Implementation of CKB Stablecoin Payment

CKB stablecoin payment is a decentralized stablecoin payment solution based on the CKB network, allowing users to use the joint network of CKB and Bitcoin.

JinseFinance

JinseFinance

Author: Beichen

There are more and more discussions about PayTech. Crypto industry giants such as Solana, Binance, and Coinbase are focusing on Web3 payments. Traditional finance such as Visa, Sequoia Capital, and Temasek are also frequently investing in crypto payments, which gives people a sense of familiarity with what happened at DePIN in early 2023 - all of them are big capitals with influence in the new and old worlds, and the narratives all fall on attracting resources from the real world. In the third world such as Southeast Asia and South America, USDT has even become a better choice than the national legal currency.

Information from various levels and channels all point to the same direction, that is, Web3 payments (PayFi/crypto payments) are blowing. After all, if the global payment market is compared to a dream wedding cake, then as long as a crumb falls from the cake, it will create a 100 billion giant, and this gold rush has just begun.

However, since the concept of Web3 payment includes too many irrelevant things, we need to first clearly define whether it is FinTech (financial technology) based on stablecoins such as USDT that evolved from the traditional financial system, or a payment system based on distributed ledger technology (DLT) that evolved from Bitcoin.

Web3 payment implemented by financial technology only adds stablecoins such as USDT to the original legal currency, and still uses the traditional nested clearing and settlement system. The only value of this type of product lies in stablecoins such as USDT as shadow dollars, otherwise it is no different from supporting Q coins and happy beans.

Web3 payment based on distributed ledger technology is now very convenient for transfers, but high-frequency payments have not yet been achieved. This type of Web3 payment is actually an economic thought that has been brewing for hundreds of years and has been verified in the encryption test field over the past decade. Going in this direction, you will find that a magnificent journey is setting sail at dawn!

1. Web3 payment under the traditional financial technology system

Most Web3 payment products, the so-called Web3, actually refers to stablecoins such as USDT. The product level is still no different from other Web2 payments. They are all applications developed based on the API of a certain link in the traditional payment system, but they support currency types such as USDT. And because alternative currencies are additionally grafted, the channel cost is actually higher than legal currency.

Let's jump out of the complicated jargon in the fields of technology and finance to clarify the true face of the payment system of traditional financial technology, and the quality of Web3 payment will be much clearer.

1.1. Traditional payment system and the evolution of PayTech

First, let’s take the payment scenarios in daily life as an example to analyze the traditional payment processing process. When we check out at a convenience store, we just scan the code with our mobile phone and confirm the payment. However, this action of less than one second is completed by six or seven parties through more than a dozen procedures.

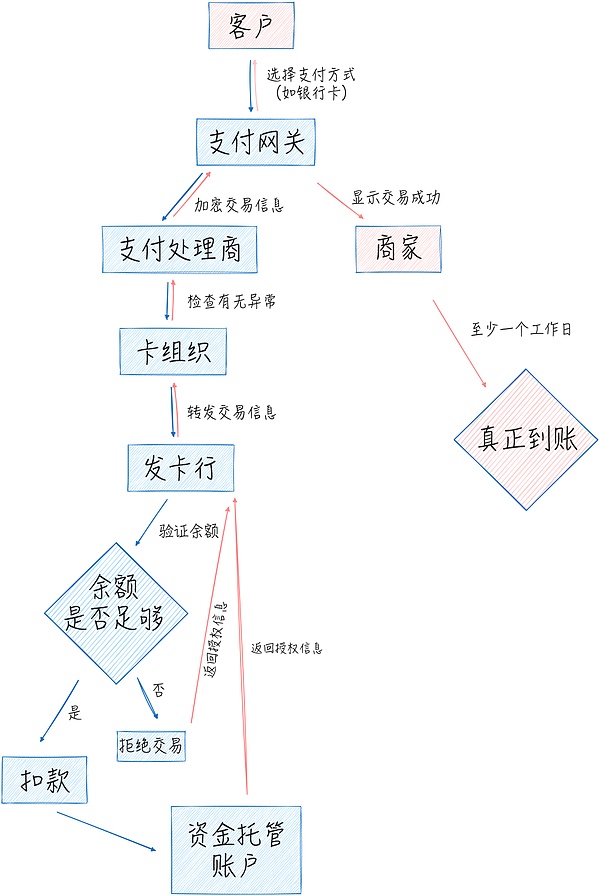

First, the customer will choose a payment method (such as a credit card, debit card, or a digital wallet such as Alipay). After confirmation, the payment gateway will encrypt the information of the transaction and pass it to the payment processor/processor. After checking that there is no abnormality, it will be released and transferred to the card organization (such as Visa, MasterCard). The card organization will then transfer it to the issuing bank where the bank card is located. After verifying whether it is sufficient, the funds will be deducted from the customer's account (but note that there is no direct transfer, but it is first held in trust). Then the information will be returned along the original route, and sent to the merchant through the card organization, payment processor/processor, and payment gateway in turn. The merchant will show that the payment is successful. However, it will take at least one working day for the actual arrival of the account, and the clearing and settlement process is also very complicated, so I will not go into details here.

Such a complex processing process of the modern financial system was gradually established in the era of postal carriages. Fintech companies did not change the system, but started from a certain link in the process and was responsible for accelerating the processing of information, which is the whole value of FinTech. After all, with the accumulation of countless transactions, each link means a huge amount of wealth.

Although banks have been electronic since the 1970s, the idea of FinTech has always been to move the business online to speed up processing. The internal structure and process of the bank have not changed. At most, it has promoted the construction of the middle platform for the purpose of intensification in order to compete with third-party payment companies.

As a cross-bank clearing network, the core business of the card organization is to solve the issuance, settlement and reconciliation of cross-bank transactions. It also began to be electronic in the 1970s, but the business logic is no different from the era of paper bills. FinTech just speeds up the processing speed.

However, card organizations represented by Visa launched payment terminals - POS machines on this basis, which not only quickly occupied the mainstream payment market in the retail industry, but also since then, the payment ecosystem has revolved around payment terminals. For example, a group of hardware manufacturers represented by VeriFone have been created, and the role of payment service providers (PSPs) has been differentiated, and the tasks of payment service providers have been abstracted into payment processors/processors and payment gateways.

If card organizations allow merchants to receive transfers from more banks by establishing a bank network, then PSPs (payment service providers) further allow merchants to receive transfers from more card organizations and other payment channels (such as Paypal later). As for payment processors/processors and payment gateways, they are responsible for transmitting and checking information at different stages.

The FinTechs in the above links are all speeding up the efficiency of information processing, and the entire process is still complicated and lengthy, and of course the cost is also high. For example, the market size of the humble payment processor alone is expected to exceed $190 billion by 2030.

The truly revolutionary FinTech was Paypal in 1998. Users registered an account/digital wallet with an email address, and after recharging, they could bypass the traditional financial system and transfer money losslessly within the platform. Only when withdrawing cash did they have to deal with the bank, which would incur fees. Although Paypal's processing method is no different from the Happy Beans of game companies, it is this simple and crude method that has torn a hole in the traditional financial system, forcing traditional finance to stumble into the era of Internet payment, and the price is that financial technology companies represented by Paypal are constantly facing prosecution and suppression.

Although the payment field after Paypal has been booming in business, such as the rising star Alipay has gradually built a financial service platform that can completely replace banks, and even established a credit system that surpasses the banking system, the progress in FinTech is only micro-innovation such as QR code, and there is no revolution in the mechanism.

1.2. Web3 payment based on financial technology

Now, whether it is a cryptocurrency giant or a traditional payment company, the Web3 payment projects launched are all based on the traditional payment system, but they can still be distinguished and introduced in detail.

1.2.1. Traditional payment companies: treat USDT as happy beans

Traditional payment companies actively enter Web3. Although they also consider acquiring new users, it is still an offensive defense to a large extent, fearing to miss the trend of cryptocurrency. Just like the candidates in the US election competed to express their support for cryptocurrency, they just spent a little effort to win resources for non-core strategic maps.

In fact, traditional payment companies have not changed the traditional financial system in the past, and entering Web3 will not change it either. They just took advantage of their existing market share and added cryptocurrency as an asset class to the many services they provide, which is technically equivalent to adding happy beans.

From banks (such as ZA Bank) to card organizations (such as Visa) to payment service providers (such as PayPal), they claim to embrace crypto, and they do have quite in-depth research, but what they say is not important, what is important is what they actually do. All the businesses can be summarized as allowing consumers to use bank cards to purchase cryptocurrencies, transfer money, and pay, that is, as a "channel for exchange between legal currency and cryptocurrency" to earn exchange fees, which is completely an OTC market. As for technologies such as "making end consumers experience seamlessly", there is nothing strange about it, because happy beans are the same.

The only traditional payment company that can really go a step further in Web3 payment is PayPal, which has issued the US dollar stablecoin PYUSD (PayPal USD) on Ethereum and Solana. PayPal claims to be "using distributed ledger technology (DLT), programmability, smart contracts and tokenization to achieve instant settlement, and be compatible with the most widely used exchanges, wallets and dApps...", because this not only earns the exchange fee between fiat currency and PYUSD, but also prolongs the sedimentation time of funds, which is the same as Binance's original intention of launching BUSD.

PayPal's longer-term goal is to replace bank cards as the main payment channel. Of course, at present, it has neither the basic plate of e-commerce platforms nor the market of offline merchants, and major platforms are also launching their own payment tools (such as Apple Pay), so the chances of trying to return to the peak moment through PYUSD seem small.

Compared to PayPal, which lacks payment scenarios, Square, a payment platform established in 2009, has established a huge merchant payment network offline, and has promoted its own payment tool Cash App through rate discounts and other means, which seems to have a trend of replacing bank cards as the main payment channel. It is worth mentioning that Jack Dorsey, the founder of Square, is also the co-founder and former CTO of Twitter.

Square's formal entry into Web3 is to develop Bitcoin mining machines, but its former employees came out in 2023 to establish Web3 payment company Bridge, and received $58 million in investment from Sequoia Capital, Ribbit, Index and other institutions, and sold it to payment processor Stripe for $1.1 billion in October. What Bridge actually does is to let customers deposit US dollars and euros, create stablecoins, and then use stablecoins to transfer money. If you use stablecoins as happy beans, you will suddenly see the light. Of course, I am not criticizing Bridge. In fact, Bridge has quietly realized the grand narrative promised by Ripple that year.

Similar products include Huiwang, which is said to be a Chengdu team. However, the main reason why it can make a thriving product in Southeast Asia is that there is a relatively large policy space there, and the payment tools for black and gray industries are undoubtedly a very large rigid demand.

The product at the bottom level of payment tools is the currency itself. Now, in addition to USDT and USDC, many stablecoins for specific scenarios have emerged, such as OUSG and USDY launched by Ondo Finance with the support of BlackRock, which are used to invest in short-term US Treasury bonds and bank demand deposits.

In short, Web3 payment of traditional payment companies is equivalent to the technical difficulty of Happy Beans, and the threshold lies in whether you can find your own payment scenario.

1.2.2. Cryptocurrency giants: keen on issuing co-branded bank cards

If traditional finance earns OTC fees by supporting Happy Beans, then cryptocurrency giants do the opposite, earning OTC fees by supporting bank cards. In short, they are working in both directions to open up the channel between bank cards and Happy Beans.

The reason why exchanges such as Coinbase and Binance choose to cooperate with old payment giants such as Visa and MasterCard to issue co-branded encrypted bank cards is certainly to leverage the infrastructure of traditional finance to attract more encrypted assets, and there is another hidden reason, which is to build a brand. After all, as long as the card is issued, it can be claimed to support "exchange and consumption of cryptocurrencies at more than 60 million online and offline merchants worldwide". In fact, it only needs to cooperate with a member bank in the Visa International Organization, or even directly outsource it to a third-party card issuing institution.

There are countless such cases, which are somewhat similar to the period around 2015 when mobile payment was just booming. Many mobile payment startups emerged, with technologies and even licenses that were shelled, but this did not prevent the capital market from favoring this new outlet.

The operating costs of the co-branded cards of cryptocurrency giants are actually quite high. For example, the OneKey Card launched by the hardware wallet OneKey was offline after more than a year of operation. According to the announcement, "There are many challenges here. It is very difficult to balance these factors while achieving low-cost operation of a small team, low handling fees, stable operation of the card segment, anti-black and gray production, and compliance."

Later, PayFi, a concept of new on-chain finance built around sending/receiving settlement, appeared, trying to redefine payment, claiming to "get rid of the constraints of the traditional banking system, allowing users to send cryptocurrencies globally at low costs, and choose to easily withdraw crypto assets to personal custody." But as far as the current solutions are concerned, they are all trying to seize the market of OTC merchants within the framework of the traditional payment system, and their compliance is destined to be no different from the traditional banking system and Happy Beans. The Web3 payment solution that can truly bring about a mechanism revolution in PayTech must be a solution based on distributed ledger technology. 2. Blockchain payment: Blockchain payments within and outside the supervision are two species. Whether it is the central bank's CBDC, private institutions or public chains, when discussing Web3 payments, distributed ledger technology (DLT) cannot be avoided. Even if many of them treat USDT as Happy Beans, at least the Happy Beans here are issued based on DLT.

DLT is essentially a database maintained by multiple nodes, each of which shares and synchronizes the same copy. Blockchain is a type of DLT, but DLT is not necessarily a blockchain. With the impact of blockchain and cryptocurrency triggered by the birth of Bitcoin, DLT is increasingly being used as a new infrastructure to replace traditional centralized entities to transfer funds. Of course, most of them are still in the experimental stage as alternatives.

The biggest advantage of DLT is that it is a peer-to-peer (P2P) network, so the two parties to the transaction no longer need complex intermediaries. Financial transactions can be verified directly through the public ledger to achieve clearing and settlement, and DLT also runs 24/7. Another advantage of payment based on DLT is that the currency is programmable - not only can different currency rules be defined through smart contracts, but more complex functions can be achieved when interacting with other smart contracts.

The above are the common advantages of using DLT for payment, but the problem is that the differences between DLT and DLT are so great that there is even reproductive isolation, such as public chains and consortium chains. Moreover, even if they are all public chains, the confirmation speed and cost structure may vary greatly just by the different types of consensus algorithms (such as PoW and PoS), not to mention payment applications built on different types of DLT.

The industry seems to have ignored these differences and only cares about the speed of TPS and whether it is compliant. However, the market is different from the academic world that relies on peer review (maybe more papers become authoritative), and the development of DLT will ultimately be verified by the market.

2.1. Alliance chain and CBDC are products of collusion

Alliance chain is largely a product of collusion with centralized system - based on DLT technology and strictly controlling access rights. This seemingly decentralized centralized solution can meet regulatory compliance, but it is still a closed system in essence. This is destined to only play a role in reducing costs and increasing efficiency in a certain link in the traditional financial system, and will not change the system itself.

In the most mainstream narrative, central bank digital currency (CBDC) seems to be the end point of Web3 payment. Although CBDC itself is a false proposition, not only in terms of technology, but also from the perspective of currency. Some CBDC solutions are not as good as alliance chain, because it is a centralized database at all, and can only be said to borrow some technical features of DLT, such as multi-node and consensus mechanism. But what is even more ridiculous is that some people, such as Sui, have used the technology of centralized databases to piece together a relational database with a version number, without blocks or chains, but boasted it as an innovation of blockchain.

Therefore, payment applications and CBDC based on alliance chains are only local tool iterations for the clearing and settlement systems within the organization, rather than involving a paradigm revolution in the entire financial system. Moreover, in theory, the effect of these tool iterations directly using centralized databases will be better.

This phenomenon of using new technologies to repeat old businesses is only a special product of the transitional stage. Hong Kong has accumulated many cases in building financial products based on DLT, but it has not brought about a qualitative leap in business at present. So let's focus on those Web3 payments that are truly built on public chains.

2.2. Public chains are imitating alliance chains

Real Web3 payments should be built on public chains, which is also the original vision of Bitcoin and blockchain. Over the years, this idea has been continuously expanded. In July this year, Lily Liu, chairman of the Solana Foundation, formally proposed the concept of PayFi. She defines PayFi as "a new financial primitive built around the time value of money", which is a financial innovation above the settlement layer. DeFi solves transaction problems, while PayFi involves a wider range of economic activities - sending and receiving, such as supply chain finance, payroll loans, credit cards, corporate credit, interbank repurchase and other scenarios, so the market is also larger. Lily Liu believes that the success of PayFi must meet three conditions: fast and low cost, widely used currency, and developers. The final conclusion is that only Solana can perfectly meet them. There is nothing wrong with the previous discussion, but this conclusion will definitely attract opposition from many competitors, such as Ripple.

Ripple officially started PayFi in 2012 (there was no such term at that time), positioning itself as a blockchain that allows global financial institutions to transfer money using XRP. It was once expected to break the monopoly of SWIFT, and was selected as one of the 50 most innovative financial technology companies by Forbes in 2019.

Ripple's Layer1 is XRP Ledger, a blockchain based on federated learning. Strictly speaking, it is a consortium chain, although it claims to be a public chain (it can only be said that it is open source). The initial business was to copy Bitcoin, but faster - allowing everyone to directly use its native asset XRP to transfer money.

The Ripple team holds a large amount of XRP and continues to sell it for profit. It has also repeatedly pulled up the secondary market by releasing repurchase messages and cooperating with market makers to increase trading volume. When they sold XRP, they deliberately blurred the relationship between XRP and Ripple's equity, so they were targeted by the SEC and were embroiled in a dispute for four years. They should be settled in the near future, but this does not hinder the basic fact that XRP is useless. Ripple later realized that no one would use XRP, a volatile air coin, to pay (even Bitcoin is not suitable for retail payments due to its volatility), so it tried to launch a stablecoin RLUSD, build CBDC for various countries, and provide asset tokenization and custody services.

If you only judge based on Ripple's promotional materials, you will think that Ripple has covered more than 80 payment markets around the world and processed more than US$50 billion in transactions by virtue of its ability to complete payments within seconds. But in fact, Ripple's xCurrent for banks only records the information of cross-bank transfers on Ripple's blockchain. The core automatic reconciliation engine technology is actually no different from that of traditional clearing institutions. Metaco, a digital asset custody technology provider acquired by Ripple in 2023, is a business whose value is mainly reflected in licenses and channels. As for using XRP, a volatile air coin, for consumer payments, it is even more of a false proposition.

In a nutshell, Ripple has played the role of a top marketer in the PayFi market.As the crypto companies mentioned earlier, as long as they cooperate with a member bank in the Visa International Organization, they can claim that their products "exchange and consume cryptocurrencies at more than 60 million online and offline merchants worldwide."

In short, almost all public chains emphasize how fast, cheap, and compliant it is when talking about PayFi, but PayFi products based on public chains (such as Huma Finance) still use blockchain as a bookkeeping tool within the traditional payment system.Except for the lack of KYC, what is the difference with the alliance chain?

2.3. Bitcoin Lightning Network and its limitations

So we still have to look at the crypto-native solutions built on the public chain, but they are often limited by the block size and confirmation time of the public chain, so they can only be used as remittance transfers and cannot support high-frequency small payments in daily life. Bitcoin Lightning Network is a good solution.

In simple terms, a payment channel is established under the chain. This channel is equivalent to a multi-signature wallet created by account A and account B. They both recharge the wallet and can transfer money unlimited times (each transfer is essentially to update the wallet balance allocation status and form a new UTXO, that is, unspent transaction output). It will not be verified by the Bitcoin network until the last transfer, that is, when the channel is closed. Therefore, the Lightning Network can achieve high-frequency payments without changing the underlying mechanism of Bitcoin.

At this point, there may be a question, that is, the balance changes in the payment channel are not on the chain, so how to ensure security? The security of the traditional financial system depends on the credit guarantee of the institution, but the Lightning Network ensures the security of the payment channel through cryptographic technologies such as LN-Penalty and HTLC (Hash Time Lock Contract), which will not be described in detail.

It should be noted that the security channel just discussed is one-to-one, but in actual transfers, it is impossible to build a multi-signature wallet with each person separately, so a one-to-many solution, that is, multi-hop routing technology, has emerged. In layman's terms, there is a payment channel between A and B, and there is also a payment channel between B and C. Then A directly transfers to B, and B transfers to C. Account B acts as a relay node, and A and B no longer need to build a separate payment channel. According to the six degrees of separation theory, you can know anyone in the world through six people.

This one-to-many solution requires that the relay user must be online regularly and have sufficient funds, otherwise the transaction may fail. The Lightning Network uses multi-path routing, node redundancy and other technologies to overcome these challenges. But in actual use, this design is too idealistic - assuming that users are willing to lock up a large amount of funds in advance, assuming that users are willing to tolerate various technical limitations, which runs counter to the capital efficiency problem that PayFi originally wanted to solve.

The Lightning Network solution was later expanded from Bitcoin to other public chains. For example, the Fiber Network built on Nervos CKB has Turing-complete smart contract capabilities and is more flexible in asset management, but it still has not escaped the dilemma brought about by the payment channel design.

This leads to a very profound question: Finance is a complex system, and it may be difficult to reshape the entire payment system with only technical innovation. So what kind of design can bring about a systematic paradigm revolution?

3. The end of money is no money

Finance has always existed as a complex system. It is difficult to bring about substantial changes with technology alone, so we need to re-examine this system.

Finance is a tool system developed to serve real transactions, in which money plays the role of a value accounting unit, which has derived extremely complex trading systems, clearing systems, and credit systems. Precisely because we cannot avoid money, to be precise, we cannot avoid legal tender, and more precisely, we cannot avoid the US dollar, so the current Web3 payment track and even the entire crypto market, the highest pursuit is to be included in the economic system of the shadow dollar represented by USDT.

"The great fortune of a man is that he must embark on an extremely difficult road, whether in adulthood or in childhood, but this is the most reliable road; the misfortune of a woman is that she is surrounded by almost irresistible temptations; she is not required to strive for progress, but is only encouraged to slide down to reach bliss. When she finds out that she has been fooled by a mirage, it is too late, and her strength has been exhausted in the failed adventure."

This passage is from "The Second Sex" written by Beauvoir in 1949. I think the "woman" in it can be completely replaced by "crypto". At least the Web3 payment track is running selflessly on this road to bliss. What I want to point out is that it is entirely possible to go down another extremely difficult road, which is deduced from hundreds of years of economic thinking and has been preliminarily verified in the encryption test field over the past decade!

So naturally, some commonly needed and easy-to-store commodities were adopted as general equivalents, entering the commodity currency stage. For example, animal skins, livestock (the word "money" in many languages has etymological relations with livestock), grains, cloth, salt, and decorations such as shells.

Later, with the expansion of the scale of trade, the requirements for portability, durability, divisibility and other characteristics became higher and higher, and the currency began to concentrate on metals, entering the metal currency stage.

However, with the development of the scale of trade, even precious metal currencies are inconvenient for merchants to store and carry in large quantities. They choose to store precious metals in goldsmiths with vaults and guards, and then directly trade in the market with storage bills similar to warehouse receipts. This bill is gradually recognized by law as a quasi-currency.

Since no one would frequently access their stored precious metals, goldsmiths would often over-issue bills, and the value of the bills was based on the credit of the goldsmiths. Later, more professional banks evolved from goldsmiths (most bankers in London in the 18th century were still members of the Goldsmiths' Guild). From then on, based on institutional credit, they directly entered the paper currency stage, and of course, relatively standardized currency issuance and redemption rules were established.

Speaking of Jiaozi, as the earliest paper currency, the background of its issuance in the Southern Song Dynasty was similar, and the subsequent development path was also similar. Private commercial institutions first issued and competed freely, and then were monopolized by the government, with national credit as the endorsement, the issuance right was concentrated in the central bank, and the printed legal tender was forced to circulate (this was extremely bad!).

After entering the stage of national credit currency, the right to issue currency has become part of national sovereignty, and the currency itself has not undergone any greater changes (at most, after the collapse of the Bretton Woods system, it was liberated from the constraints of the gold standard and further released). The next development is about technology.

With the expansion of the scale of trade, paper money (essentially bills) can no longer meet the demand. However, if both parties open accounts in the same bank, they do not actually need to use paper money. The transaction can be completed through pure bookkeeping records such as bank transfers. The bank only needs to perform complex clearing behind the scenes. This clearing can naturally serve transfers between different banks, so a banking network and a banking credit system have gradually been formed, including the credit cards and electronic payments that we are familiar with, which are also within this system. This is why today's financial system is so bloated, which is the result of accumulation in the process of historical evolution and has a very strong path dependence.

Looking back to here, we can find that money is generated by service trade, in order to efficiently match supply and demand, from commodity money to credit money, even national credit money is no exception.

However, national credit money depends on the regulation of the central bank. Regardless of whether the regulation of the central bank is correct, the starting point of the interests of the central bank of each country is inconsistent, so these policies will eventually disrupt the original price structure and guide resources to the wrong direction. The mistakes continue to accumulate until they are finally gathered together and cleared. Therefore, Hayek advocated the denationalization of money, and a free currency movement like the free trade movement in the 19th century was needed to form a new banking system.

Since with the evolution of the exchange mechanism (especially the clearing system), money has evolved from a physical medium of exchange to an abstract unit of account, then can it be further directly completed The exchange of goods and services? After all, the emergence of money is only to overcome the limitations of barter. This is by no means a regression to primitive society. The reason why barter was replaced by currency was because the market at that time was too small and lacked enough coincidence to match the demand.

But with the expansion of market size and the evolution of exchange mechanisms, these can be overcome. In fact, in Argentina in the 1990s, some communities have tried to use internal credit notes as an alternative currency to help vulnerable groups participate in economic activities by bartering, and have achieved phased success (the peak was 6 million people using it), but later because of the flooding of the issuing end, it was like the junk bonds issued by local governments today. The world of crypto directly eliminates the possibility of such a bad ending in technology.

However, I would like to add that the author does not think that currency should be completely eliminated in an extreme way, but believes that currency will no longer be needed as an intermediary for transactions in the future, but a common value reference standard is still needed. After all, the ratio between the vast number of commodities is almost endless. The ideal unit of measurement should not be a fiat currency with unlimited inflation, but it should not be an asset with limited supply such as gold or Bitcoin, because this means that the cost of latecomers must be higher than that of early holders, which will inevitably lead to holders tending to hoard, and ultimately cause unnecessary deflation.

This technology that touches a deeper level of the financial system is the blockchain opened by Bitcoin. As a trustless peer-to-peer value exchange system, it can directly skip the multi-level clearing system in traditional finance (what they do is nothing more than calculating the amount).

Moreover, in the blockchain world, each token means a certain value, ownership, or even access rights, which means that they are naturally a kind of native goods or services on the chain. They can be exchanged through DEX (decentralized exchange), skipping the intermediary of currency to directly calculate the exchange rate, so not only does it not need physical currency, but it does not even need currency at all.

This scheme seems to be a fantasy that Nakamoto came up with from a crack in the stone, but in fact, as early as 1875, British economist and logician William Stanley Jevons deduced the development path of currency in his book "Money and the Mechanism of Exchange", believing that it would enter the stage of barter in the future, and he prophetically predicted at the time that the US dollar was firmly moving towards international currency.

And the cryptographic practice over the past few decades has also verified this conjecture.

Colored Coins allow Bitcoin to represent various digital assets, but due to the functional limitations of Bitcoin, it can only be issued and traded, and still cannot support Turing-complete scripts. So Vitalik Buterin, a core member of the team, started a new project and published the Ethereum white paper "Next Generation Smart Contract and Decentralized Application Platform". From then on, the blockchain with built-in Turing-complete programming language was officially launched, allowing anyone to write smart contracts and decentralized applications.

So far,

Conclusion

In the garden of forked paths of Web3 payment, the converts’ path is bustling with the tricks of happy beans, attracting countless audiences. The rebels’ path is full of thorns, destined to "tread on an extremely difficult path, but it is the most reliable path."

From Jevons to Hayek, liberal economists have foreseen that money will eventually return to a more essential form of exchange. From cyberpunk to crypto-anarchism, creators and cryptographers have shown us this possibility in the testing grounds of the crypto world.

On this difficult but reliable road, we look forward to more like-minded partners joining us, contributing to the technology stack and business scenarios, and pioneering our own paradigm revolution. Welcome to follow and discuss~

CKB stablecoin payment is a decentralized stablecoin payment solution based on the CKB network, allowing users to use the joint network of CKB and Bitcoin.

JinseFinance

JinseFinanceGolden Finance launches "Golden Web3.0 Daily" to provide you with the latest and fastest game, DeFi, DAO, NFT and Metaverse industry news.

JinseFinance

JinseFinanceOrganised by DeFi platform ArrayFi, Bridge Web3 2023 was a three-day conference hosted on Phú Quốc island in Vietnam.

Davin

DavinIt has also collaborated with Poolsuite to launch its flagship shop by offering co-designed Ralph Lauren x Poolsuite NFT.

Beincrypto

BeincryptoTwitter is continuing to develop a new feature that will allow users to give each other “Awards” using “Coins” that can be purchased with fiat currency.

decrypt

decryptAccording to Jess Houlgrave, crypto companies are taking to the stablecoin settlement layer offered by Checkout.

Beincrypto

BeincryptoThe crypto industry has evolved exponentially, dating from the time of its creation till now. As a result, several advantages ...

Bitcoinist

BitcoinistIvan Soto-Wright, the co-founder and CEO of MoonPay said the partnership enhances the tail-end of a user's journey by replacing complex characters with NFT domains.

Cointelegraph

CointelegraphStripe is looking to re-enter the crypto space after exiting the bitcoin market three years ago.

Cointelegraph

CointelegraphTexas' second-fastest-growing city will begin exploring policy capabilities to accept bitcoin as a payment option and integrate other Web3 applications to improve residents' lives.

Cointelegraph

Cointelegraph