Author: Shane Neagle, CryptoSlate; Compiled by: Deng Tong, Golden Finance

Within one year after the three halving events, Bitcoin has experienced three major bull markets in its 15-year history . In 2013, 2017, and 2021, each time the Bitcoin price dropped significantly, until the next one.

However, the market after the listing of Bitcoin ETF seems to have created some new rules of the game. Since February 16, Bitcoin ETFs have seen net inflows from January 11 of nearly $5 billion as of February 26. According to BitMEX Research, this equated to buying pressure of 102,887.5 Bitcoins during the period.

As expected, BlackRock’s iShares Bitcoin Trust (IBIT) leads the way with $5.3 billion, Fidelity’s Wise Origin Bitcoin Fund (FBTC) follows with $3.6 billion, and ARK 21Shares Bitcoin Bitcoin ETF (ARKB) ranked third with $1.3 billion.

More than five weeks of Bitcoin ETF trading has brought in $10 billion in accumulated AUM, bringing the total cryptocurrency market cap to nearly $2 trillion. This level of market participation was last seen in April 2022, between the Terra (LUNA) crash and 1 month later. The Federal Reserve begins a rate hike cycle.

The question is, How will the market dynamics driven by the new Bitcoin ETF shape the future cryptocurrency landscape?

The impact of US$10 billion in AUM on market sentiment and institutional interest

To understand how Bitcoin prices affect the overall cryptocurrency market, we first need to understand:

The answer to the first question is simple. Bitcoin’s limited supply of 21 million BTC implies scarcity, which is enforced by a powerful computing network of miners. Without it and its proof-of-work algorithm, Bitcoin would be just another copy-pasted digital asset.

This digital scarcity, backed by real assets such as hardware and energy, will usher in the fourth halving in April, making Bitcoin’s inflation rate Dropping below 1%, Bitcoin has been mined at 93.49%. Additionally, the sustainable custody vector for Bitcoin miners has been weakening as they ramp up renewable energy.

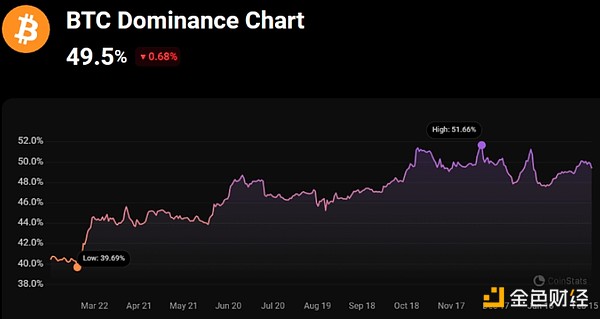

In effect, this treats Bitcoin as a sustainable and permissionless sound currency that cannot be tampered with at will like all fiat currencies. In turn, Bitcoin’s simple proposition and leadership dominates the cryptocurrency market, currently holding 49.5% dominance.

Bitcoin’s market share among all cryptocurrencies shows the focus of investor sentiment. Bitcoin has been viewed as a safe-haven asset for years. Image source: CoinStats

As a result, the altcoin market is centered around Bitcoin as market sentiment reference point. There are thousands of altcoins to choose from, which creates a barrier to entry because their fair value is difficult to measure. The rise in Bitcoin prices has increased investor confidence to engage in such speculation.

Since altcoins have a much lower market capitalization per token, their price movements result in larger profit gains. This is evidenced by SOL (+98%), AVAX (+93%) and IMX (+130%), among many other altcoins over the past three months.

Investors looking to earn higher profits from small-cap altcoins can benefit from Bitcoin interest spillovers. Beyond this, altcoins offer unique use cases beyond the sound currency aspects of Bitcoin:

Decentralized Finance (DeFi) – lending, borrowing, and exchange;

Tokenized games that make money while playing;

Cross-border remittances are settled with near-instant settlement and negligible fees;

Utility and governance tokens for DeFi and AI-based protocols.

With the emergence of Bitcoin ETFs, institutional capital takes the lead . The rapid growth in AUM for spot-traded Bitcoin ETFs is an unmitigated success. For example, when the SPDR Gold Shares (GLD) ETF launched in November 2004, it took the fund a year to reach a total net asset level of $3.5 billion, and Bayley Germany's IBIT reached this level within a month.

Looking ahead, Whales will continue to drive up Bitcoin prices through strategic allocations.

Integrate a spot Bitcoin ETF strategy into your portfolio

After receiving legal support from the U.S. Securities and Exchange Commission (SEC), the Bitcoin ETF gives financial advisors the power to allocate. Nowhere is this more evident than when Bank of America sought SEC approval to grant them the same authority.

The bank lobby joins the Bank Policy Institute (BPI) and the American Bankers Association (ABA) in petitioning the SEC to rescind the March 2022 Staff Accounting Bulletin 121 (SAB 121) rule. Depending on the requirements within their balance sheet, they can expand their clients’ cryptocurrency exposure.

Even without the banking portion of the Bitcoin allocation, the potential for inflows into portfolios is huge. As of December 2022, the total net assets of the U.S. ETF market are US$6.5 trillion, accounting for 22% of the assets under management of investment companies. Since Bitcoin is a powerful tool against inflation, the case for its allocation is not difficult.

Steflation CEO Stefan Rust said:

“In this environment, Bitcoin is a good safe-haven asset. It is a limited resource and this scarcity will ensure that its value grows with demand, ultimately making it a good asset class to store value and even increase in value.”

Without holding actual BTC and addressing the risk of self-custody, financial advisors can easily demonstrate that even a 1% allocation to Bitcoin has the potential to increase returns while limiting the market risk exposure.

Balancing enhanced returns with risk management

Sui Chung, CEO of CF Benchmarks, said mutual fund managers, Registered investment advisors (RIAs) and wealth management firms using the RIA network are buzzing about Bitcoin exposure through Bitcoin ETFs.

“We are talking about platforms with over a trillion dollars in assets under management and assets under advisory alone...A very large floodgate that was previously closed will open, probably in about two months’ time ."

Before the Bitcoin ETF is approved, Standard Chartered expects this exposure to only increase in 2024 It can bring in capital inflows of US$50 to US$100 billion. Matt Hougan, chief investment officer of the Bitwise Bitcoin ETF (which currently has $1 billion in assets under management), noted that RIAs have set portfolio allocations between 1% and 5%.

This is based on a Bitwise/VettaFi survey released in January, in which 88% of financial advisors Bitcoin ETFs are seen as the main catalyst. The same proportion noted that their clients had inquired about cryptocurrency risks in the last year. On top of that, the share of financial advisors advising on larger cryptocurrency allocations (more than 3% of portfolios) more than doubled from 22% in 2022 to 47% in 2023.

Interestingly, 71% of advisors preferred Bitcoin to Ethereum. This is not surprising given that Ethereum is an ongoing coding project suitable for purposes other than sound currency.

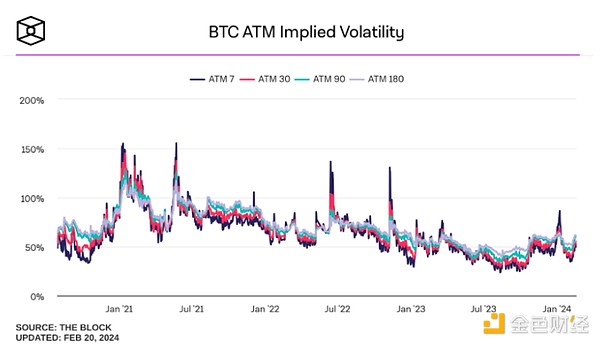

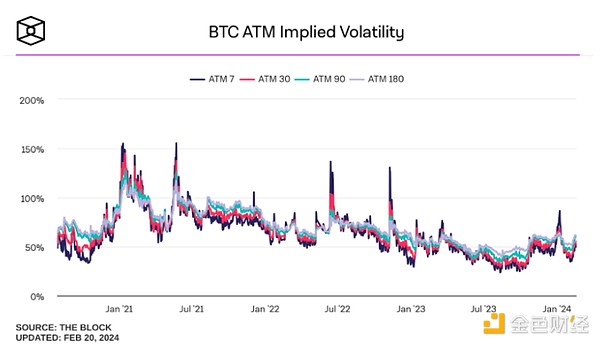

In a feedback loop, more Bitcoin allocations will stabilize Bitcoin’s implied volatility. Currently, Bitoin’s at-the-money (ATM) implied volatility, which reflects market sentiment on possible price movements, has subsided compared to the massive spike in January when Bitcoin ETF approval was announced.

Since all four The time periods (7 days, 30 days, 90 days, 180 days) are all above the 50% range, and market sentiment is consistent with the Crypto Fear and Greed Index entering high “greed” territory. At the same time, larger liquidity pools can increase price discovery efficiency and reduce volatility due to the creation of larger walls of buyers and sellers.

However, some obstacles remain.

Cryptocurrency Investment and CashFuture Trends of Bitcoin ETF< /span>

Relative to inflows into Bitcoin ETFs, the Grayscale Bitcoin Trust BTC (GBTC) caused outflows worth $7 billion. This selling pressure is due to the fund's relatively high fee of 1.50%, compared with IBIT's 0.12% (12-month exemption). Combined with profit-taking, this created significant selling pressure.

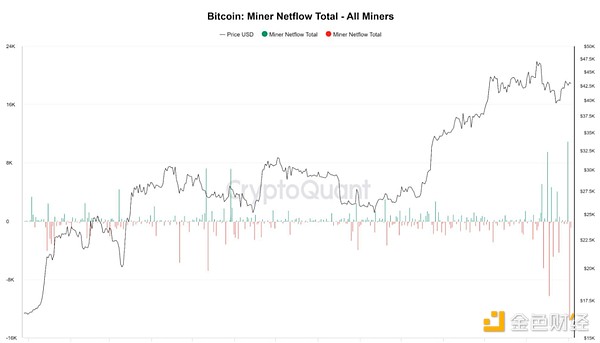

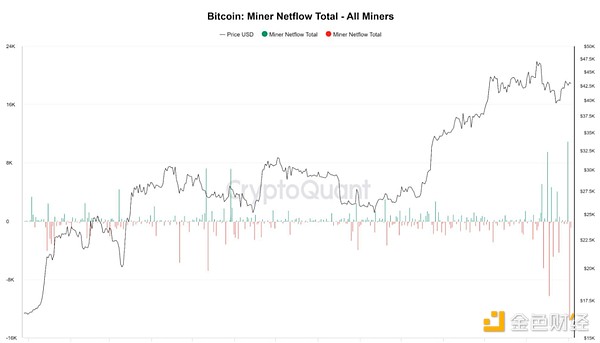

As of February 16, GBTC held 456,033 Bitcoins, four times more than all Bitcoin ETFs combined. In addition to unresolved selling pressure, miners are also reinvesting in preparation for Bitcoin's fourth halving by selling Bitcoin. According to Bitfinex, this resulted in an outflow worth 10,200 BTC.

Bitcoin miners daily Output is approximately 900 BTC. Regarding weekly ETF inflows, BitMEX Research reported an increase of +6,376.4 BTC as of February 16.

This dynamic has so far lifted the BTC price to $52,100, the same price as Bitcoin in December 2021 and just one away from the $68.7 ATH level reached on November 10, 2021 moon. Going forward, 95% of the Bitcoin supply is in profit, which is bound to exert selling pressure due to profit taking.

However, pressure on the SEC from the bank lobby suggests that buying pressure will mask such market exits. By May, the U.S. Securities and Exchange Commission (SEC) may further boost the overall cryptocurrency market with the approval of an Ethereum ETF.

In this case, Standard Chartered Bank predicts that the ETH price may exceed $4,000. Barring a major geopolitical upheaval or stock market crash, crypto markets are likely to see a repeat of the 2021 bull run.

Conclusion

The erosion of money is a worldwide problem. Wage growth is not enough to outpace inflation, forcing people to engage in riskier investments. Powered by cryptographic mathematics and computational power, Bitcoin represents the remedy to this trend.

As the digital economy expands and Bitcoin ETFs reshape the financial world , investors and advisors are increasingly behaving digitally. This shift reflects the wider trend of society going digital, with 98% of people wanting the option to work remotely and therefore prefer purely digital communications. This digital preference affects not only our work but also investment choices, indicating greater acceptance of digital assets like Bitcoin in modern investment portfolios.

Financial advisors are ready to view Bitcoin exposure as a booster of portfolio returns. Bitcoin prices have been severely suppressed in 2022 due to a string of cryptocurrency bankruptcies and sustainability concerns.

This supply of FUD has been exhausted, leaving only straightforward market dynamics. The approval of the Bitcoin ETF for institutional investment represents a disruptive reshaping of the cryptocurrency landscape, causing the price of BTC to get closer and closer to the previous ATH .

Xu Lin

Xu Lin