Source: Grayscale; Compiled by: Baishui, Golden Finance

The cryptocurrency market appreciated after regulators approved the initial application for a spot Ethereum ETF in the U.S. market, with Ethereum outperforming the broader cryptocurrency market.

Also this month, cryptocurrency-related legislation made progress in Congress. The latest Harris Poll survey conducted on behalf of Grayscale found that cryptocurrency remains a bipartisan issue of concern ahead of the November election.

The financial cryptocurrency industry led Grayscale's cryptocurrency sector, while Bitcoin lagged slightly behind the broader market, despite an increase in net inflows into U.S. spot Bitcoin ETFs.

Grayscale Research believes that digital assets have a good outlook, although the macro market has priced in smooth sailing and may be affected by adverse surprises.

Crypto markets rallied in May 2024 as U.S. regulators appeared to pave the way for trading in spot Ethereum exchange-traded funds (ETFs). Like the spot Bitcoin ETF that came to market in January 2024, these new products could open up the crypto asset class to a wider range of investors and could help accelerate public blockchain adoption.

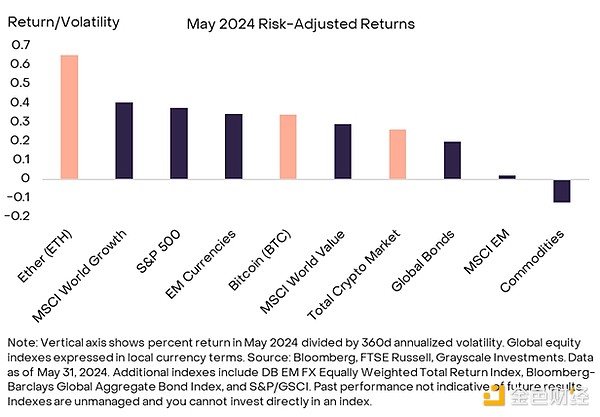

With the exception of commodities, most traditional asset classes posted positive returns for the month as market volatility generally declined.On a risk-adjusted basis (i.e., taking into account the volatility of each asset), high-potential assets and emerging market (EM) currencies led the gains (Chart 1).ETH outperformed both in absolute terms and on a risk-adjusted basis, while Bitcoin’s risk-adjusted returns were in the middle of the pack for traditional assets.

ETH outperformed in both absolute and risk-adjusted terms, while Bitcoin’s risk-adjusted returns were in the middle of the pack for traditional assets.

The FTSE Grayscale Crypto Industry Total Market Index (a measure of returns for the largest and most liquid digital assets) rose 15% in May 2024, reaching a market capitalization of $2.3 trillion.

Figure 1: Ethereum outperforms traditional assets and the cryptocurrency market

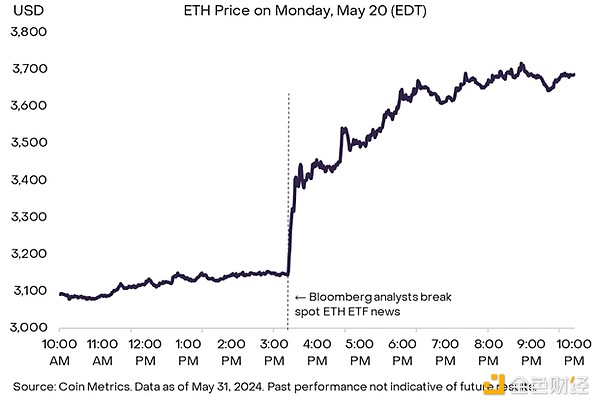

On May 23, 2024, the U.S. Securities and Exchange Commission (SEC) approved Form 19b-4 filed by several issuers for spot Ethereum ETFs, indicating significant progress in listing these products on U.S. exchanges. Just a few days ago, SEC approval seemed unlikely; a week ago, estimates from decentralized prediction platform Polymarket put the chance of approval at only about 10%. Because approval was not expected, when Bloomberg analysts broke the news of possible approval on May 20, the price of ETH rose by about 17% in the next five hours (Chart 2).

Figure 2: ETH prices soar as US may approve spot ETF

Based on international precedents, Grayscale Research believes that demand for spot Ethereum ETFs will reach 25%-30% of spot Bitcoin ETFs (For more details, see our report "The State of Ethereum"). In the long term, Ethereum’s market capitalization will likely depend on the network’s fee income and other fundamentals, but in the short term, increased demand for new ETFs could have an impact on the token’s price. While these products will not allow staking, at least initially, we do not expect this to have a significant impact on investor demand. Ethereum’s staking yield is only 3.6%, and all base transaction fees on the network are burned, rewarding all token holders with a reduced supply. [1]

In addition to the unexpected approval of a spot Ethereum ETF, Congress has made progress on various legislation related to crypto regulation. On May 8, the House of Representatives voted to repeal SEC Accounting Bulletin (SAB) 121, which required banks to hold capital against digital assets in custody, thereby limiting their involvement in custody services; despite a threatened veto from the White House, 71 Democrats voted in favor of the rule. [2] The Senate subsequently passed the legislation—also with a bipartisan consensus. On Friday, May 31, President Biden vetoed the bill, citing the need to protect consumers. [3] Later that month, on May 22, the House of Representatives passed another cryptocurrency-focused bill, the Financial Innovation and Technology for the 21st Century Act (FIT21). The legislation would provide a comprehensive regulatory framework for cryptocurrencies[4] and is now headed to the Senate for consideration. Against the backdrop of these recent legislative initiatives, a new Harris Poll survey conducted on behalf of Grayscale found that cryptocurrency is a bipartisan issue, with similar holdings among Republicans (18%) and Democrats (19%) (2024 Election: The Role of Cryptocurrency).

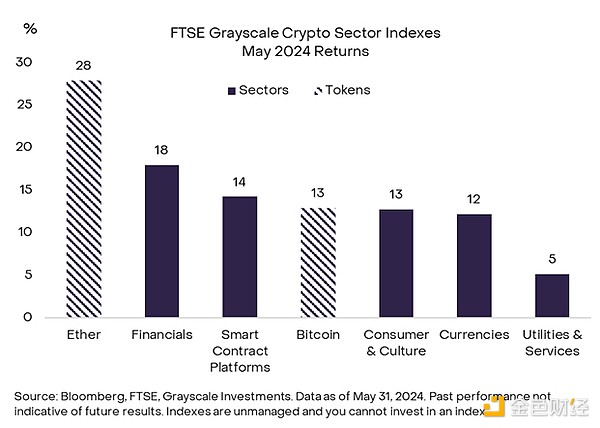

From a cryptocurrency sector perspective, the best performing segments in May 2024 were Finance, Consumer & Culture, and Smart Contract Platforms, which includes Ethereum (Figure 3). As discussed further below, the Finance cryptocurrency sector is likely to benefit from progress toward approval of a spot Ethereum ETF, as the Ethereum network is home to most DeFi activity and many tokenized projects. The Consumer & Culture cryptocurrency sector was boosted by strength in certain memecoins—tokens that are primarily used for entertainment value and are related to internet culture. [5] Some video game-related assets also boosted returns in the Consumer & Culture cryptocurrency sector. [6]

Figure 3: Financial-related crypto sectors outperformed

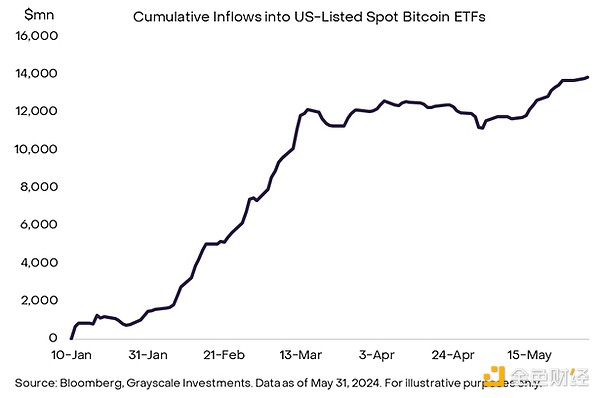

Bitcoin, the largest crypto asset by market capitalization in the cryptocurrency sector, rose slightly less than the broader market, up 13% in May.[7] Inflows into U.S.-listed spot Bitcoin ETFs rebounded during the month, totaling $2.1 billion. [8] Since launching on January 11, spot Bitcoin ETFs have seen cumulative inflows approaching $14 billion (Figure 4). Meanwhile, Bitcoin’s price may be suppressed by concerns about a potential sell-off in tokens associated with Mt Gox. The bankrupt cryptocurrency exchange once handled more than 70% of Bitcoin trading volume, but it has been struggling to emerge from bankruptcy for the past decade. Last September, the bankruptcy trustee announced that creditor repayments would begin in October 2024. Late last month, wallets associated with the bankrupt exchange began moving Bitcoin on-chain, refocusing sales on the cryptocurrency market. [9] Mt Gox holds nearly $10 billion worth of Bitcoin, [10] so sales could have a significant impact if they were converted to fiat currency.

Figure 4: Cumulative inflows into spot Bitcoin ETFs approach $14 billion

The financial cryptocurrency sector was mainly supported by the rise of Uniswap (UNI) and Celsius (CEL) tokens.[11] Uniswap is an Ethereum-based automated market maker that allows decentralized token trading without intermediaries. The market seems to interpret the partial approval of the spot ETH ETF as generally positive for decentralized finance (DeFi) tokens, including UNI. While UNI had strong monthly performance throughout the month, a governance vote to distribute a portion of the protocol’s fee revenue directly to token holders was postponed on May 31, leading to a 6% price drop on the day. Separately, the CEL token gained around 750% after more than 90% of the token supply was destroyed during the bankruptcy of the failed crypto lender. [12]

Finally,Among the utility and service cryptocurrencies, returns were driven primarily by growth in Chainlink (LINK), Ethereum Name Service (ENS), and Livepeer (LPT). LINK’s gains appeared to reflect news that the oracle network’s co-founder would be attending the Consensus conference alongside representatives from payments service SWIFT, as well as the end of a pilot program between Chainlink and the Depository Trust & Clearing Corporation (DTCC)—both potential signs of public blockchain adoption by traditional financial institutions. [13] ENS Labs, the organization that develops the ENS software, announced various upgrades to the project, including a planned transition to Ethereum Layer 2. [14] Finally, Livepeer announced a subnet designed to support GPU sharing and other activities related to the artificial intelligence (AI) industry (see our report, The Emergence of Synergies between AI and Crypto). [15] Crypto markets have benefited from a variety of tailwinds, including steady inflows into U.S.-listed spot Bitcoin ETFs, bipartisan efforts in Congress to bring regulatory clarity to the industry, and growth in activity within the Ethereum ecosystem. As long as the macro market backdrop remains favorable, Grayscale Research believes valuations can continue to climb throughout the (Northern Hemisphere) summer and beyond. However, it is important to emphasize that financial markets are well prepared for smooth sailing: implied volatility has fallen for many traditional assets (Figure 5). Therefore, although the favorable backdrop is likely to persist, markets could be affected by adverse news on the economic outlook, the Federal Reserve's monetary policy, and/or the upcoming U.S. presidential election. Figure 5: Implied volatility falls to the lower end of the range. References [1] Source: StakingRewards.com. Data as of May 31, 2024. [2] Source: Axios, American Banker.

[3] Source: Axios, The Block.

[4] Source: House Financial Services Committee.

[5] A similar situation occurred in public equity markets in mid-May due to the reactivation of the X account of trader Keith Gill (aka Roaring Kitty). Source: The New York Times.

[6] For example, IMX (+13%), PRIME (+18%), and YGG (+24%). Source: Artemis. Data as of May 31, 2024.

[7] Source: Artemis. Data as of May 31, 2024.

[8] Source: Bloomberg, Grayscale Investments. Data as of May 31, 2024.

[9] Source: The Block.

[10] Source: Arkham. Data as of May 31, 2024. The asset also holds approximately 141k Bitcoin Cash.

[11] “PEOPLE” also made a significant contribution to the financial crypto industry’s returns in May 2024.

[12] Source: Artemis, Etherscan. Data as of May 31, 2024.

[13] Source: Decrypt, CoinDesk.

[14] Source: The Block.

[15] Source: Livepeer.

Alex

Alex

Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Alex

Alex Kikyo

Kikyo Hui Xin

Hui Xin Hui Xin

Hui Xin Hui Xin

Hui Xin Alex

Alex