Author: DeFi Cheetah Source: X, @DeFi_Cheetah Translation: Shan Ouba, Golden Finance

CRV rose from $0.2 to $1.1 in 1 month, what happened? Curve Finance is gradually becoming the main channel for institutional funds to enter DeFi, and $crvUSD may achieve exponential expansion due to huge institutional capital inflows.

Problem Background

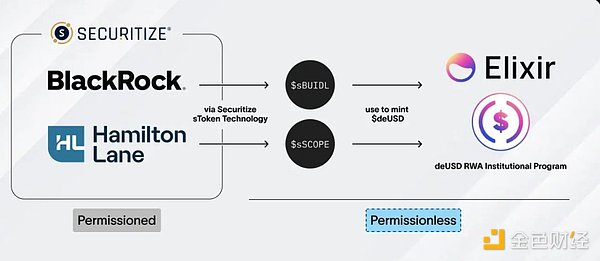

BlackRock launched $BUIDL (tokenized US treasury, tokenized US Treasury fund), however, due to regulatory requirements, $BUIDL holders can only transfer tokens to other pre-approved investors. This means that $BUIDL transactions are completely isolated from the DeFi ecosystem.

Through the Elixir platform, $BUIDL holders can mint $deUSD through pledged $BUIDL (i.e. $sBUIDL). Most importantly, similar to $USDe, Elixir chose Curve Finance as the main liquidity hub for $deUSD. This choice has far-reaching consequences.

Potential impact: Institutional capital enters DeFi

Currently, $BUIDL's asset size has reached US$551 million, and it is expected that this will be the first batch of institutional capital to enter DeFi. As this trend expands, more tokenized U.S. Treasuries may also flow into DeFi, and these funds are likely to be realized through Curve Finance.

The inflow of institutional capital is of great significance to $crvUSD’s business:

• Inflows are likely to purchase and stake $crvUSD to enjoy an annualized yield of approximately 15%.

• This yield comes from interest income on $crvUSD, creating a self-reinforcing flywheel effect.

The Impact of the Flywheel Effect

This interest income comes from leveraged demand in a bull market. For example, on the DeFi Saver platform, users can use $crvUSD to loop $BTC, $ETH or other collateral.

Once institutions holding $BUIDL or other tokenized treasuries mint $deUSD or other stablecoins on the Curve platform, they can easily use these funds to buy $crvUSD and stake it to obtain high returns without lock-in.

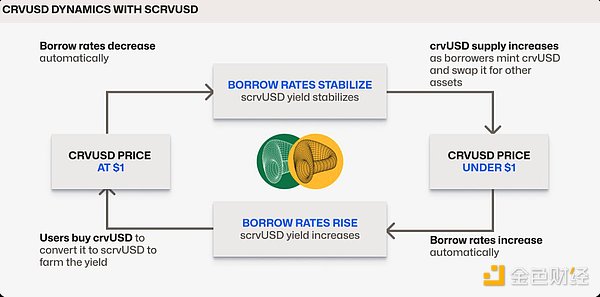

Many people may worry that the yield will drop significantly as more participants participate. But in fact, the flywheel effect is at work here:

• When more people buy and stake $crvUSD, the price of $crvUSD will be higher than $1.

• Pegkeeper will mint more $crvUSD, increase Pegkeeper debt, and lower interest rates.

• In a bull market, huge borrowing demand will once again push the price of $crvUSD below $1, thereby increasing the staking yield, attracting more people to participate in staking, and driving borrowing demand again.

This self-reinforcing flywheel mechanism can help $crvUSD achieve exponential expansion. The dynamic adjustment of its interest rate mechanism ensures that it is always attractive in market changes.

Currently, the main bottleneck of $crvUSD is not insufficient borrowing demand, but insufficient buying pressure or actual use cases, which cannot effectively digest the selling pressure brought by circular operations or leveraged transactions. If $crvUSD is below $1 for a long time, its high interest rate will discourage other potential participants.

Opportunities brought by BlackRock and Elixir

BlackRock’s $BUIDL and Elixir provide a bright prospect for the flywheel effect of $crvUSD:

• Institutional investors earn substantial returns through interest income from $crvUSD;

• The increase in institutional demand for returns drives the scale development of $crvUSD.

This is a win-win situation, marking the possibility of a deep integration of DeFi and traditional finance. With the continued inflow of institutional capital, the value of $CRV may further increase. If the flywheel effect of $crvUSD can be fully released, its scale potential will be immeasurable.

Alex

Alex

Alex

Alex Kikyo

Kikyo decrypt

decrypt Others

Others Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist