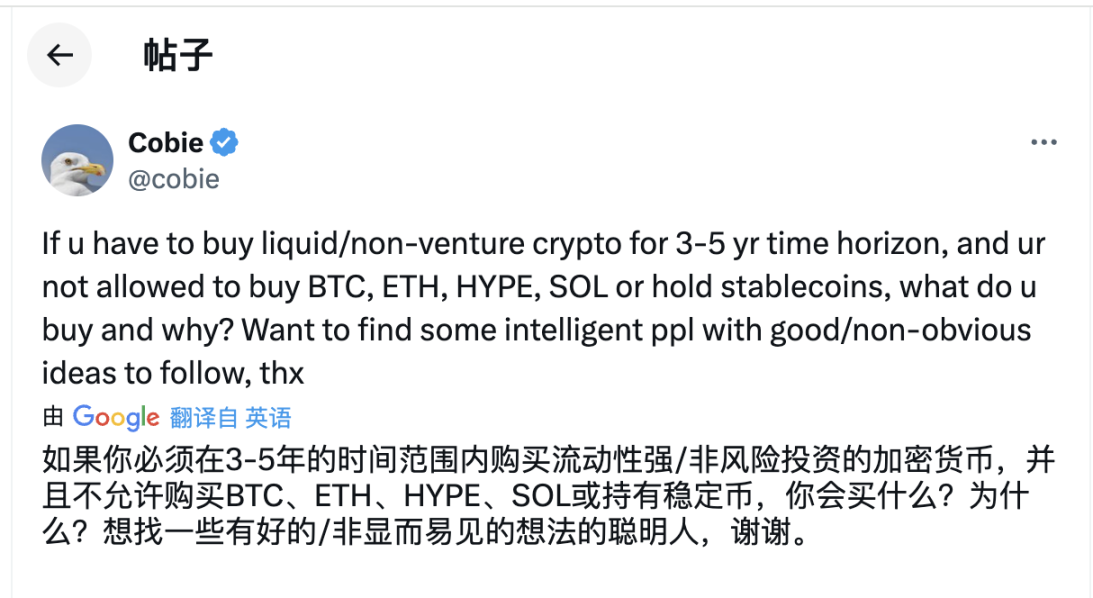

"If you had to buy a liquid/non-VC cryptocurrency in a 3-5 year timeframe, and were not allowed to buy BTC, ETH, HYPE, SOL, or hold stablecoins, what would you buy? Why?"

On June 22, the well-known crypto KOL @Cobie asked the above question on X.

Crypto KOLs, traders, and VC investors all gave their own "wealth codes" in the comment section.

We have reviewed the opinions and choices of some well-known industry figures to see if there are any investment targets that you are interested in.

Base Head jesse.base.eth: Coinbase ($COIN)

We are optimistic about $COIN (Coinbase) because: (1) it has an incredibly diversified and powerful product line, has formed a large-scale user base and a market-leading brand; (2) it is one of the most powerful and visionary on-chain teams in this field, perhaps even the strongest.

Crypto KOL Ansem: Worldcoin ($WLD)

Hedge against the risk of OpenAI/Altman winning the AI race and the surveillance state. In the post-AGI era, we need a verifiable way to distinguish who is human and who is AI. If OpenAI is going to do something with their huge personal database in the future, it will most likely be related to decentralized identity (WLD).

AllianceDAO founder qw: Tokens with strong revenue

In the 3-5 year time frame, the only correct answer is a token with strong (future) revenue that is currently trading at a reasonable multiple.

Everything else will go to zero. Currency premiums outside of Bitcoin are a thing of the past.

Crypto Trader Auri: Starknet ($STRK)

If you think decentralization and privacy are important, pay attention to Starknet

Current Status:

- As Ethereum L2, it can compete with Solana in terms of TPS (transactions per second)

- Provide top user experience with unique AA (account abstraction) features and on-chain performance

- Relatively low valuation ($1 billion fully diluted valuation, compared to Arbitrum/Optimism's $3 billion)

There are three paths to success:

- Become a universal layer

- Bitcoin L2 (if settlement on Bitcoin becomes feasible and efficient), this alone I think can multiply Starknet's valuation several times

- If all else fails, can serve as backend infrastructure for other on-chain applications

Helius Labs Founder mert: Jito ($JTO), Zcash ($ZEC)

JTO — If you believe SOL will still exist in the next 3-5 years (it will), then this is a no-brainer

Zcash — I think privacy coins will make a comeback, plus the chain is about to be redesigned under the new Labs body, which is impressive from a technical perspective

Nansen Founder Alex Svanevik: Building an L1 Portfolio

Build a diversified Layer 1 (L1) blockchain asset portfolio to achieve long-term investment returns. There are already BTC, ETH, HYPE, SOL, and newly added BNB, SUI, APT, TRX, AVAX, a total of 9 assets, covering mainstream and potential public chains, and staking all assets to obtain an annualized return of about 4.5%.

Crypto KOL Fishy Catfish: Chainlink ($Link)

Chainlink has maintained its top dominance in market share and security for 6 years (even higher than in 2021)

Real World Assets (RWA) tokenization and stablecoins are the two largest practical application scenario markets. Chainlink provides a complete data, connection and computing service platform for these two fields.

Chainlink is years ahead of competitors in serving TradFi needs:

A. Automated Compliance Engine (ACE) coming soon: identity verification, onboarding, accredited investor verification, and sanctions checks

B. CCID coming soon: a cross-chain identity system

C. Chainlink has a complete privacy suite (CCIP private transactions, blockchain privacy manager, DECO (patented zkTLS))

In addition, it is also far ahead of other competitors in traditional financial adoption (including SWIFT, DTCC, JPMorgan, ANZ, UBS, etc.)

The value capture of blockchain is decreasing, and the value capture of Chainlink and applications is increasing. For example: Liquidation arbitrage caused by oracle updates MEV was previously owned by blockchain validators, but is now shared by Chainlink and Aave.

Crypto KOL Murad: $SPX

Reason: As the first "Movement Coin", SPX aims to subvert the entire stock market. SPX's impact on GME is comparable to BTC's impact on gold, or even more. It can be said to be the most enthusiastic and unrestrained community on cryptocurrency Twitter, and it is still in its early stages. It is the only "meme" coin with a real mission. It is a perfect meme carrier, representing a cultural counterattack against the plight and challenges of millennials faced by Generation Z around the world. It merges the financial and spiritual worlds and targets a larger potential market than any other crypto asset before. As millions of people begin to lose their jobs and meaning, many will seek tokenized digital shelter, which is one of the strongest rising forces.

APG Capital trader Awawat: $BNB, $LEO, $AAVE, $MKR, $XMR

Given this time span, only a few choices make sense:

PAXG/XAUT (gold tokens), for obvious reasons

BNB/LEO, limited upside but low downside

AAVE/MKR: should survive

XMR (Monero)

Many replies are promoting their respective portfolios, but objectively speaking, which coins will go to zero in this time span

Crypto KOL W3Q: $HOOD, $TSLA

5 years ago, I would not consider holding pure cryptocurrencies except Bitcoin.

$HOOD (Robinhood) - Shovel and pickaxe in retail finance (infrastructure)

From betting to mortgages to expanding crypto products, they are entering all the verticals that make money, and have better user experience and distribution channels than most companies.

$TSLA (Tesla) - AI robotics, covering both software and hardware. Musk may be interested in cryptocurrencies again in the next hype cycle.

If not restricted by self-custody, I would choose

2x leveraged Bitcoin ETF

Deploy part of the portfolio at the low point of the market cycle or extreme sell-off.

Framework Ventures partner Vance Spencer: $SKY

$SKY, it should be noted that it is not currently on any CEX.

DeFiance Capital founder Arthur: $AAVE, $ENA, $PENDLE, $JUP

The above are their investment choices, so what are your long-term investment targets for 3-5 years?

Davin

Davin