Cointelegraph recently reported on the strategic cooperation between Web3 banking protocol Fiat24 and Safepal DApp wallet: Fiat24 launched an in-DApp Web3 banking gateway and virtual encrypted payment Visa card for Safepal DApp wallet. To enhance the usability of DApp wallet and further open up the interaction with the real world.

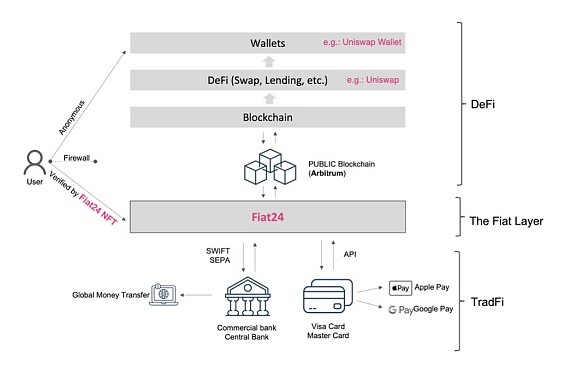

1. After moving the banking business logic to the chain, the protocol layer can be seamlessly connected with DApp/DeFi;

2. Bring U-based Web3 on-chain banking services to users;

3. For DApp/DeFi Bringing innovative logic to fiat currency business.

This article will first introduce the strategic cooperation between Fiat24 and Safepal, and then further explain how the Web3 banking protocol opens up the infinite imagination of the DeFi Lego game.

(Singaporean fintech launches USDC-powered Visa card with Swiss bank Fiat24)

1. Seamless grafting of Safepal DApp wallet

On March 8, the Safepal DApp wallet strategically invested by Binance Labs has connected to Fiat24 as its default legal currency protocol layer. Users of the Safepal wallet can create a Fiat24 on-chain bank account on Arbitrum through the in-DApp's Web3 online banking portal to achieve :

1. U-based on-chain banking services, accounts are self-hosted, and all related transactions are recorded securely and transparently on the chain;

2. Deposits and withdrawals between the crypto asset Crypto in the wallet and the fiat currency Fiat;

3. Fiat24 on-chain bank Fiat currency transfers and remittances between accounts and physical bank accounts, and Euro/USD fiat currency swaps;

4. After accessing the virtual encryption payment Visa card, use crypto assets to Seamless consumer payments in the real world.

(https://www.safepal.com/en/bank)

Safepal founder & CEO Veronica Wong said: "After creating a Fiat24 on-chain bank account in SafePal's wallet, users can exchange any crypto assets in the wallet into USDC and deposit them into the Fiat24 on-chain bank account for virtual encrypted payments. Visa cards can also be linked to third-party payments such as Paypal, Google Pay, Apple Pay, and Samsung Pay to enhance user payment convenience."

2. Web3 Banking Agreement Fiat24

Fiat24 is a Swiss financial A financial technology company licensed by the Market Supervision Authority (FINMA), it launched the First Web3 banking protocol that completely structures banking logic on a public blockchain (Arbitrum) and is completely driven by smart contracts, create an on-chain bank account for users, and provide a series of Web3 banking services such as deposits and withdrawals, encrypted consumption payments, savings, transfers, and currency exchange.

(Temperature Check - [Issue a Visa Card with Uniswap Logo ])

You can think of Fiat24 as the legal currency protocol layer (Additional Fiat Layer for DApps) of DApp/DeFi. At the legal currency protocol layer, Fiat24 creates an on-chain bank account (Cash Account) for users who pass KYC. On the one hand, this account can integrate Web3 payment services. For example, users can directly access and withdraw money through on-chain bank accounts. gold payment and encrypted consumer payment; on the other hand, relying on the financial technology license, the bank account on the chain can be directly connected to the Swiss National Bank, the European Central Bank and the VISA payment network, enabling legal currency savings, exchange, and merchant settlement. and other traditional banking services.

Fiat24 moves the bank’s core operating logic (Core Banking System) to the chain, which is a perfect practice of Fintech’s blockchain innovation , which integrates the decentralized ledger technology of blockchain to the greatest extent, enhances convenience while also enhancing security and avoiding the risk of single point of failure.

What is even more commendable is that this innovative approach has been recognized by Swiss supervision. Swiss supervision is based on Technology Neutral supervision principles to ensure that Fintech companies meet the business fundamentals. Bold technological innovation is carried out on the premise of functionality. As a result, Fiat24, on the one hand, realizes bank accounting through blockchain, and on the other hand, uses NFT to realize KYC of user identities on the chain to meet anti-money laundering requirements.

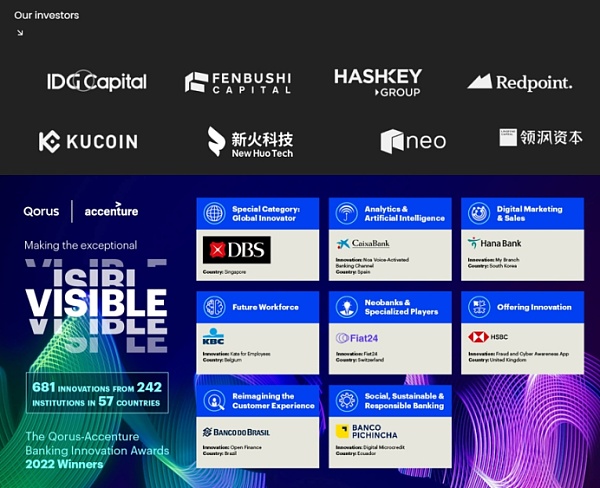

Fiat24’s blockchain banking architecture seamlessly integrates traditional bank financial services and Web3 blockchain innovation, and has won the favor of many top capitals. Received the honor of 2022 Best Neobanks (Neobanks & Specialized Players) by Qorus and Accenture.

(Qorusand Accenture Announce Winners of 2022 Banking Innovation Awards)

3. Bring innovative logic of legal currency business to DApp/DeFi

Fiat24’s previous innovation was to put bank logic on the blockchain, which was recognized by Swiss regulators. After this, Fiat24’s innovation lies in opening new legal currency business logic for DApp/DeFi.

Due to the restrictions of the Fintech license, Fiat24 is not able to carry out lending business and can only engage in savings and payment businesses. However, these limitations bring huge advantages to Fiat24, which adopts Web3 banking architecture:

A. Global card issuance payment based on Debit Card. Credit Card is essentially a lending business. Due to the restrictions of the Fiat24 license, it cannot develop its business, and there is huge pressure for default collection, so it is generally limited to a fixed geographical area. The Debit Card for recharge payment can realize card issuance and payment on the global network, and there is no default problem.

For those who want to put crypto assets into daily use, Fiat24’s revolutionary ability to provide deposits, withdrawals and crypto payment solutions for DApp/DeFi It is an innovation to the traditional payment system.

B. Seamless integration of DApp/DeFi. Due to license restrictions, it is impossible to carry out lending business, but this does not prevent the Fiat24 banking protocol itself (Fiat Layer Protocol) from being directly and freely grafted on DApp/DeFi, and realizing the lending business on the chain through DeFi smart contracts.

The key point here is that as a protocol, it can bring the business logic of legal currency to DeFi. Take the most common financial activities as an example:

1. Collateral lending: Bob provides the crypto asset ETH as collateral to borrow stablecoins on the DeFi platform , the DeFi protocol can directly call the Fiat24 banking protocol to lend USD legal currency;

2. Investment/pledge to earn interest: Alice provides the encrypted asset ETH for pledging to earn interest, The DeFi protocol can directly call the Fiat24 banking protocol to issue interest-bearing assets in French currency. Can this really win?

3. Investment and financial management: Will provides the encrypted asset ETH to directly invest in the tokenized security Coinbase of the DeFi protocol. Then the DeFi protocol can directly call the Fiat24 banking protocol and use legal currency. Go to Nasdaq and buy stocks.

(X@Fiat24)

Add the logic of legal currency DeFi has a lot of room for imagination! Similarly, as the protocol itself (Fiat Layer Protocol), the ability to be directly and freely grafted onto DApp/DeFi can also help Fiat24 smoothly connect to the Blockchain Network and bring huge ecological value.

Just imagine how many contracts need to be signed, how many department discussions need to go through, and how many contracts need to be signed for the centralized Metamask wallet to access the centralized deposit and withdrawal Moonpay. How many leaders signed? Imagine again, how does the centralized deposit and withdrawal Moonpay sign a contract with the decentralized DeFi protocol? The DeFi protocol has no legal entity and no official seal at all.

There is no obstacle or friction between Fiat24 Banking Protocol and DeFi Protocol, just by one Click!

We are not legally bound. Instead, we make Lego games together through smart contracts. This is the essence of Web3.

Four. Write at the end

There are now two waves of people doing Web3 Banking/Payment business. One wave is traditional cross-border payment people. They still follow the traditional cross-border payment method. The idea is that Crypto just has one more currency. They make money through channel fees and membership fees and subscription fees, and they are doing cash flow business; the other wave is the people of Web3 Native, who are not very good at thinking about cash flow business. , but will directly use blockchain to transform the old system, release new vitality, embrace the community ecology, do some Blockchain Network things, and do ecological business.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Beincrypto

Beincrypto Coinlive

Coinlive  Coinlive

Coinlive  Others

Others Coinlive

Coinlive  Coinlive

Coinlive  Coinlive

Coinlive  Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist