Written by: 0xjs@黄金财经

“Of The People, By The People, For The People” is the most famous speech by US President Lincoln.

“Owned by the people, governed by the people, for the people” is the slogan of Dr. Sun Yat-sen’s Three Principles of the People.

Once these ideas were proposed, they firmly occupied the minds of the people.

In the crypto industry, the same is true for “user sovereignty, community ownership”. Those crypto projects that do not consider users and communities due to various factors such as first-mover advantage will sooner or later encounter challenges.

In the past two days of falling market, Usual, a stablecoin protocol targeting USDT/USDC, performed well and attracted the attention of the crypto community.

What is Usual?

According to official documents, Usual is a secure and decentralized issuer of fiat stablecoins, aggregating growing RWA tokens (mainly tokenized U.S. Treasuries) from Hashnote, BlackRock, Ondo, Mountain Protocol, M^0, etc., and converting them into permissionless, on-chain verifiable, and composable stablecoins USD0. Ownership and governance rights are redistributed through the governance token USUAL.

It can be summed up in one sentence that Usual wants to be Tether on the chain.

Usual targets two key issues of USDT/USDC: user ownership and bank bankruptcy risk.

1. User ownership. USDT and USDC are the top two stablecoins by market value, with USDT having a market value of more than $140 billion and USDC having a market value of more than $42 billion. According to the public data of USDT issuer Tether, Tether's annual profit in 2024 can reach 10 billion US dollars. Circle's annual profit can reach 3 billion US dollars. However, the income generated by the assets provided by these crypto users is all taken away by Tether and Circle, and users have no rights. Unlike Tether and Circle, Usual will not privatize the profits generated by USDT and USDC, but redistribute power and income to the community (Of The People, By The People, For The People). 100% of the income of the Usual protocol flows into the treasury, of which 90% is distributed to the community through governance tokens.

Second, the risk of bank bankruptcy. A large part of USDT and USDC is guaranteed by commercial banks, which brings security and stability risks due to the bank's partial reserves. Usual has introduced a new way to issue stablecoins. The underlying assets of its stablecoins are 100% collateralized by short-term U.S. Treasury bonds. It is not linked to the traditional banking system and is far away from the risk of bank bankruptcy.

Usual mainly targets these two gaps of Tether/Circle.

In other words, Usual can be described as a "vampire" attack on USDT/USDC, just like Sushi's "vampire" attack on Uniswap in the summer of DeFi in 2020.

So how does Usual work?

Analysis of Usual's working mechanism

Usual mainly consists of five core tokens: stable coin USD0, LST token USD0++, governance token USUAL, pledge governance token USUALx and contributor token USUAL*.

USD0: USD0 is Usual's stablecoin. Users can exchange USD0 at a 1:1 ratio through USDC or USYC.

USD0++: LST tokens generated by staking USD0++. Holding USD0++ can get USUAL token incentives.

USUAL: USUAL is Usual's governance token.

USUALx: Staking USUAL can get USUALx. Users holding USUALx can activate governance rights and obtain USUAL rewards. USUALx can vote on the Usual protocol, such as the source of future supported collateral.

USUAL*: USUAL* is the founding token of the Usual protocol, allocated to investors, contributors and advisors, and is given different privileges than USUA tokens.

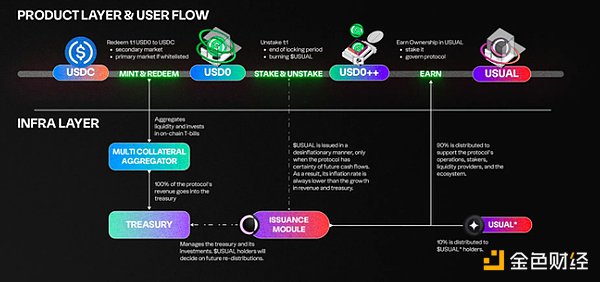

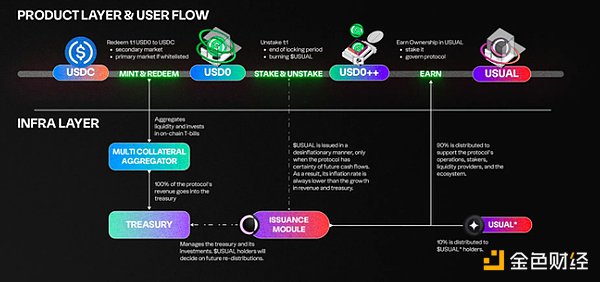

The following figure is a schematic diagram of Usual's products and user flows:

The following is a detailed description.

USD0 Minting

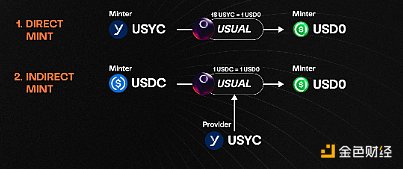

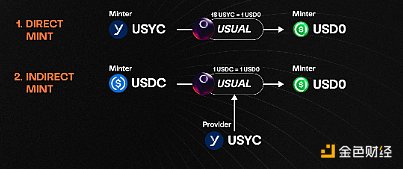

USD0 tokens can be minted by Usual in two ways:

Direct Minting: Get the equivalent of USD0 at a 1:1 ratio by depositing eligible RWA into the protocol.

Indirect Minting: Receive USD0 at a 1:1 ratio by depositing USDC into the protocol. In this method, a third party called a collateral provider (CP) provides the necessary RWA collateral, allowing users to obtain USD0 without directly holding RWA. At the beginning of the protocol launch, all orders below 100,000 USD0 will be redirected to secondary market liquidity.

The above picture takes USYC, the first collateral source of USD0, as an example. Currently, Usual’s first collateral comes from Hashnote’s USYC. USYC is the on-chain representative of Hashnote International Short Duration Yield Fund Co., Ltd. (SDYF), which mainly invests in reverse repurchases and short-term US Treasury bonds.

USD0++

USD0++ is the liquid pledge token (LST) of USD0. It is a composable token that represents staked USD0 and functions like a liquid savings account. For each staked USD0, Usual mints new USUAL tokens and distributes them to users as rewards.

The staking period of USD0++ is 4 years, and users can cancel the pledge early at any time or sell USD0++ on the secondary market at the current price. Users who cancel the pledge early will need to destroy their accumulated USUAL earnings. A portion of the destroyed USUAL will be distributed to USUALx holders.

USD0++ has two parts of earnings:1. USUAL token incentives, USD0++ holders can receive USUAL token earnings daily; 2. Basic interest protection, USD0++ holders can receive earnings at least equivalent to the USD0 collateral earnings (risk-free earnings). But users must lock their USD0++ for a specified period of time. At the end of this period, users can choose to receive rewards in the form of USUAL tokens or risk-free earnings of USD0.

USUAL

USUAL serves as the main reward mechanism, incentive structure, and governance tool. The core concept of its design is that USUAL tokens are actually minted as proof of income and are directly linked to the income of the protocol treasury. USUAL is distributed daily to different categories of participants.

USUALx

USUALx is a form of staking for USUAL. Holding USUALx can activate governance rights and obtain 10% of the total amount of newly issued USUAL, thereby promoting the long-term participation of USUAL holders in the Usual ecosystem. Users can unstake USUALx at any time, but they need to pay a 10% fee on the unstaking amount.

USUAL*

USUAL* is the founding token of the Usual protocol, which is allocated to investors, contributors and advisors to fund the creation of the protocol and is endowed with specific rights different from USUAL tokens, but it has no liquidity.

USUAL* holders have two main permanent rights:1. USUA token allocation rights: USUAL* holders are entitled to 10% of all USUAL tokens minted, and the remaining 90% are allocated to the community. 2. Fee allocation rights: USUAL* holders will also receive one-third of all fees generated by USUALx staking exits.

In the early stages of the protocol, USUAL* holders were granted majority voting rights to ensure compliance with the roadmap and promote effective decision-making during the launch phase. Over time, governance will transition to a decentralized model centered on USUALx. However, this transition will not affect the permanent economic rights of USUAL* holders.

As mentioned above, USD0++, USUALx, and USUAL* are all closely related to the issuance and emission distribution of USUAL.

Through the distribution of USUAL, users are encouraged to exchange USDC for USD0 and pledge it into USD0++, and to pledge the USUAL tokens they receive into USUALx. In addition, by giving USUAL* 10% USUAL incentives, the interests of Usual's team, VC, and community are bound for a long time.

Exquisite USUAL token issuance and distribution mechanism

USUAL token issuance adopts a strategy different from other crypto projects, mainly its token issuance and distribution mechanism.

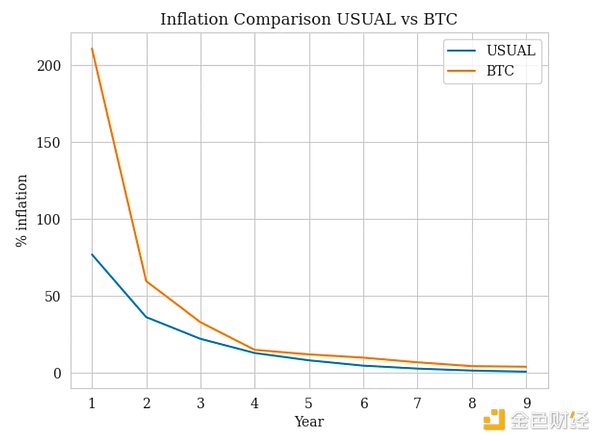

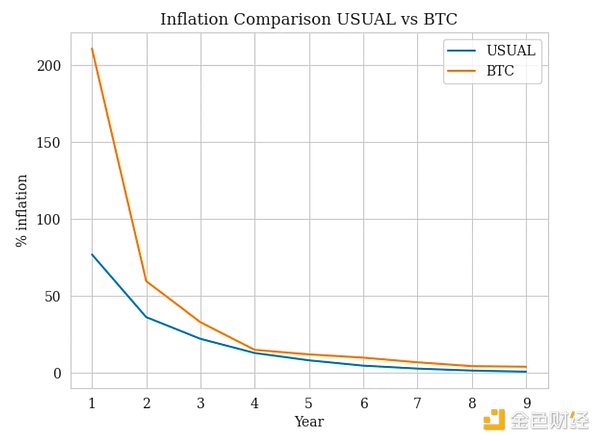

Let's talk about token issuance first. The maximum supply is 4 billion USUAL in 4 years. USUAL uses a dynamic supply adjustment emission mechanism, and the emission rate is adjusted according to the growth of TVL denominated in USD0++ and the change of interest rate of supporting USD0 assets, and a cap is set to prevent over-issuance. As the supply of USD0++ increases, the minting rate will decrease, which helps to create scarcity and reward early participants.

Usual's issuance model is designed to be deflationary, and USUAL has a lower inflation rate than Bitcoin. The inflation rate is calibrated to stay below the growth of protocol revenue, ensuring that the rate of token issuance does not exceed the rate of economic expansion of the protocol.

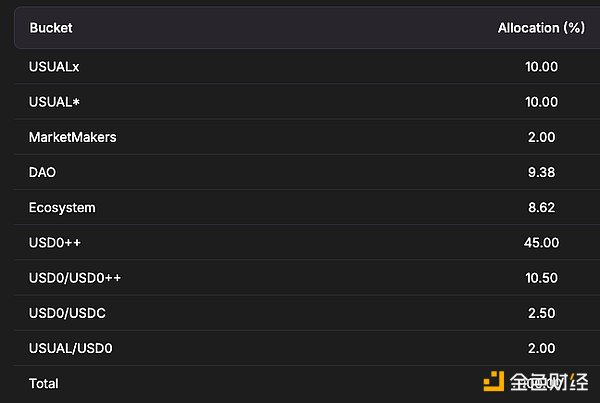

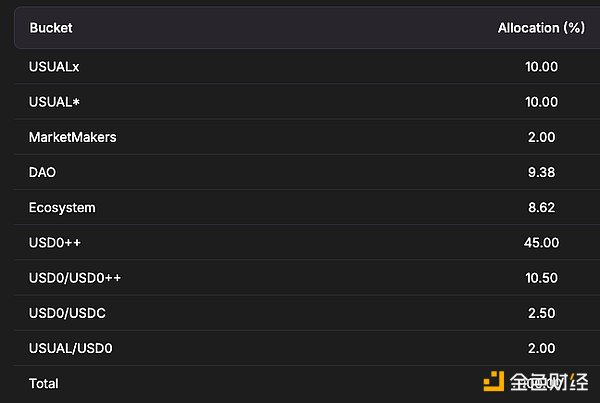

Let's talk about the distribution. The following figure shows the distribution of USUAL:

As mentioned in the previous section, USUAL* is a special token model designed by the team and VC. Through two permanent economic rights, insiders such as the team, VC, and consultants can obtain 10% of the USUAL issuance, and they are obtained synchronously with the entire community within 4 years, and are locked in the first year.The remaining 90% is fully allocated to the Usual community.

As a result of this design, USUAL avoids becoming a widely criticized low-circulation, high-FDV VC token, ensuring the alignment of interests among the team, VC, and community.

At the same time, USUAL token issuance is linked to protocol revenue, and its supply increases as protocol revenue grows. Therefore, unlike other DeFi projects where VCs and early adopters quickly sell tokens, Usual's token model incentivizes long-term holders.

Where does Usual's super high returns come from?

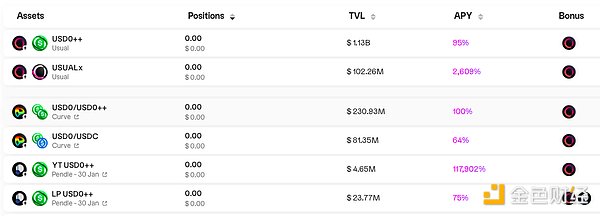

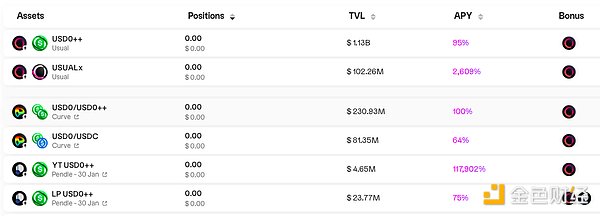

One of the reasons for USUAL's recent rapid development is its super high returns.

On December 20, 2024, the APY of USD0++ reached 94%, and the APY of the staking token USUALx of the governance token USUAL reached 2200%, with corresponding APRs of 66% and 315%, respectively. On December 19, 2024, the APY of USUALx is as high as 22,000%, and the corresponding annualized rate of return APR is 544%.

Where does this high yield come from?

Currently, Usual’s first collateral comes from Hashnote’s USYC. USYC is the on-chain representative of Hashnote International Short Duration Yield Fund Co., Ltd. (SDYF), which mainly invests in reverse repurchases and short-term US Treasury bonds. According to Hashnote's official website, the total return of USYC in the past 5 months is only 6.87%.

Obviously, the income of the underlying assets is not enough to support the ultra-high returns of USD0++, USUALx and related LPs on Curve and related LSTs on Pendle. The high returns mainly come from the incentives of USUAL tokens.

Conclusion: Usual Flywheel

As a killer application of cryptocurrencies, stablecoins have a broader market prospect as US regulations become clearer after Trump took office. The stablecoin market is likely to reach one trillion US dollars in 2025.

According to Usual's plan, Usual will also achieve USD0 asset diversification in the future, and future collateral will come from other US debt RWA projects such as BlackRock and Ondo. With the relaxation of US regulations, on-chain US debt will surely develop on a large scale in 2025. According to data from the US Treasury Department, the scale of short-term US debt exceeds 2 trillion US dollars. In 2025, Usual's RWA collateral market may be comparable to Tether.

From the above analysis, we can see that Usual has formed the Usual flywheel by targeting real problems (on-chain Tether, short-term US Treasury bonds) and through sophisticated token economics design (USD0, USD0++, USUAL, USUALx and USUAL*):

Usual stablecoin market expectations——>USUAL price increase——>High yield——>Large amount of USD0 minted and USUAL pledged——>Increased protocol income, USUAL locked and minted less——>USUAL scarcity——>USUAL price increase——>High yield——>Large amount of USD0 minted and USUAL pledged———>Increased market share of Usual stablecoins.

The Usual flywheel has already started to turn. Since USUAL was launched on Binance, the market value of its stablecoin USD0 has increased by nearly $1 billion in less than a month and has now reached $1.38 billion.

Weatherly

Weatherly