The yen rate hike triggered a V-shaped reversal after the market plunged. The fundamental data is positive, but the market will continue to fluctuate in the short term.

Crypto Market Summary

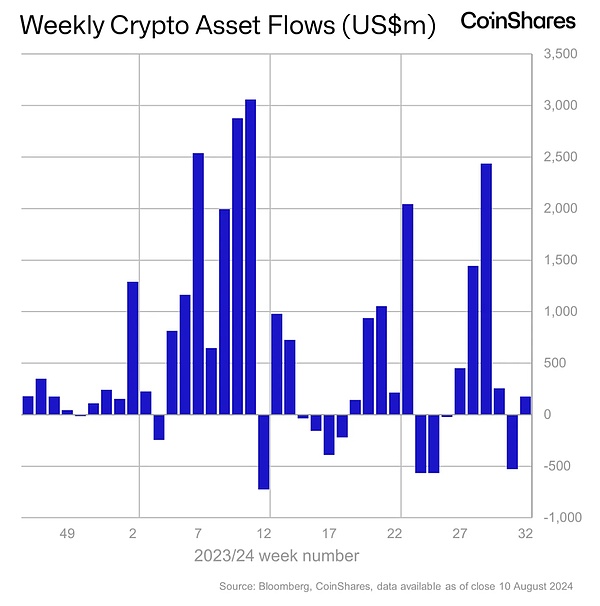

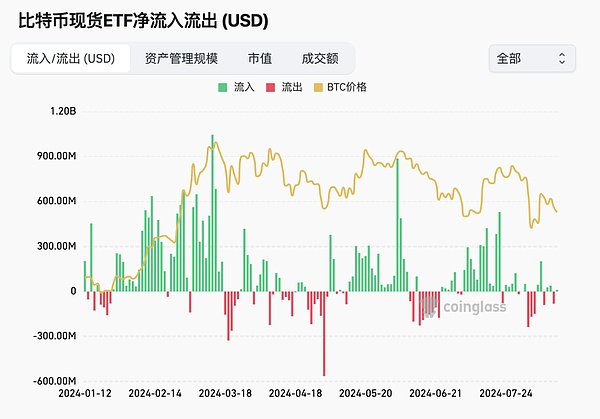

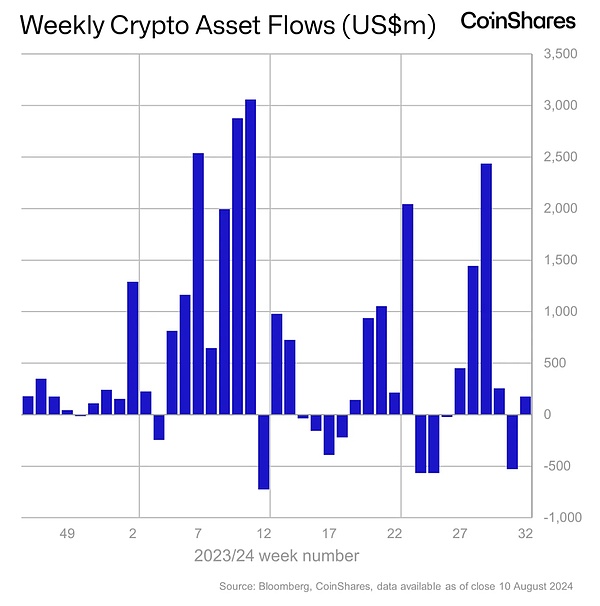

1. From August 1 to August 16, the BTC market experienced a 14.43% plunge after the surge in late July. The maximum drop during the period reached 24.5% (August 5). The main reason was that the U.S. stock market was in a high-level correction and technology stocks were under pressure. The yen suddenly raised interest rates, causing capital panic. In the following week, the market gradually dispelled panic. Both the U.S. stock market and crypto ushered in a V-shaped reversal. The V-shaped reversal is very rare, proving that the long-term supply of chips quickly hit the market to grab chips, which is very bullish for the capital market. It can also be seen from the U.S. stock market that a large amount of funds have poured in.

2. The world's first Solana spot ETF was approved by the Brazilian Securities and Exchange Commission (CVM) on August 7 and is currently awaiting approval from the Brazilian Stock Exchange B3. The fund will be launched in Brazil soon after approval. In view of the growing market demand, the US Solana spot ETF product may also be launched soon.

3. On August 2, the US Bureau of Labor Statistics released data showing that the US non-farm payroll data in July cooled across the board, with only 114,000 new non-farm payrolls, far below the market expectation of 175,000; the unemployment rate rose to 4.3%, triggering the critical value of Sam's Law. Affected by this, the optimism caused by the Fed's interest rate cut took a sharp turn for the worse, and the "recession trade" replaced the "interest rate cut trade" as the main narrative of the market.

4. In terms of regulation, the Republican Trump's speech at the Bitcoin Conference concluded that Bitcoin would be included in the national reserve and predicted that its market value would exceed that of gold. He promised that after being elected, he would remove the SEC chairman from office and retain the government's Bitcoin as a strategic reserve. Harris, a Democrat, is also trying to win over the crypto community.

IMarket Overview

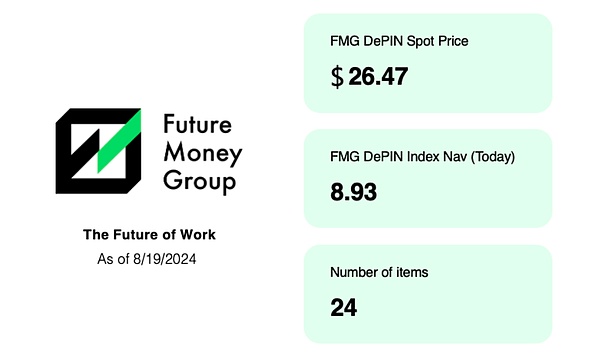

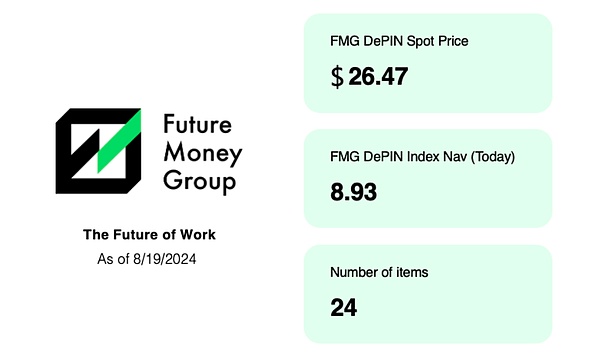

1.1 FutureMoney Group DePIN Index

The FutureMoney Group DePIN Index is a DePIN high-quality portfolio token index constructed by FutureMoney, which selects the 24 most representative DePIN projects. The initial value of the index is 10, with January 5, 2024 as the base period. As of August 19, the net value of the index was 8.93, down 22% from the previous report. Among them, hnt was the most resistant to decline in this market, and Rndr continued to be observed.

1.2 Crypto Market Data

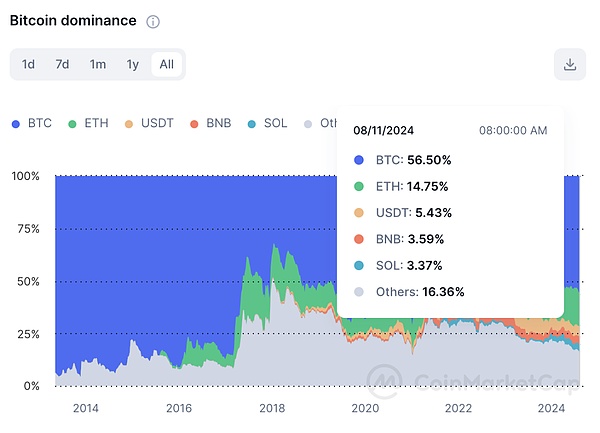

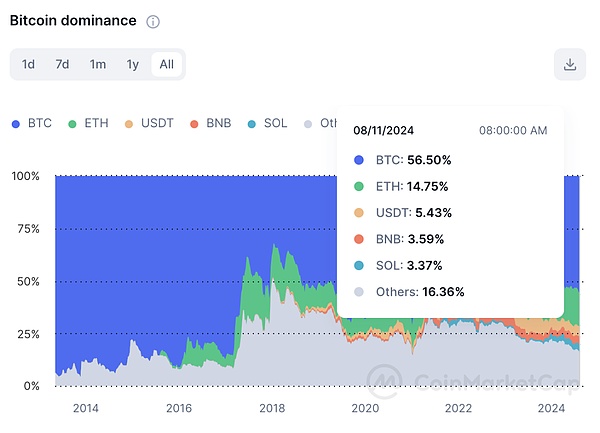

From August 1 to August 18, the market value of stablecoins increased by $1.41 billion, an increase of 0.95%. Bitcoin's share of the total crypto market value remained flat at 53.19%.

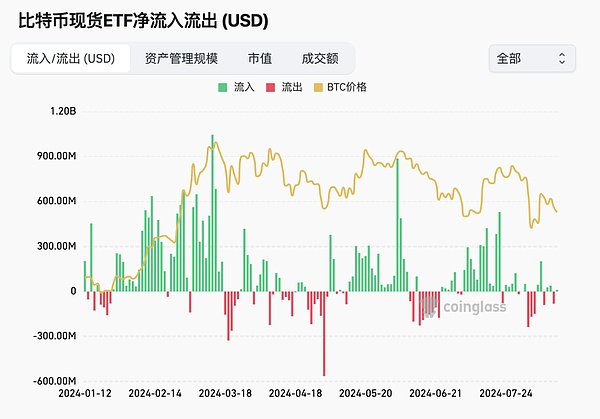

From the trend changes of Coinglass contract holdings, bearish sentiment has eased.

In July, the total open interest of Bitcoin contracts increased to $36.9 billion, and continued to fall to $26.6 billion from August 1 to August 6, and then rebounded to $29.5 billion (August 16). The total open interest of Ethereum contracts fell from $14.4 billion on August 1 to a low of $9.734 billion (August 8), and then rebounded to $10.6 billion. The recent price drop caused by the market's expectations of a recession may be seen by institutions as a buying opportunity.

1.3 CPI/initial jobless claims/retail data and market reaction to market judgment

In two days, there are 3 favorable macro data:

Macro:

The macro data this time is very good. The three data CPI/unemployment benefits/retail data should be positive feedback to the market. In fact, the US stock market is also reflecting this sentiment, and the head concentration is still obvious. Moreover, a very noteworthy phenomenon has appeared in the US stock market. The Russell has pulled up 2.45%. Small-cap stocks are also starting. Small-cap stocks and junk stocks need to be vigilant about the risks of US stocks within one month from the beginning of the surge. Looking back at crypto, BTC and ETH led the decline. Analysts predict that there is a high probability that funds will go to the US stock market. Embracing higher certainty, the crypto market is likely to fluctuate sideways in the short term, and it is not ruled out that some sectors will begin to exert their strength.

Crypto:

The good data this time, the decline of crypto has a guiding effect on the market. Analysts believe that it is not conducive to the short-term trend of crypto, and they are still firmly bullish in the long term. This short-term volatile market is a good opportunity to observe and increase positions. However, it is still unclear how much downward space there is. BTC falls below 54,000 and the normal callback / falls below 51,000. It may be necessary to operate cautiously, and pay attention to ensuring that it is not washed down and does not explode.

Sectors worth layout:

In these 12 hours, we found that sectors with real yields are more resistant to declines. In addition, some coins that are rising have also appeared. This is the first time that a large-scale real income sector has resisted falling, mainly DeFi, such as Aave/CRV/DYDX/UNI, which have all fallen less than BTC. This phenomenon has been studied before and represents a logical shift in the market. This 12 hours is likely to be a turning point.

Second, hot spots and narratives in the crypto market

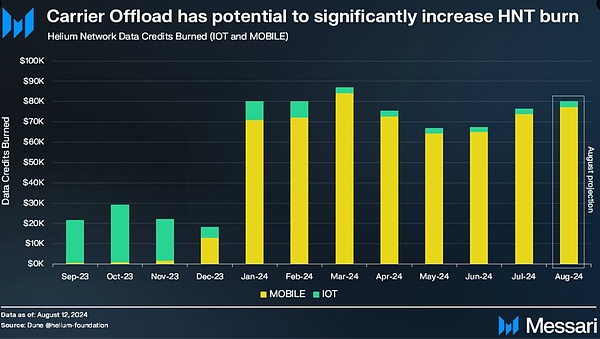

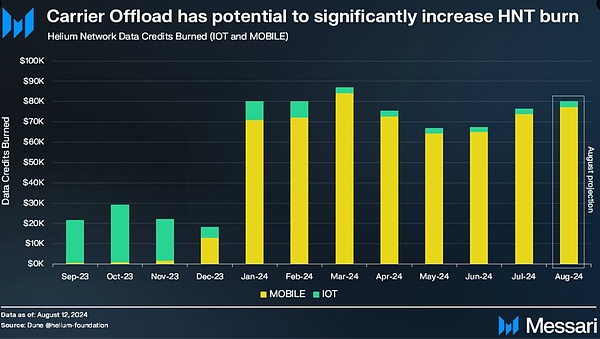

2.1 Helium launches Carrier Offload Program

This is one of the most exciting developments in Helium.

The two major telecom operators in the United States are using Helium, and the synergy between the two parties is very obvious:

1. Operators save costs and provide better coverage.

2. Traffic on the Helium network increases, which brings more rewards to hotspot providers, and more HNT is destroyed.

Meanwhile, Helium is expanding its subnetworks with an IoT subnetwork and an upcoming energy subnetwork.

2.2 DOGS releases token economics, with a total supply of 550 billion

TON Ecological Meme Project DOGS releases token economics, with a total supply of 550 billion community tokens $DOGS. 81.5% of them are allocated to community users, 73% will be rewarded to Telegram OG users, and the rest will be used to reward traders, sticker creators and future community members. In addition, 10% is allocated to the team and future development, most of which will be gradually released within 12 months. 8.5% is used for liquidity and related listing activities for CEX and DEX.

DOGS, as a community token derived from VK and Telegram, will launch the function of emoticon stickers that can be minted and traded on the chain in the future to further expand its application scenarios.

From the current most active applications, it can be seen that the main trend is to shift to the real income track, with public chain platforms Ethereum and Solana as the main ones. The games in the Ton ecosystem are based on low thresholds and community participation.

Three, regulatory environment

Since the beginning of this year, under the background of the US election, with the unexpected passage of the Ethereum spot ETF as a turning point, the cryptocurrency regulatory policies have been frequently reported to be favorable, and this year's crypto market may move out of the election market.

On August 16, according to The Block, Nasdaq withdrew two applications to list and trade Bitcoin spot and Ethereum spot ETF options. The NYSE also withdrew the listing and trading applications of Bitwise and Grayscale Bitcoin spot ETF options on the same day. Bloomberg analyst James Seyffart expects Nasdaq and NYSE to resubmit applications for listing Bitcoin spot ETF options in the coming days or weeks. ·

Meanwhile, as Russia continues its shift toward crypto assets, ministers in Moscow and the country's central bank are discussing plans to create a "Russian crypto exchange." Russian Finance Minister Anton Siluanov noted that existing Russian cryptocurrency exchanges are still operating in a "gray area" of regulation, but Russia's recent legislative efforts on cryptocurrency regulation are "significant progress."

Xu Lin

Xu Lin