Author: Alana, Variant Fund Investment Partner; Translation: Golden Finance xiaozou

Stablecoins are the most transformative form of payment since credit cards, changing the way money moves. With low cross-border fees, near-instant settlement, and global accessibility, stablecoins have the power to transform the financial system. For those who custody dollar deposits backing digital assets, stablecoins can also be a very lucrative business.

Today, the global supply of stablecoins exceeds $150 billion. There are five stablecoins with a circulation scale of at least $1 billion: USDT (Tether), USDC (Circle), DAI (Maker), First Digital USD (Binance), and PYUSD (PayPal). I believe that in our future world, all financial institutions will issue their own stablecoins.

I have been thinking about what opportunities the growth of stablecoins will bring. I think that referring to the maturity of other payment systems - especially credit card networks - may provide some answers.

1. How similar are credit card and stablecoin networks?

To consumers and merchants, all stablecoins should look like dollars. But in reality, each stablecoin issuer treats the dollar differently - due to different issuance and redemption processes, reserve backing for each stablecoin supply, different regulatory regimes, frequency of financial audits, and more. Reconciling these complexities is undoubtedly a difficult task.

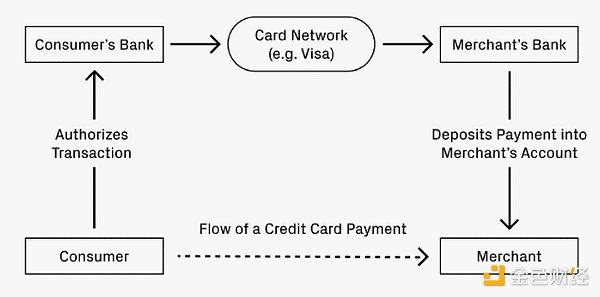

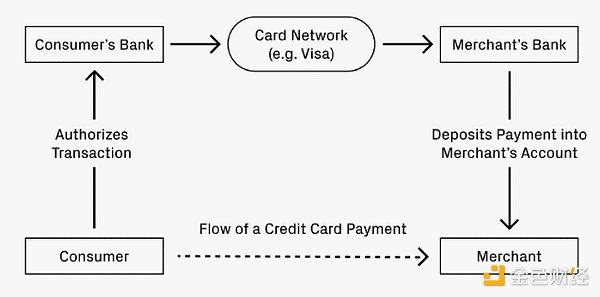

We have seen this before in the development of credit cards. Consumers spend using assets that are almost but not completely fungible, which represent dollars (they are loans in dollars, but these loans are not fungible because people have different credit scores). Some network (such as Visa and Mastercard) handles the payment orchestration of the entire system. The stakeholders in these two systems look (or may eventually) be very similar: consumers, consumers' banks, merchants' banks, and merchants.

The following example may help to reveal the similarities in the network structure.

● Say you go out to eat and pay with a credit card. How does your payment get into the restaurant's account?

● Your bank (the credit card issuer) authorizes the transaction and sends the funds to the restaurant's bank (called the acquirer).

● An exchange network - such as Visa or Mastercard - facilitates this exchange of funds and takes a small fee.

● The acquirer then deposits the funds into the restaurant's account (minus its fees).

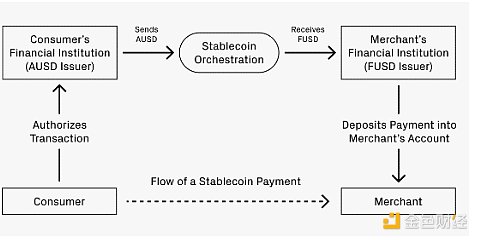

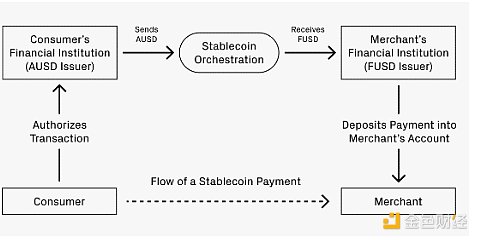

Now let’s say you want to pay using a stablecoin. Your bank (Bank A) issues the AUSD stablecoin. The restaurant’s bank (Bank F) uses FUSD. These are two different stablecoins, although they both represent USD. The restaurant’s bank only accepts FUSD. How is the AUSD payment converted into FUSD?

The process should end up looking very similar to that of the credit card network:

● The consumer’s bank (which issues AUSD) authorizes the transaction.

● Orchestration services support swaps from AUSD to FUSD, and may charge a small fee. This swap can happen in at least a few ways:

Method 1: Stablecoin-to-stablecoin swaps on a decentralized exchange. For example, Uniswap offers many such pools with fees as low as 0.01%.

Method 2: Use AUSD to exchange USD deposits, and then deposit these USD into the first order line to obtain FUSD.

Method 3: Orchestration services can calculate net flows between each other through the network, but this may only appear as scale increases.

● FUSD is deposited into the merchant account (of course, a fee may be subtracted).

2. Where to upgrade and surpass?

The above are the obvious similarities between credit card and stablecoin networks that I think. It also provides a useful framework to think about where stablecoins begin to meaningfully upgrade and surpass credit card networks.

The first is cross-border transactions. If the above scenario is an American consumer checking out at a restaurant in Italy - the consumer wants to pay in US dollars, and the merchant wants to accept euros - the existing credit card will charge more than 3%. The exchange between such stablecoins on a decentralized exchange may only charge 0.05% (a difference of 60 times). Applying this magnitude of fee reduction to cross-border payments, it goes without saying how much productivity stablecoins can contribute to global GDP.

Second, the payment flow from business to individual. The time between authorizing a payment and the funds actually leaving the payer's account is very fast: once authorized, the funds can leave the account. Instant settlement is valuable and everyone wants it. In addition, many companies have employees spread all over the world. The frequency and scale of cross-border payments may be much higher than that of ordinary individual consumers. The continued globalization of the workforce should provide a strong impetus in this regard.

3. Where may opportunities appear?

If the comparison between network structures is correct in the general direction, it helps to reveal where entrepreneurial opportunities may exist. In the credit card ecosystem, the main business has spread across orchestration, issuance innovation, form support, etc. This may also be the case with stablecoins.

The above example mainly describes the role of orchestration. That's because transferring money is by no means a small business. Visa, Mastercard, American Express, and Discover are all worth at least tens of billions of dollars. Their combined value is even greater than $1 trillion. The existence of multiple credit card networks in equilibrium suggests that competition is healthy and the market is large enough to support major businesses. It seems reasonable to believe that similar competition in stablecoin orchestration will exist in mature markets. We are only 1-2 years away from having sufficient underlying infrastructure to allow stablecoins to succeed at scale. There is still plenty of time for new startups to seize this opportunity.

Issuance is another area that needs innovation. Similar to the growing popularity of commercial credit cards, we may see a similar trend emerge in the stablecoin space: enterprises want to have their own white-label stablecoins. Owning a payment unit can provide better control over end-to-end accounting, from expense management to handling foreign taxes and more. These have the potential to become direct business lines for stablecoin orchestration networks, but they may also be opportunities for entirely new startups (such as Lithic). The byproduct of these enterprise needs may lead to more new business.

There are also many ways to make issuance increasingly professional. Consider a tiered approach. For many credit cards, customers can pay a fee upfront to get a better rewards structure, think: Chase Sapphire Reserve or AmEx Gold. Some companies (usually airlines and retailers) even offer their own dedicated cards. I wouldn’t be surprised to see similar experiments in stablecoin rewards tiering. This could also be a way for startups to break into the market.

In many ways, all of these trends reinforce each other. As issuance becomes more diverse, the demand for orchestration services increases. As orchestration networks mature, the barriers to entry for new issuers will get lower and lower. All of these are huge opportunities, and I expect to see more startups in this space. Long term, these markets will be worth trillions of dollars and should be able to support the growth of many large companies.

JinseFinance

JinseFinance