Author: Brayden Lindrea, CoinTelegraph; Compiler: Tao Zhu, Golden Finance

Bitcoin trading firms BlackRock and MARA Holdings purchased a total of 9,173 bitcoins, while an unknown whale acquired 600 bitcoins as the price of bitcoin fell to $92,957 on December 5.

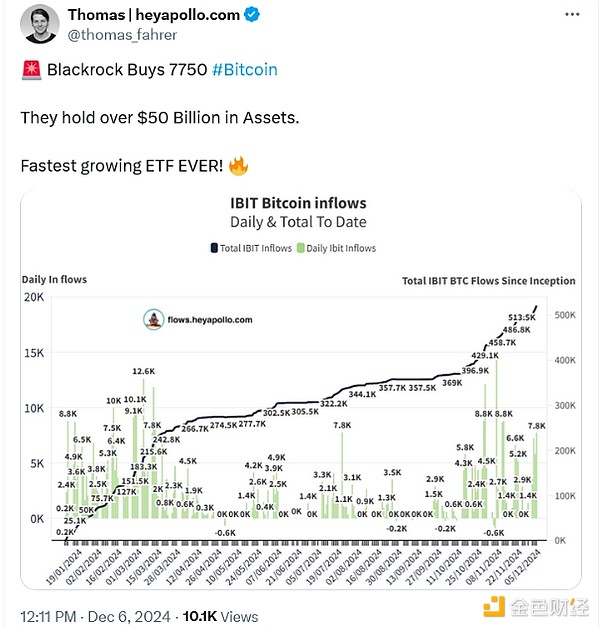

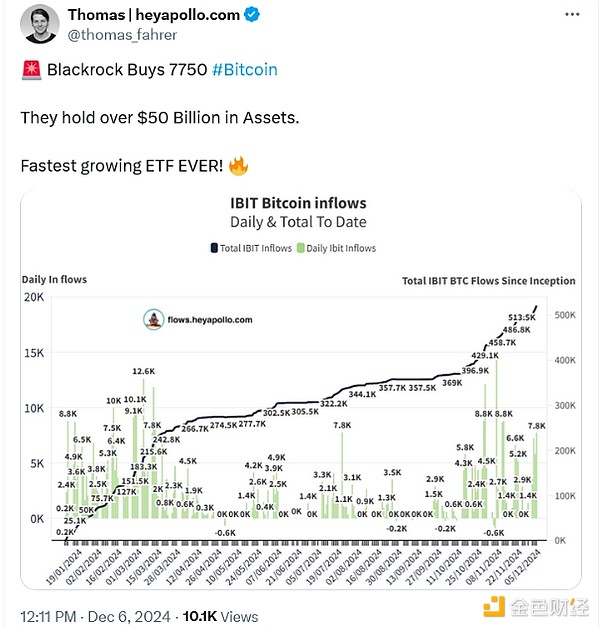

BlackRock bought as many as 7,750 bitcoins as buyers snapped up shares of its spot bitcoin exchange-traded fund, bringing its total bitcoin holdings to $48.9 billion at current prices, according to Arkham data.

“The fastest growing ETF ever,” said Thomas Fahrer, founder of Apollo, a cryptocurrency market firm that tracks the spot bitcoin ETF market.

Source: Thomas Fahrer

Meanwhile, Bitcoin miner MARA Holdings purchased 1,423 bitcoins worth $139.5 million in four transactions between December 5 and 6.

Prior to the Bitcoin purchase, MARA completed a second $850 million convertible note offering, which the company said it would use to accumulate more Bitcoin.

MARA currently holds 22,108 Bitcoins, valued at $2.17 billion, according to Arkham Intelligence. This is a sharp increase of 162% compared to the same period last month.

In the third quarter, MARA shifted to a new fiscal policy of "retaining all" the Bitcoin it mined and employing a range of capital market tools to increase its Bitcoin reserves - similar to MicroStrategy's Bitcoin playbook.

Meanwhile, Lookonchain noted in another X post that an anonymous crypto whale also appeared to take advantage of the Bitcoin price crash on December 5 and bought 600 BTC worth $58.85 million.

Data from BitInfoCharts shows that the whale’s wallet address “bc1pg…u0pk3” held no Bitcoin before the first transaction on November 24.

Just a day earlier, medical technology company Semler Scientific bought 303 Bitcoins at an average price of $96,779 on December 4 - just hours before Bitcoin broke the $100,000 milestone.

The company’s recent purchase brings its holdings to 1,873 bitcoins, valued at $182.8 million.

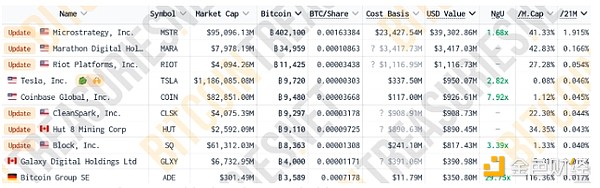

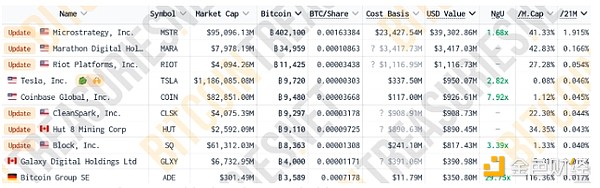

According to data from 67 public companies tracked by Bitcoin Treasury, bitcoin-holding companies like Semler Scientific hold a total of 527,026 bitcoins, or 2.66% of bitcoin’s current supply.

The Ten Largest Publicly Listed Bitcoin Holders. Source: Bitcoin Treasuries

The government holds 2,856 bitcoins, while asset managers and private companies hold 1,253 bitcoins and 410,418 bitcoins, respectively.

JinseFinance

JinseFinance