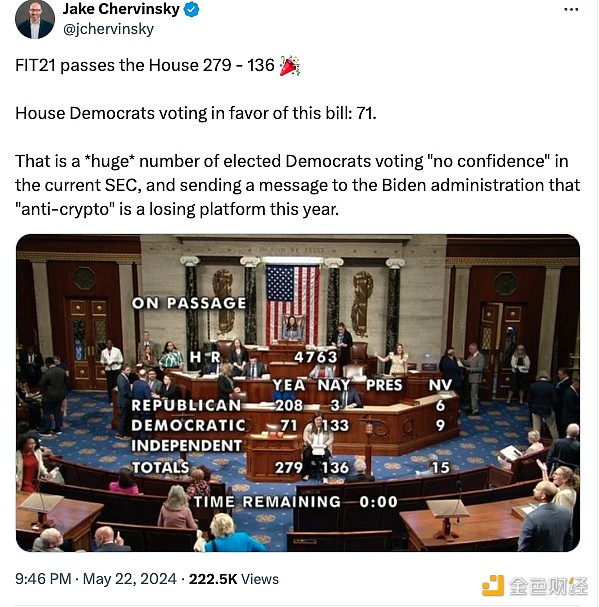

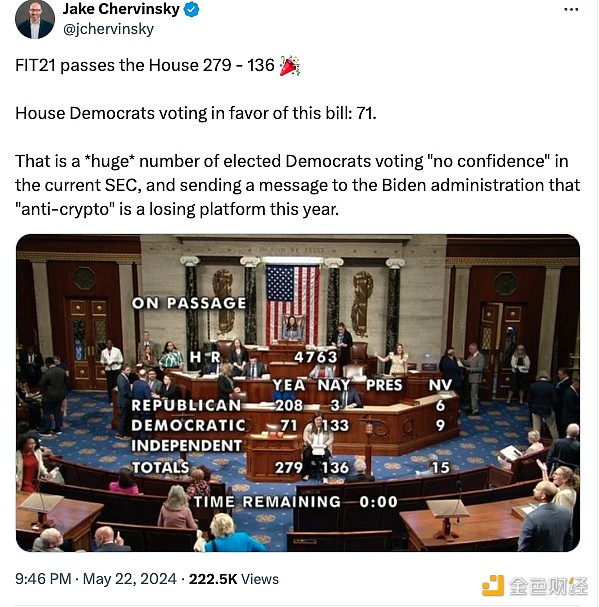

“A large number of elected Democrats have voted ‘no confidence’ in the current SEC,” said Jake Chervinsky, head of legal at Variant Fund.

Source: Jake Chervinsky

However, cryptocurrency-focused attorney Gabriel Shapiro poured cold water on the celebrations, arguing on X that FIT21 would still give the SEC “tremendous power.”

“It provides a dual regulatory regime, run separately by the SEC and the CFTC,” he added. “It does that by giving the CFTC unprecedented power — regulatory authority over spot commodity markets.”

FIT21 largely hands control of cryptocurrencies to the CFTC, which is seen by the industry as a lighter-handed regulator than securities regulators.

The SEC will, however, have regulatory authority over cryptocurrencies that aren’t decentralized enough, but FIT21 will also create a way for cryptocurrencies it deems to be securities to be sold as commodities.

JinseFinance

JinseFinance