What are "arbitrage" and "foreign exchange knocking"?

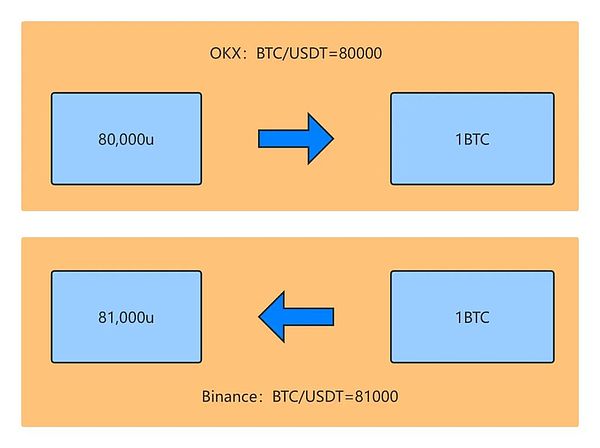

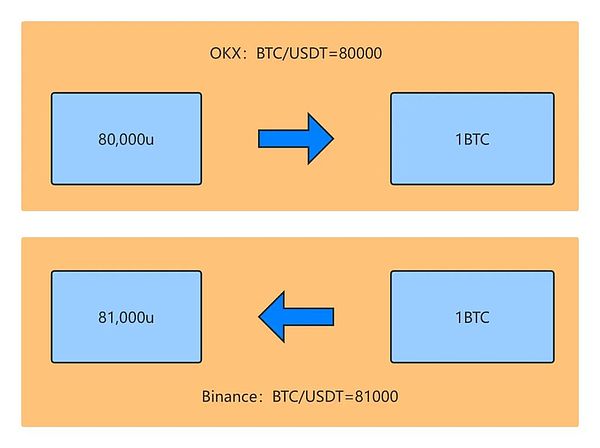

Virtual currency arbitrage refers to the strategy of using the price difference between different exchanges or trading pairs to buy high and sell low. Its core is to complete the purchase and sale of the same subject in a very short time, and achieve risk-free or low-risk returns through fast transactions. For example: an arbitrage trader found that there were often arbitrage trading opportunities between the BTC/USDT trading pairs of OKX and Binance, so he deposited USDT in OKX and BTC in Binance at the same time. When the arbitrage opportunity appeared, he exchanged u for BTC in OKX and BTC for u in Binance at the same time to complete the arbitrage.

The above is the simplest description of arbitrage, but in practice, in order to arbitrage profits, the transaction chain required by traders will be much more complicated than the above, and it is very likely that legal currency will be exchanged in a certain chain, which leads to possible "foreign exchange counter-trading" behavior.

(I) Analysis of typical foreign exchange illegal arbitrage models:

1. Receipt and delivery of legal tender type

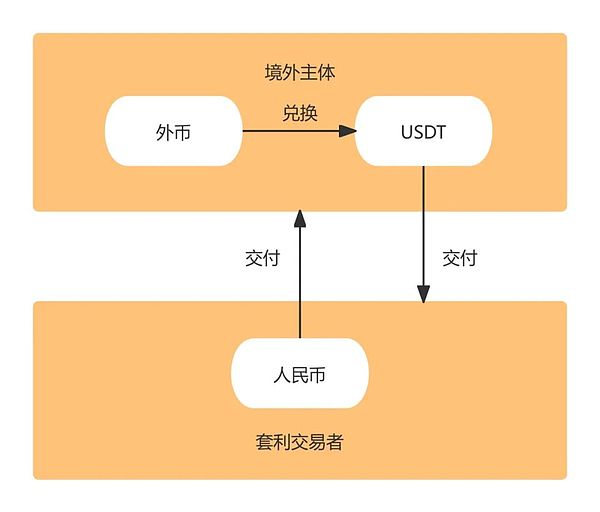

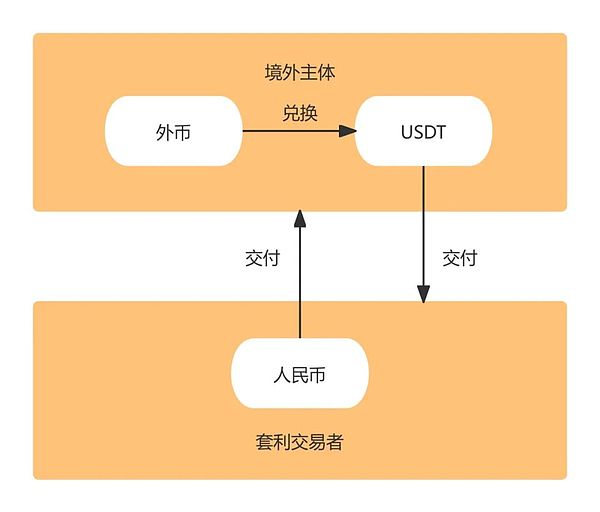

Knowing that the other party’s virtual currency such as USDT used for transactions was purchased with foreign currency, but still providing RMB for exchange, or knowing that the other party’s virtual currency such as USDT used for transactions was purchased with RMB, but believing that the other party provides foreign currency for exchange, constitutes illegal foreign exchange arbitrage of the type of receipt and delivery of legal tender.

2. Cross-trading type

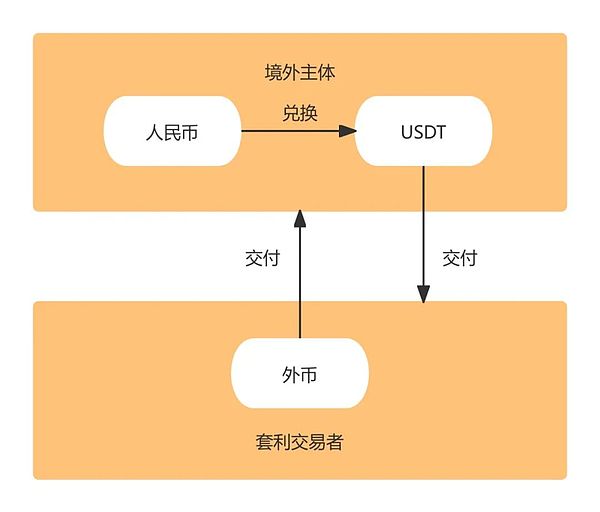

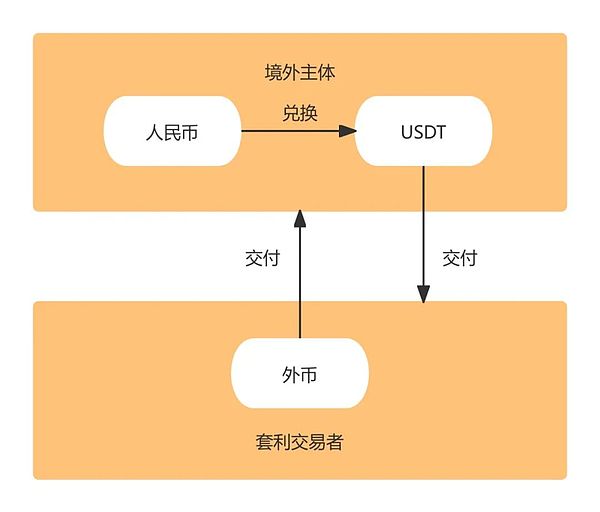

Collecting RMB in the country, transferring foreign currency in overseas accounts to the designated account of the foreign exchange purchaser, and using the collected RMB to purchase virtual currencies such as USDT and convert them into overseas legal tender; or collecting foreign currency in an overseas account, transferring RMB to the designated account of the foreign exchange purchaser, and using the collected foreign currency to purchase virtual currencies such as USDT and converting them back to RMB, constitutes cross-trading type illegal foreign exchange arbitrage. 3. The core difference between ordinary arbitrage and illegal foreign exchange knocking The core difference between arbitrage and foreign exchange knocking is whether the transaction chain involves both RMB and foreign currency. It is not difficult to distinguish between ordinary arbitrage and illegal foreign exchange knocking. First, confirm whether the transaction subject is a virtual currency trading pair normally launched on the exchange. If the transaction subject of the two-way knocking is virtual currency, it is generally not suspected of illegal foreign exchange knocking; secondly, if it involves deposits and withdrawals, it is necessary to determine whether the source of the virtual currency is directly purchased with foreign currency. If the virtual currency purchased with RMB also comes from RMB purchase, it is generally not involved in illegal foreign exchange knocking.

Why does "counter-knocking" constitute the crime of illegal business operation?

Article 225 of the Criminal Law stipulates: Whoever violates state regulations and engages in any of the following illegal business operations, thereby disrupting the market order, shall, if the circumstances are serious, be sentenced to fixed-term imprisonment of not more than five years or criminal detention, and shall be fined not less than one times but not more than five times the illegal gains; if the circumstances are especially serious, he shall be sentenced to fixed-term imprisonment of not less than five years, and shall be fined not less than one times but not more than five times the illegal gains or have his property confiscated: ......

(IV) Other illegal business operations that seriously disrupt the market order.

At the same time, according to the "Explanation on Several Issues Concerning the Application of Laws in Handling Criminal Cases of Illegal Fund Payment and Settlement Business and Illegal Foreign Exchange Trading", if a person violates state regulations and engages in illegal foreign exchange trading such as speculation or disguised foreign exchange trading, disrupting the order of the financial market, and the circumstances are serious, he shall be convicted and punished for the crime of illegal business operation in accordance with the provisions of Article 225, Paragraph 4 of the Criminal Law.

In judicial practice, foreign exchange counter-trading is usually identified as "speculation or disguised foreign exchange trading".

In the "receipt u delivery of legal currency" foreign exchange illegal arbitrage model, the transaction chain is foreign currency-virtual currency-RMB, and virtual currency only plays the role of bridge and medium, which is essentially the exchange of foreign currency and RMB. Subjectively, the perpetrator, with the purpose of profit, knowing that the virtual currency he received was directly purchased with foreign currency, still deliberately bypassed foreign exchange control and provided payment for the other party. Objectively, this large-scale operation behavior undermined the foreign exchange regulatory system, caused a certain degree of damage to financial stability and financial order, and constituted the crime of illegal business operation.

In the "counter-trading type" foreign exchange illegal arbitrage model, the perpetrator provides foreign currency to the foreign exchange buyer and receives local currency, and uses virtual currency to complete the circulation between foreign currency and local currency. The transaction chain of this model is also foreign currency-virtual currency-RMB, and virtual currency only plays the role of bridge and medium, which is essentially the exchange of foreign currency and RMB. Like the "receive and deliver legal currency type" foreign exchange illegal arbitrage, it should also be punished for the crime of illegal business operation.

Real case 1 - Lin's illegal business case:

Lin was originally engaged in ordinary arbitrage in a virtual currency exchange, and later met a Nigerian who called himself "Prince" by chance during a transaction. "Prince" said that the cost of buying and selling foreign exchange in banks or foreign exchange companies was high, and wanted to exchange the local legal currency Naira into RMB through Lin.

The two parties negotiated, and "Prince" used the local legal currency Naira to buy USDT on Binance Exchange, and then transferred it to Lin's account on Binance Exchange. Lin sold the received USDT to domestic currency dealers for RMB, and then transferred the RMB to the bank account in China provided by "Prince". Lin determined the purchase price in advance based on the listing price of Tether on that day, which was 5% lower than the listing price, and then sold it to domestic currency dealers at the listing price to earn the difference.

In just a few months, Lin and others completed more than 650 foreign exchange transactions, involving nearly 30 million yuan in foreign exchange exchange.

Lin's behavior seems to have only two steps of "collecting" and "paying", and Lin only used RMB as the currency for buying and selling U, but he subjectively helped others to illegally exchange foreign exchange, circumvented the state's foreign exchange control, undermined the state's foreign exchange supervision system, and disrupted the normal financial market order. His behavior was a disguised foreign exchange transaction. He was eventually sentenced to five years in prison and fined for the crime of illegal business operations.

Real case 2 - Illegal business case of Zhao and others:

In this case, Zhao and others used the cryptocurrency USDT as a medium for counter-trading foreign currencies, received dirhams in cash in Dubai, paid RMB to the domestic account provided by the other party, and used dirhams to buy Tether, while letting the domestic gang sell Tether in exchange for RMB. In this way, they not only realized the circulation of funds, but also earned huge profits through the exchange rate difference.

This "counter-trading" illegal exchange, using virtual currency as a medium, realized the one-way flow of two currencies, which objectively increased the difficulty of police investigation and evidence collection. However, this operation achieved a decrease in the amount of the two currencies in the total accounts of Zhao and others, bypassed foreign exchange supervision, disrupted the normal order of the financial market, and was a disguised illegal exchange of foreign exchange.

Finally, the main members of the case were sentenced to seven to eleven years in prison for illegal business operations and fined between 2 million and 20 million yuan.

Which behaviors of brick-moving arbitrage may violate criminal legal risks?

Combined with the above analysis, I believe everyone can have their own opinions on the criminal legal risks of "foreign exchange counter-trading" involved in brick-moving arbitrage. In principle, if the behavior of brick-moving arbitrage comes purely from the exchange rate difference between virtual currencies and does not involve any legal currency, it does not constitute the criminal risk of illegal business operation. However, in practice, there are still some brick-moving arbitrage behaviors, and the transaction chain is long and complicated. For those who have not conducted in-depth research, it is not clear whether legal currency transactions are carried out in which link. For example, the following brick-moving arbitrage behaviors have a high criminal risk:

1. Indirect capital closed loop:

2. Abuse of structured tools:Use DeFi protocols, cross-chain bridges and other tools to split the transaction chain and cover up the essence of the final flow of funds to legal currency exchange;

3. Concealed knock-on transactions:The two parties to the transaction conduct currency-to-currency transactions on the surface, but privately agree to settle legal currency earnings with the difference in domestic and foreign exchange rates.

Therefore, for the arbitrage behavior that you do not understand, you should not try to make quick success and quick profit, otherwise you may put yourself at risk.

Explore the possibility of technological innovation within the compliance framework

The compliance of virtual currency transactions is not "black or white", but requires a dynamic balance between regulatory logic and technical characteristics. For practitioners, strictly adhering to the bottom line of "not touching the closed loop of legal currency exchange" and building a verifiable full-process compliance chain through a professional legal team can achieve the coexistence of business security and innovative value.

Miyuki

Miyuki