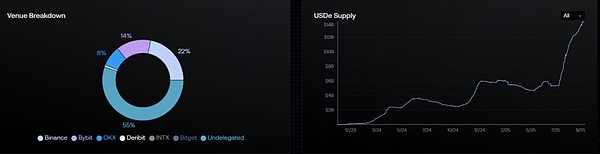

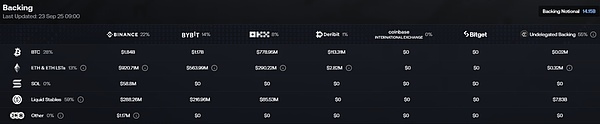

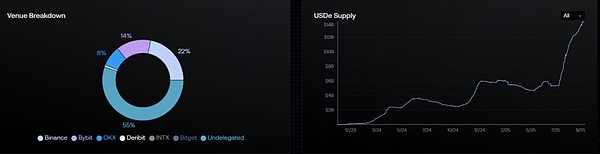

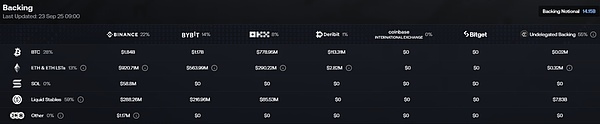

Which stablecoin do you think is third? USDT and USDC hold the top two spots, practically unsurprisingly. However, the third spot isn't occupied by DAI, FDUSD, or TUSD, but a newcomer, USDe, launched less than two years ago. According to CoinGecko data, as of September 23rd, USDe's circulating supply exceeded $14 billion, placing it firmly in third place behind only USDT and USDC. More notably, if USDT and USDC are excluded, USDe already accounts for nearly 40% of the market share of all other stablecoins, significantly squeezing the viability of established stablecoins. What has enabled this up-and-coming cryptocurrency to achieve such rapid success? What are the profitability and potential risks behind it? As USDe rapidly rises, what new variables are brewing in the stablecoin market? Source: Coingecko From $0 to $14 billion, the non-linear rise of USDe The stablecoin market has always been a lucrative one. By comparison, leading player Tether's "money-printing" capabilities rival even those of top CEXs. According to Tether's Q2 2025 forensic report, Tether's total holdings of US Treasury bonds exceeded $127 billion (an increase of approximately $8 billion from the first quarter). Its net profit in the second quarter totaled approximately $4.9 billion, and its net profit for the first half of this year reached $5.7 billion. Considering that Tether has only about 100 employees, its profit margins and operational efficiency are staggering, at least an order of magnitude lower than those of crypto exchanges and Web2 traditional financial giants.

However, not all players are sitting comfortably at this lucrative table. It can even be said that, with the exception of USDT, the performance of established stablecoins in recent years has not been perfect:

USDC was once decoupled due to reserve risk during the 2023 banking crisis, and its volume shrank sharply and its vitality was severely damaged. The impact has not yet completely subsided;

After the transformation of MakerDAO, DAI has gradually become "super-USDC", and its volume has also reached a bottleneck period;

Although newcomers such as TUSD and FDUSD have seen short-term growth, it is difficult to shake the pattern.

Source: Ethena official website

It was against the backdrop of slowing growth and solidified models of traditional stablecoin giants that USDe emerged and embarked on a completely different "non-linear" growth curve. Since its official launch in November 2023, USDe's total market capitalization has rapidly grown from $0 to $14 billion in less than two years, experiencing only two pullbacks and quickly resuming growth. Since July of this year, its value has nearly tripled from approximately $5 billion in just two months, and it has been deeply integrated by several leading CEXs. It can be said that over the long term, USDe's growth curve is almost unparalleled. This almost counterintuitive growth curve is also inseparable from its well-known high-yield flywheel. When the competition in stablecoins entered the "stock game" stage, USDe's extremely high annualized yield, practical scenarios for trading margin, and "Delta neutrality" story indeed helped it quickly open up the incremental market, becoming the most controversial and most watched rising star. Deconstructing USDe: Where does the high yield come from? USDe's biggest impact on the stablecoin market is undoubtedly its high-yield attribute. Users can obtain all the profits generated by the protocol by staking USDe as sUSDe.

Data from the Ethena Labs official website shows that as of the time of publication, sUSDe's annualized yield remains as high as 7.83%, having previously maintained above 20%. So what kind of stablecoin mechanism is USDe, and why does it have such a high annualized yield?

To understand USDe, we must first clarify its essential difference from the previously devastated UST - UST is an uncollateralized algorithmic stablecoin, while USDe is a fully collateralized synthetic dollar that uses a "delta-neutral" strategy to maintain its value stability. Behind this is actually a practical version of the "Satoshi Dollar" concept proposed by BitMEX founder Arthur Hayes in his article "Dust on Crust" as early as March 2023.

Source: BitMEX

In short, excluding the expected airdrop income, USDe's high income mainly comes from two sources:

LSD staking income:The assets such as ETH or stETH deposited by users will generate stable staking income;

Delta Funding fee income from hedged positions: This is the bulk of the income, namely the funding fee earned from short perpetual futures positions opened on CEX. The former is relatively stable, fluctuating around 3%-4%, while the latter is entirely dependent on market sentiment. Therefore, USDe's annualized return is also directly dependent on the overall funding rate (market sentiment) to some extent. The key to the operation of this mechanism lies in the "Delta Neutral Strategy" - if a portfolio is composed of related financial products and its value is not affected by small price fluctuations of the underlying assets, such a portfolio is "Delta Neutral".

That is, USDe will form a "Delta-neutral strategy" through equal amounts of spot ETH/BTC long positions and futures ETH/BTC short positions: the Delta value of the spot position is 1, the Delta value of the futures short position is -1, and the Delta value after hedging the two is 0, thus achieving "Delta Neutrality".

Simply put,

When the USDe stablecoin module receives user funds and buys ETH/BTC, it will simultaneously open an equal amount of short positions. Thus, through hedging, the total value of each USDe position remains stable,which also ensures that the collateralized position is free from the risk of liquidation loss.

Source: Ethena official website

Let's assume the BTC price is $120,000. For example, if a user deposits 1 BTC, the USDe stablecoin module will sell 1 BTC futures at the same time. After hedging the two, the Delta value of the total investment portfolio is 0:

If BTC falls to $100,000: the spot position loses $20,000, but the futures short position makes a profit of $20,000, and the total value of the portfolio is still $12 $10,000. If BTC rises to $140,000: the spot position earns $20,000, but the futures short position loses $20,000, leaving the portfolio with a total value of $120,000. In this way, the total value of the collateral remains stable, while the short position continues to earn funding fees. Historically, funding rates have been positive in the crypto market for most of the time (especially in bull markets), meaning longs pay shorts. The combination of these two benefits creates USDe's attractively high APY.

Shadows Beneath the Halo: Potential Risks and Controversies of USDe

Although USDe's mechanism is ingeniously designed, its high returns are not entirely without risks. The market's main concerns focus on the following points.

First is funding rate risk. Because USDe's yield model is highly dependent on a positive funding rate,

if the market turns to a bear market, the funding rate may remain negative for a long time. At that time, short positions will not only have no returns, but will also have to pay fees.This will seriously erode USDe's yield and may even trigger the risk of decoupling. Then there is the risk of centralization and custody. Because USDe's collateral and hedge positions are stored in centralized custodians and CEXs, although they are relatively decentralized, they still face counterparty risk. Once problems occur in the exchange (such as bankruptcy or theft), it will directly threaten the security of USDe assets.

Finally, there is liquidity and execution risk. After all, during extreme market fluctuations, Ethena needs to quickly adjust its large spot and futures positions. At that time, market liquidity may dry up, resulting in huge transaction slippage, making the "Delta Neutral" strategy ineffective. There's also a hidden risk: LSD collateral depegging. If the liquid staking tokens used by Ethena, such as stETH, depeg from ETH, their hedging effectiveness will be significantly reduced, resulting in asset losses. Overall, the rapid rise of USDe reflects the market's immense anticipation for a high-yield, capital-efficient decentralized stablecoin, the "holy grail," amidst the retreat of algorithmic stablecoins and regulatory pressure on centralized stablecoins. Furthermore, it has indeed pioneered a new paradigm for the "synthetic dollar." However, while users embrace its high returns, they must also be aware of its unique risk model. This competition for the future of core on-chain assets deserves our continued attention.

Weatherly

Weatherly