Source: The DeFi Investor Translation: Shan Ouba, Golden Finance

Where are we in the cycle?

If you’ve seen my recent X posts, you know that I’m optimistic about cryptocurrencies in Q4. This article will cover exactly where I think we are in this cryptocurrency cycle and explain why I remain optimistic about the near-term outlook.

In short: there are a lot of reasons to be excited.

Let’s start with some charts that I think are relevant to cryptocurrencies.

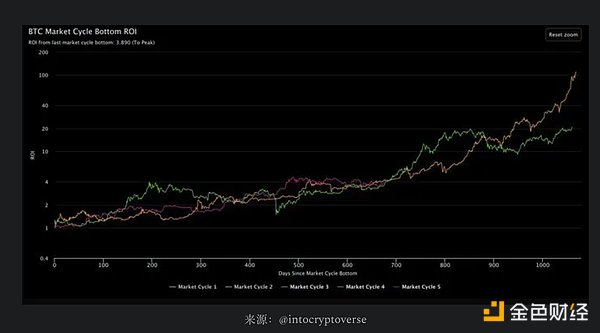

1/ BTC cycle ROI is at its usual position in the cycle

This market cycle is very similar to the bull markets of 2016 and 2020 in terms of BTC performance.

Financial markets tend to be cyclical because human nature never changes. That is why it seems unlikely that Bitcoin has peaked.

The past two bull runs have two things in common:

Only 160 days have passed since the 2024 Bitcoin halving event.

Given what has happened in the past, it is very likely that we are only a few weeks away from resuming Bitcoin’s uptrend.

Of course, this assumes that history repeats itself, but I don’t see any major reason why this time would be different.

2/ Bitcoin Exchange Reserves Decline at Record Pace

Since January 2024, more than 500,000 Bitcoins have been withdrawn from exchanges.

When whales withdraw their tokens from exchanges, it usually indicates that they plan to hold them rather than sell them in the near future.

The chart from above seems to show that whales have been accumulating Bitcoin in large quantities over the past few months.

If this accumulation continues, a supply squeeze is imminent.

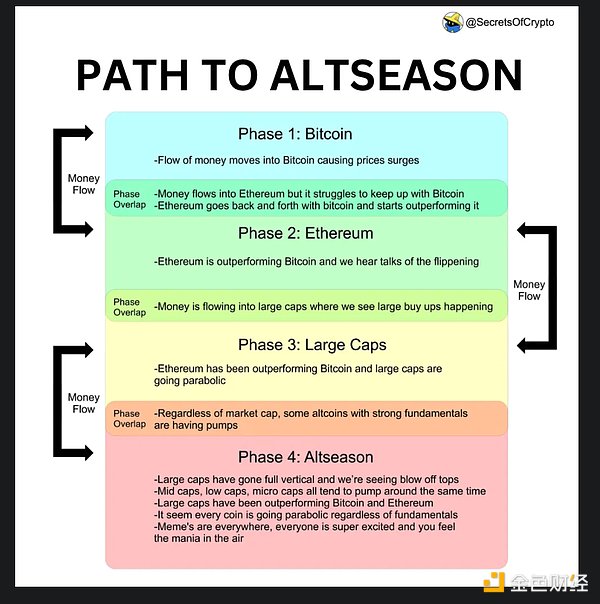

3/ Historically, Bitcoin seasons are the first stage of each new cycle

The infographic above was made many years ago, but it does a good job of summarizing what happened in the 2016 and 2020 cycles.

First, BTC rises and dominance increases

Then attention starts to turn to large-cap stocks (ETH, SOL, etc.)

Eventually, almost every altcoin will start to rise regardless of its market cap or fundamentals

Recently, BTC dominance hit a multi-year high.

This may indicate that we are still in the first stage. Historically, altcoin seasons only start after BTC dominance starts to decline. I think we are about to enter the second stage.

All of the above charts and historical data from previous bull cycles make me think that there is a good chance that BTC will hit a new all-time high in the fourth quarter.

What could go wrong?

Let's also briefly touch on the bear case scenario.

There is still some macro uncertainty.

If a global recession begins, cryptocurrencies will be severely affected.

However, the reason why I think a recession is unlikely in the near term is that 2024 is an election year in the United States.

In order for Kamala Harris to have a chance to win the US presidential election, the Democratic Party will do everything in their power to delay the election.

While I think a US recession could start sometime in the next 3-4 years, I definitely don't think it will happen in 2024.

Therefore, I am bullish on cryptocurrencies in the fourth quarter.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Coindesk

Coindesk Others

Others Coindesk

Coindesk Coindesk

Coindesk Beincrypto

Beincrypto Coindesk

Coindesk