With the GENIUS Act passing a procedural vote in the Senate with an overwhelming majority on May 19, the US stablecoin regulatory framework is accelerating towards implementation. This is not only a regulatory update, but also a national strategic deployment of the United States in the field of digital finance. In recent years, the US government has been quietly advancing a far-reaching financial strategy, trying to regulate and guide the stablecoin market, respond to the reshaping of the global financial landscape, and consolidate the international dominance of the US dollar.

According to Bloomberg, This strategic consideration may be more far-reaching than the market generally believes. As early as the Trump administration, there were signs that it had included the development of US dollar stablecoins in national strategic considerations through administrative means, using it as a tool to continue the hegemony of the US dollar. The advancement of legislative frameworks such as the GENIUS Act also reflects the continuation of this idea in the current government. Treasury Secretary Scott Bessent pointed out at a congressional hearing a few days ago that digital assets are expected to bring up to $2 trillion in new demand to the U.S. Treasury market in the next few years.This not only provides new structural buyers for U.S. Treasuries, but also extends the influence of the U.S. dollar in the world in a digital way through the mechanism of linking to stablecoins.

Stablecoin legislation: policy design for strategic double gains

The core provisions of the GENIUS Act, such as requiring stablecoin issuers to use 100% of highly liquid assets such as U.S. dollar cash or short-term U.S. Treasury bonds as reserves, supplemented by monthly transparency reports, have policy intentions that go beyond simple risk control. Such regulations will directly generate structural demand for the U.S. dollar and U.S. Treasury bonds. In theory, every $1 of compliant stablecoin issued means that the corresponding value of US dollar assets is locked up as reserves. With nearly 99% of the world's stablecoins pegged to the US dollar, the scale effect of this mechanism cannot be underestimated. On the one hand, this move has introduced a new and growing group of buyers to the growing US Treasury market, especially in the context of some traditional foreign sovereign buyers (such as China and Japan) continuing to reduce their holdings of US debt in recent years, its strategic value is more prominent. On the other hand, by supporting a compliant US dollar stablecoin ecosystem, the United States can continue to maintain its monetary influence in the digital currency era without directly expanding the Fed's balance sheet.

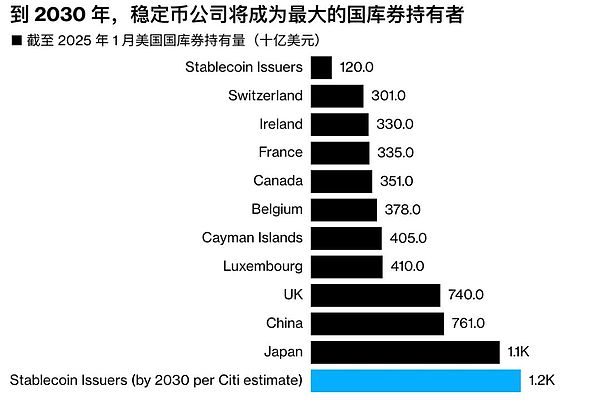

The strategic value of this emerging flow of funds to the U.S. Treasury market has been further confirmed in recent forecasts from mainstream financial institutions. Standard Chartered, for example, estimates that the market value of stablecoins pegged to the U.S. dollar could soar eightfold to $2 trillion by the end of 2028. Analysis by Citigroup also depicts a similar growth trajectory, with its "base case" forecast of a market size of $1.6 trillion by 2030, and in a "bull case" that figure could even reach as high as $3.7 trillion.

Source: U.S. Treasury, Tagus Capital, Citi Institute

Critically, both international banks have made it clear that since stablecoin issuers must purchase low-risk assets such as U.S. Treasuries to support the issuance of their tokens, they are very likely to surpass many sovereign countries in the scale of holding U.S. Treasuries in the next few years. The background of this trend is particularly noteworthy: on the one hand, traditional major U.S. debt holders such as China have continued to reduce their positions in recent years; on the other hand, policies such as trade tariffs implemented during the Trump administration once caused the market to examine and question the traditional safe-haven status of U.S. Treasuries. In this context, compliant stablecoin issuers are transforming from a specific participant in the crypto field to a potential and even major source of structural demand for U.S. Treasuries.

Tether's role: from market giant to strategic hub

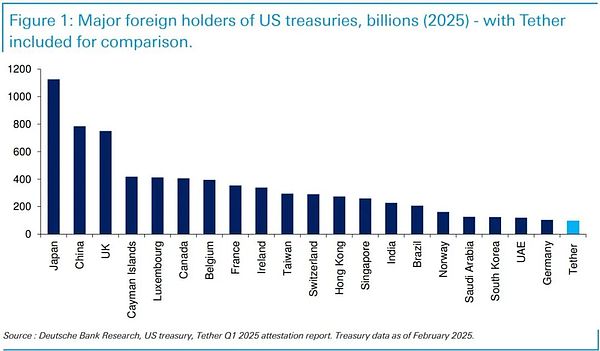

In this strategic landscape, the role of Tether, the world's largest stablecoin USDT issuer, is becoming increasingly prominent. Data shows thatTether's holdings of U.S. Treasuries are comparable to those of major industrial countries such as Germany.This makes Tether not only an important infrastructure in the crypto market, but also an important holder of U.S. Treasuries.

Tether's holdings of U.S. Treasuries are about to exceed Germany

Tether's uniqueness lies not only in its huge asset size, but also in its in-depth cooperation with Cantor Fitzgerald, a veteran U.S. financial institution. As a direct trading partner of the Federal Reserve, this primary dealer provides Tether with unparalleled liquidity support in extreme market environments. Through Cantor Fitzgerald, Tether can quickly sell its U.S. Treasuries in exchange for U.S. dollar cash when users redeem USDT in a centralized manner. For example, when the crypto market was in turmoil in 2022, USDT was briefly decoupled from the US dollar, but Tether used this mechanism to successfully handle redemption demands of up to $7 billion within 48 hours, accounting for 10% of its supply at the time. A bank run of this scale is usually enough to plunge most traditional financial institutions into crisis, but Tether survived smoothly, highlighting the robustness of its reserve system and the uniqueness of its liquidity arrangements.

To some extent, this institutional design coincides with the United States' long-term goal of promoting financial innovation and consolidating the dominance of the US dollar in recent years, that is, strengthening the United States' financial advantages through non-traditional means. The result is a powerful stablecoin issuer that is deeply tied to the US dollar, which is objectively conducive to the global penetration of the US dollar system.

Global Expansion and the Soft Power Projection of Digital Dollars

Tether's ambitions do not stop at existing markets. The company is actively expanding its USDT business to emerging markets such as Africa and Latin America, and building what it calls an "AI Agent-driven peer-to-peer network" through diversified initiatives such as acquiring local physical infrastructure, developing an asset tokenization platform called Hadron, launching a self-hosted open source wallet, and investing in brain-computer interfaces and peer-to-peer communication applications Keet (based on the Holepunch protocol). Its latest QVAC platform natively supports USDT and Bitcoin payments and integrates decentralized communication tools, aiming to create a digital ecosystem that emphasizes user autonomy, anti-censorship, and trustlessness.

Tether CEO Paolo Ardoino once mentioned his observations on China's promotion of its influence in developing countries through infrastructure projects and potential non-dollar payment systems (such as gold-backed digital currencies). In this context, Tether's layout in these regions can be seen as a market-driven business behavior aimed at promoting the use of US dollar stablecoins. Objectively, it is also competing with other digital currency systems to expand the influence of the US dollar in the digital field. This is in line with the US's macro strategy of maintaining its global currency status to a certain extent.

Despite its prominent market position and unique liquidity mechanism, Tether's operations are not without controversy. According to a report by the Wall Street Journal in October last year, federal prosecutors in Manhattan investigated Tether for possible violations of sanctions and anti-money laundering regulations (Tether said it was unaware of this or was cooperating with law enforcement). In 2021, Tether paid $41 million to settle with U.S. regulators to resolve allegations that it misreported its reserves. These historical events and ongoing scrutiny highlight the challenges large stablecoin issuers face in compliance and transparency. CEO Ardoino himself did not visit the United States for the first time until March of this year. He once joked that he might be arrested if he came earlier, which indirectly reflects the delicate relationship between Tether and U.S. authorities. However, the Bloomberg report also pointed out that from certain policy perspectives, "Tether's interests suddenly coincide with those of the United States."

A New Path to US Dollar Hegemony in the Digital Age

The US strategy of regulating and guiding the development of the stablecoin market through legislative tools such as the GENIUS Act, combined with the rise and global expansion of market players such as Tether, is opening up a new path to consolidate the international status of the US dollar. This not only brings important new demand for US Treasuries, but Standard Chartered Bank analysts even believe thatthe US Treasury bonds purchased by the industry in the next four years "may roughly cover all additional US Treasury bonds that may be issued",relieving the pressure brought by traditional buyers' reduction of holdings, but also maintaining and extending the global influence of the US dollar in a relatively low-cost and more penetrating way in the wave of global digital transformation. As Treasury Secretary Bessent acknowledged, digital assets could bring $2 trillion in new demand for U.S. Treasuries in the coming years, but the expansion of stablecoins also brings risks, such as any sudden surge in redemptions could force operators to quickly liquidate their Treasury positions, potentially disrupting the market. In addition, with the entry of traditional financial giants such as PayPal and new players such as World Liberty Financial, which is associated with the Trump family, the market competition landscape is also evolving. However, the long-term effectiveness of this "open conspiracy" will still be carried out in the multiple tests of global regulatory coordination, technological security, geopolitical competition, and market competition.

Weiliang

Weiliang

Weiliang

Weiliang Weatherly

Weatherly Catherine

Catherine Anais

Anais Weatherly

Weatherly Alex

Alex Catherine

Catherine Alex

Alex Joy

Joy Kikyo

Kikyo