The Policy Declaration 2.0 on the Development of Digital Assets in Hong Kong (hereinafter referred to as the Policy Declaration 2.0) is a policy document issued by the Government of the Hong Kong Special Administrative Region of China on June 26, 2025, aiming to build Hong Kong into a global innovation center in the field of digital assets, and further update and improve the existing policy and regulatory framework to adapt to the rapid development of the digital asset industry.

Financial Secretary Paul Chan said that the Policy Declaration 2.0 demonstrates the SAR Government's vision for the development of digital assets, and demonstrates the substantive application of tokenization through practice to promote the diversification of application scenarios. By combining prudent regulation and encouraging market innovation, a more prosperous digital asset ecosystem that is integrated with the real economy and social life will be built, bringing benefits to the economy and society, while consolidating Hong Kong's leading position as an international financial center. Then with the release of the Policy Declaration 2.0, I believe everyone will raise the following question:

“2.0”? What is Policy Declaration 1.0...

What is the relationship between Policy Declaration 2.0 and it...

What does Policy Declaration 2.0 mainly talk about...

What is Hong Kong's attitude towards the development of digital assets...

The Crypto Salad team will combine the development of virtual assets and digital assets to interpret the important information in Policy Declaration 2.0 from multiple dimensions.

The above picture is "Hong Kong Digital Asset Development Policy Declaration 2.0"

▍Hong Kong releases digital asset declaration

First of all, before explaining the "Policy Declaration 2.0", the Crypto Salad team will help everyone review what the "Declaration 1.0" said?

The so-called "Declaration 1.0" is officially known as the "Policy Declaration on the Development of Virtual Assets in Hong Kong" (hereinafter referred to as the "Policy Declaration 1.0"). The "Policy Declaration 1.0" was issued in 2022. It clarifies the policy stance and guidelines set by the Hong Kong Special Administrative Region Government to develop a vibrant virtual asset industry and ecosystem in Hong Kong, including: the vision and guidelines of the Hong Kong Government, the regulatory framework for virtual assets, the pilot programs such as green bonds and digital Hong Kong dollar launched by the Hong Kong Government, and the Hong Kong Government's outlook on the future of virtual assets, etc.The Policy Declaration 2.0 is a further upgrade based on it, including: continuation of goals, deepening of supervision, expansion of key points, expansion of scenarios, change of terminology, increase in tax incentives, etc.The difference between the two is shown in the following table:

The above table is a brief description of the difference between the Policy Declaration 1.0 and the Policy Declaration 2.0

In recent years, the concept of digital assets has become increasingly clear, and as all stocks related to digital concepts have skyrocketed, the concept of stablecoins and virtual assets is no longer feared by the public. With the release of the Policy Declaration 2.0, it is obvious that the concept of "digital assets" is about to replace the original concept of "virtual assets". Not only do more and more senior leaders, professional investment institutions, native Crypto and new players prefer to use the term "digital assets", but also, as shown in the table above, in the Policy Declaration 2.0, "virtual assets" are also transformed into the term "digital assets". This also means that the development of digital assets will enter a new era.

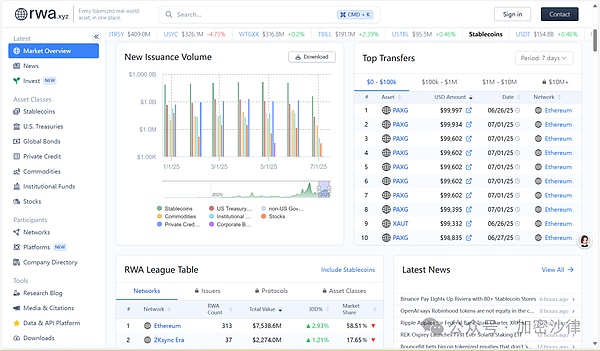

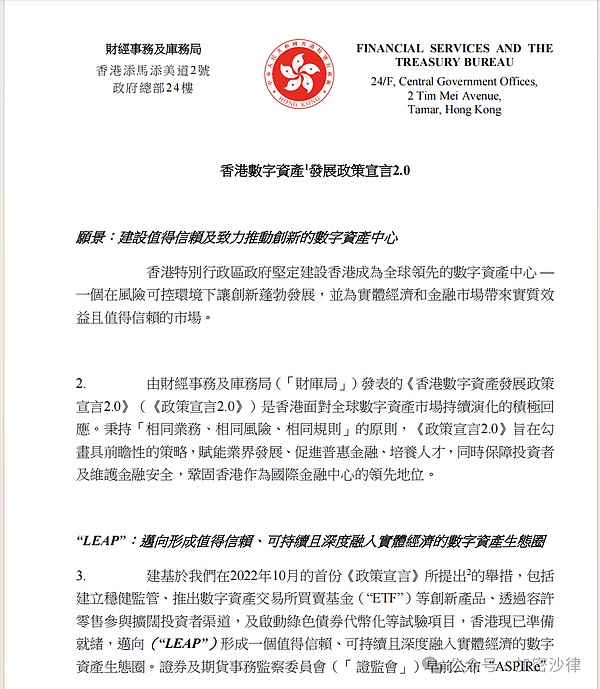

The above figure shows the global RWA market size and transaction volume (Source: RWA.xyz)

The release of the "Policy Declaration 2.0" was proposed on the basis of the "Policy Declaration 1.0" released in October 2022. Compared with the "Policy Declaration 1.0", the release of the "Policy Declaration 2.0" not only changed the concept of "virtual assets" to the concept of "digital assets", but also upgraded the stablecoin from "tool currency" to "infrastructure currency", and clearly implemented the stablecoin issuer supervision system from August 1, 2025, and set requirements for reserve asset management, etc., to make it more legal and more widely accepted.

In addition, the policy declaration regards the tokenization of real-world assets as a key industrial development direction, not only promoting the normalization of bond tokenization, but also planning to include more profitable assets in the scope of tokenization, which will break the boundary between the virtual economy and the real economy.

▍Four core pillars of the LEAP framework

In traditional businesses, a considerable part of the business is regulated by corresponding laws, but in emerging businesses such as RWA and digital assets, there is a lack of relevant laws and regulations to restrict them. The "Leap" framework proposed in the Policy Declaration 2.0 makes up for this. It includes four core pillars: optimizing laws and regulations, expanding the types of tokenized products, promoting application scenarios and cross-sector cooperation, and developing talents and partners. The following will be introduced in detail.

(I) Optimizing laws and regulations (Legal and regulatory streamlining)

The Hong Kong government announced on its official website that the government is building a unified and comprehensive regulatory framework for digital asset service providers, covering digital asset trading platforms, stablecoin issuers, digital asset trading service providers and digital asset custody service providers. Among them, the Securities and Futures Commission (SFC) will serve as the main regulatory agency for the future licensing mechanism for digital asset trading service providers and digital asset custody service providers. At the same time, the Financial Services and the Treasury Bureau (FSTB) and the Hong Kong Monetary Authority will lead a comprehensive legislative review to promote the tokenization of real-world assets and financial instruments.

The review will comprehensively examine all processes of tokenized bond issuance and trading, including but not limited to settlement, registration and record requirements. In the core points, the respective responsibilities of the Securities and Futures Commission, the Treasury Bureau and the Hong Kong Monetary Authority are mainly mentioned, which lays the foundation for the governance of the digital asset industry.

The above picture is the announcement of the Hong Kong government on the release of the "Policy Declaration 2.0" on its official website

(II) Expanding the suite of tokenised products

Regarding this, the Hong Kong government mentioned: "The Government will regularize the issuance of tokenized government bonds and provide incentives for the tokenization of real-world assets (including by clarifying the stamp duty arrangements applicable to tokenized exchange-traded funds) to enhance liquidity and popularity. On this basis, the Government welcomes the secondary market trading of relevant tokenized exchange-traded funds through licensed digital asset trading platforms or other platforms in the future. The Government will also promote the tokenization of a wider range of assets and financial instruments, demonstrating the diverse applications of this technology in different sectors, including precious metals (such as gold), non-ferrous metals and renewable energy (such as solar panels). ”

And "regularizing the issuance of tokenized government bonds" means that all financial products are put on the chain from the bottom up; and "tokenization of real-world assets" includes not only RWA, but also the tokenization of other financial instruments. In addition, the "stamp duty exemption" and "welcome to see other platforms for secondary trading" emphasized in the Policy Declaration 2.0 can promote the liquidity and popularity of digital assets, and the problem that most people have criticized that digital assets cannot be circulated in the secondary market can also be solved.

(III) Advancing use cases and cross-sectoral collaboration

In promoting use cases and cross-sectoral collaboration, the Hong Kong government mentioned that the licensing mechanism for stablecoin issuers will be implemented on August 1, which will help promote the development of real application scenarios. At the same time, the government is also committed to strengthening cooperation among regulators, law enforcement agencies and technology providers to develop digital asset infrastructure. To express support and take the lead, the government welcomes market participants to make suggestions on how the government can experiment and use licensed stablecoins. In addition, Cyberport will also launch a pilot funding program for blockchain and digital assets, which supports start-ups and related institutions, covering multiple aspects such as incubation, accelerators, marketing, artificial intelligence, etc., and provides funding for application projects with future application potential, iconic and market influence, thereby promoting the development of digital technology in Hong Kong, cultivating relevant talents and enterprises, attracting more talents, promoting industrial upgrading, and creating a good digital technology ecosystem.

The most important point about this framework is that regulators and law enforcement agencies are required to cooperate with technology providers, that is, they are required to learn the technology in related fields as soon as possible, so that they can handle related cases fairly and impartially; and market participants can also communicate with institutional participants and provide valuable suggestions on the questions of "how to get a license?" and "how to conduct tests?"

(IV) People and partnership development

Regarding the last point, the Hong Kong Special Administrative Region Government mentioned that the Government is committed to working with the industry and academia to promote talent development and position Hong Kong as a center of excellence for digital asset knowledge sharing and promoting international cooperation, including joint research programs and global regulatory collaboration. The Government will build a sustainable talent pool by cultivating a new generation of entrepreneurs, researchers and technical experts.

Currently, talents from the mainland and Singapore have been lost due to policy reasons, and Hong Kong has seized this opportunity and implemented a series of programs such as "high talent" and "excellent talent", making unremitting efforts to attract talents and become a talent highland.

▍Key Interpretation of Policy Declaration 2.0

(I) Unified and Comprehensive Regulatory Framework

Currently, in this section, we can find the following keywords: Digital asset exchanges, stablecoin issuance, digital asset trading service providers and digital asset custodians. These four entities are the key participants in the digital asset ecosystem.

Among them, digital asset exchanges, as the core platform for digital asset trading, provide users with digital asset trading, exchange and derivative trading services. They need to apply to the CSRC for "Category 1 (Securities Trading)" and "Category 7 (Providing Automated Trading Services)" licenses to ensure compliance operations.

The issuance of stablecoins mainly refers to the issuance of stablecoins anchored to physical assets, which aims to reduce the price risk of digital assets and is subject to the "Stablecoin Regulations" that will be implemented on August 1, 2025.

Digital asset trading service providers refer to those who provide users with auxiliary services for digital asset transactions and do not directly operate exchanges. They need to comply with the "Securities and Futures Ordinance".

The above picture is excerpted from "Unified and Comprehensive Regulatory Framework" in the Policy Declaration 2.0

(II) Review of Tokenization Laws and Regulation

In addition, in this section, it is clearly stated that Hong Kong needs to formulate tokenization laws and strengthen regulatory measures. To unleash the potential of financial technology and digital technology, legal and regulatory systems are essential. The key links that should be regulated and reviewed at present include but are not limited to: Tokenized bond issuance, transaction process, settlement, registration and record requirements.

The Hong Kong SAR Government has previously issued two tokenized green bonds worth HK$6.8 billion, and has made it clear that it will make the issuance of government tokenized bonds regular, and include different denominations, different currencies and different periodic arrangements, so as to cater to a wider range of investors. This move is in line with the "potential of financial technology and digital technology" mentioned in the document.

The above picture is excerpted from "Tokenization Legal and Regulatory Review" in the Policy Declaration 2.0

(III) Providing incentives for the tokenization of real-world assets and financial assets

The third aspect is more important, which mainly talks about providing incentives for the tokenization of real-world assets and financial assets. The HKMA and the SFC have always cooperated very closely, and the regulatory sandbox has not been advanced quickly. It has been almost a year since the launch of the Longxin project. The slow progress is mainly due to the fact that the HKMA must be responsible for promoting the construction of the digital Hong Kong dollar. In the Policy Declaration 2.0, it is also mentioned that the settlement of interbank tokenized deposits must be promoted. In other words, it is necessary to encourage the construction of the digital Hong Kong dollar.

At present, the London Metal Exchange (LME) has included Hong Kong in the scope of the licensed delivery location within the global warehouse network. For the commodity ecosystem, if tokenization and physical asset tracking technology are applied in the warehousing plan, then tokenization technology can become an identification tag for global warehouses, which is a very important technology in the fields of supply chain finance, commodity trading and international logistics settlement. In addition to gold and precious metals, other non-ferrous metals and renewable energy are also at the forefront of tokenization.

The Stablecoin Regulations, which will be implemented on August 1, 2025, focus on the management of reserve assets, stabilization mechanisms, redemption processes, and prudent risk management. This is consistent with the content mentioned in the Policy Declaration 2.0.

The above picture is excerpted from "Providing Incentives for Tokenization of Real World Assets and Financial Assets" in "Policy Declaration 2.0"

(IV) Hong Kong's First Batch of Digital Asset Indexes

In addition, the "Policy Declaration 2.0" document also mentioned the first batch of Hong Kong digital asset indexes that have been released by the Hong Kong Stock Exchange. This will increasingly become a reliable price benchmark for Bitcoin and Ethereum in Asia, and the ultimate goal is to consolidate Hong Kong's leading position as an international financial center.

(V) The Finance Bureau and the Securities and Futures Commission provide consulting services

The document also points out that, for now, the Finance Bureau and the Securities and Futures Commission are still providing certain consulting services on digital asset trading service providers and digital asset custody service providers, which will also make the operation of digital assets smoother.

▍Crypto Salad Interpretation

The core goal of the Policy Declaration 1.0 is to solve the basic problems of the Hong Kong market from "nothing" to "something", so its content is mainly to build the most basic framework regulations. So far, with the gradual establishment and improvement of various law enforcement agencies, the market has formed a clear understanding of the implementation methods and specific forms of "something".

However, in the new stage of market development, being satisfied with "having a basic framework" alone can no longer meet the needs, and the pursuit of ecological prosperity has become the core direction. This requires balancing the interests of all parties and absorbing almost all participants, including not only traditional asset holders and investors, but also players, speculators and other speculative participants. To achieve this goal, it is necessary to open up more clear development outlets. The "Policy Declaration 2.0" has a clearer explanation of precious metals and other categories, which is a reflection of this idea.

In addition, the "Policy Declaration 2.0" mentions "issuing licenses", "regulatory frameworks", "consulting services" and other related contents, not only publicly soliciting opinions, but also clearly stating that it will be implemented in the future. By standardizing the key processes of the entire chain from issuance, circulation to exit of digital assets, ensuring their safety and reliability and implementing license management, it can provide participants with a stable operating environment. This is a significant progress of the "Policy Declaration 2.0". At the same time, government officials, legislators and other parties actively absorbed and supplemented public opinions. This feature is also reflected in the accuracy of the Policy Declaration 2.0 and more laws and regulations.

As mentioned above, according to the "LEAP" framework, it is necessary to first promote compliance supervision, then promote the expansion of categories, then extend cross-field scenarios, and finally implement the work of attracting talents. These constitute the cornerstone of ecological prosperity and provide the necessary conditions such as "talent", "funds" and "clear goals" for relevant entities to participate in the digital asset industry.

Crypto Salad believes that the Policy Declaration 2.0 has an accurate management direction for this field. If it can be properly implemented, the Hong Kong digital asset ecosystem will be basically formed; if the practice is successful, the crypto financial market and funds will be highly integrated.

Only represents the personal views of the author of this article, and does not constitute legal advice and legal opinions on specific matters.

Weiliang

Weiliang