Author: Crypto Tuanzi

When interest rates fall, where does the money go?

The US announced a 2-point interest rate cut, reducing the original benchmark interest rate from 5.25% to 5.5% to 4.75% to 5%. This move greatly boosted market confidence. In addition to the US S&P 500 index hitting a new high, BTC also broke through integer levels such as 63,000 and 66,000, and the market was full of joy.

In addition to FOMO, whether there is really a continuous inflow of funds into the market is the key to the long-term appreciation of assets. In the final analysis, where did the funds go after the interest rate cut?

What is market liquidity?

In simple terms, good liquidity means that when you buy or sell this product, someone will trade with you immediately, and the price fluctuation is small, and the trading experience is good. On the contrary, poor liquidity means that the transaction is more difficult, it is not easy to find buyers/sellers, and it may lead to larger price fluctuations. In the currency circle, good liquidity is such as BTC, ETH and other cryptocurrencies, and lack of liquidity is such as NFT and other commodities.

For traders, the quality of liquidity is very important, because poor liquidity will lead to changes in transaction prices, which may cause traders to suffer losses or even fail to trade, so market liquidity is a factor that every trader must consider.

Interest Rate and Liquidity

First, we need to know the impact of interest rates on the entire banking system. The so-called increase/decrease in interest rates changes the "benchmark interest rate for overnight lending."

Direct impact of rate cuts: Reduce interbank lending costs / Reduce the cost of banks borrowing money from the central bank

Direct impact of rate hikes: Increase interbank lending costs / Increase the cost of banks borrowing money from the central bank

Here we discuss the interest rate cut part. The interest rate cut will lead to a reduction in banks' borrowing costs, and the reduction in borrowing costs will prompt the following behaviors.

Banks are more willing to increase lending because they can obtain higher interest rate spreads

Lending standards may be relaxed and more borrowers can obtain loans

Banks may increase their holdings of long-term assets, such as long-term loans and bonds (long-term interest rates are less affected by interest rate cuts and can guarantee higher returns)

Bank interest income may be cut in the short term

At this time, banks may face the risk of reduced income, and the original returns on low-risk assets can no longer meet the bank's principle of using high returns to attract customers, so they need to seek higher-yielding assets, which may lead to rising asset prices and potential bubble formation.

Observation on the Liquidity of the Cryptocurrency Market

Since the crypto market has only developed since the advent of Bitcoin in 2009, historically, the only event that caused the crypto market to be crazy due to interest rate cuts is the interest rate cuts caused by the epidemic in 2020. Let's look at the chart for comprehensive reference.

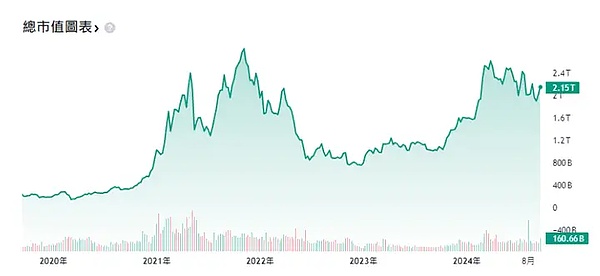

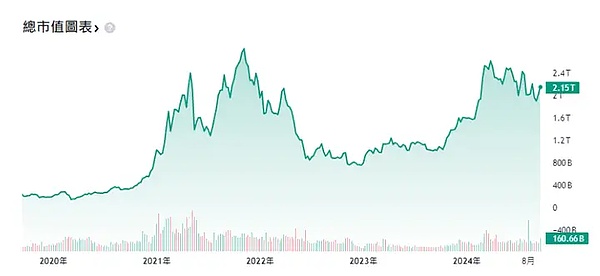

Key Indicator 1: Total Market Capitalization of the Crypto Market

Total market capitalization is one of the factors that help us understand market liquidity. We can see that after the interest rate cut in 2020, the market capitalization of the crypto market began to rise, reaching a peak of 3 trillion in 2021, but the total market capitalization will deviate due to currency price fluctuations.

Key indicator 2: Crypto market trading volume is still insufficient compared to previous bull markets

Trading volume can also be used as one of the market liquidity indicators, because sufficient market liquidity can support high daily trading volume. According to the current market, a daily trading volume of US$100 billion represents good market liquidity. After the interest rate cut, the daily trading volume also increased due to the market recovery, approaching US$100 billion, and has now fallen back to around US$60 billion.

Key indicator 3: The issuance of stablecoins (USDT, USDC, etc.) is close to a high point

The issuance of stablecoins is a more accurate indicator. From the issuance of stablecoins, we can clearly know how much legal currency is needed to enter the market, and it will not change with the fluctuation of currency prices. The current market value of stablecoins has exceeded the 170 billion US dollar mark, which is at a historical high, indicating that the market liquidity is sufficient.

Although the above three indicators can help us understand the liquidity status of the cryptocurrency circle, the cryptocurrency circle has a unique feature, that is, there are too many investable assets, which may lead to the dispersion and fragmentation of liquidity, and evolve into a situation where everyone has food to eat but no one is full. Investors still need to deal with this part carefully.

The impact and risks of excess liquidity

After talking so much above, it seems that interest rate cuts are all good, and it would be best if quantitative easing (QE) was added. In addition to rapid economic development and smooth corporate financing, the financial market is also ushering in a carnival. However, everything has two sides. When there is excess liquidity in the market, the following situations may occur.

Asset bubble risk:

The value of the world as a whole continues to grow, but if the growth rate of currency exceeds the growth of value, it is a bubble. Warren Buffett, the stock god, once said: "Prices will eventually reflect value." That means that the asset bubble will eventually burst, and at that time, the assets of most people will shrink significantly, or even lose everything.

Inflation risk:

Excess liquidity will further push up commodity prices, leading to excessive inflation, a rapid decline in purchasing power, and the collapse of the monetary system. For example, Zimbabwe in 2000 and Venezuela in 2010 were both due to wrong economic policies that led to excess market liquidity, and finally had to abandon the original monetary system and find another way out.

Excessive leverage and financial system risks:

When banks have a lot of excess funds, it may lead to lower standards of lending conditions. At this time, it is easy for a large number of companies and individuals to engage in leveraged behavior. However, when the policy turns, it is easy to have problems such as a broken capital chain and a crisis of trust, leading to an imbalance in the overall financial system.

Therefore, market liquidity should be just right. Too much liquidity will lead to economic and market turmoil. We investors should always pay attention to risks.

Reducing interest rates is undoubtedly a powerful measure to supplement market liquidity. However, in recent years, due to shock events such as the 2008 financial tsunami and the 2020 epidemic, interest rate cuts and quantitative easing policies seem to have thrown too much money into the market. The entire market has become a sea of money. As an investor, you need to pay more attention to the risks in the market during this period. Making hedging decisions at the right time is a necessary measure for us to continue sailing. Only at the poker table will we have the opportunity to continue.

JinseFinance

JinseFinance