Author: hitesh.eth, crypto KOL; Translation: Jinse Finance xiaozou

After MATIC is upgraded to POL, what changes will occur in the token economics, and what impact will it have on the future value of the POL token? Let's explore it together in this article.

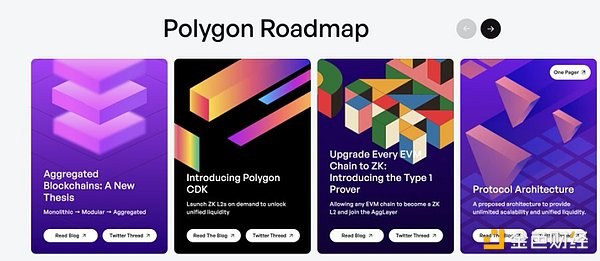

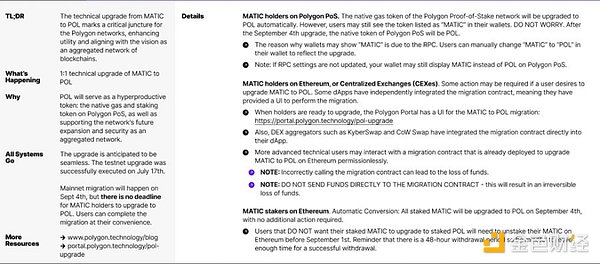

Polygon announced two major plans in its roadmap last year. The first plan is to upgrade the Polygon PoS chain to the ZkEVM Validum chain for higher scalability, faster finality, and connection to AggLayer. The other plan is to launch the POL token through a 1:1 MATIC-POL token migration.

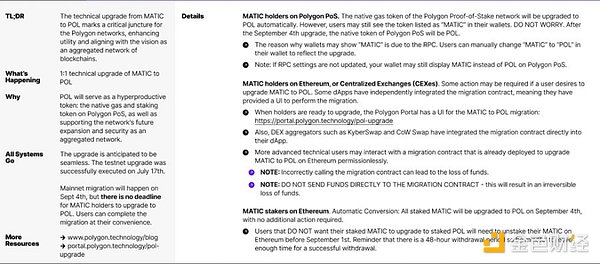

Starting September 4, 2024, holders will be able to migrate their MATIC 1:1 to the new POL token. CEXs (centralized exchanges) such as Binance and OKX will handle the migration on behalf of users.

You just need to follow their announcements, cancel all open orders, and if you hold MATIC, you will receive POL tokens.

Some DEX (decentralized exchanges) and DEX aggregation platforms will use their own UI to migrate MATIC to POL. You can also use the Polygon migration portal or smart contract address to complete this migration yourself.

Interestingly, the token upgrade also brought major changes to the token economics, and its design considerations also covered future roadmaps and value capture.

What changes have been brought?

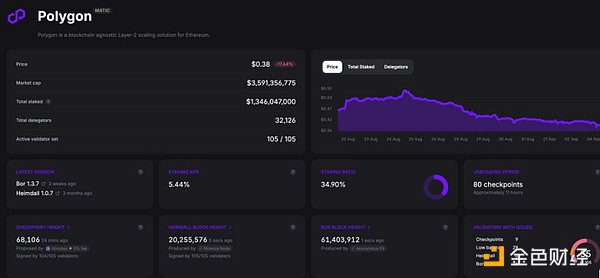

Polygon validators’ Matic token inflation rewards ended last year after Polygon completed its inflation cycle.

We all know how difficult it is to maintain network growth without token rewards, so they need to solve this problem to keep the network running in an orderly manner and maintain the enthusiasm of validators.

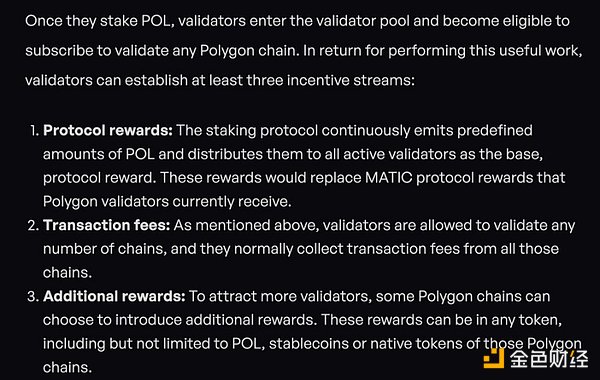

200 million new tokens POL will be put into circulation every year to be used for validators’ rewards in the next 10 years. If 1 POL = $0.5, then the value of these 200 million tokens is equivalent to $100 million.

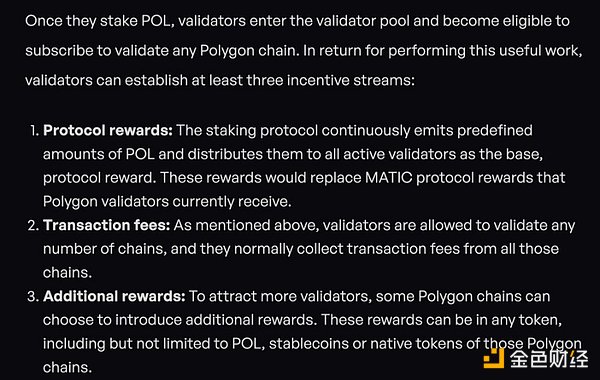

This is the standard compensation they will receive, but Polygon also provides some additional rewards to encourage them to play more roles in supporting other chains.

Polygon has built a L2 creation technology stack, and they have also built a unified liquidity layer called AggLayer, which will help L2 provide sufficient liquidity for their own ecosystem through the Polygon network.

The idea here is very straightforward, as a staker you will delegate your stake to the validator, the validator will mint coins through the inflation cycle, they will collect fee income from the aggregator, and they will also receive additional token rewards from the CDK chain that is part of the Polygon network.

Rewards are divided into two types:

• Provide CDK chain token rewards to stakers

• Share AggLayer fee income with stakers

More forms of rewards are still in preparation:

• Shared sorting income

• Zero-knowledge proof income, etc.

It's like a validator payment network that encourages them to play multiple roles at different times.

We have discussed the foundation of the new token economics.

Token demand side:

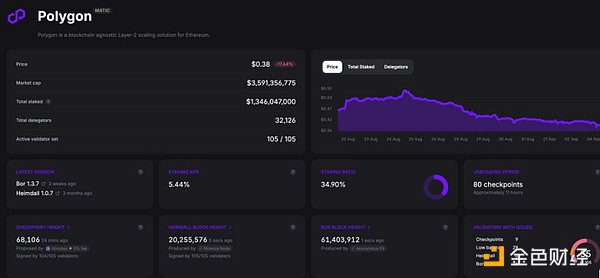

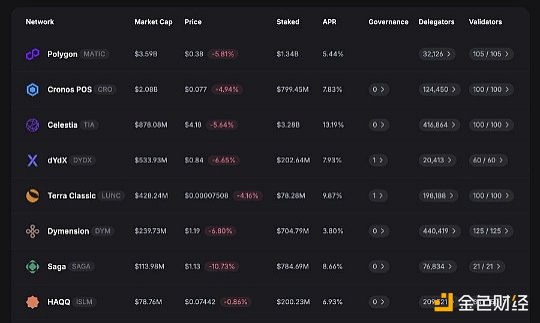

I think it is very simple - it will be a staking-driven demand. There are less than 33,000 MATIC holders participating in staking, and the overall staking rate has been low recently due to the lack of rewards.

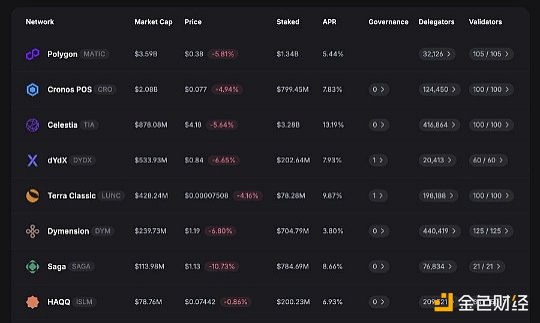

The current staking yield is around 5.65%, which is better than ETH, but lower than Solana and Avalanche. After the POL migration and the new inflation policy activation, the yield should rise to 7-8%, and may continue to increase as AggLayer and CDK gain more adoption.

Ultimately, the best case scenario is that those POL stakers start to receive additional token rewards in the form of airdrops, similar to Celestia... The chances of this happening are also quite high.

There are already more than a dozen well-funded projects on AggLayer, and they may do some airdrops when the time is right.

This type of behavior will drive FOMO and could increase the number of stakers from 33k to at least 100k. Celestia has 400k stakers, from which you can see the upside potential for staking demand.

Overall, I think this is a good time for the MATIC token to upgrade, and with Polygon's overall technology deployment, they can drive more demand for the token through more partnerships on their key infrastructure product (AggLayer).

JinseFinance

JinseFinance