Author: Marcel Pechman, CoinTelegraph; Compiled by Wuzhu, Golden Finance

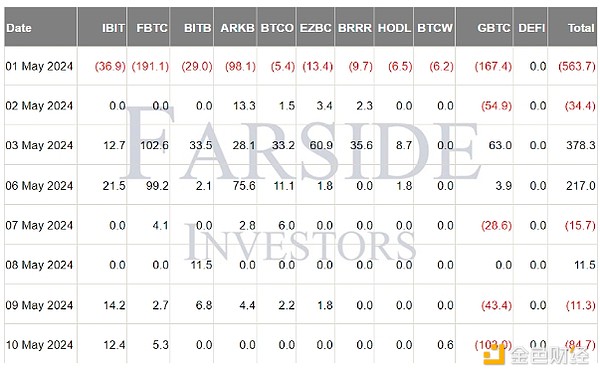

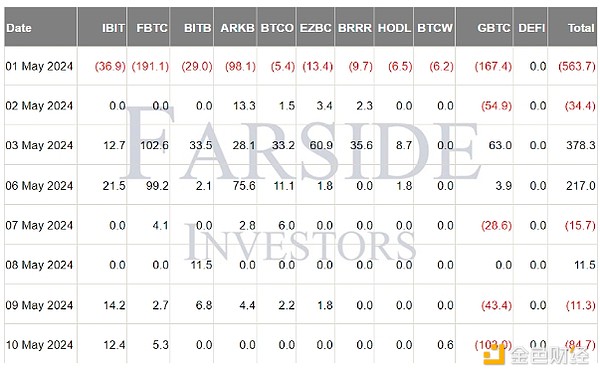

Bitcoin has risen 2% in the past 24 hours, recovering after struggling to break through the $61,500 resistance level for two consecutive days. Maintaining the price level above $62,500, The current upward trend shows that Bitcoin can still experience positive price fluctuations regardless of the United States. Spot Bitcoin exchange-traded fund (ETF) fund flows, net outflows of $100 million in four days.

US Spot Bitcoin ETF Daily Flow, Millions of USD. Source: Farside Investors

Several factors have improved sentiment towards cryptocurrencies, starting with China’s announcement of a $138 million long-term bond issuance to boost its economy. While this was expected since the announcement in March, it reiterated that governments acknowledged the increased risk of a recession. This was in response to data showing that China’s total credit fell in April for the first time in seven years.

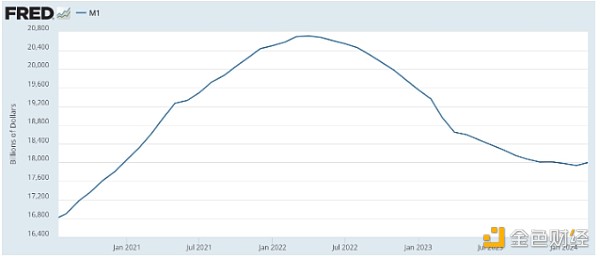

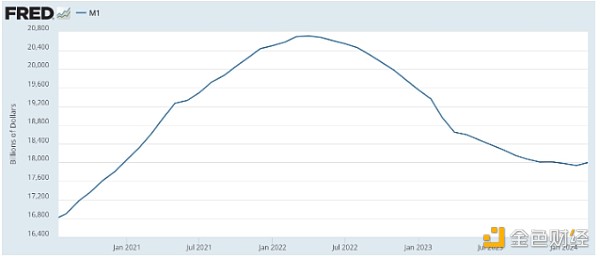

The market now expects the People's Bank of China to inject further liquidity, possibly including rate cuts, the investment director of Shanghai Anfang Private Equity Fund Management Co., Ltd. told Reuters. Such actions would exacerbate the problems caused by the recent large-scale measures taken by the United States. The U.S. Federal Reserve has recently taken expansionary measures, which led to the first increase in the U.S. money supply in two years in March.

U.S. M1 base money, USD. Source: Fed Saint Louis

At first glance, pumping more money into the economy may seem beneficial, but over time it could lead to higher inflation, especially as companies and individuals may hold off on spending and investing. As fixed-income investors begin to realize that their returns are barely keeping pace with rising inflation, scarce assets like Bitcoin could become more attractive.

Ultimately, investors may be preparing for a continued trend wheregovernments will need to continue to provide liquidity to prevent economic crises. While some may argue that the stock market will primarily benefit from increased liquidity, higher interest rates can have a negative impact on businesses by raising their cost of capital. Any debt issued in the past 16 years will face significantly higher interest rates when it is refinanced.

Last week, Federal Reserve officials hinted that interest rates could remain elevated for an extended period of time, Yahoo Finance reported. Minneapolis Fed President Neel Kashkari specifically pointed out that "I think we may be sitting here for a lot longer than we expected," and Chicago Fed President Austan Goolsbee said, "I think now we will wait for this strategy, even though it seems to contradict our expectations." The purpose of promoting increased liquidity is to delay inflationary pressures.

Essentially, the actions of the US central bank are aimed at encouraging companies and individuals to increase borrowing to support employment and consumer markets. However, what the Fed cannot foresee is how much of these borrowed funds will be used to purchase scarce assets to hedge against inflation rather than stimulate the economy. It seems too early to fully assess such risks, but Bitcoin investors are skeptical about the Fed's chances of a soft landing.

In addition, Bitcoin’s value was impacted on May 13 by an unexpected factor: the return of social media influencer “Roaring Kitty,” a former marketer who played a key role in the 2021 GameStop (GME) rally.For nearly three years, the Bitcoin community seemed to hope that this figure would have some form of notable impact.

Cryptocurrency investors expect a positive shift in sentiment toward digital assets due to growing distrust of banks and traditional finance, especially in light of recent government bailouts, including a rescue of Philadelphia-based Republic First Bank.These developments, these investors believe, could drive more participants toward cryptocurrencies.

Edmund

Edmund