Author: Mario Kan Web3

Foreword

We have just experienced the fastest encryption cycle in history. It only took less than two quarters to go from a bear market to an extreme bull market. At that time, the price of BTC quickly rose from less than 30,000 US dollars to a record high. The core driving force of this process naturally came from the passage of a large number of BTC ETFs under the macroeconomic background of the Fed's tightening cycle that was about to end, which injected new energy into the market. of large amounts of funds. In the process of this great speculation, the Web3 world has also quietly changed. On the one hand, new narratives are emerging one after another, from Ordinal to BTC Layer2 to Restaking, creating one wealth myth after another. On the other hand, the Web3 project is the most typical The genes of Web3 are also quietly changing, which is also the topic we want to explore in depth today, that is, the mysterious flywheel that the Web3 project is proud of, which seems to be undergoing a transformation from Tokenomics to Pointomics. From my perspective, this doesn’t seem so wonderful!

First of all, let me explain this topic. The so-called Tokenomics refers to the combination of "Token" and "Economics", that is, the issuance of an on-chain Token as the core subject matter and is built around this subject matter. An economic model usually has the following three core purposes:

1. Promote the growth of the project by giving certain token incentives to user behaviors that are beneficial to the development of the project;

< p>2. Solve the financing needs of the project party through the design of the Token issuance ratio;

3. Grant certain governance rights to the Token to achieve a relatively decentralized user and project co-governance management mechanism< /p>

The success or failure of most Web3 projects usually depends on whether the first core purpose can be achieved. A good Tokenomics design can usually achieve a long-term, relatively stable effect on the core behavioral incentives of the project. And the cost for the project party to maintain this effect is low. For the best among them, we usually think that it has a flywheel with positive feedback capability, which absorbs the energy of development through continuous operation and achieves a cold start of the project.

Pointomics is a word named by the author. Its definition is an economic model with Loyalty Point as the core incentive subject matter. It emphasizes the incentives for users’ key behaviors to promote the growth of the protocol. Its design paradigm is usually similar to The design of the user incentive part in Tokenomics is similar, but the subject matter around the incentive mechanism is changed from a Token on the chain to a Point number (commonly called Loyalty Point) that exists in the project party's centralized server.

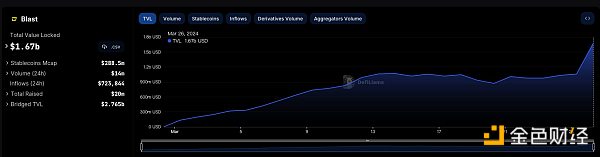

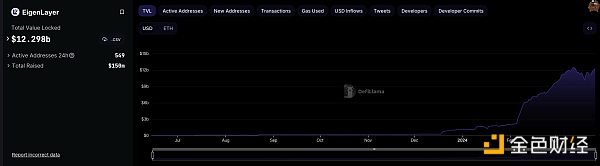

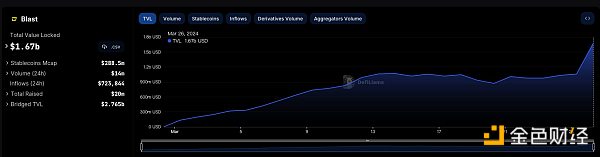

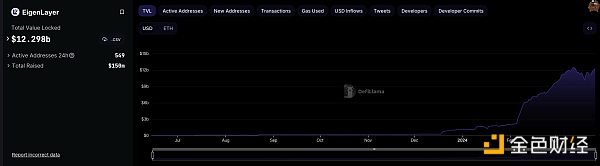

In the recent period, it is not difficult to find that most of the recent star Web3 projects have chosen to use Pointomics instead of Tokenomics during the project launch process, and these projects usually have good data performance. We can easily select some representative project data to illustrate this trend, taking our most popular Ethereum Layer2 project Blast and EigenLayer and EtherFi of the Restaking track as examples. They all chose Loyalty Point as their core flywheel, and the total amount and growth rate of TVL of these projects far exceeded other projects that chose Tokenomics to start.

So can we say that the new flywheel of Web3 has changed from Tokenomics to Pointomics? I think it's too early to make this conclusion.

Pointomics originated from the last resort choice of the project side in the bear market

First of all, it needs to be pointed out that I think using centralized Loyalty Point to replace Token as the core incentive system, which is the so-called Pointomics is not a necessary and sufficient condition for the success of the Web3 project. It comes from the last resort choice of the project side in the bear market.

Let us take a closer look at the difference between Pointomics and Tokenomics, although the purpose they want to achieve is the same. , however, there are actually big differences. The difference is:

1. Fuzzy rights and interests: Unlike Tokenomics, project parties that use Loyalty Point as the core flywheel usually do not give precise values. Commitment, and will only choose some vague soft commitments, such as there may be expected airdrops, which may correspond to certain boosting effects, etc. This is unusual in projects that choose Tokenomics as the core flywheel, because the subject matter of the reward It has been publicly circulated at the beginning. When the value is priced by the market through transactions, its speculative returns have been quantified, which has reference value for user participation.

2. Opaque incentive mechanism: A considerable number of project parties do not even provide precise explanations of Loyalty Point’s incentive mechanism. Since Loyalty Point exists in a centralized server, its incentive mechanism is a In a black box, users can only see a number but cannot know the reason and calculation process for obtaining the number, so it is difficult to explore whether it is fair and accurate. In Tokenomics, the incentive mechanism is implemented through smart contracts, which ensures that users have the ability to self-check under any circumstances and ensures the openness and transparency of the entire reward process.

3. The income is not negotiable: When users obtain Loyalty Points, they are usually not tradable. In order to realize the income, they can only wait until the project party actively fulfills its soft promises. However, this process is usually long and full of variable. In Tokenomics, user rewards are issued in the form of Tokens, which gives users the ability to vote with their feet and allows users to cash in their earnings directly through transactions. This, in turn, creates certain requirements for the project side to work hard to optimize the project to retain users.

This doesn’t look good, so why is this happening? I think it stems from the project side’s last resort choice in order to reduce project operating costs during the bear market. Going back to a year ago, Blur and Friend.tech was a phenomenal project at the time. Blur was an NFT exchange and Friend.tech was a decentralized social media platform. The difference For most projects at that time, both chose to use centralized points as the subject matter to encourage users to use their products, and achieved good results at the time. I think they basically shaped the current basic paradigm of Pointomics.

On the one hand, the reason for its success is due to the success of project operation and design. On the other hand, I think it is mainly due to the fact that the encryption market was still at the end of the bear market at that time, market liquidity and user purchases. Willingness is at a relatively low stage. If you rashly choose to distribute Tokens as incentives, you will face greater market pressure. The cost of maintaining the rate of return of project incentives is relatively large. Choosing Pointomics can effectively reduce this. One cost, because in the cold start stage, the project side does not have the pressure of market value management, and the benefits need to be cashed out after the startup is successful. This reduces the project side’s operating costs in the early stages of the project to a certain extent, but this will damage user benefits. To a certain extent, this comes at the expense of reducing user willingness to participate. When the market fast-forwarded to a new bull market cycle, users' willingness to participate in projects and purchase Tokens were restored. At this time, due to the existence of market inertia, users had a certain tolerance for Pointomics, which also made its recent The performance is good on the surface, but it would be a bit crude to blindly adopt Pointomics as a necessary and sufficient condition for the success of the Web3 project. When the market is flooded with a large number of unredeemed hidden centralized Points, tired users will come back to bite the crypto world.

The intrinsic value of Loyalty Point is the credit of the project party

Next we need to discuss what is the key to a successful Pointomics design, or what is the intrinsic value of Loyalty Point. I I think the answer is the credit of the project party. Based on the above sharing, we know that projects that choose Pointomics usually do not give a clear right to their Loyalty Point, but only use some vague descriptions to perfunctory the matter. This can certainly bring more initiative to the project side, and the final equity exchange method can be dynamically adjusted depending on the operating status of the project, thereby maintaining a more appropriate relationship between cost and effect.

In this case, the reason why users still maintain their enthusiasm for the illusory Loyalty Point lies in their trust that the project party will allocate appropriate rewards to Points in the future, and the strength of trust determines It determines whether the project’s Pointomics has successfully stimulated users’ enthusiasm for participation. However, this is usually strongly related to the background of the project. A team that has obtained luxurious VC investment, strong support from a certain ecosystem or has a strong background will have a stronger sense of trust, and for those degen, community-driven projects This is usually difficult to have at the beginning of a project, which explains that projects that choose Pointomics and achieve success are usually some large Web3 oligarchs. You can easily find such examples, especially in the Restaking track. in this way.

Therefore, I think that compared to using Token directly as the incentive subject matter, the trust cost of choosing Pointomics is higher and more suitable for monopoly projects. However, this also provides more opportunities for these oligarchs to exploit users by using their scale advantages. For convenient tools and conditions;

Web3 oligarchs exploit users through Loyalty Point in exchange for initiative, but abandon network effects

So in what aspects does this exploitation of Web3 users specifically manifest? There are three main points:

1. Time cost: Since the Web3 oligarchs will actually reward cunning delays in the unknown future, and for most Web3 projects, TVL is an important indicator. , so incentives for financial participation are a common means. For users, they need to participate in the project in some way to earn potential benefits, which also increases the user's time cost, because before the oligarchs actually publicly promise that the benefits will be realized, you will not be able to There is no expectation for him to continue, and the increasing time cost makes it more difficult for users to make a decision to quit.

2. Opportunity cost: We know the importance of liquidity in the bull market, because the market has never lacked hot spots, and it is relatively easy to capture Alpha returns. However, the funds locked in order to obtain potential benefits will cause users to face a large opportunity cost. Just imagine, you could have used your 10 ETH to participate in project A and get 15% APY in real time, but you chose to participate in project B. Earn Points and hope for a potential return, only to find out when the return is announced in the future that the return is only 1%. Not long ago, such a tragedy was happening in the EtherFi community, another star project.

3. High risk and low potential benefit: Projects are often fragile at the beginning. This is especially true in the Web3 field. We have seen too many star projects achieve high results in a short period of time. TVL, however, eventually lost funds due to certain smart contract vulnerabilities or operational errors, and these errors were ultimately paid for by early participating users. Therefore these users often face higher risks than participating in a mature project. However, due to the initiative Pointomics brings to the project side, it can easily abandon its early participating users after the project is successfully launched and runs smoothly, because they have lost value and become a burden. If the project does not launch successfully, In order to save costs, projects will also choose to reduce actual benefits as much as possible. The process therefore becomes a dangerous game for users with high risks and low potential returns.

But is this kind of exploitation perfect for the project? The answer is also no. Because the project ignores network effects in the process. We know that the core values of the Web3 world are decentralization, co-governance, and openness. Using the blockchain to switch the originally closed database to an open and transparent open platform, and using a fair incentive mechanism (usually Token) to fully leverage the power of the community to build together, many miracles have been created, and the key to these lies in the network effect. However, choosing a centralized Loyalty Point will close the entire incentive system, which has to be said to be a step backwards and a neglect of network effects. I can conclude that if projects using Pointomics cannot successfully complete the switch to Tokenomics, In other words, if this process cannot satisfy users, they will not be able to have a vibrant community, let alone a hopeful ecosystem. This has to be said to be a greater loss.

Giving liquidity to the Loyalty Point of the Web3 project is crucial and unstoppable

So haven’t things changed? I think the crypto community has noticed this phenomenon and taken action. The reason is that the centralized nature of Loyalty Point has caused it to lose its liquidity and transparency, thus causing users to become passive. So in some ways, Loyalty Point Giving liquidity is fun. And it is different from the Loyalty Point Plan of most Web2 projects. Since most of the key user behaviors of Web3 projects are on-chain behaviors, these data are open and transparent. Therefore, it is also possible to transfer off-chain Points through some kind of on-chain agent. On-chain brings possibilities that are difficult to achieve in the Web2 world.

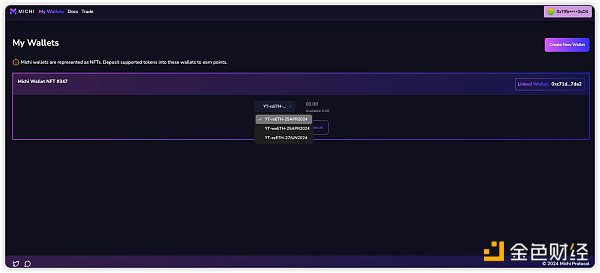

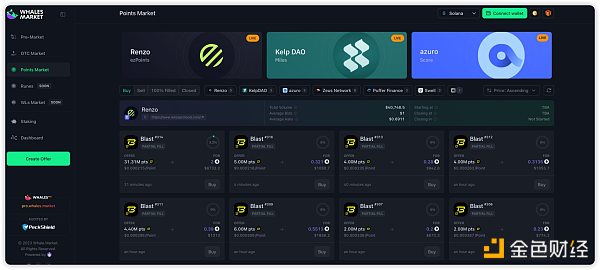

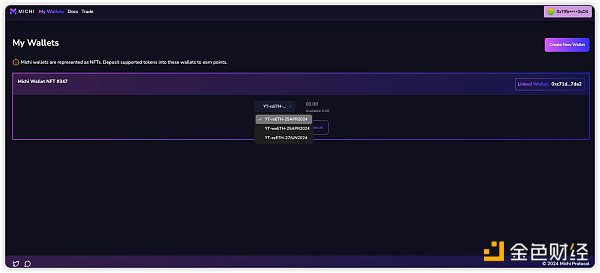

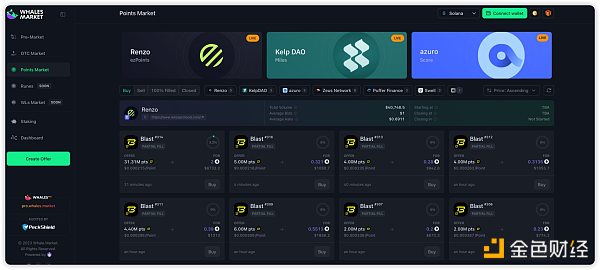

We have seen some interesting projects trying to solve this problem, such as WhaleMarkets, Michi Protocol and Depoint SubDAO, among which we have seen a lot of focus on WhaleMarkets’ Point Market At the same time, Michi Protocol won the ETH Denver Hackathon reward for the transactions in the Point profit account, which shows that the pain point is indeed established and has relatively large market potential. To sum up, these projects are generally divided into two core ideas:

1. By creating an on-chain agent or on-chain wallet, and converting this on-chain agent to NFT, thereby realizing on-chain encapsulation of all income rights of this account, and purchasing the ownership of an on-chain agent , the user can obtain all future rights and interests of the account, and the seller can also discount his future income in advance and lock in profits, thus reducing his time cost and opportunity cost. Such as WhaleMarkets and Michi Protocol. However, this method has certain limitations. Since NFT is a carrier with poor liquidity, it cannot form an effective secondary market. Moreover, there are no very successful cases of financial innovation surrounding NFT, so the relative network effect potential is also limited. relatively low.

1. By creating an on-chain agent or on-chain wallet, and converting this on-chain agent to NFT, thereby realizing on-chain encapsulation of all income rights of this account, and purchasing the ownership of an on-chain agent , the user can obtain all future rights and interests of the account, and the seller can also discount his future income in advance and lock in profits, thus reducing his time cost and opportunity cost. Such as WhaleMarkets and Michi Protocol. However, this method has certain limitations. Since NFT is a carrier with poor liquidity, it cannot form an effective secondary market. Moreover, there are no very successful cases of financial innovation surrounding NFT, so the relative network effect potential is also limited. relatively low.

2. It is the same as the first idea, but by directly tokenizing the Loyalty Point off the chain, issuing the corresponding on-chain ERC-20 Token to directly map the amount of the Loyalty Point, and through certain mechanism design, the value of the Token and the Loyalty Point are Value binding allows users to obtain Tokens, which is equivalent to obtaining the ability to cash in on the corresponding Points in the future. For example, Depoint SubDAO. Compared with the first idea, this method allows the secondary market to have better liquidity and has stronger potential for financial innovation. However, how to solve the value mapping relationship between Loyalty Point and Token is more difficult. is the key. Although the key user behaviors motivated by Pointomics in most Web3 projects are usually on-chain behaviors, it does not rule out that many off-chain operations, such as following X, etc., enter the community, which brings certain limitations to the coverage of value mapping. challenge.

In summary As mentioned, I think it’s time for Web3 Degens to pay attention to this kind of exploitation. Through unremitting efforts, we have regained ownership of the network and avoided the ruthless monitoring and exploitation of Web2 oligarchs. Don’t abandon Web3 and lead to it. The root of pride.

Brian

Brian

1. By creating an on-chain agent or on-chain wallet, and converting this on-chain agent to NFT, thereby realizing on-chain encapsulation of all income rights of this account, and purchasing the ownership of an on-chain agent , the user can obtain all future rights and interests of the account, and the seller can also discount his future income in advance and lock in profits, thus reducing his time cost and opportunity cost. Such as WhaleMarkets and Michi Protocol. However, this method has certain limitations. Since NFT is a carrier with poor liquidity, it cannot form an effective secondary market. Moreover, there are no very successful cases of financial innovation surrounding NFT, so the relative network effect potential is also limited. relatively low.

1. By creating an on-chain agent or on-chain wallet, and converting this on-chain agent to NFT, thereby realizing on-chain encapsulation of all income rights of this account, and purchasing the ownership of an on-chain agent , the user can obtain all future rights and interests of the account, and the seller can also discount his future income in advance and lock in profits, thus reducing his time cost and opportunity cost. Such as WhaleMarkets and Michi Protocol. However, this method has certain limitations. Since NFT is a carrier with poor liquidity, it cannot form an effective secondary market. Moreover, there are no very successful cases of financial innovation surrounding NFT, so the relative network effect potential is also limited. relatively low.