Source: DeFi Monk, Messari researcher; Translated by: AIMan@黄金财经

The coin you should buy now is ETH.

Wall Street is experiencing a crypto moment.

There are not many growth stories left in TradFi. Everyone is overly focused on artificial intelligence, and software companies are far less exciting than in the 2000s and 2010s.

Growth investors who have raised funds and are ready to invest in exciting innovation stories with huge potential markets (TAM) know deep down that most AI companies are trading at ridiculous premiums, and other "growth" stocks are hard to find. Even the once highly regarded FAANG stocks are gradually becoming high-quality, profit-maximizing, "compound" stocks with an annual compound growth rate of around 15%.

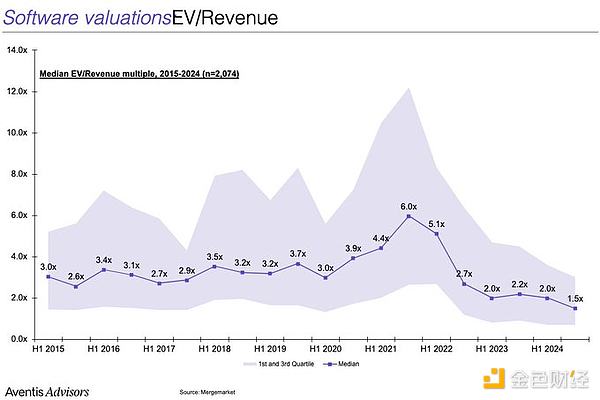

For reference, the average EV/Rev multiple for software companies has fallen below 2.0x.

Crypto is here.

BTC breaking through all-time highs, the U.S. President’s heavy promotion of crypto products at a press conference, and regulatory tailwinds have put the crypto asset class back in the spotlight for the first time since 2021.

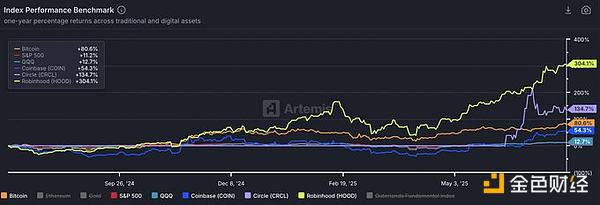

BTC COIN HOOD CIRCL vs. SPY and QQQ (Source: Artemis)

This time, the focus is no longer NFT and Dogecoin. but digital gold, stablecoins, "tokenization" and payment reform. Stripe and Robinhood claim crypto will be their top priority for the next round of expansion. COIN enters the S&P 500. Circle shows the world that crypto is an exciting enough growth story that growth stocks can once again ignore P/E ratios.

This all translates to ETH

For us crypto natives, the smart contract platform space seems very fragmented. There’s Solana, there’s Hyperliquid, and there are a dozen new high-performance blockchains and Rollups.

We know that Ethereum’s lead is indeed being challenged and faces existential threats. We also know that it has not yet solved the problem of value accumulation.

But I highly doubt that Wall Street really understands this. In fact, I would go so far as to say that most ordinary people on Wall Street know almost nothing about Solana. To be honest, XRP, LTC, Chainlink, Cardano, and Dogecoin are probably more well-known outside the circle than SOL. Don’t forget, these guys haven’t paid attention to our entire asset class for several years.

But what Wall Street knows is that ETH has stood the test of time, has been battle-hardened, and has been the main "beta target" outside of BTC for many years. What Wall Street sees is that it is the only other crypto asset with a liquid ETF. And it is this kind of classic relative value trading opportunity with a clear catalyst that Wall Street favors.

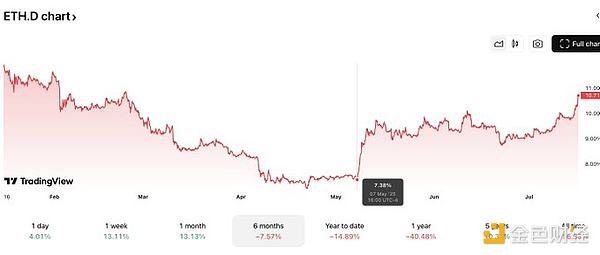

These suits don't know much, but they know that Coinbase, Kraken, and now Robinhood have decided to "build on Ethereum." With just a little due diligence, they can find the largest stablecoin fund pool on the Ethereum chain. They start doing their 'moonmath' and quickly realize that while BTC is at a new all-time high, ETH is still over 30% below its 2021 high. You might think that relative underperformance looks bearish, but these people think differently. They'd rather buy lower priced assets with clear price targets than chase the ones that are soaring higher - because after that, they'll only wonder if it's "too late". I think they've gotten there. Mandates aren't a problem, any fund can drive crypto investments with the right incentives. Despite the crypto community vowing to never touch ETH again for over a year, it has outperformed for over a month. Year-to-date, SOL/ETH is down nearly 9%. ETH’s dominance bottomed out in May and has since been on its longest uptrend since mid-2023.

So if the entire crypto community calls ETH a “cursed token,” why is it outperforming the market?

ETH is attracting new buyers

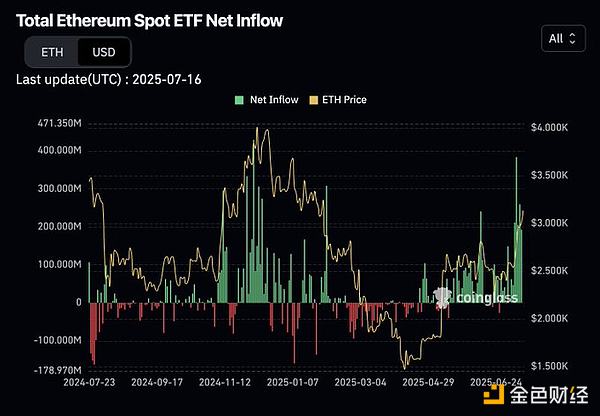

ETH spot ETF inflows have remained flat since March.

Source: Coinglass

ETH version of MicroStrategy has been taking active actions, injecting early-stage structural leverage into the current market.

Perhaps, some cryptocurrency native participants have realized that their positions are insufficient and have begun to adjust their positions. They may be withdrawing from BTC and SOL positions that have performed well in the past two years.

I am by no means saying that Ethereum has solved any problems. I think what is happening is that the ETH asset is beginning to decouple from the Ethereum network.

External buyers are pushing the ETH asset, challenging our perception that it can only go down and not up. Shorts will eventually be liquidated. Then, our native crypto capital will decide to chase the rise until there is some kind of speculative frenzy in the market. ETH ends with a spectacular scene.

If this happens, then ETH's all-time high is not far away.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bitcoinist

Bitcoinist Nulltx

Nulltx Bitcoinist

Bitcoinist