Crypto+AI Web3's last hope?

The meme market seems to be facing a collapse, and the market's anxiety is spreading again. What's the reason? The lack of new narratives, the investors are smart, and all went to blue chip NFT.

JinseFinance

JinseFinance

Source: Web3port Foundation

Web3Port Foundation is a cryptocurrency fund focusing on blockchain and Web3 ecology, committed to promoting the widespread adoption of Web3 technology through strategic investment and incubation of start-ups and projects with innovative potential.

We are currently investigating the Web3 payment track and PayFi track. Through the research on the concepts, payment types and typical cases of the Web3 payment/PayFi track, we understand the overall situation of the track and assist in business investment decisions. The content is only for industry learning and communication purposes and does not constitute any investment reference.

With the expansion of the volume of stablecoins and the expansion of application scenarios, Web3 payment has become a hot track in the crypto market. Web3 payment covers a wide range of business scenarios and categories, including stablecoins, wallets, asset custody, transactions, payments, deposits and withdrawals, credit cards, etc. Traditional financial institutions and Web3 entrepreneurs have built numerous Web3 payment projects and use cases by combining blockchain technology and cryptocurrency.

Traditional payment: Monetary transactions conducted through the traditional financial system, usually involving centralized institutions such as banks, credit card companies, and payment processing companies (such as PayPal, Visa, Mastercard, etc.). The payment process is verified, cleared, and settled by these financial institutions. Traditional payments include cash payments, bank transfers, credit card payments, debit card payments, electronic checks, and electronic wallets.

Web3 payment: Web3 payment is a payment method based on blockchain and cryptocurrency technology. It completes transactions through smart contracts, decentralized applications (DApps), and cryptocurrencies. Web3 payment does not rely on traditional financial institutions, but directly transfers value between users through a decentralized network.

Traditional payment is a payment method based on an account system, and the transfer of value is recorded in the accounts of intermediaries (such as banks and third-party payment companies). Due to the large number of participants, the process of transferring funds is very cumbersome and the friction cost is also very huge, so the cost is high.

Web3 payment is based on the blockchain network infrastructure, allowing cryptocurrencies to be transferred between senders and receivers, which can solve the problems of high fees, low efficiency and high costs in traditional payments.

Specific scenarios of Web3 payment include consumers using encrypted assets to interact on the chain, paying for consumption to enterprises/merchants, cross-border transfers, and encrypted asset payments between enterprises. In summary, there are two main types of Web3 payments:

On Ramp & Off Ramp, which refers to the exchange and payment between cryptocurrency and legal tender. Deposit refers to exchanging fiat currency for cryptocurrency, and withdrawal refers to exchanging cryptocurrency for legal tender.

Cryptocurrency payments include 2 types:

On-chain native payments: **refers to the use of cryptocurrency to participate in transactions in Web3 native scenarios, such as using cryptocurrency to purchase NFTs, LaunchPad new listings, swaps between different cryptocurrencies, on-chain fees, etc.;

Off-chain entity payments: **refers to the direct use of cryptocurrency to purchase goods or services in the offline real economy, such as using cryptocurrency to pay for offline consumer orders, cross-border transfer transactions, etc.;

Web3 payments connect legal tender and cryptocurrency through deposit and withdrawal payments, and enable encrypted assets to circulate in payment and consumption scenarios through cryptocurrency payments (on-chain/off-chain payments), thereby building a complete closed-loop payment ecosystem.

Based on the needs and types of Web3 payment scenarios, common Web3 payment projects/companies have the following profit methods:

Deposit and withdrawal fees: Users need to pay deposit and withdrawal fees when they deposit and withdraw cryptocurrencies and fiat currencies through third-party payment institutions. Generally, third-party payment institutions charge 0.6% of the transaction amount as a fee. The fee is ultimately paid by consumers/merchants and distributed to payment participants (third-party payment institutions, aggregators, issuing banks and international card organizations).

Access service fees. This scenario involves the aggregation of payment and settlement networks, that is, connecting existing third-party payment products to their own product systems as one of the underlying payment channels to broaden the ability to transfer funds, and providing Web3 payment settlement services to merchants and institutions, and charging access service fees in the process.

Blockchain Gas Network Fee: When using Web3 payment, the final result of the payment needs to be confirmed and processed on the chain, which generates the blockchain network Gas fee.

Foreign exchange spread. Only cross-border payment products are involved. As a payment channel for the transfer of funds in different currencies, a fund pool will be generated. At this time, when there is a cross-currency transaction, the bank can be avoided to directly exchange currencies for users, thereby obtaining exchange rate spreads.

Among them, deposit and withdrawal fees and access service fees are one of the main profit methods of Web3 payment projects/companies. These two profit methods rely heavily on network effects (referring to the phenomenon that the value of a product or service increases with the increase in the number of users). The more users and merchants use Web3 payment, the larger the transaction volume generated, and the more revenue can be generated. At the same time, with the increase in the number of users and the expansion of transaction volume, the market share and influence of the Web3 payment network built by the Web3 payment project/company will be greater, further promoting its brand and market influence.

Crypto exchanges: Exchanges generally conduct payment business in the form of issuing credit cards in cooperation with centralized financial systems. Coinbase, Binance, Crypto.com, etc. all launched payment business around 2020, cooperating with Mastercard or Visa to issue cryptocurrency credit cards, supporting users with crypto assets to use credit cards for consumption worldwide.

Independent deposit and withdrawal payment institutions: such as Moonpay, BitPay, Paypal, Stripe, Mastercard, etc., around their main business, gradually open/access Web3 payment business and scenarios, including wallets, custody, payment, transactions and stablecoins, and eventually gradually cover their entire ecosystem to form a logical closed loop.

Web3 aggregation payment platform and Web3 bank: access the interfaces of multiple independent deposit and withdrawal payment institutions to form an aggregation platform, and provide multi-account banking services for Web3 users. For example, Alchemy Pay is a hybrid cryptocurrency payment gateway solution that supports two-way exchange and payment of fiat currency and crypto assets; Fiat24 creates an on-chain bank account for users, providing a series of Web3 banking services such as deposits and withdrawals, encrypted consumer payments, savings, transfers, and currency exchanges.

Cryptocurrency retail terminals: including crypto ATMs (head project Bitcoin Depot) and offline convenience store retail terminals POS (typical project Pallapay)

According to Galaxy Ventures' research, participants in the Web3 payment track can be divided into four categories from the perspective of technology stack:

Alchemy Pay: is a company that provides cryptocurrency and fiat currency payment solutions, aiming to connect the traditional financial system with the world of decentralized finance (DeFi). Alchemy Pay provides merchants and consumers with a hybrid payment gateway that allows them to trade in both cryptocurrencies and fiat currencies, thus simplifying the use and popularization of cryptocurrencies. It plans to expand global crypto payment coverage and has obtained more than 20 regulatory licenses worldwide. It currently has more than 2 million users and supports crypto payments in 180+ countries and regions.

Fiat24: is a fintech company licensed by the Swiss Financial Market Supervisory Authority (FINMA). It has launched a Web3 banking protocol driven by smart contracts to create an on-chain bank account (IBAN+Card) for users, providing a series of Web3 banking services and Crypto services such as deposits and withdrawals, crypto consumer payments, savings, transfers, and currency exchanges.

Helio: A platform focused on cryptocurrency payments and Web3, it provides a set of tools for receiving, processing, and managing cryptocurrency payments. It is the leading Web3 payment platform on Solana, with more than 450,000 unique active wallets and 6,000 merchants. With its Solana Pay plugin, millions of Shopify merchants can now settle payments in cryptocurrencies and convert USDY to other stablecoins such as USDC, EURC, and PYUSD in real time.

Moonpay: is a global cryptocurrency payment infrastructure provider that allows users to purchase cryptocurrencies using credit cards, debit cards, bank transfers, and more. Moonpay is currently the leading project for cryptocurrency deposits and withdrawals, with more than 20 million registered users, supporting crypto payments in more than 160+ countries and regions, supporting the exchange of more than 80 cryptocurrencies and more than 30 legal currencies, holding payment business licenses in most jurisdictions, and has processed more than 6 billion+ transactions.

BitPay: is a cryptocurrency payment processing company founded in 2011 that is dedicated to helping merchants and individuals use Bitcoin and other cryptocurrencies for payments and transactions. BitPay provides a range of services that allow merchants to accept cryptocurrency payments and convert these payments into fiat currencies, helping users to more easily use cryptocurrencies for daily consumption. Currently, BitPay enables merchants to accept payments in 16 different cryptocurrencies from customers in 229 countries and regions, and has processed more than 10 million transactions with a total value of more than $5 billion.

Coinify: is a cryptocurrency exchange and payment processing service provider. Coinify's payment solution allows merchants to let their customers pay with 10 supported cryptocurrencies while getting paid in the fiat currency of their choice. The company operates in more than 180 countries and is serving more than 45,000 merchants.

CoinPayments: Founded in 2013, it is one of the world's leading crypto payment service providers. The company is serving more than 100,000 merchants from more than 190 countries. CoinPayments' payment solution enables merchants to accept payments in more than 175 cryptocurrencies. The company also provides merchants with many tools, including shopping cart plugins, payment buttons, APIs, invoice generators, and sales tools. As of October 2022, the company has processed more than $10 billion worth of crypto payments.

PayPal: In August 2023, the stablecoin "PayPal USD" (PYUSD) pegged to the US dollar will be launched, and the PYUSD stablecoin will be used as a bridge between fiat currency and cryptocurrency for transfers, payments and other businesses.

MetaMask: MetaMask itself does not provide direct fiat currency exchange functions, but through integration with third-party services (such as MoonPay, Wyre, Transak, etc.), users can easily convert between fiat currency and cryptocurrency (deposit and withdrawal operations). Currently, MetaMask Portfolio DApp has aggregated functions such as Sell, Buy, Stake, Dashboard, Bridge and Swap to help users conveniently manage assets and realize unified on-chain asset operations.

Regulatory compliance for Web3 payment tracks mainly requires that projects meet the compliance requirements of licenses, qualifications, and permits before they can carry out Web3 payment business in compliance with the standards.

Regulatory requirements for Web3 payment business vary from country to country, so Web3 payment track projects need to apply for corresponding licenses if they want to carry out related business in certain countries and regions.

Lily Liu, Chairman of the Solana Foundation, proposed the concept of PayFi at the Hong Kong Web3 Carnival:

PayFi is motivated by the original vision of Bitcoin payment. PayFi is not DeFi, but a new financial market built around the Time Value of Money. This on-chain financial market can achieve new financial paradigms and product experiences that traditional finance cannot achieve.

PayFi can be understood as the integration of DeFi + Web3 payment, with the focus on helping users maximize the time value of money. PayFi is suitable for Web3 transactions, off-chain consumption scenarios, retail environments, creator monetization, accounts receivable, payment processing, private credit pools and other scenarios. Through the interoperability, programmability and composability of blockchain, it creates a new paradigm of on-chain finance.

Since 2015, stablecoins have grown exponentially, providing effective payment and settlement for the 2 trillion market value of the crypto market. At present, the overall market value of stablecoins has exceeded $171B, and the market value of Tether USDT has further increased to the current $117.9B on the basis of breaking through $83B in 2022, an increase of 42%, showing a sharp increase in the demand for stablecoins in the crypto market.

In addition to serving as a unit of account in cryptocurrency transactions, stablecoins are also gradually exerting their strength in traditional payment tracks, cross-border financial trade, and other aspects, and are changing the global payment landscape. The PayFi market, which combines stablecoins and Web3 payments, will further expand the demand scenarios for stablecoins and provide financial support for on-chain and off-chain payment applications.

PayFi can:

Bring trillions of offline traditional payment volumes to the chain to better optimize the time value of money.

Provide sustainable risk-adjusted returns: single-digit to double-digit returns.

Rapidly expand scale with extremely low systemic risk and improve asset liquidity.

Rely on the convenience of smart contracts to provide more efficient and rich new financial paradigm applications.

Combining the on-chain DeFi finance and instant settlement capabilities, users can use the real-time income generated by on-chain DeFi finance to pay for instant consumption off-chain.

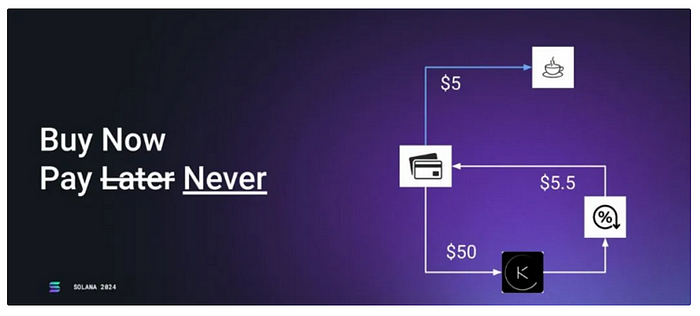

Case: Buy Now Pay Later: A user deposits $50 in the on-chain DeFi protocol and earns an interest of $5.5, which can be used for instant settlement and payment to buy a cup of coffee (without paying).

Combining Web3 and Web2 banking to provide users with digital banking services.

Case: Fiat24 is a financial service platform based on blockchain technology, dedicated to providing users with decentralized digital banking services. Fiat24 establishes a Swiss bank account (Cash Account) for users who have passed KYC. On the one hand, it can integrate Web3 payment services into it, and can realize currency acceptance and Web3 payment; on the other hand, Fiat24's Swiss bank account is directly connected to the Swiss National Bank, the European Central Bank and the VISA/Mastercard payment network, which can realize traditional banking services such as legal currency savings, currency exchange, merchant settlement, etc.

Bring offline RWA assets to the chain to capture the time value of assets and provide more asset investment categories and returns for crypto users.

Case: Ondo Finance is an RWA tokenized U.S. debt protocol dedicated to providing institutional-grade financial products and services to everyone. Ondo Finance tokenizes low-risk, stable interest-bearing, scalable fund products (such as U.S. Treasuries, money market funds, etc.), providing on-chain investors with a way to earn income with stablecoins. USDY (Dollar Yield Token) was launched for non-U.S. users, the world's first permissionless, yield-generating tokenized note backed by U.S. Treasuries. USDY can be used for a variety of use cases, including lending, cash management, payments, etc., while earning income. USDY has also made breakthroughs in Web3 payments. With USDY, users and merchants can now use income-generating assets for payment or settlement, which means that merchants can now earn interest on balances by accepting USDY as a settlement method. More and more projects are starting to use USDY to promote wider adoption of crypto payments.

Use funds borrowed from DeFi to solve financing needs in real payment transaction scenarios and realize on-chain settlement of payment financing income.

Case: Huma Finance is a PayFi network that allows businesses and individuals to borrow against future income by connecting them to global investors on the chain, providing financing and liquidity support for global payments. Its specific use cases include cross-border payment financing, digital asset credit cards, RWA instant settlement, trade financing, DePIN financing, etc.

Use Web3 payment and blockchain DID identity to build an encrypted payment network to adapt to offline payment scenarios.

Case: PolyFlow is a modular decentralized encrypted asset operation protocol with the goal of building a PayFi encrypted payment network. Through modular design, it has launched two key components, Payment ID (PID) and Payment Liquidity Pool (PLP), which can abstract and separate the information flow of payment transactions from the capital flow and extract value from them. PID is a digital identity system used for KYC identification, identity authentication, compliance access, and data confirmation. PLP uses smart contracts to process the capital flow of service providers to achieve capital management and payment settlement. Polyflow incentivizes merchants and liquidity providers by providing nearly risk-free DeFi returns for providing liquidity for payment transactions. This model not only opens up new sources of income, but also encourages a wider range of stakeholders to participate in the DeFi ecosystem and promote the development and popularization of crypto payments.

Use on-chain credit and Web3 payments to transform traditional consumption scenarios.

Case: Blackbird is a Web3-based catering loyalty platform that focuses on the catering industry. It relies on Blackbird Pay (on-chain credit card) and $FLY (on-chain consumption points) to build on-chain payment and loyalty programs, and uses payment business as a lever for growth to drive the development of the entire ecosystem. Currently, 40,056 wallets hold 125,571 Blackbird restaurant membership cards (NFTs), and 142 restaurants have already generated check-in behaviors.

Stream payment is an emerging payment method that allows the transfer of value (usually currency or cryptocurrency) from the payer to the receiver continuously and in real time over a period of time, rather than completing the entire payment at one time. Stream payment is mainly applicable to the billing or payment of continuous services, such as hourly work, network services charged by traffic, content subscription or consumption, continuous contracts and lease payments, etc. In the future, stream payment will have a profound impact on value streams, working capital management, IoT payments, and even the valuation models of large companies.

Case:

Sablier is a token distribution protocol that can create token streams using the Sablier protocol, handle the issuance of token vesting, payroll, airdrops, grants, etc., and the recipient can track and withdraw stream funds at any time. This payment method enables users to make continuous real-time payments in units of seconds, enabling seamless and frictionless transactions and improving the financial flexibility of users, businesses and other entities. Sablier uses the passage of time itself as a trust constraint mechanism, unlocking previously unavailable business opportunities.

Zebec is a decentralized infrastructure network that aims to create a future where real-world value flows freely and seamlessly, giving individuals, businesses, investors, and teams instant access to funds and tokens; providing instant financial control and promoting a more inclusive and accessible financial environment. Zebec's integrated products include RWA payments (real-time payroll and cross-border remittances), on-chain payment infrastructure (Zebec Cards), and networked DePIN (PoS retail equipment that provides merchants and consumers with convenient, immediate, all-in-one crypto payment processing solutions).

Reference articles:

1. Web3 payment research report: The full-scale attack of industry giants is expected to change the existing encryption market landscape

https://mp.weixin.qq.com/s/oWec4gDu8Hqk86aLs3K9Qw

2. Web3 payment research report: From electronic cash, tokenized currency, to the future of PayFi

https://mp.weixin.qq.com/s/gzr9q9kM3j-R0ec7sCb3NQ

3. Panoramic Interpretation and Trend Analysis of Web3 Payment Track|ZONFF Research

https://mp.weixin.qq.com/s/gzr9q9kM3j-R0ec7sCb3NQ

3. Panoramic Interpretation and Trend Analysis of Web3 Payment Track|ZONFF Research

https://mp.weixin.qq.com/s/5QuHqzvTNmG546CeGbt6og

4.Blackbird's Trojan Horse: Turning Crypto consumer companies into payment companies and using payment to leverage the growth flywheel

https://www.web3brand.io/p/web3brand-blackbird-crypto-payment

5.IOSG Weekly Brief | Flow Payment — — A new payment paradigm enabled by blockchain #154

https://mp.weixin.qq.com/s/TOZ48uRmTfRbf17w DxnQew

6. Crypto payment development research |THUBA Research

https://mp.weixin.qq.com/s/_5oQMNT8I1OsW8ZgmkAebg

7.2022 Crypto Payment Track Status: Despite the bear market, the demand for crypto payments is still rising

https://mp.weixin.qq.com/s/xgs1XpHKfaWP_32pZY0wdA

14px;">8.【English long push】A comprehensive view of the crypto payment market: Which trends and innovations are worth paying attention to?

The meme market seems to be facing a collapse, and the market's anxiety is spreading again. What's the reason? The lack of new narratives, the investors are smart, and all went to blue chip NFT.

JinseFinance

JinseFinanceLong-termist seems to be a very unpopular word at the moment, because most people in the circle are pursuing "opportunities to get rich quickly" and "immediate wealth feedback."

JinseFinance

JinseFinanceArtificial Intelligence, Grayscale, Grayscale: Crypto x AI Project Overview How Crypto Can Achieve Decentralized AI Golden Finance, The AI Era Is Coming, Crypto Can Enable AI to Develop Correctly

JinseFinance

JinseFinanceBitcoin's recent price decline, triggered by ETF-related uncertainties, led to a surge in 'buy the dip' sentiment on social media, raising concerns based on historical patterns.

Huang Bo

Huang Bo JinseFinance

JinseFinanceBinance CEO Changpeng Zhao advised investors not to buy crypto given the volatility cause by the FTX collapse.

Beincrypto

BeincryptoChipotle launched a limited time market simulation game 'Buy the Dip' which will give away $200k in crypto. Chipotle Mexican ...

Bitcoinist

BitcoinistPayment company Ripple invested in the non-fungible token (NFT) financing platform Supermojo, according to a press release shared with Bitcoinist. ...

Bitcoinist

Bitcoinist Nulltx

NulltxIt may not happen, but a crash to $27,000 would be the chance for many investors to "go all in" on BTC.

Cointelegraph

Cointelegraph