Author: Jack Inabinet, Bankless; Compiler: Deng Tong, Golden Finance

GBTC Grows. Grayscale Bitcoin Trust (GBTC) Sees First Net Inflow Since Converting to Spot ETF! Have we just entered a more bullish paradigm, or is there another explanation for this unexpected inflow?

During the last bull run, Bitcoin was much less institutionalized, but investors could still use GBTC to gain exposure to BTC through traditional brokerage accounts.

At this point, new net purchases are limited to accredited investors and are subject to a lock-up period (initially 12 months, later shortened to 6 months) before they can sell these assets on the market, causing the assets to trade at a significant premium to their net value. As retail investors frantically seek to buy and sell Bitcoin through convenient and regulated channels, the asset value (NAV) has also fallen.

Unfortunately for holders, this premium turned into a discount as demand for BTC weakened in late February 2021, and the instrument’s lack of redemption prevented its market price from converging toward its net asset value.

Friday’s inflows ended GBTC’s nearly 80-day streak of outflows since it enabled redemption following its conversion to a spot ETF, and it was the first time Grayscale had purchased BTC for the product since the premium ended three years ago!

GBTC’s strong performance coincided with inflows across all spot BTC ETFs, in stark contrast to Wednesday’s record outflow day, when all products experienced simultaneous outflows.

Clearly, BTC price action is the primary driver of spot ETF flows, with Wednesday’s outflows coinciding with BTC’s drop below $60,000 and Friday’s inflows coinciding with the sudden price surge, and they appear to remain the primary factor behind ETF flows.

While bulls are hoping that GBTC will be able to resist the outflow trend, which could be a sign that the instrument has found a natural equilibrium, one day of inflows alone is not enough to confirm this speculation: this one-off event will have little meaning behind it if it does not continue.

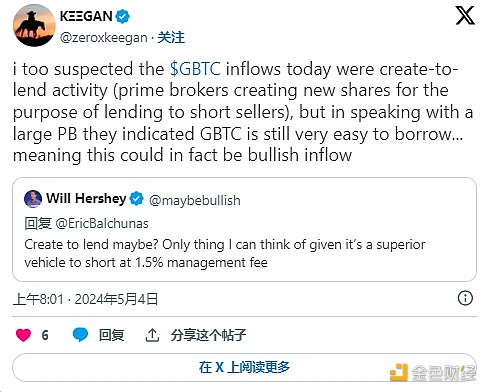

Given that GBTC’s management fee is as high as 1.5%, six times higher than most issuers, it is often considered one of the best ways to short BTC.

While it is conceivable that shares were created with the intent of lending them to short sellers, the high availability of GBTC shares for lending supports the idea that this could actually be a bullish inflow signal.

JinseFinance

JinseFinance