Author: Aaron Brogan Source: cointelegraph Translation: Shan Ouba, Golden Finance

In recent months, we have repeatedly witnessed such a pattern: US President Trump took certain actions that were objectively harmful to the US economy, and then the market plummeted. Seeing this, Trump pressured Federal Reserve Chairman Powell to lower the federal funds rate (the interest rate at which the Federal Reserve lends money to banks). Powell, with a firm look in his eyes, responded: "No."

Trump wants to cut interest rates because it is actually equivalent to injecting cash into the US economy, which can stimulate economic activity and boost market performance. He believes that this will help him show his economic success to the public. Powell hopes to formulate interest rate policy based on rigorous economic criteria, accurately balancing the Fed's two missions of "promoting maximum employment and maintaining price stability."

More importantly, Powell is committed to maintaining the Fed's independence from political interference - and the public's trust in its independence. If the market generally believes that the independence of the US central bank has collapsed, it will become more difficult to sell US Treasuries (i.e. US sovereign debt). This will not only fundamentally lead to higher borrowing costs for the United States and make the country poorer, but it is also particularly dangerous in the current context - because the United States already has a huge debt of up to $30 trillion that needs to be continuously rolled over and refinanced.

If the US is forced to refinance at higher interest rates due to a loss of market trust, an increasing portion of the US GDP will be eroded by interest payments. As the younger generation joked: "America, it's over."

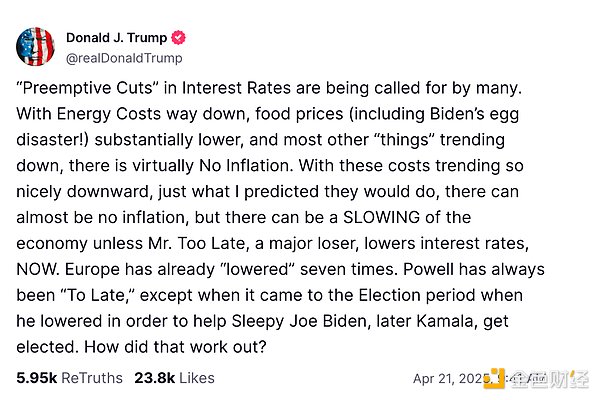

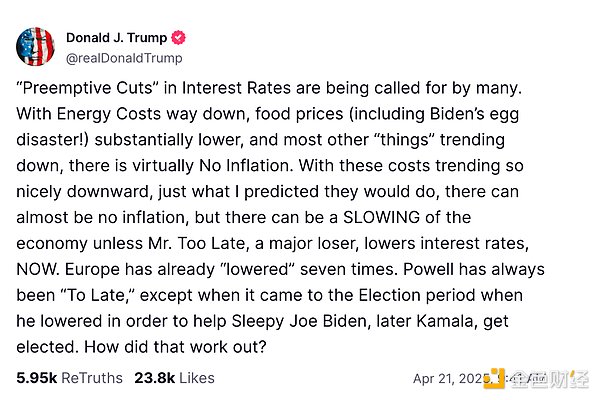

This "dance" of politics and finance has been brought to the current point in time. Last week, Trump repeatedly hinted that he wanted to fire Powell, and the market reacted extremely negatively. On Monday, Trump publicly called Powell "the number one loser" on Truth Social, causing the market to fall sharply again. It is reported that Treasury Secretary Scott Bessant has privately expressed to Trump the serious risks of firing Powell. Trump seems to have accepted the advice for the time being and stated on Tuesday that he would not fire the current Fed chairman.

Nevertheless, the process is more like a downward spiral than a true steady subsidence. Many market observers are watching closely, waiting for the next shock wave to arrive. This also raises a key question: What will happen if Trump finally follows his instinct and fires Powell? In particular, what impact will this have on the cryptocurrency industry?

Shaking the Fed

First of all, it should be pointed out that the president cannot fire the Fed chairman at will. According to Section 10 of the Federal Reserve Act of 1913, "Each member of the Board of Governors shall continue to serve for a period of fourteen years after the expiration of the term of his predecessor, unless earlier removed by the President for good cause." This legal statement may seem ambiguous, but in the 1935 case of Humphrey Executors v. United States, the U.S. Supreme Court clearly ruled that the Constitution does not grant the President an unlimited power of removal, and that the President's power of removal must be limited by legislative provisions. This case established the concept of "independent agencies", that is, certain agencies affiliated with the executive branch, although nominally belonging to the administrative system, in actual operation have independent decision-making power. Although agencies such as the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the Federal Trade Commission (FTC) are also such independent agencies, the Federal Reserve is undoubtedly the most important one. Economists usually have little need to worry about political interference in central banks. After all, politicians’ incentive cycles are often short, and their thinking time is measured in election years. This short-termism naturally tends to promote “immediate stimulus” policies, the most typical of which is hot money injection. However, fiscal and monetary policies are essentially an art that requires delicate trade-offs, and often require difficult and painful choices.

Take a classic case as an example: Before the 1972 election, Richard Nixon pressured then-Federal Reserve Chairman Arthur Burns to adopt an expansionary monetary policy to improve his chances of re-election. Nixon won re-election with an overwhelming advantage, but what followed was a disastrous “stagflation” situation, which plagued the entire US economy for a decade, and the hollowing-out effect of industries caused during that period still has a profound impact in some areas today.

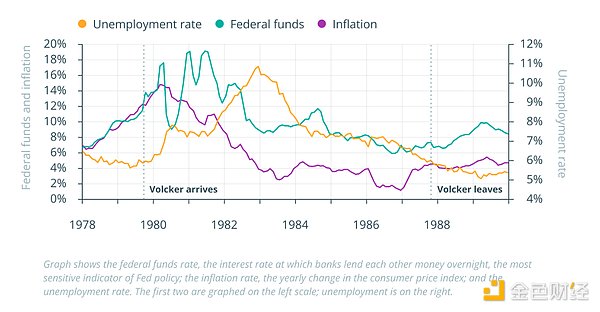

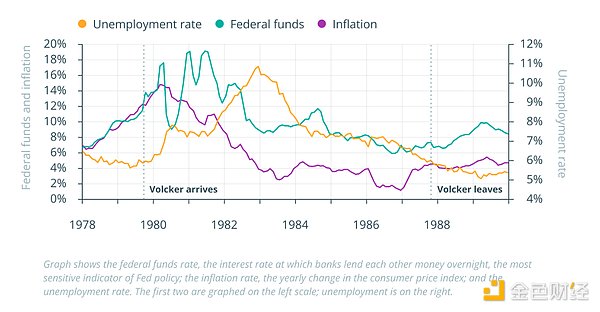

In sharp contrast, Paul Volcker subsequently implemented a series of radical interest rate hikes between 1979 and 1987, known as the “Volcker shock”. Although these policies triggered successive recessions, they ultimately succeeded in curbing inflation, laying the foundation for the US economic prosperity in the 1990s and creating conditions for Bill Clinton to implement excellent fiscal policies.

This is the core of the problem. Economists - and more importantly, the market - are convinced that the Federal Reserve must maintain its independence, otherwise the entire economic system of American society is at risk of collapse. This is by no means an exaggeration. Historically, countries like Weimar Germany, Peron-era Argentina, and Venezuela have experienced devastating hyperinflation after political manipulation of their central banks, leading to geopolitical regression for generations, famine, and even eating rats to survive, and even the rise of Hitler. This is extremely serious.

If Trump wants to fire Powell, he first needs to overturn the precedent of Humphrey’s Executor—and given the current makeup of the Supreme Court, many legal scholars believe that such an overturn is not impossible. Once this Rubicon is crossed, there is no turning back. From now on, not only Trump, but every future president can command all federal agency heads at will, including the chairman of the Federal Reserve, with complete legal power. Most people believe that this will lead to disaster.

However, whether it causes disaster or not, this incident will become a touchstone for cryptocurrency. The mission of the Bitcoin white paper when it was first created was to decentralize financial transactions so that they no longer rely on "financial institutions as trusted third parties." If the Federal Reserve collapses and US monetary policy is no longer based on prudent judgment, the concept of the early days of cryptocurrency will be clearly verified.

With Trump triggering capital flight in recent weeks, investors have begun to look for safe havens. Traditionally, whenever a crisis breaks out, smart money will withdraw from risky assets and flow into US Treasuries. The reason is simple: US Treasuries were once considered zero-risk assets.

Trump admonished Powell, calling him "Mr. Too Late"

But that era may be over. During the tariff crisis, the 10-year Treasury yield once approached 5%, and it has not yet fully fallen back. If Trump really breaks the independence of the Federal Reserve, then the current capital outflow is just a drop in the river, and funds may quickly flow into cryptocurrencies.

Historically, Bitcoin's price movements are highly correlated with the Nasdaq (and often have an amplified effect). However, since the tariff crisis, even though the overall US stock market has been sluggish, Bitcoin has unexpectedly started to rise. This has triggered market discussions about the so-called **"decoupling" phenomenon** - that is, crypto assets will truly begin to break away from their dependence on traditional centralized assets and move out of independent markets.

Whether this decoupling will actually happen is still uncertain. But one thing is certain: If Trump really fires Powell, we will soon see the answer.

Out of the frying pan, into the furnace

Of course, a global historic collapse will never be all good news for cryptocurrencies. In fact, this crisis will have a serious impact on many levels.

The first victims may be stablecoins.

Over the past decade, two stablecoins pegged to the U.S. dollar, USDC$0.9997 and Tether’s USDT$1.00, have almost dominated the market. Their issuers, Circle and Tether, have become systemically important institutions and important buyers of U.S. Treasuries, which are used as reserve assets to support their stablecoins.

If the Federal Reserve is in crisis, a U.S. Treasury default may follow. Economist Noah Smith speculates that Trump may try to deal with bad debts as he did in the business world in the past - seeking cheap bailouts and simply "going bankrupt" if they fail.

In fact, Trump himself hinted at this idea in February this year:

"There may be a problem with the national debt - you should have seen some reports about this recently. This may be an interesting question. […] It is possible that we will find that a lot of it is fake, and then our actual debt may be less than we think."

If a sovereign default occurs, the US Treasury bonds held by Circle and Tether will suffer asset impairment, which will lead to insufficient stablecoin reserves. This may trigger a stablecoin run, shake market confidence, and even cause a chain reaction.

The subsequent secondary disasters are equally terrible: a large number of smart contracts that rely on stablecoins as collateral will be forced to liquidate, and the market will experience a series of liquidations and systemic contagion.

However, the direct consequences of the stablecoin crisis may not be as far-reaching as the political consequences. After all, for the crypto world, it is not just the national debt that is important, but the dollar itself. As the global reserve currency, the dollar has long supported all basic functions such as cross-border trade and financial settlement. If the US government, which supports the credit of the dollar, is no longer stable, the system will also be shaken. Once global trade shifts more to euros or renminbi, regulators in the EU and China will have greater control over the flow of fiat currencies in the cryptocurrency system. A well-known cryptocurrency lawyer who wishes to remain anonymous commented: "I think China will fill most of the gaps, and the EU will take up most of the rest. But whether it is the CCP or the EU, their regulatory orientation is different, but it is not good news for cryptocurrencies." This situation may prompt the market to flee to uncollateralized native crypto assets (such as BTC, ETH, etc.), but there is no successful precedent for the large-scale application of such assets in real-world transactions in history. Therefore, the stablecoin crisis may also mean that the entire crypto industry will fall into a trough for several years, rather than accelerating its development.

Conclusion

In the end, no one can be sure whether Trump will really fire Powell, or whether he has the ability to do so. Similarly, no one can accurately predict what chain reactions will be brought about if this incident occurs.

But if the flapping of an Argentine butterfly's wings can still cause a tornado in Prague, then a spell from Trump in the White House may either prove the legitimacy of blockchain or completely subvert its future.

Whether we like it or not, we are already on this journey.

Joy

Joy