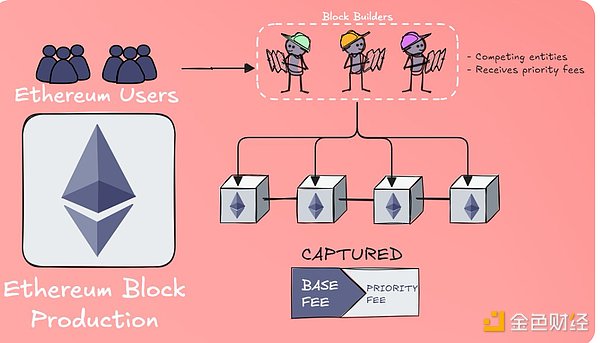

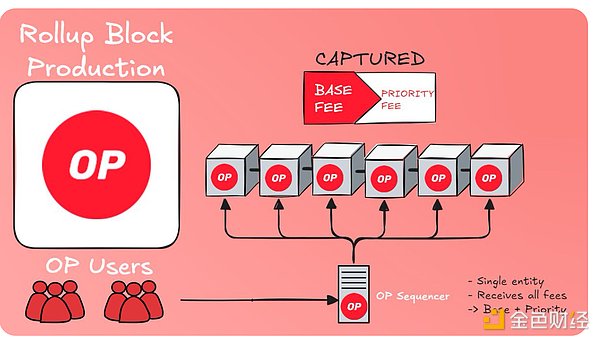

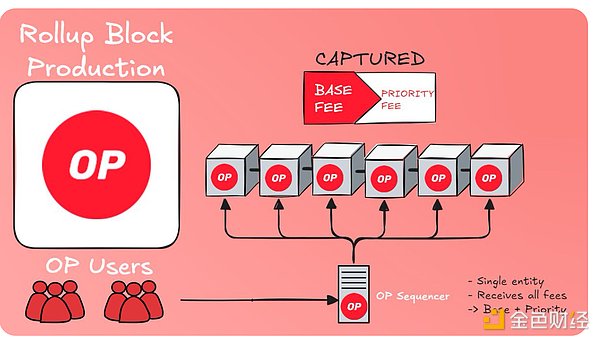

Traditional Rollup Block

Taking Optimism as an example, we can keep the same relative structure as Ethereum, simply replacing Builders (a collection of competing entities) with Sequencers (a single machine run by the team behind Optimism).

Visualization:

Again, follow this flow and you’ll see they’re very similar:

Optimism users submit their transactions to the OP Sequencer

As with Ethereum, these transactions will state the user’s maximum fee, covering the base fee (OP Stack chains will destroy this fee, but not all L2s do this [e.g. Arbitrum]) and uses the remaining fee increment as a priority fee/tip (which is kept by the team running the sequencer)

The Sequencer then orders the transactions, proposes the next block to the canonical chain, and updates the L2 state/worldview to mainnet Ethereum

The important thing to note here is that the end-user relationship and 100% of the fees go to the ordering entity (i.e. they stay in the L2 ecosystem). What that entity (whether it is Optimism, Base, Arbitrum, or Blast) does with those fees is entirely at their discretion.

- Some will burn the base fee and pocket the priority fee (base fee). - Some will give both to token holders (Arbitrum). - Others will return some of the funds to developers on the chain (Blast).

But if the L2 captures all of these fees, how does Ethereum benefit? Let’s talk about how these two block building processes fit together…

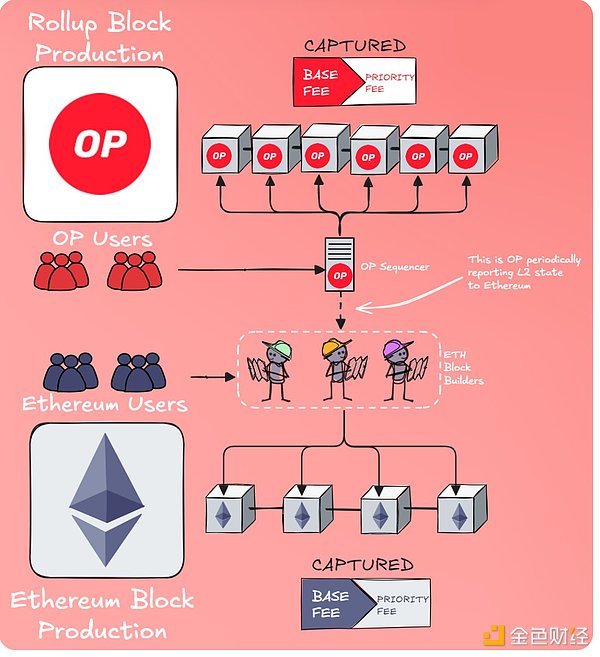

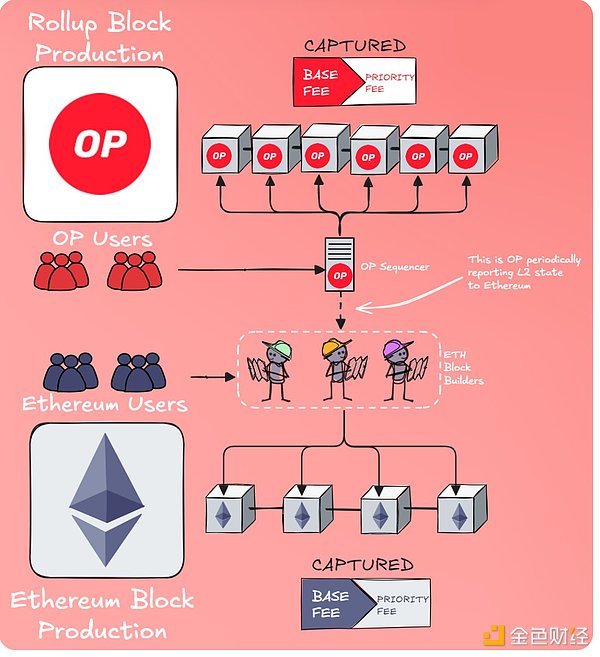

Traditional Rollup + Ethereum Block

As always, first a visualization:

As you can see, not a whole lot was added to tie two separate block building processes together (one line).

This line represents the L2 sequencer publishing data to the Ethereum mainnet at regular intervals so that the L2 can provide some safety guarantees (such as forced inclusion) to L2 users.

Note: Ethereum cannot dictate when any given L2 publishes transactions, which means the cadence and efficiency of publishing is entirely in the hands of the submitter.

All in all, it is quite beneficial for traditional L2s, which can both capture all fees generated within their ecosystem and control their largest single expenditure (publishing to the mainnet) because it is arbitrary.

Recap

Okay, we have laid the foundation for the mystery. Let’s review the most important concepts from the traditional concept so that we can dive into the Based differentiators:

Ethereum blocks are built by competing, unrelated parties

Traditional Rollup blocks are built by collators run by the Rollup team

Each block construction process captures 100% of fees in that ecosystem, and Ethereum/L2 are linked via an arbitrary L2 release cadence

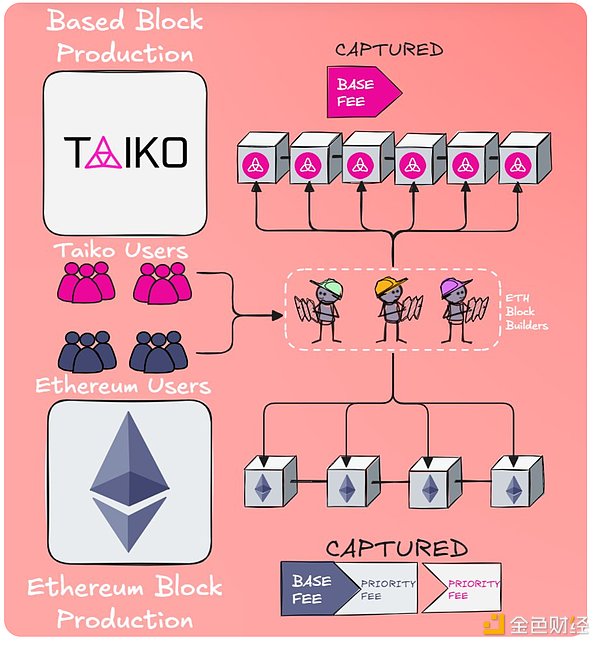

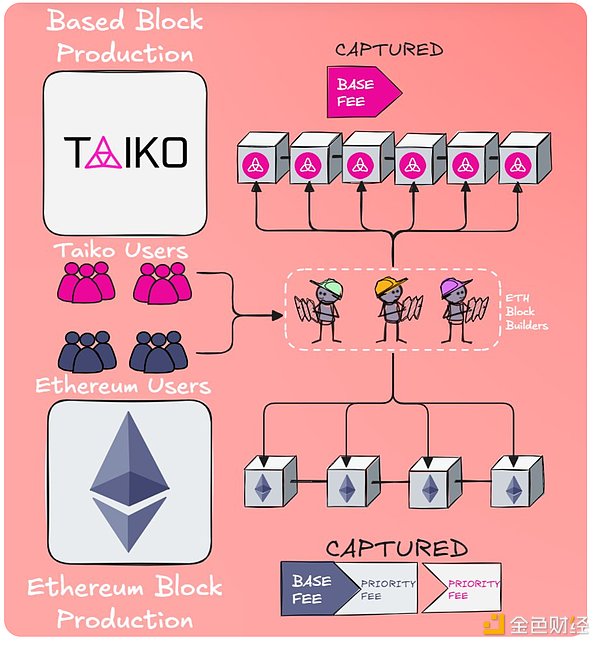

Based Rollup + Ethereum Blockchain

The reason we don’t need to start with a graph-only Based is that Based constructions are relatively simple (which makes them elegant).

They asked "Why don't we just use Ethereum as our sequencer?" So, they did this by leveraging the builder of our Ethereum block building part.

Visualization

You might ask, how does this work? The process itself is not too different from traditional Rollups, but the user experience is a little subtle.

Flow

Users send their transactions to L1 builders who choose to be Ethereum and L2 based builders.

Users specify their maximum fee

L2 captures the base fee (determined by L2 congestion) and passes the priority fee/tip to the L1 builder responsible for ordering.

Under this model, Ethereum not only captures 100% of the fees for its own ecosystem, but also captures a portion of the L2 tip on top of the settlement posting costs.

In exchange, Based L2 inherits:

Ethereum liveness (i.e., as long as Ethereum is processing blocks, the L2-based blockchain will continue to operate, whereas if a single collator of a traditional rollup fails, the entire chain may stop operating), and

the ability to atomically compose with L1 state (e.g., swaps on L2 can interact with L1 liquidity).

But it is not without its drawbacks, as being so tightly intertwined with Ethereum means that Ethereum-based teams sacrifice some profitability (priority fees) and also have to bear the friction associated with Ethereum's mechanisms (such as 12 second block times).

These things can be mitigated by mechanisms such as pre-confirmation, but they still have to be considered.

Recap & Prediction

So, are Based Rollups the solution to all our L1<>L2 economic relationship problems and the future of Ethereum?

I actually doubt that many teams will choose to use Based, as it will directly affect their business bottom line. Thankfully, some of their advantages (L1 atomic composability) are attracting builders, so we can at least see the progress of experiments.

There is also an interesting research going on by Taiko Gwyneth and Spire, called "next generation Based", who emphasize L1 applications running their own base application chain, obtaining priority fees and maintaining composability with L1 contracts. I will keep an eye on this.

If the Ethereum Rollup ecosystem had been based on this from the beginning, I believe its narrative position would be better than it is today, but you never know.

Anais

Anais