Author: Dilip Kumar Patairya, CoinTelegraph; Compiler: Baishui, Golden Finance

Bear attacks are when whales deliberately drive down cryptocurrency prices through short selling, panic and uncertainty (FUD), and large-scale sell-offs to cause panic and profit from them.

These attacks can cause market volatility, trigger liquidations, and damage retail investor confidence. However, they can also expose some weak or fraudulent projects.

Signs of bear attacks include sudden price drops, surges in trading volume, lack of news coverage, and rapid price recovery, all of which indicate price manipulation rather than natural market trends.

Traders can guard against bear attacks by setting stop-loss orders, diversifying their portfolios, monitoring whale activity, and trading on reputable and regulated platforms.

In the dynamic world of cryptocurrency trading, not all market volatility is natural; some is engineered for quick profits. Bear raids are one such strategy, often driven by powerful market participants, known as “whales.”

These traders strategically use short selling, which involves borrowing an asset at its current price and selling it, with the goal of buying it back at a lower price after the price drops.

So, how exactly does this strategy work?

This article dives into the concept of bear raids and how they work. It also covers how bear raids affect the cryptocurrency market, their signs, and how retail investors can protect their interests.

What is a bear raid?

A bear raid is a deliberate strategy to drive down the price of an asset, often carried out through aggressive selling and spreading fear, uncertainty, and doubt (FUD). This strategy dates back to the early days of traditional stock markets, when influential traders would collude to manipulate prices for profit.

The execution of a bear attack involves a massive sell-off of a target asset, flooding the market with money. The dramatic increase in supply puts downward pressure on prices. At the same time, the perpetrators spread negative rumors or sentiment, usually through the media, to fuel fear and uncertainty. As panic spreads, small or retail investors tend to sell their holdings, further accelerating price declines.

Bear attacks are different from natural market declines. While both cause prices to fall, bear attacks are carefully planned, purposeful, and designed to benefit those holding short positions. Natural market declines are driven by broader economic trends, market corrections, or legitimate changes in investor sentiment.

Bear attacks are generally considered a form of market manipulation. Regulators are responsible for monitoring trading activity, investigating suspicious patterns, and penalizing fraudulent practices such as pump-and-dump or wash trading. To promote transparency, regulators require exchanges to implement compliance measures, including KYC (know your customer) and AML (anti-money laundering) protocols. By imposing fines, bans or taking legal action, regulators work to maintain fair markets and protect investors.

Regulators try to curb cryptocurrency market manipulation by enforcing strict rules and oversight. In the United States, the Securities and Exchange Commission (SEC) focuses on crypto assets that qualify as securities, while the Commodity Futures Trading Commission (CFTC) regulates commodities and their derivatives. Enforcement in the European Union is the responsibility of the financial regulators of the member states under the Regulation of Markets in Crypto-Assets Act (MiCA).

Who Executes Bear Raids?

In the cryptocurrency world, a “whale” is a large investor who is able to execute a bear raid. Due to their large holdings of cryptocurrencies, whales are able to influence market trends and price movements in ways that smaller retail traders cannot.

Compared to other traders, whales operate on a larger scale, thanks to their access to more capital and more advanced tools.

You may be looking for short-term gains or simply following a trend, but whales often use strategic buying or selling to create price fluctuations that benefit their long-term positions. Their moves are carefully planned and can even affect the market without your knowledge.

If you are an experienced cryptocurrency trader, you may have noticed large-scale transfers of cryptocurrency between wallets. Such large-scale transfers of cryptocurrency have caused panic or fear in the cryptocurrency community. For example, when a "whale" transfers a large amount of Bitcoin to an exchange, it can indicate a potential sell-off, causing the price to fall. Conversely, moving cryptocurrency from an exchange to a self-custodial wallet may indicate long-term holding, which may cause the price to rise.

The relatively low liquidity of the cryptocurrency market gives "whales" influence over cryptocurrency trading. Compared to traditional financial markets, with fewer buyers and sellers, a single large transaction is enough to move prices significantly. This means that "whales" can manipulate market movements intentionally or unintentionally, which often makes it difficult for retail traders to keep up.

Real-world examples of whales profiting from price drops

In the cryptocurrency space, short-selling attacks are often difficult to confirm due to anonymity. However, the following examples of whales profiting from falling cryptocurrency prices will help you understand how such situations work:

Terra Luna Collapse (May 2022)

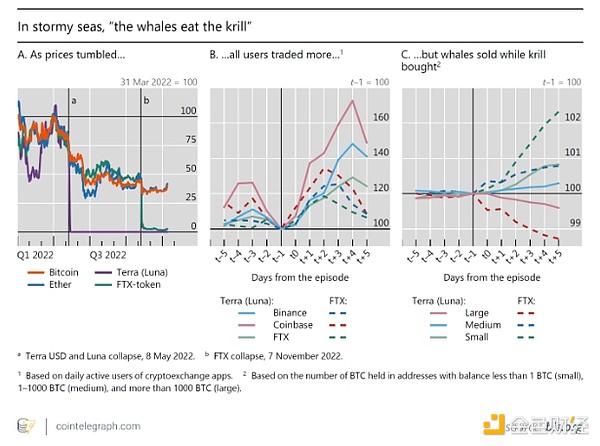

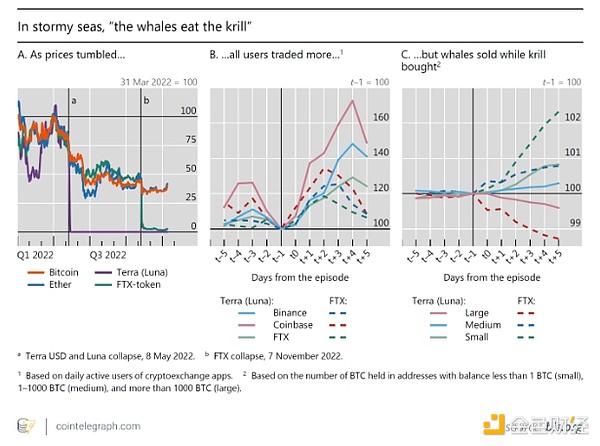

A report from the Bank for International Settlements (BIS) revealed that whales made profits at the expense of retail investors during the 2022 cryptocurrency market crash triggered by the Terra crash. Small retail investors mainly bought cryptocurrencies at lower prices, while whales mainly sold their holdings to profit from the market downturn.

In May 2022, the Terra blockchain was briefly suspended due to the collapse of its algorithmic stablecoin TerraUSD (UST) and its associated cryptocurrency LUNA, causing its market value to evaporate by nearly $45 billion in a week. The company behind Terra filed for bankruptcy on January 21, 2024.

FTX Collapse (November 2022)

In November 2022, the close financial ties between FTX and Alameda Research set off a chain reaction: a bank run, a failed acquisition deal, FTX bankruptcy, and criminal charges against founder Sam Bankman-Fried.

However, as FTX collapsed, retail investors once again flocked to buy. However, according to the same report from the Bank for International Settlements (BIS) discussing the Terra Luna collapse, whales dumped cryptocurrencies in large quantities before the price crashed.

Figure 1.B shows the wealth transfer, with large investors liquidating their holdings, leaving small investors at a disadvantage. In addition, Figure 1.C also shows that after the market shock, large Bitcoin holders (whales) reduced their holdings, while small holders (referred to as "shrimps" in the report) increased their holdings. The price trend shows that whales sold their Bitcoin holdings to "shrimps" before the price fell sharply, thereby making profits at the expense of the "shrimps"' losses.

Bitconnect (BCC) Crash (January 2018)

Bitconnect, a cryptocurrency that promised unusually high returns through so-called trading bots, experienced a brutal crash in early 2018. Although the platform was once valued at over $2.6 billion, it was widely suspected of being a Ponzi scheme.

The token plummeted by more than 90% in a matter of hours. While this was not a typical bear attack, the sudden exit of insiders and whale selling, combined with negative publicity, created a chain reaction that hit retail investors hard.

How Whales Execute Short Attacks in Cryptocurrencies, Key Steps

In the cryptocurrency space, whales can execute short attacks by using their large holdings to cause a price crash and profit from the subsequent panic. These strategies are usually divided into several steps:

Step 1: Accumulate positions:Whales first establish positions that can profit from price declines, such as shorting cryptocurrencies or preparing to buy large quantities after prices fall.

Step 2: Launch a raid:Next, whales trigger a sell-off by selling a large amount of the target crypto asset. The sudden surge in supply can cause a sharp drop in prices and shake market confidence.

Step 3: Spread fear, uncertainty and uncertainty (FUD):To maximize their impact, whales may use coordinated social media campaigns or fake news to spread fear, uncertainty and uncertainty. Rumors such as adverse regulatory actions or bankruptcies can spread quickly, prompting retail investors to panic sell.

Step 4: Trigger a Sell-off:Obvious large sell orders and negative sentiment prompt other investors to sell their holdings, adding to downward pressure on asset prices.

Step 5: Profit on the Dip:Once prices plummet, whales step in and either buy back assets at lower prices or close their positions to take a profit.

Whale Tricks: How Do They Manipulate the Market?

Crypto whales use sophisticated strategies to conduct short raids and manipulate the market for their own benefit. These strategies give whales an advantage over retail traders, allowing them to manipulate prices and profit, while retail traders are left to deal with market chaos on their own:

Trading Bots and Algorithms:Advanced bots allow whales to execute large sell orders in milliseconds, triggering price crashes. Before the market reacts, whales turn the tide in their favor.

Leverage and Margin Trading:Whales rely (to a large extent) on leverage and margin trading to profit. Borrowing funds allows them to increase the size of their positions and put more pressure on their sell orders. This can trigger a stronger market reaction than if they were holding shares.

Low liquidity on some exchanges:Whales can place large sell orders on less liquid markets with fewer participants and lower trading volume, causing prices to fall sharply. They may even manipulate the order book by placing and canceling large fake orders (so-called "spoofing") to deceive other traders.

Cooperation with other whales:Whales may cooperate with other large holders or trading groups to coordinate attacks, making short attacks more effective and harder to track.

The impact of bear attacks on the cryptocurrency market

Bear attacks can seriously disrupt the cryptocurrency market. Here are the effects on different players and the wider ecosystem:

Impact on Retail Investors:Retail investors tend to overreact during bear market raids. The sudden drop in prices and the spread of panic often lead to panic selling, resulting in heavy losses for investors who exit at the bottom. Most retail investors sell emotionally, not realizing that they are playing into the hands of whales.

Broader Market Impact:Bear market raids increase market volatility and expose new and existing investors to greater risks. These events can shake overall confidence in the cryptocurrency space, leading to reduced trading activity and investor hesitation. In extreme cases, they can even trigger liquidations on multiple platforms.

Potential Positive Impact:Bear market raids can sometimes have a cleansing effect on the cryptocurrency market. Market corrections triggered by such raids remove overvalued assets from unsustainable highs. In some cases, these raids may expose weak or fraudulent projects, forcing investors to re-evaluate their options.

Signs of a Crypto Bear Attack

A bear raid is a misleading market behavior that resembles a real market decline, often tricking traders into selling prematurely. A rapid drop in price can look like the beginning of a bear trend, leading retail traders to make impulsive decisions.

Typically, these drops are short-lived, with prices quickly recovering once whales take profits. Identifying the signs of a crypto bear raid is key to avoiding losses.

Here are some signs of a crypto bear attack:

A sudden drop in prices that appears to have broken support

A surge in trading volume during the market drop

A rapid rebound after the drop

Negative sentiment triggers panic among traders

No major news to explain the drop

How to Protect Yourself from a Crypto Bear Attack

To protect your investment from a crypto bear attack, you can adopt the following strategies:

Perform thorough technical analysis:Regularly analyze price charts and indicators to discern true market trends and manipulation.

Execute stop-loss orders:Set a preset sell point to automatically close your position when the price falls to a certain level, thereby limiting potential losses in the event of a sudden market decline.

Diversify your portfolio:Spread your investments across a variety of assets to reduce risk. A diversified portfolio is less susceptible to any single asset being hit by a bear market.

Stay informed of market developments:Follow market news and developments to better predict and respond to potential manipulation.

Choose reputable exchanges:Choose trading platforms that have strong market manipulation measures to ensure a fairer trading environment.

Ethical Debate: Cryptocurrency Market Manipulation vs. Free Market Dynamics

The principles of free market dynamics contrast with market manipulation strategies such as bear raids.

Proponents of free markets advocate for minimal regulatory intervention, arguing that this facilitates innovation and self-regulation. A free market is an economic system in which supply and demand determine the prices of goods and services. However, the decentralized and generally unregulated nature of cryptocurrency markets makes them susceptible to manipulative behavior.

Bear raids require a coordinated effort by perpetrators to drive down asset prices, mislead investors, and undermine market integrity. Such strategies can result in losses for retail investors and erode trust in the financial system.

Critics point out that without adequate regulation, these manipulative strategies could proliferate, leading to unfair advantages and potential economic harm.

While free market dynamics are valued for promoting efficiency and innovation, in the cryptocurrency space, unfettered market manipulation can have disastrous consequences. Events like the bear raids highlight the need for balanced regulation to ensure fairness and protect investors.

Crypto Regulation Targeting Manipulative Strategies Worldwide

Crypto market manipulation, including tactics such as short raids, has sparked varying regulatory responses around the world. In the United States, the Commodity Futures Trading Commission (CFTC) classifies digital currencies as commodities and actively combats fraud, including market manipulation practices such as spoofing and wash trading. The U.S. Securities and Exchange Commission (SEC) has also taken action against individuals who manipulate digital asset markets.

The European Union has implemented Market Regulation for Crypto Assets (MiCA) to establish a comprehensive framework to address market manipulation and ensure consumer rights for stablecoins.

Despite these efforts, the decentralized and borderless nature of cryptocurrencies continues to present challenges for regulators. Global cooperation and adaptive regulatory frameworks are essential to effectively combat market manipulation and protect investors in the evolving digital financial landscape.

Weatherly

Weatherly