In the field of investment, fixed investment is often regarded as a simple and easy-to-use strategy. However, the reality has poured cold water on many investors. Many people have not only failed to increase their wealth, but have suffered repeated losses and their wallets have continued to shrink.

"I made fixed investment, but lost a lot of money"

"I have no money to make fixed investment"

CryptoDCA has received many similar feedbacks as early as the user research stage. They either lose money or have tight funds, and they are not even clear about the true value of fixed investment, so they cannot feel the steady growth of wealth.

What is the reason for this? In fact, although fixed investment seems simple, it contains many mysteries. Before embarking on the road of fixed investment, we must be fully prepared in multiple key links, so as to effectively increase the income of fixed investment, reduce risks, and truly realize the accumulation of wealth.

But first of all, let's take a look at what kind of mentality we should have.

01 Don't predict the short-term market

First of all, if we choose fixed investment, we must adhere to the most basic principle-Don't predict the short-term market.

The cruel reality is that subjective judgment cannot accurately predict the short-term rise and fall of the market.

Few people can accurately predict the short-term rise and fall of the market in the long term, which is a common problem for most people. Here we should pay attention to the short-term rise and fall of the market. Because to predict the long-term rise and fall of the market, we can actually refer to off-site factors such as macro policies, peripheral markets, micro technologies, and changes in segmented news. These factors usually have a certain degree of predictability.

02 Look more at policy factors

The financial market, including the cryptocurrency market, is a large and complex ecosystem that brings together participants from all walks of life around the world, including individual investors, institutional investors, and enterprises. The investment decisions of these participants are affected by countless factors, such as macroeconomic data, political situation, industry dynamics, corporate financial reports, sudden natural disasters, and investors' own emotions and expectations.

In this extremely complex short-term situation, the direction of things can easily become confusing. With so many factors working together, it is difficult for people to take all factors into consideration, so misjudgments will occur.

These many complex factors often do not last for a particularly long time and do not have a strong cyclicality.

However, macro factors are often sustainable and last for a long time. For example, a country's industrial development policy often takes decades to see real results, and this level of influencing factors is easy to be known to the public, and the future trend can be predicted. Therefore, it can become a factor for people to consider market trends, especially long-term trends.

For example, the current cryptocurrency market is generally bullish in the long run, and mainstream currencies such as Bitcoin (BTC) and Ethereum (ETH) are even more bullish in the long run.

Why?

Because with the rapid development of the digital economy, more and more countries are beginning to face up to the value of cryptocurrency. For example, countries such as Japan and Singapore have included cryptocurrency as a means of payment and supported its development through a sound regulatory framework. Although the United States does not have unified regulations at the federal level, it is generally open to cryptocurrency. China has adopted strict regulatory policies, completely banning cryptocurrency transactions and mining activities, while actively promoting the research and development and pilot of central bank digital currency.

Once changes at the policy level are released, they are usually sustainable and predictable.

Trump and Cryptocurrency

Trump, before 2024, was skeptical of cryptocurrencies. He once said on Twitter: "We only have one real currency in the United States - that is the US dollar", believing that cryptocurrencies have no real value and may provide a breeding ground for various criminal activities.

But after he was officially nominated by the Republican Party to participate in the US presidential election in 2024, his attitude towards cryptocurrencies took a 180-degree turn and began to strongly support cryptocurrencies. Trump plans to make the United States the global capital of cryptocurrency, and promised that if elected, he would relax cryptocurrency regulation and create a cryptocurrency-friendly environment. He also expressed the idea of listing Bitcoin as a strategic reserve asset of the United States and the vision of establishing a national reserve of Bitcoin. He said that cryptocurrency is a very interesting thing, and perhaps using cryptocurrency can resolve the US debt crisis.

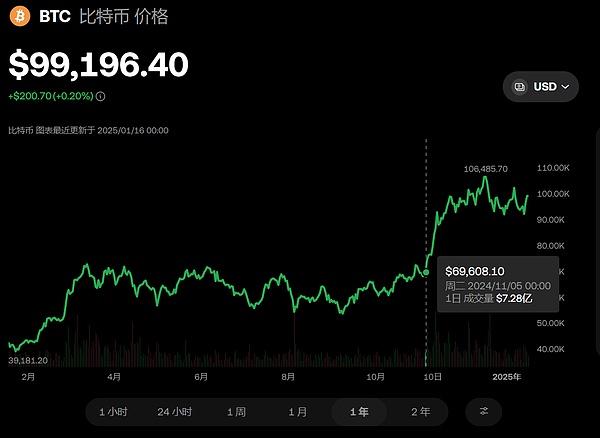

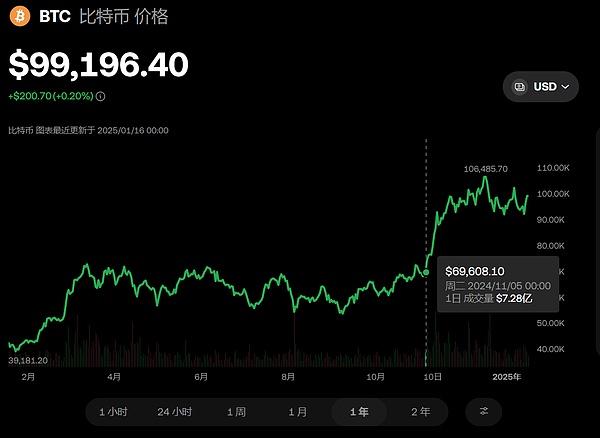

BTC price trend after Trump's election on November 5, 2024

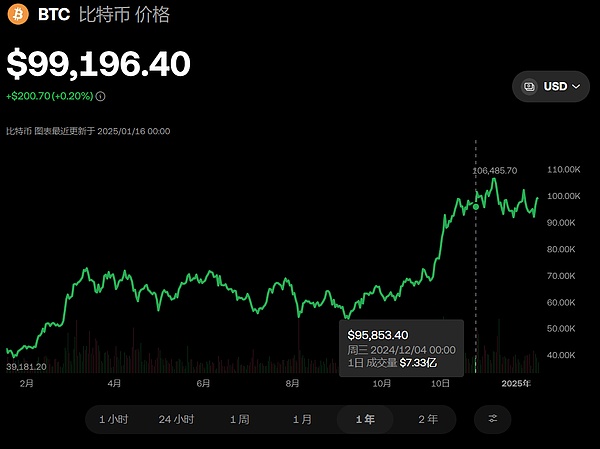

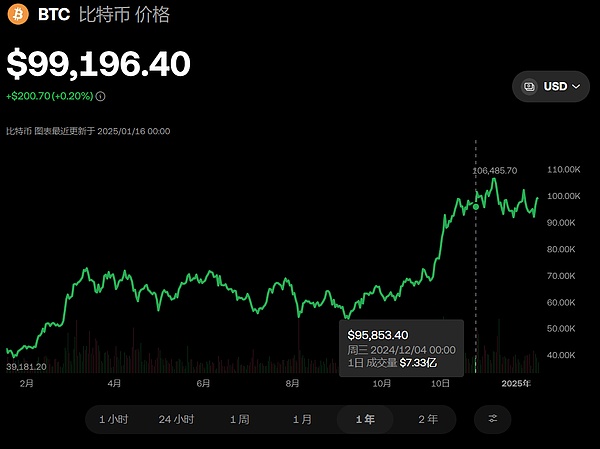

On December 4, 2024, Trump nominated Paul S. Atkins as chairman of the U.S. Securities and Exchange Commission (SEC). Atkins was the CEO of Patomak Global Partners, a company that provides consulting services to financial companies and cryptocurrency companies. He is also the co-chairman of the cryptocurrency industry lobbying group, the Token Alliance. Choosing Atkins, who is closely associated with the crypto industry, as the next chairman of the SEC, even if there is a possibility that Trump has a good personal relationship with him, the relevant background in the crypto industry must be an important reason for Trump to choose him.

Such personnel appointments are undoubtedly positive for the development of the entire crypto industry in the United States.

BTC prices rose slightly after the announcement of personnel appointments

At the same time, the Trump team is planning to add a new position in the White House to focus on cryptocurrency policy. The person in charge of this position will lead a team to build a bridge of communication between Trump, Congress and various federal agencies. Cryptocurrency practitioners have high hopes for this and look forward to directly giving feedback to Trump through this position.

As the most developed country in the world, the US policy on cryptocurrency can be regarded as a weather vane. As the policy is developed and deepened, other countries will also join in. A certain big country in the East across the ocean will not allow itself to fall behind in this technological and financial transformation. The initial exploration and relaxation of its policies have been quietly rolled out on some platforms and media.

Policies of other countries

Switzerland has gathered many well-known cryptocurrency companies in its "Crypto Valley", such as the Ethereum Foundation, and has formulated clear and supportive guidelines for the initial token issuance and token classification related to cryptocurrencies.

Germany is the first country to officially recognize the legal trading of cryptocurrencies such as Bitcoin, and regards major cryptocurrencies as legal private currencies. Its number of Bitcoin and Ethereum nodes is second only to the United States. In terms of tax policy, residents do not need to pay taxes if they hold cryptocurrencies for more than 18 months, while capital gains tax is only levied on investors who hold them for less than a year and whose gains exceed 600 euros.

These are all macro-policy impacts. We can assist our judgment based on historical trends, social development, domestic politics of various countries and other factors. Trump frequently shows goodwill to cryptocurrency enthusiasts, mainly for his campaign; similarly, the Democratic Party will also win over this group in order to gain their votes. Through this factor, we can say with certainty that cryptocurrencies, especially mainstream cryptocurrencies, are bullish in the long term.

03 Be patient, my friend

Fixed investment is the abbreviation of regular fixed-amount investment. Its basic principle is to invest a fixed amount of funds at fixed time intervals and continue to buy regardless of market price fluctuations. When the market falls, the same amount of money can buy more shares. When the market rises, the purchase of shares is reduced, but the overall investment cost can be smoothed.

However, this cost-smoothing effect is not achieved overnight. It requires multiple fixed investment operations across different market cycles, ranging from several months to several years, to fully reflect. Long-term adherence to the fixed investment strategy can effectively cope with market fluctuations. By deploying in batches at different time points, investors can buy more shares at a lower price when the market falls, thereby gaining greater upward elasticity after the market recovers.

The cryptocurrency market is highly uncertain and volatile. In the fixed investment process, short-term market ups and downs are the norm. If you lack patience, investors may panic due to short-term market declines, worry about the expansion of losses, choose to stop fixed investment or even cash out, and miss the opportunity to make profits in the subsequent market rebound; or because of the short-term market rise, they are eager to make profits and terminate fixed investment in advance, and fail to achieve the goal of accumulating returns in long-term market fluctuations.

The charm of fixed investment lies in the compound interest effect, that is, the investment income in the early stage can be used as the principal of the later investment and continue to generate income.

Suppose we have invested in Bitcoin (BTC) for a period of time and have achieved overall returns, then we choose to sell it. Then we will receive the original investment principal plus returns after deducting the handling fee. Then when the price of Bitcoin is relatively low, start another round of fixed investment and continue to be patient.

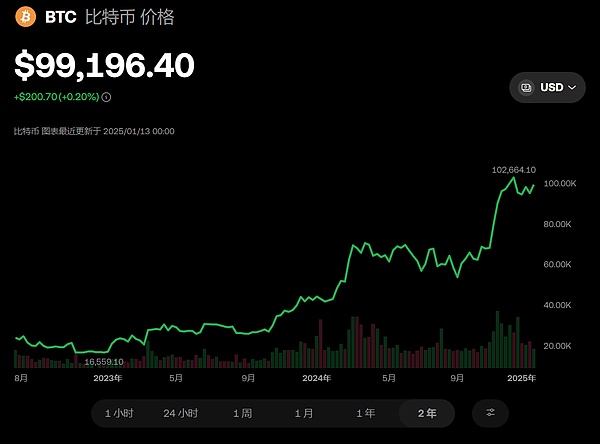

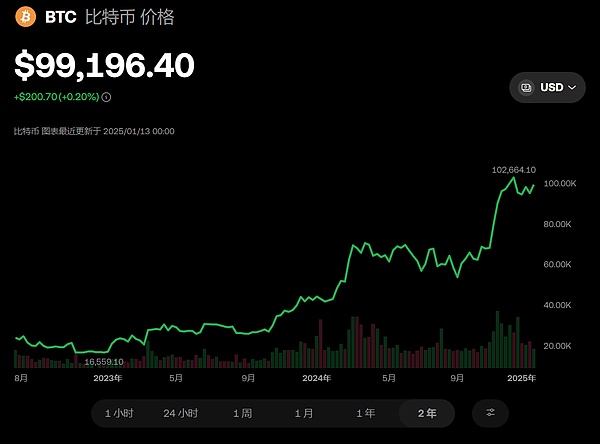

BTC two-year price trend chart

We can see that in the two-year period, the price of Bitcoin is generally bullish, but there are still declines. This is often the time when we can choose to start a new round of fixed investment. Of course, the premise is to choose a long-term bullish investment target such as Bitcoin.

ETH two-year price trend chart

ETH can also be used as our fixed investment target. Although we can see that there was a drop of more than 10% in September, it soon recovered to its previous peak.

However, it takes a long time for compound interest to take effect. Patience can allow investors to persist in long-term fixed investment, so that funds continue to increase in value over multiple cycles. Long-term fixed investment, rolling growth of principal and income, and ultimately significant appreciation of assets.

The investment market information is complex, and various short-term news and market forecasts are easy to interfere with investors' decision-making. Patient investors can focus on long-term investment goals, not be moved by short-term information, stick to the fixed investment plan, and avoid being misled by market noise and making wrong decisions.

In the early stage of fixed investment, investors often doubt the effect, but after patiently persisting, they witness that fixed investment smooths costs in market fluctuations and the returns gradually increase. Their confidence in the fixed investment strategy is strengthened, and their determination to invest is also more firm.

On the road of fixed investment, every ideal return across a market cycle is the best affirmation of investors' patience. This successful experience encourages investors to be more patient in subsequent investments. Patience and fixed investment help each other to form a virtuous circle, helping investors to achieve good results in long-term investment.

04 CryptoDCA is your only choice for fixed investment

The target of fixed investment should preferably be a long-term bullish investment target.

The current investment options of CryptoDCA are Bitcoin (BTC) and Ethereum (ETH). These two major cryptocurrencies are undoubtedly bullish in the long term. Bitcoin has proven its value after 16 years of time and is now known as "digital gold". ETH is the native cryptocurrency of the Ethereum network. It plays an important role in the Ethereum ecosystem, just like real-world currency, used to pay various fees and incentivize network participants. So it is very correct to choose these two cryptocurrencies as the choice for fixed investment.

At the same time, CryptoDCA is a decentralized fixed investment protocol deployed on Optimism, which avoids the risk of funds being misappropriated by centralization. Users directly link their wallets, and the cryptocurrency purchased in each period after the fixed investment begins will go directly into the user's wallet. As long as the user does not lose his wallet and mnemonic, the asset will be guaranteed to be in the hands of the user, truly realizing decentralization and security.

05 Summary

Fixed investment seems simple, just invest a fixed amount regularly in a set goal; however, the real challenge of fixed investment lies in adjusting our mindset.

Avoid trying to predict short-term market fluctuations, but evaluate the overall trend of the market from a macro perspective.

Be patient and let time be our partner on the road to investment.

Believe that as long as we adhere to these two mental principles, we will eventually achieve the appreciation of wealth and the improvement of the value of life. At the same time, choosing the on-chain centralized fixed investment protocol - CryptoDCA, fixed investment will not only help users realize the preservation and appreciation of assets, but also ensure security, so that users can gain more security and gain a stable future.

Catherine

Catherine