The first half of this year is almost over. Since BTC broke through the previous bull market high and rose to 70,000, there has been no exciting glory.

In recent months, the market has fluctuated repeatedly, and the flag of making money set at the beginning of the year is also slightly shaken. In any case, the main rising wave of the bull market has not yet arrived, and there will be opportunities everywhere, so don't worry.

This node is very suitable for reflection and review. This article is a statistics and comparison of the return rates of different encryption tracks from 2024 to the present. It is no longer an era of "picking up money". Which track is the most profitable? You will know after reading this article.

How have the returns of different encryption tracks performed since the beginning of the year?

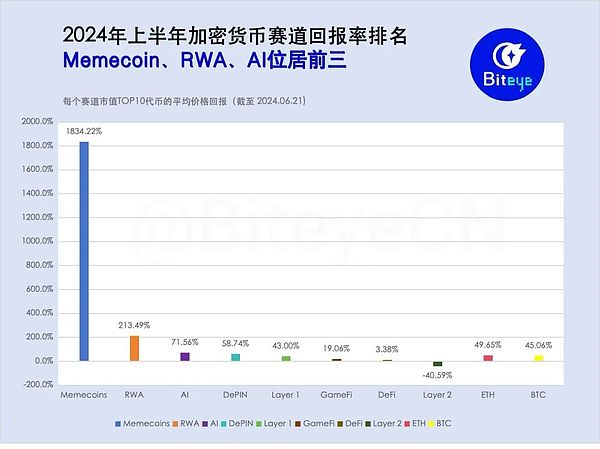

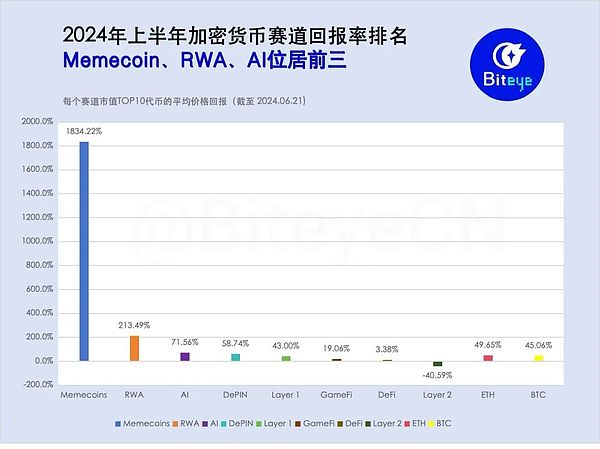

Ranked by the average YTD (January 1, 2024 to June 21, 2024) price return rate of the top 10 tokens in each track, data source is CoinGecko. The performance of the cryptocurrency track in the first half of 2024 is shown in the figure below.

Meme coin becomes the most profitable track

In recent months, "value investment is empty, all in MEME lives in the palace" has gradually become one of the "coin speculation mantras" in this round of bull market.

After statistics, there is no doubt that Meme coin has been the most profitable track so far in 2024, with the highest average return rate reaching 2405.1%. As of June 19, three of the 10 largest Meme coins by market value were newly launched around March-April: Brett (BRETT), BOOK OF MEME (BOME), and DOG•GO•TO•THE•MOON (DOG).

Among them, BRETT has the highest rate of return, up 14,353.54% from its issue price; dogwifhat (WIF) has risen 933.93% from 2024 to date (YTD), triggering the Meme coin craze at the time.

It is worth noting that the profitability of Meme coins is 8.6 times that of the second largest profitable track RWA and 542.5 times that of the least profitable DeFi track.

(Note: The return rate of the Layer 2 track ranked last is negative, and multiple comparison is not performed)

The second most profitable track RWA has a return rate of 213.5% since 2024

The concept of RWA (Real World Assets) has been discussed in recent months, and major giants have laid out in this track, including BlackRock Fund.

Therefore, RWA briefly became the most profitable track in February, with the highest return rate, but was subsequently surpassed by Meme Coin and AI tracks, until it surpassed AI Narrative again at the end of March, and performed well in early June.

Among the RWA tokens with the highest market capitalization, MANTRA (OM) and Ondo (ONDO) have seen the largest increases, at 1123.8% and 451.12% YTD, respectively, while XDC Network (XDC) has performed the worst, down 44.38%. Except for some old DeFis, RWA projects are generally in the early stages, so you can pay more attention to them.

The AI track follows closely behind, with a return rate of 71.6%

As early as the end of 2023, the AI track has frequently appeared in the annual outlooks of major investment institutions. As Messari said in its 2024 investment forecast, AI has become the new darling in the technology field. Indeed, it lived up to expectations. From 2024 to date, the average return rate of the AI track is 71.6%, ranking third.

Among them, Arkham (ARKM) had the highest increase of 215.50%. AIOZ Network (AIOZ) was the second, up 192.19%. Render (RNDR) and Fetch.ai (FET), which received much attention in the first half of the year, had returns of 57.47% and 116.00% respectively, and performed well.

DePIN and Layer1 achieved steady growth

DePIN's return rate was basically negative in the first half of the first quarter, but it began to reverse the downward trend since March, and its return rate has reached 58.7% so far.

The best performer among the large-cap DePIN tokens is JasmyCoin (JASMY), with an increase of 323.42%, followed by Arweave (AR) and Livepeer (LPT), with YTD increases of 174.07% and 116.06%, respectively.

In contrast, Helium (HNT) performed poorly and was the only large-cap DePIN token to fall by more than 50%, with a return rate of -50.94%.

DePIN is also one of the tracks that capital bets on in this round of bull market. If the total market value of DeFi increases 10 times and the total market value of DePIN reaches half of DeFi, then the total market value of DePIN will reach 500 billion US dollars, with at least 20 times of growth space.

The return rate of the Layer 1 (L1) track from 2024 to date is 43.0%. Although Solana (SOL) has received a lot of attention as a public chain that has given birth to many high-potential memes, with a YTD increase of 22.91%, it has fallen a lot compared to the return rate of 85.05% in mid-March.

The best performing large-cap L1 cryptocurrencies are actually Toncoin (TON) and Binance Coin (BNB), with increases of 204.72% and 86.10% respectively.

In contrast, Bitcoin (BTC) has increased by 45.06% since the beginning of the year after setting a new high, while Ethereum (ETH) has only increased by 49.65% YTD despite high expectations through ETF applications, which is comparable to BTC.

GameFi, DeFi and Layer 2 lag behind

The return rate of the GameFi track is 19.1%. It is a track with relatively few market rotations since the beginning of the year. The overall financing is not small, but there is no hot product yet.

The best performing large-cap GameFi tokens are FLOKI (FLOKI), with an increase of 362.79%, Ronin (RON) at 21.16%, and Echelon Prime (PRIME) 5.27% YTD. The returns of other large-cap tokens are all negative, including GALA (GALA) at -13.43% and Immutable (IMX) at -32.02%.

The DeFi track performed well in the first quarter, boosted by the Uniswap (UNI) fee conversion proposal at the end of February, but it was a little underpowered in the second quarter, with a year-to-date return rate of 3.4%. The large-cap DeFi token with a high return rate is Maker (MKR), with a YTD increase of 49.88%.

The Layer 2 (L2) track was the worst performer, with a return rate of -40.59%, almost halved. Among the large-cap L2 tokens, AEVO (AEVO) and Starknet (STRK) performed the worst, with returns of -85.40% and -63.16%, respectively.

The mainstream Ethereum L2 also performed poorly: Optimism (OP) had a return rate of -54.64%, and Arbitrum (ARB) had a return rate of -53.71%. It is worth noting that Mantle (MNT) is far ahead with a YTD return rate of 26.09%.

Calculation Methodology

Based on data from CoinGecko, this study examines the performance of the most popular cryptocurrency tracks from January 1 to June 21, 2024, based on the average daily price returns of the top 10 market capitalization tokens in each track compared to the price at the beginning of the quarter. For tokens launched during the quarter, the comparison is made with their first-day price data.

The representative tokens in each track (the top 10 market capitalization tokens) are selected by market capitalization ranking on the last day of the quarter.

In order to better meet the purpose of this study, tracks of specific chains, tracks with a small number of large-market capitalization tokens, or tracks with a high degree of overlap with other tracks are excluded.

This study is for reference only and does not constitute investment advice. Always do your own research and exercise caution when investing in any cryptocurrency or financial asset.

JinseFinance

JinseFinance