Deng Tong, Golden Finance

Bulls are back, come back soon!

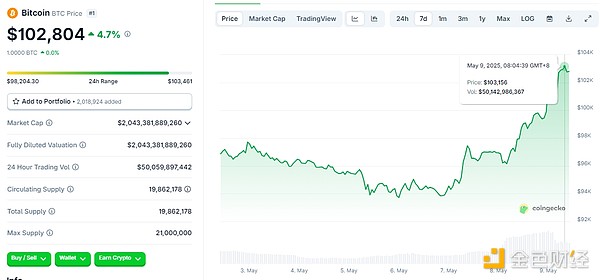

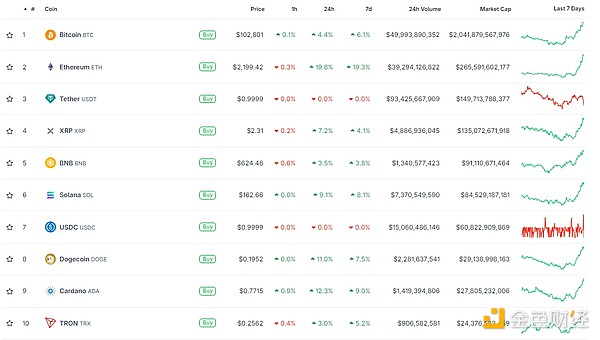

Overnight, the crypto market rebounded sharply, with Bitcoin rising again to over $100,000, reaching a high of over $103,000, and Ethereum even increasing by more than 20%. The crypto market is in a good situation. As of press time, BTC rose 4.7% to $102,804. In addition, many other mainstream currencies have achieved double-digit increases.

What are the favorable factors that are boosting the rapid recovery of the encryption market? How much can this round of market rise?

1. Multiple U.S. states may start a crypto reserve competition

On May 6, New Hampshire Governor Ayotte issued an announcement on social media, announcing that New Hampshire will pass a bill passed by the state Senate and House of Representatives to allow the state to "invest in cryptocurrencies and precious metals." House Bill 302 was introduced in New Hampshire in January this year, which would allow the state's treasury department to use funds to invest in cryptocurrencies with a market value of more than $500 billion."The 'Live Free or Die' state is leading the future development of business and digital assets," the New Hampshire Republican said in a May 6 X post. With the signing of the bill, New Hampshire became the first of several U.S. states to consider legislation to establish a strategic Bitcoin reserve, including an initiative to cooperate with the federal government.

Subsequently, Arizona Governor Katie Hobbs signed a bill on May 7 that allows the state to retain unclaimed cryptocurrencies for at least three years and deposit them in a "Bitcoin and Digital Asset Reserve Fund." House Bill 2749 allows Arizona to claim abandoned digital assets if no communications are responded to within three years. Custodians in the state can stake these cryptocurrencies to earn rewards or receive airdrops.

Meanwhile, on the same day, a Texas House committee voted 9-4 to pass a Republican-backed bill to establish a Bitcoin reserve, which now only needs a full house vote to be sent to Governor Greg Abbott's desk.

North Carolina’s Digital Asset Investment Act would authorize the state treasurer to invest 5% of any designated funds in “qualified digital assets.”The bill passed the House of Representatives on second reading on April 30 by a vote of 71 to 44 and was sent to the Senate for consideration. The bill would also “examine the feasibility of allowing members of state retirement income plans to make such investments (through cryptocurrency ETPs)” and study the creation of a state reserve to hold seized or confiscated cryptocurrencies.

Ishmael Green, a partner at law firm Diaz Reus, said he expects about a half-dozen states to follow New Hampshire’s lead in the short to medium term — “as states seek to hedge against inflation in addition to protecting their balance sheets.”

David Lawant, head of research at FalconX, said he also expects at least a few more states to enact such laws in the next six to 12 months.

For more information, please refer to 《What are the highlights of the New Hampshire Bitcoin Reserve Act? Will it trigger other states to follow suit? 》

《After New Hampshire wins the cryptocurrency reserve competition, which states are next? 》

2. The United States and the United Kingdom reach a trade agreement

The United States and the United Kingdom announced a trade agreement on Thursday, May 8, which is the first formal trade agreement reached by US President Trump since launching the global reciprocal tariff policy. Trump called the agreement a "historic breakthrough", while British Prime Minister Starmer said that the consensus reached by both sides on the anniversary of Victory in World War II was a "historic day".

According to Trump, the UK will open its market to the US on a number of agricultural products, including US beef, ethanol and "almost all the products produced by our farmers", which is expected to involve "billions of dollars" in exports.

On the British side, Starmer pointed out that the agreement is "extremely important" to the UK's automobile and steel industries. According to the British Prime Minister's Office (Downing Street), The US import tariff on British cars will be reduced from the original 25% to 10%. In addition, the United States will relax tariffs on British steel and aluminum products.

Although the terms of the agreement are still to be further determined, the Trump administration is eager to announce this preliminary achievement, which has attracted the attention of the market. Paul Ashworth, an analyst at Capital Economics, pointed out: "This reflects the Trump administration's increasing urgency to seek compromise space before tariff measures affect economic growth and inflation."

Trump denied exaggerating the importance of the agreement and said that the agreement is "the best result that can be achieved at present."

After Trump announced that he had reached a trade agreement with the United Kingdom, U.S. Commerce Secretary Lutnick said that improving market access for U.S. exporters will bring billions of dollars in revenue. Lutnick said in the Oval Office: "They agreed to open the market, which will increase opportunities for U.S. exporters by $5 billion." "We still have a 10% tariff, which will bring $6 billion in revenue to the United States." Lutnick said that the agreement will not put pressure on the British economy and British workers will not be negatively affected by the agreement. He added that the agreement means Britain can export 100,000 cars to the United States, "and only have to pay a 10% tariff."

A direct impact of U.S. President Donald Trump's announcement of a "trade deal" with the United Kingdom, the price of Bitcoin rose to more than $100,000, the Dow Jones Industrial Average rose 500 points, and the S&P 500 rose 1.47%.

Trump wrote in a Truth Social post: "There are many other deals that are in serious negotiation!"

The agreement between the United States and the United Kingdom will mark a easing of global trade tensions, thereby boosting risk appetite in various markets, including cryptocurrencies.

Third, the vote on the US dollar stablecoin bill is imminent, and many giants are entering the stablecoin market

The U.S. Senate is scheduled to hold a key vote on the GENIUS stablecoin bill on Thursday local time (Friday Beijing time). The bill requires that stablecoins must be fully backed by liquid assets such as the U.S. dollar and short-term Treasury bonds. Therefore, the bill needs 60 votes to pass, and it needs the support of Democratic senators. Although there were changes on the eve of the vote, nine Democratic senators announced that they would withdraw their support. But the bill is likely to pass. Because the U.S. dollar stablecoin is expected to be one of the main buyers of U.S. Treasury bonds in the future, U.S. Treasury Secretary Bessant said that the demand for digital assets for U.S. Treasury bonds will be as high as $2 trillion. Coinbase CEO also said that the GENIUS Act may eventually be close to the president's signature in the form of bipartisan support. While the United States is legislating the stablecoin bill, several U.S. Internet giants are also entering the stablecoin market. Patrick Collison, CEO of global payment platform Stripe, announced on May 5 that it is developing a dollar-based stablecoin product, mainly for markets outside the United States. Stripe announced on May 7 that it will launch a new feature that allows platform customers to "send, receive and hold balances in USD stablecoin accounts, similar to how traditional fiat bank accounts work". The account supports Circle's USDC and Bridge's USDB, which was acquired by Stripe in October 2024. The service will cover more than 100 countries, including Argentina, Chile, Turkey, Colombia and Peru.

Separately, Meta, which has more than 3 billion daily active users, is considering integrating stablecoins to reduce payment costs compared to fiat currencies, such as paying Instagram creators. The report said that "the company does not seem to have determined which stablecoin to use at this time". In addition, Meta has "contacted crypto infrastructure companies to solve the cost problem of cross-regional payments". The company has also hired "former Ripple executive Ginger Baker as vice president of product".

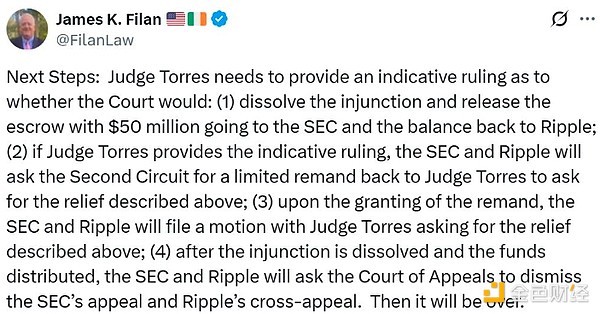

Fourth, SEC and Ripple settle

According to the SEC’s statement on May 8, the SEC and Ripple submitted a joint settlement letter to a New York court, requesting the lifting of the August 2024 ban on Ripple and the return of $75 million of the $125 million civil penalty held in escrow to the cryptocurrency company.

The settlement comes as the SEC fully withdraws from a series of cryptocurrency investigations and lawsuits initiated during Gensler’s tenure. After Trump took office in January this year and appointed Paul Atkins, who is friendly to cryptocurrency, as the new chairman of the SEC, the SEC’s attitude towards cryptocurrency regulation has taken a 180-degree turn.

But SEC Commissioner Caroline Crenshaw harshly criticized the pending deal in a May 8 statement, saying it would hurt the regulator’s ability to oversee cryptocurrency companies and undermine the court’s ruling.

"This settlement, combined with the procedural dismantling of the SEC’s crypto enforcement program, does great harm to the investing public and undermines the role of courts in interpreting our securities laws," she said. "At the same time, this settlement, along with a series of dismissals, collectively undermines the credibility of our lawyers in court, who are being asked today to take the opposite legal position from just a few months ago."

Meanwhile, Crenshaw believes that if Judge Torres accepts the settlement, it will erase "the investor protections we have won" and leave a "regulatory vacuum" until the cryptocurrency task force develops a regulatory framework. "This settlement is not in the best interests of the investors and markets that our agency serves and protects. It raises more questions than answers."

5. SEC considers new rules to relax security token issuance

In a speech on May 8, Hester Peirce, a commissioner of the U.S. Securities and Exchange Commission (SEC), said that the commission is considering amending the rules to allow companies to issue tokenized securities more freely.

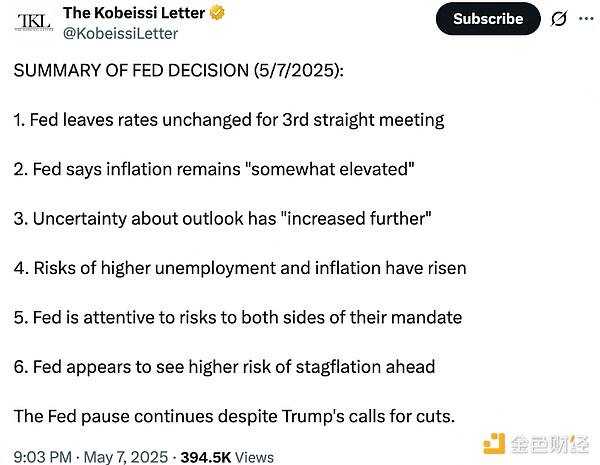

In her speech, Peirce said that regulators are "considering potential exemptions for companies that use blockchain technology to issue, trade and settle securities" from certain registration requirements. For example, decentralized exchanges (DEX) may no longer need to register as "broker-dealers, clearing agencies or exchanges." The SEC has previously issued multiple Wells notices to DEXs such as Uniswap, accusing them of failing to register as securities exchanges. Companies "should not be subject to inappropriate regulations, which in many cases were developed before the technology being tested existed and may be eliminated because of the nature of that technology." The Federal Reserve's decision on May 7 to keep interest rates at 4.25%-4.50% has enhanced the appeal of cryptocurrencies. Fed Chairman Jerome Powell, in his post-meeting remarks, stressed that the risk of stagflation — slow economic growth and persistent inflation — is rising, in part because of Trump’s tariffs.

“The Fed seems to expect both higher inflation and higher unemployment in the future,” Kobeissi Letter said on X, adding: “They are holding off on cutting rates to see which part of their dual mandate will heat up further. Uncertainty remains.”

This environment has boosted Bitcoin’s status as a store of value, often likened to “digital gold.” Investors are using Bitcoin as a hedge against fears that inflationary pressures will erode fiat currencies, just as cryptocurrencies rose during periods of monetary easing in 2020. "The Fed is worried about stagflation, and we think this outcome is good for Bitcoin," said Zach Pandl, head of research at Grayscale. 7. Technical rebound in the cryptocurrency market From a technical perspective, the current rise in cryptocurrencies is part of a rebound from the $2.4 trillion support level. The last time the market value broke through the $3 trillion mark was on March 3, after which a tariff-induced sell-off on April 7 caused the market value to fall to $2.27 trillion. The total market value of the crypto market is currently $3.03 trillion, trying to break through the resistance zone between $3.1 trillion and $3.25 trillion.

Cryptocurrency market capitalization daily chart.

If this happens, it will show that bulls are able to maintain the uptrend and set their sights on the all-time high above $3.69 trillion. The daily RSI has steadily risen from the oversold state of 30 on April 7 to the current 68, indicating that bullish momentum is accelerating.

Eight, how high can this round of market rise?

Standard Chartered Bank: The target of $120,000 in the second quarter may be too low.

VALR Chief Marketing Officer Ben Caselin: As Bitcoin seeks to consolidate its value above $100,000, it is "very likely" to hit a new high of more than $110,000 soon. "Retail is only entering the traditional second half of Bitcoin's four-year cycle, which could see a macro peak in the fourth quarter of this year."

Charlie Sherry, treasurer of Australian cryptocurrency exchange BTC Markets: While we may see psychological resistance at the $100,000 mark, it seems inevitable that Bitcoin will add another zero to its price.

Crypto entrepreneur Anthony Pompliano: The trade deal means the odds are increasing that we'll hit a new all-time high in 2025.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Davin

Davin YouQuan

YouQuan YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan Joy

Joy Hui Xin

Hui Xin YouQuan

YouQuan