Source: The DeFi Report; Compiled by: Deng Tong, Golden Finance

We are experiencing (we think) a once-in-a-century structural change in world trade and global markets.

The Changing World Order

Everyone is focusing on tariffs right now. I get it, but let's not be distracted or lose sight of the big picture. Don't forget, We are in the "Fourth Turning" period - which occurs approximately every 80 years.

If you are not familiar with the "Fourth Turning," Neil Howe and William Strauss defined it as a period of turmoil and reconstruction that occurs approximately every 80-90 years. During the Fourth Turning, society enters an existential crisis, often catalyzed by war, revolution, and other turbulent factors, during which old institutions are destroyed or fundamentally reshaped in response to perceived threats.

They tend to coincide with the end of long-term debt cycles (which we are also experiencing).

These are historical “winter” times when all aspects of life undergo dramatic changes:

Social unrest

Political unrest

Changes in the global monetary system

Economic and technological disruption

Cultural and moral reshaping

Geopolitical upheaval

In many ways, the “Fourth Turning” represents a reset of society, a time of destruction and rebirth. Historical examples include the American Revolution (1775), the Civil War (1861), and the Great Depression/World War II (1939).

The end of the “Fourth Turning” gave rise to the “First Turning,” with renewed optimism and the consolidation of a new social order.

Now, look around you. Look at how divided America is. Look at inequality, class struggle, social war, the breakdown of American and global institutions, populism, geopolitical conflict, the rise of cryptocurrencies like Bitcoin, and artificial intelligence.

You are living through the “Fourth Turning.”

Donald Trump is a byproduct of these underlying conditions. He happens to be a product of the “Fourth Turning” — a period in which voters tend to elect “strong” leaders to meet today’s challenges.

I share this because I believe you need to have the right perspective to see clearly what is happening today. If you don’t study history, you have no reference point to understand what we are going through.

We recommend you read Ray Dalio’s The Changing World Order, which is another great resource on this topic.

So in this context, Trump’s tariffs make sense, right?

About those tariffs…

Tariffs aren’t (really) tariffs

On the surface, these tariffs don’t seem very reasonable. Of course, the Trump administration will defend them in the media and make the following arguments:

Some of this is true. We know that the middle of the country has suffered greatly over the past few decades as manufacturing moved to China. But that still doesn’t explain the term “Liberation Day.” Because the term “Liberation Day” itself is meaningless.

I won’t go into detail because I think everyone understands that free markets work better than markets distorted by government intervention.

So, what happened?

We analyzed the tariffs that Trump imposed on China during his first term, hoping to find some clues to explain it all. As a result, we found a key clue, which led us to conclude that the tariffs imposed on other countries on "Liberation Day" were intended to put pressure on China.

What is this clue?

After the United States raised tariffs on Chinese goods in 2018-2019, China actively redirected its exports to other markets and through third countries. Instead of losing sales, Chinese companies found other buyers. For example, exports to the EU and ASEAN countries (Cambodia, Malaysia, Singapore, Thailand, Vietnam) increased, making up for the loss of exports to the United States. By the early 2020s, China's exports to the EU ($580 billion) exceeded its exports to the United States ($440 billion), a trend that began to accelerate after the United States imposed tariffs on China in 2018-2019. Many Chinese manufacturers also circumvent U.S. tariffs by transshipping products through neighboring countries.

A Harvard Business School study found that between 2017 and 2022, Vietnam made up nearly half of China’s loss in U.S. import market share (from $42 billion to $109 billion), while Vietnam’s imports from China climbed—suggesting that Chinese products are being transshipped through Vietnam. Similar patterns have been observed in Taiwan and Mexico.

In short, Chinese goods are able to reach the United States indirectly. In fact, China’s own statistics show that its exports to the United States have barely fallen, while U.S. data show a sharp drop.

The data discrepancy suggests that there is an “import gap” of more than $150 billion between what China claims to export and what the United States claims to import, meaning that a large number of Chinese exports are being diverted or mislabeled.

Who benefits the most? Vietnam, Taiwan, Malaysia, Cambodia, Thailand, Mexico and Europe.

Who will be hit the hardest by the April 2 tariffs?

Cambodia (49%), Vietnam (46%), Thailand (36%), Taiwan (32%) and the European Union (20%).

Is this starting to make sense?

We believe that Trump does not really want to generate revenue by imposing tariffs on these countries. He wants to drive these countries into a corner and use tariffs as leverage. We believe Trump’s goal in this move is to incentivize these countries to shut out Chinese products through negotiations. In return, we speculate that he may offer reduced tariffs, increased trade with the United States, and security guarantees.

We believe Mexico and Canada may have agreed to shut out Chinese products. Why? Because neither country is on the “Liberation Day” list. We also believe Trump’s preemptive strike is strategic - sending a message to other countries that if he can do it to his neighbors, no one can be spared.

To be clear, we have no inside information on this and do not endorse this strategy. This is just our conclusion after studying past tariffs on China and questioning the motivation for imposing reciprocal tariffs on everyone else. Our goal is to find the signal among the many arguments and play the game based on the incentive mechanism. We think this is the United States versus China.

As Charlie Munger (RIP) once said, “Give me an incentive and I’ll show you a result.” The US has an incentive to impose tariffs on Vietnam (among others) in order to exclude China from those markets and shift supply chains away from China.

Scott Bessant

We think Scott Bessant is the main architect of this plan (and the man who convinced Trump to pause for 90 days to save the bond market). Yes, the man who helped bring down the Bank of England may now be trying to bring China to its knees.

Bessant frequently makes statements like “China is the most unbalanced economy in the history of the world” (referring to China’s trade surplus). If you’ve seen his interview with Tucker Carlson, you’ll see that almost all of his statements are a foregone conclusion. We think he sees an opportunity to radically change China’s trade imbalances – and he deeply understands the levers behind it all. Consider, for example, that the People's Bank of China sucks dollars from exports and uses them to manipulate the yuan (to make exports cheaper).

We believe there is a bigger game at work here. Remember, this is a macro view of the changing world order.

What's next?

Negotiations. We think the Trump team will seek to negotiate with all countries except China.

Markets rebounded strongly on Wednesday after the 90-day moratorium was announced. It's worth noting that crypto assets have rebounded less than stocks.

We are currently viewing this as a bear market rally. It's normal to see a correction of about 50% after a big sell-off. We will reassess if the S&P holds at 5,550 and the Nasdaq holds at 17,600.

But the "biggest" adversary is China. We don't think there will be any negotiations here. Trump doesn't want to negotiate. He wants to win over the other countries on the “Liberation Day” list and then work to shift supply chains away from China. This is a power struggle. This has nothing to do with tariffs and “fairness.”

If the U.S. makes a deal with countries like Vietnam to keep China out, we should expect China to retaliate with far more than reciprocal tariffs.

To be clear, we think the market will view the initial agreement announcement as positive news. But China’s pushback could sober the market as it gradually realizes that a trade war could lead to a capital war, and possibly even a hot war. Remember, we now have a 90-day trade suspension. But there is no solution that will allow investors and business owners to plan for the future with more confidence. In fact, the opposite is happening as Trump has again raised China tariffs to 145%.

Now we see reports like this:

Bitcoin and Risk Assets

Looking ahead, the market environment for Bitcoin is beginning to improve. We recently allocated about 15% of our funds to BTC (entry price $77,000) and a small amount of TIA (entry price $2.34) as a long-term holding.

Despite the uncertainty in the market, what makes us more optimistic about Bitcoin?

Given the volatility in the market, we think the time for liquidity conditions to improve is approaching:

Inflation is 1.4% (according to Truflation data)

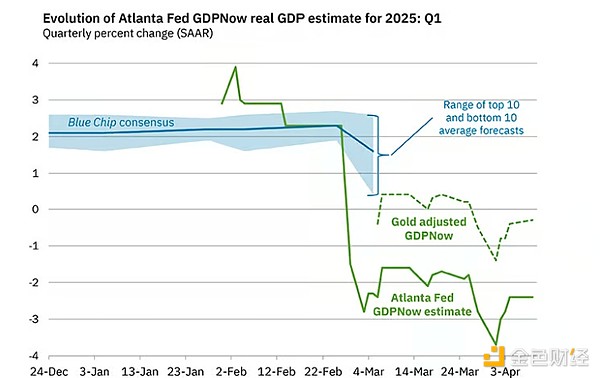

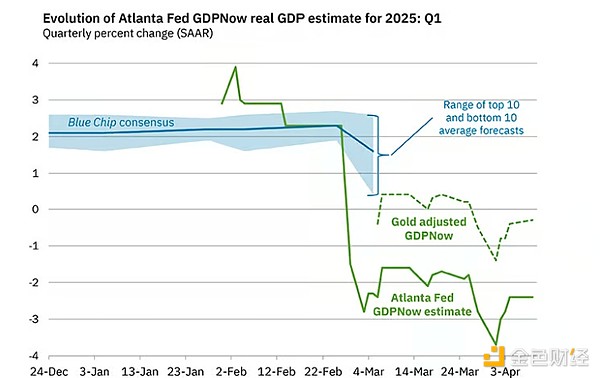

Economic growth is slowing. We think tariffs will accelerate this process. Meanwhile, the Atlanta Fed expects GDP to shrink by 2.4% in the first quarter.

The probability of a recession is quite high (we think more than 50%). According to the Atlanta Fed's forecast, we may already be in a recession.

The Treasury needs to refinance $2.5 trillion of debt by the end of the year and issue another $2 trillion (to cover the deficit), with more to come in 2026.

The dollar has fallen sharply (to $100).

In addition, China has begun to stimulate its economy. We think there will be more stimulus to come. As the RMB comes under pressure, capital will flee China and we think Bitcoin will be bought (just like it did when China devalued the RMB in 2015 and during the escalation of the trade war in 2019).

That said, we still prefer caution given Bitcoin's volatility, the lack of certainty/resolution on tariffs and Chinese policy, and Bitcoin's recent strong correlation with the stock market.

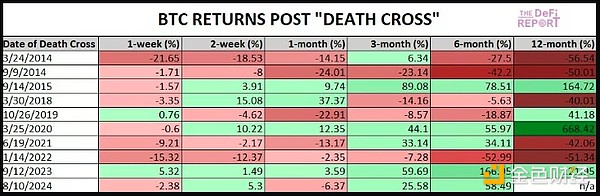

In terms of momentum indicators, Bitcoin's 50-day moving average fell below the 200-day moving average this week (a "death cross") and is currently trading below the all-important 200-day moving average. We are currently eyeing the previous all-time high. A break below $70,000 ($70,000) would be further confirmation that a more prolonged bear market is on the horizon. So caution is warranted. We are also starting to see signs of seller exhaustion as things unfold. We are watching this closely.

Below, we can look at how BTC performs following a “death cross.”

It’s also important to consider that the Fed may be somewhat constrained in this regard. Bond yields are rising again. If the Fed starts to ease policy, the long end of the yield curve may not do so (as we saw last September). In this more stagflationary environment, Bitcoin should do well. The challenge, though, is that stocks (and altcoins) may not. Given the correlation to the Nasdaq and other risk assets, this could act as a headwind for Bitcoin in the near term.

Conclusion

We think it is prudent to look at the bigger picture. We believe we are in the early stages of a once-in-a-century event (in terms of its potential domino effects). If we are correct, it will take time to resolve. Therefore, we want to remain well prepared. Of course, we must weigh these views against the fact that the situation could change quickly if: 1) China comes to the negotiating table, 2) Trump backs off, 3) the courts step in to block or reduce tariffs. We simply believe that tensions and uncertainty could increase further in the short term.

We believe the real game is to try to shut out Chinese goods from many key markets around the world. It is not clear whether this strategy will work. Our base case is that China sees Trump’s actions as an adversary rather than one seeking to negotiate. We expect further escalation as a result.

Trump’s aggressive style has worked well on many occasions. However, in this instance, it may be a critical flaw. Why? He can’t bully the bond market. The more he pressures China, the greater the headwinds from the long end of the bond market.

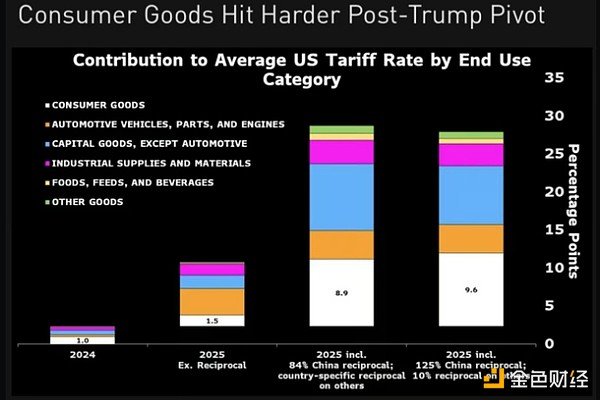

Despite the 90-day suspension, the market still has not found a long-term solution. Moreover, considering the 145% tariff on China, the revised tariff package (10% on other products) is actually more harmful to consumers than the tariff package implemented on April 2 (this is due to the volume of goods imported from China).

We will continue to monitor the situation as always.

Alex

Alex