Source: Zhitong Finance APP

Current US President Joe Biden announced that he would not seek re-election and supported Vice President Kamala Harris as the Democratic Party's candidate. The news, released at a critical moment less than four months before the November election, may exacerbate Wall Street's instability.

(I) Market observers have different opinions

Current political uncertainty in the United States is increasing. Since the Democratic candidates did not go through the normal primary process, the market lacks precedent to predict its impact. Market observers have different opinions, mainly including the following views:

Viewpoint 1: Bring more uncertainty

Zachary Griffiths, head of US investment grade and macro strategy at CreditSights, said: "The first impact of this statement should be more uncertainty, which usually puts the market into risk-averse mode-stock markets sell off and investors buy high-quality stocks."

Barry Knapp, managing partner of Ironsides Partners, believes that market uncertainty has greatly increased, which may affect the performance of futures opening. Although Bitcoin has shown some volatility, the market has just experienced a turbulent week, and the main factor behind this is not Trump. The deeper reason lies in the weak economic situation and the Federal Reserve's hesitation to cut interest rates by 50 basis points in September. Obviously, many factors are intertwined, indicating that the market will face more uncertainty in the future.

Gregory Faranello, head of U.S. interest rate trading and strategy at AmeriVet Securities, expects more deadlock in the bond market. The U.S. Treasury market will continue to closely monitor Treasury supply, central bank balance sheet dynamics, and key economic indicators. Although the market may experience some price fluctuations, the Fed's interest rate decisions should reflect more of what has happened rather than being purely based on expectations.

Wayne Kaufman, chief market analyst at Phoenix Financial Services, said the market may be hesitant in uncertainty. He pointed out that although the optimism of artificial intelligence has supported the market to a certain extent, the upcoming August and September have historically been periods of weak market performance.

Viewpoint 2: The "Trump deal" will continue

Supporters of the "Trump deal" believe that the market has long anticipated and priced in Biden's withdrawal, and the impact of the public announcement is not significant.

Art Hogan, chief market strategist at B. Riley Wealth, said that the most striking phenomenon in the current transactions around Trump is the rise in the prices of Bitcoin and other cryptocurrencies, which reflects the market's view that Trump holds a more positive attitude towards these asset classes. He believes that the market has gradually absorbed the news that President Biden will not seek re-election, and speculates that if Trump is re-elected, it may bring trading opportunities similar to small-cap stocks benefiting from lower interest rates. He expects the Federal Reserve to cut interest rates in September.

Viewpoint 3: "Trump trades" will recede

Yung-Yu Ma, chief investment officer of BMO Wealth Management, expects that Trump trades may be temporarily paused until the identity of the Democratic candidate is clearer. He warned that the event has brought more political uncertainty to the market and may cause volatility in the short term.

Rhona O'Connel, head of market analysis at Stonex, said Biden's withdrawal from the election, "My instinctive reaction is that everything is up in the air in the short term, especially the Democratic nomination. But it is likely to put the brakes on the 'Trump trade.' In terms of risk aversion, purely from this perspective, gold has a stronger tailwind than headwind."

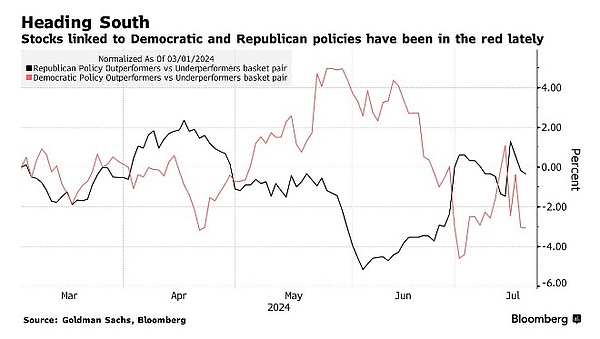

Matt Maley, chief market strategist at Miller Tabak + Co.: "Trump trades such as Bitcoin and energy will begin to unwind, and some hit trades such as solar stocks or electric vehicles will also rebound. But there is still a lot of uncertainty now, and the market doesn't like this. From now to Labor Day and then to September, we will see a sharp surge in volatility."

Yung-Yu "The 'Trump trade' is likely to take a breather until the Democratic nominee becomes clearer," said Ma. The news also shook currency and bond markets, while emerging market money managers expect some early 'Trump trades' - including selling some Asian and Latin American currencies and buying Salvadoran bonds - to be unwound, providing a short-term boost to risk assets. Concerns about a strong dollar under the new Trump administration, coupled with tariffs and the possibility of a landslide victory for Republicans, have begun to weigh on emerging assets, which continue to languish under the Fed's uncertain timetable for rate cuts."

Viewpoint 4: More optimistic about a Democratic victory

Jack McIntyre, portfolio manager at Brandywine Global Investment Management, believes that risk assets, including emerging markets, may be affected by the initial positive impact, and the market is more inclined to see a Democratic victory in the House of Representatives.

Fibonacci Asset Management Global Pte CEO Jung In Yun expressed concern about the possibility of Trump's re-election, believing that his protectionist policies may have a negative impact on trade, geopolitical risks will intensify, and supply chain shocks may become more frequent, which in turn will drive up overall inflation levels. This macroeconomic environment poses a severe challenge to industries that rely on global supply chains and stable market conditions, such as automobiles, biotechnology and real estate.

(II) Market spotlight is on Harris

US President Biden's support for Vice President Kamala Harris does not ensure that she will receive the Democratic nomination. Democratic National Committee delegates are free to vote for the person of their choice. The most popular candidates in recent weeks have been California Governor Newsom and Michigan Governor Whitmer, but Harris remains the most likely candidate.

Dave Mazza, CEO of Roundhill Financial, said: "Investors should expect volatility to rise sharply. If Vice President Harris can mobilize quickly and bring a substantial impact on Trump, then we can expect volatility to continue. However, if Trump continues to lead in the polls and investors believe his victory is inevitable, then the 'Trump trade' will take over and volatility will decline." Therefore, whether Harris, who is highly expected, can bring a substantial impact on Trump is the focus of the market at present.

Warren endorses Harris

ZhiTong Finance summarizes Harris' main political propositions as follows:

Politics:

--Supports the transition to universal health insurance, but the role of private insurance plans;

--Advocates more radical drug pricing policies, including tying U.S. prices to those negotiated with other wealthy countries;

--May continue many of Biden's foreign policy goals, including supporting Ukraine and maintaining alliances in the Asia-Pacific region;

--May take a more sympathetic stance toward the Palestinians in the Israel-Hamas conflict;

--Supports a tough policy toward China and advocates "de-risking."

Economy:

--Expected to promote the Biden administration's economic policies, including the Infrastructure Deal and Inflation Reduction Act;

--Supports raising corporate taxes and has criticized Trump's tax cuts;

--Supports proposed policies for the middle class, such as refundable tax credits for low-income individuals and couples

Fighting Climate Change:

--Supports policies to combat climate change, including a transition to 100% renewable energy;

--Helped to introduce a $20 billion plan to fund climate and clean energy projects.

Immigration:

--Her positions have evolved over time, and now supports potential ICE reforms and criticizes Trump's border wall;

--Supports a bipartisan border security deal (ultimately blocked by Senate Republicans).

Harris vs. Biden Key Differences

--Harris supports a transition to Medicare for All, though private insurance plans also play a role. This is more progressive than Biden's position, which favors a public health insurance option on the Affordable Care Act exchanges;

--Harris has called for more aggressive drug pricing policies than Biden, such as pegging U.S. prices to those negotiated in other wealthy countries;

--While both support a $15 national minimum wage, Harris has been more outspoken about punishing companies that violate labor wage regulations;

--Harris advocates for stronger pro-union policies, including repealing "right to work" laws and allowing secondary boycotts, which go beyond Biden's labor stance;

--Harris proposes a specific tax credit for renters to pay more than 30% of their income for rent and utilities, a policy that is not prominent in Biden's platform;

--Harris approved a $2,000 monthly minimum wage during the pandemic. stimulus payments, which is more generous than the proposal Biden implemented;

--Harris has expressed opposition to the Trans-Pacific Partnership and said she would vote against the North American Free Trade Agreement, positions that are more protectionist than Biden's.

Alex

Alex

Alex

Alex Brian

Brian Brian

Brian Brian

Brian Cheng Yuan

Cheng Yuan Bernice

Bernice Brian

Brian Bitcoinworld

Bitcoinworld Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist