Shiba Inu's Burn Rate Soars, Signalling Market Evolution

Shiba Inu's burn rate spikes 5000%, indicating active market dynamics and investor interest despite inherent risks.

Kikyo

Kikyo

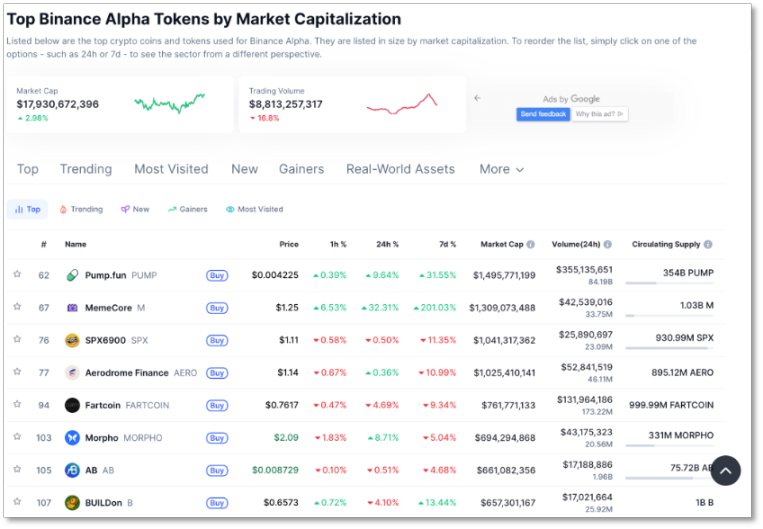

As of September 4, Binance Alpha's trading volume was US$8.813 billion

The points are high, but traders and score-boosting people are still there. This is a scenario that happened as early as May and June when Alpha was running, accompanied by Binance's dynamic adjustment measures for two consecutive months. Essentially, Alpha Points is an initiative designed to reward users for their active participation in the Binance ecosystem. Officially launched on April 25th of this year, users accumulate points based on their balance and trading volume. Once they reach the required points, they can claim new airdropped tokens. Even before the launch, some users keenly seized the opportunity and secured significant token airdrops through minimal trading, quietly amassing tens of thousands of yuan in profits within a month, earning nearly 1,000 yuan a day. On the day the points system launched alone, the number of active users on the Binance wallet soared by over 58%, from 44,967 to 71,228. Trading volume doubled within 24 hours, jumping from $48.46 million to $118 million. The internal competition had begun. Binance has also been iterating its points system to dynamically balance reward distribution among participants, while also strengthening risk control measures to prevent cheating and maintain fairness. In May, as the point threshold for claiming the Alpha airdrop was surging from double digits in April to triple digits, approaching 200 points, Binance upgraded its Alpha points system on May 13th, adding a "consumption mechanism" that required users to actually spend 15 points upon confirming their participation in Alpha or the TGE. By reducing points and lowering the threshold, Binance attempted to adjust its rules to benefit more contributors, curb excessively high points, and attract newcomers. However, it took nearly two weeks for the "points consumption" mechanism to truly lower the threshold to around 200 points, roughly equivalent to the 15-day point accumulation period. User @Mingo shared his earnings on social media. He reportedly earned $1,795 from 24 Alpha and TGE airdrops that month. After deducting $133.50 in transaction costs, his monthly salary exceeded 10,000 yuan. The lowest single-period profit on his account was $70. The popular project NXPC (MapleStory), which offered a 187-point entry threshold, boosted many users' earnings to $600 or even over a thousand dollars. This set a new record for Alpha airdrop earnings and undoubtedly became @Mingo's highest daily salary that month. Image from Binance user @Mingo Mingge's social media post. Undoubtedly, the high returns in the early stages of the Alpha airdrop were a key factor in attracting continued user participation. However, ordinary users have consistently viewed studios operating as teams as a major threat to the fairness of the Alpha airdrop. Photos of multiple phones scrambling to get an Alpha airdrop, along with recruitment notices from studios seeking dedicated airdrop scoopers, have circulated on social media. Consequently, Binance has launched a crackdown. In early June, Binance detected the use of bots by some teams in its Alpha campaign. The company clarified that any use of bots (including but not limited to scripts, automated tools, or other non-manual methods) will be considered a violation. The company has upgraded its risk control system to enhance its ability to detect and address violations. Accounts that trigger risk control will be disqualified from participating in Alpha Points. On Binance's "Square" social media platform, many users reported receiving notifications of violations, some successfully appealing them while others failed. However, despite over 100,000 active users per week, the threshold for claiming airdrops directly based on points was raised to between 210 and 251 in June. Starting June 19th, Binance further refined its points distribution system, implementing a two-stage distribution mechanism for the Alpha airdrop. In the first stage, high-point users were prioritized for a limited time. In the second stage, points were lowered to a certain level, with distribution distributed on a first-come, first-served basis to qualified users. After the introduction of the tiered points system, many users discovered that claiming/grabbing airdrops required a "machine test." In addition to facial recognition, a slider was added to verify that you were human. Binance has further strengthened its ability to detect bots, and Alpha points remained relatively stable in July. In the 31st Alpha airdrop (excluding the TGE), the highest score for "priority claiming" was 234, which only occurred in the PEAQ airdrop, with a single number earning around $45. The lowest score was 210, which occurred in BGSC at the beginning of the month and RCADE on July 10th, both of which yielded around $40. The threshold for "first-come, first-served" airdrops has stabilized at 200 points after ranging from 120 to 190 points. According to one user, after he worked hard to accumulate the high threshold of 240 points, he received five airdrops in July. After deducting costs, he received a profit of about US$240, with an average profit of about US$48 per period. "Compared with the previous two months, it is obviously much lower." In August, the "first-come, first-served" threshold with 200 points as the main mark was being broken by 230 points at the end of the month. The internal circulation of the Alpha airdrop continued, and data from Dune showed that the weekly active users of Binance Wallet wallet transactions had climbed from more than 120,000 at the beginning of the month to more than 180,000 at the end of the month.

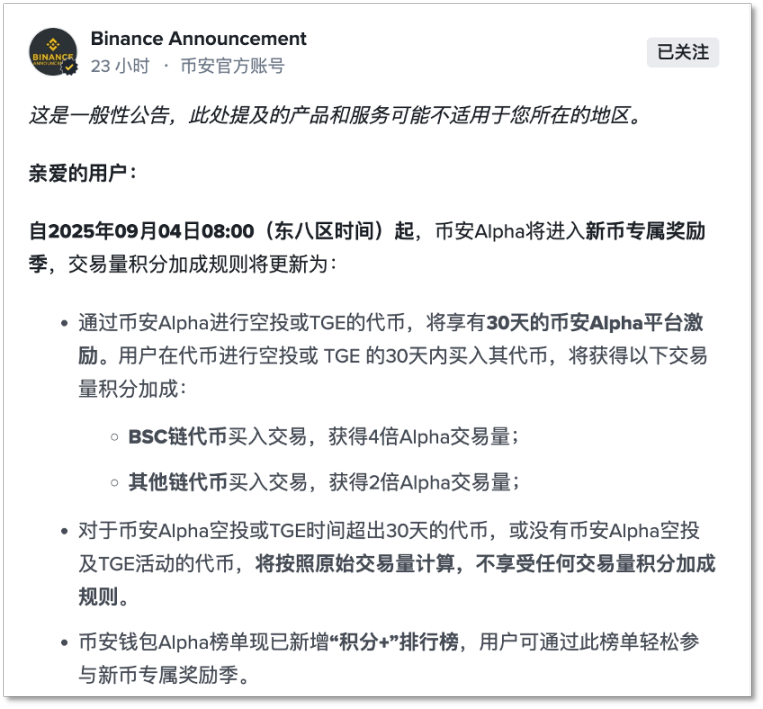

On September 4, Alpha Points updated the trading volume rules

Finally, on September 4, Alpha adjusted the points rules again and added a new "Points Plus" gameplay, which "super-doubled" the trading volume points to achieve a trading volume bonus for the new airdrop/TGE tokens within 30 days. At the same time, it also opened an "accelerator" for users who are keen on accumulating points and taking airdrops to increase the points return. KOL @BitHappyX sees the "30-day trading volume doubling period" as a "redistribution of resources and benefits": it limits studio arbitrage models while shifting resources and traffic toward genuinely engaged users and new projects. He explained that since only 1x trading volume points are retained for legacy coins, this will cut off studios' channels for earning points through large-scale trades on sideways-trading legacy coins, thus reducing their arbitrage opportunities. While new coins enjoy point bonuses, their prices tend to fluctuate significantly in the first month (within 30 days). While ordinary users face risks, studios pursuing high points and heavily invested in them clearly bear greater financial risks. He predicts that with the lack of advantage in legacy coin points and the significantly increased risk of new coins, some studios will be forced to abandon "fake activity" or even withdraw from Alpha altogether. As Winson Liu, Global Head of Binance Wallet, emphasized, "Through rewarded participation, we provide a fairer path for Alpha's truly loyal users to participate, while also enabling Binance Alpha to support more high-quality Web3 projects." Does the "Selection Pool" work for Binance listings? In over eight months of operation, Binance Alpha has distributed over 100 airdrops. When trading volume in this sector exceeded $10 billion, the continued surge in trading volume demonstrated that this ecosystem has strongly stimulated user interest, allowing Alpha to form a momentum cycle independent of the traditional altcoin market. Using trading as a hard-core indicator, Binance continuously verifies market projects. In fact, as early as December of last year, when Binance announced the launch of Alpha, it intended to cultivate this on-chain DEX within the Binance wallet as a selection pool for new tokens listed on the main site. While there was no guarantee that Alpha tokens would be listed on the main site, the fact that some projects that conducted exclusive TGEs (token generation events) on the Binance wallet were listed earlier this year reinforced the perception of Alpha as a "listing candidate pool." At the time, Binance was plagued by public outcry over "poor listing quality" and "girlfriend coins." Co-founder He Yi had to repeatedly address the criticism, repeatedly disclosing listing criteria and emphasizing "rigorous selection." Binance even implemented a "voting for listing/delisting" system. Although Binance later intentionally slowed its pace of new asset listings, the downward trend of most new assets, which peaked immediately upon listing, has not been significantly improved. It was against this backdrop that Binance Alpha officially launched its testing phase. The results proved that even the best promises are less effective than transforming user demands into effective products and experiences, a hallmark of Binance. On March 18th, Binance Alpha 2.0 was released, integrated into the main site. This integration breaks the distinction between centralized exchanges (CEXs) and Web3 wallets, allowing CEX users to directly purchase early-stage tokens from various emerging on-chain projects using on-site assets like USDT and USDC. Winson Liu stated, "Binance Alpha serves as a pre-listing token selection pool, aiming to enhance transparency in Binance's listing process. By publicly recommending selected early-stage projects, the Alpha platform strengthens community trust and provides users with insights into promising tokens within the Binance ecosystem." As the number of Alpha tokens increases, and the number of projects in the selection pool grows, is Binance's main site experiencing a surge in new listings driven by this surge in new tokens? Have these Alpha-selected projects improved Binance's listings? As of September 4th, CoinmarketCap recorded 274 token projects listed and trading on Binance Alpha. According to Binance’s official data from August 18 and subsequent updates, 177 tokens listed on Alpha have launched TGE/airdrop/Booster activities, accounting for 64.6%; of these, 26 have entered the spot market on Binance’s main site, accounting for 14.6%, and 77 have been listed on the contract market, accounting for 43.5%. The conversion rate of Alpha airdropped tokens listed on the spot market was 14.6%. According to DWF Labs data from June, 18 of the more than 190 tokens in Binance's Alpha section were listed on the Binance main site's spot market, with a conversion rate of 9.5%. Two months later, only 26 of the 274 Alpha tokens were listed on the spot market, with a conversion rate still at 9.48%. It's clear that even with Alpha as a pre-selection pool, Binance has maintained a nearly unchanged conversion rate despite its "strict selection" standards. Looking at the Alpha tokens listed on Binance, the vast majority participated in TGEs, airdrops, and booster campaigns. Airdrops are the most frequent channel for listing tokens on Binance's spot or futures markets. Honeycomb Tech counted 107 airdropped tokens launched by Binance Alpha over the three months from June to September. A total of 13 tokens were listed on Binance's spot and futures markets, and 19 tokens were listed solely on the contract market.

Performance of Alpha Airdrop Tokens on Binance Spot Market

(Data statistics as of 16:30 on September 4)

From the performance of these 13 Alpha tokens on Binance spot market, as of September 4, 8 tokens have fluctuated with the market correction in the current overall decline of the crypto asset market. However, the current prices of PROVE, ERA, SAHARA, and SPK remain strong, still 1-5 times higher than the opening price. Among them, SPK has the highest increase, reaching 501%; only three tokens significantly fell below their first-day opening prices (dropping over 10%). RESOLV, launched in June, performed the worst, falling 51.8% from its IPO price. Of the 13 projects, nine tokens saw their ATHs (all-time highs) rise by over 100% from their first-day opening prices, with the lowest increase exceeding 40%. PROVE, SAHARA, ERA, and SPK saw ATHs rise by 540%, 737%, 928%, and 1922% from their respective opening prices on Binance spot trading. Using Alpha's airdrop closing price as a benchmark, with the exception of LA, the earliest listed token (-9.1%), all other tokens still achieved a minimum 20% increase in their ATHs after being airdropped and listed on Binance's spot market. TREE, SPK, and C's spot ATHs increased by 123%, 476%, and 245%, respectively, compared to Alpha's airdrop closing price. This demonstrates the Binance ecosystem's ability to support these project tokens. This performance significantly surpasses the new projects launched on Binance at the end of last year, breaking the cycle of new projects frequently breaking their IPO prices. This demonstrates that Alpha's strategy of listing through airdrops is indeed achieving a selective effect. Accelerating Towards the Core Web3 Market With an increasing number of projects, the "launch-at-peak" phenomenon is now emerging in the Alpha trading zone. This aligns with the market characteristics of Alpha, a nascent Web3 blockchain space: early-stage projects and limited on-chain liquidity. However, Binance plans to make changes. First, the new Alpha Points rules, announced on September 4th, will prioritize newly launched projects, hopefully bringing real trading volume to them and further enhancing Binance's "killing two birds with one stone" strategy. From a regulatory perspective, BSC, the dominant issuance chain for Alpha tokens, remains a key ecosystem supported by Binance. Binance is offering a "quadruple trading volume" incentive to boost traffic to BNBChain (previously an unlimited, 2x incentive). This is expected to boost on-chain activity and transaction fee revenue. The trading efficiency and price performance of new project tokens on the Alpha trading platform are also expected to improve as user participation increases. In addition to improving the trading performance of new tokens through traffic, on August 28th, Binance officially announced the launch of the Alpha 2.0 Limit Order Market Maker Program, inviting users with extensive DEX trading experience to join. This program offers zero-fee limit buy/sell trading and access to the Alpha-exclusive API. Binance is leveraging its years of experience as a CEX exchange to address Alpha's liquidity shortcomings as a core Web3 marketplace. This strength has become increasingly evident over the past six months. Alpha has already attracted a significant number of users through airdrops and trading competitions, and Binance Wallet already ranks among the top major Web3 wallets globally in terms of active users compared to other wallets. Furthermore, the majority of tokens listed on Binance Alpha originate from the BNBChain chain. 77% of airdrops from June to August alone originated from the BNBChain chain. Messari's latest BNBChain Q2 2025 report shows that BNBChain maintained strong growth in the second quarter, with both user activity and on-chain transactions reaching record highs. Daily active addresses and transaction volume increased significantly, and DeFi activity remained robust. DEX trading volume, stablecoin transactions, and active users all ranked first across all blockchains, solidifying its leading position in the Web3 ecosystem. In terms of market capitalization and investor confidence, BNB's market capitalization increased by 7.5% quarter-over-quarter to $92.6 billion. Regarding on-chain transactions and activity, with transaction fees dropping by 90% to 0.1 gwei, BNBchain's average daily transaction volume increased by 101.9% quarter-over-quarter to 9.9 million, and its average daily active addresses grew by 33.2% to 1.6 million. In May, 17 million new addresses were added. In terms of DEX performance, BNB ranked first across all blockchains in terms of trading volume, with an average daily trading volume of $3.3 billion in Q2. PancakeSwap, which handles a large portion of Alpha transactions, held an 85.1% market share.

Active users, surging traffic and DEX trading volume are attracting project parties to build on BNBChain. One crypto OG bluntly suggested in the community that innovative projects deploy directly on BNBChain. “Low transaction fees and high traffic are what early-stage projects desire most. BNBChain almost meets both of these requirements now. Project tokens also have the opportunity to enter Alpha and even receive support from Binance. Why not?” Winson Liu, Global Head of Binance Wallet, believes that the surge in trading volume represents a change in the way users interact with Web3. “Binance Alpha is redefining how users discover early-stage projects and earn real rewards – we’re setting a new standard for priority participation for Web3 users.” From the DEX function in the Binance Web3 wallet gradually becoming a key section of the main site, Alpha is developing towards becoming a core Web3 product, as evidenced by the richness of its interface. Initially, Alpha was displayed alongside Binance's spot and futures trading areas on mobile. Later, with the advent of the points system, a separate airdrop interface, similar to Launchpool, emerged. This interface, which later expanded beyond airdrops, also allowed users to access trading competitions, wealth management, TGEs, and Bootstrapping tasks with one click. This meticulously integrated the popular features of the Binance Web3 wallet into a single interface. Now, users no longer need to enter their wallet addresses on third-party websites to calculate their trading volume and accumulated points. Alpha directly provides an estimated value for reference. Today, projects listing on Alpha are achieving similar results to those listed on Binance's main website: optimal exposure, access to significant traffic from top platforms, and effective market liquidity. Binance Alpha is increasingly taking shape as a core Web3 marketplace. The new rule of doubling transaction volume to earn points for users also means that Alpha will continue to release new products. When this pie grows bigger, "airdrops" will have the opportunity to become a continuous benefit for users.

Shiba Inu's burn rate spikes 5000%, indicating active market dynamics and investor interest despite inherent risks.

Kikyo

KikyoAnodos is innovating in blockchain with user-friendly Web3 applications and strong XRPL integration.

Alex

AlexBlockchain Loans Double to $582 Million Amid Rising Interest Rates

Kikyo

KikyoHong Kong, embracing a crypto-friendly stance, may pioneer in launching Bitcoin spot ETFs in Asia, influenced by the U.S. and backed by a robust regulatory framework.

Alex

AlexCurve Finance mitigates a $73.5M hack through community-led efforts, enhancing user trust while highlighting security needs.

Kikyo

Kikyothe evolving alliance between the UAE and China, characterized by a notable shift towards local currency trade, represents more than an economic strategy. It signifies a bold step in reshaping the global economic structure, challenging the dominance of the US dollar, and marking the advent of a new era of multipolarity.

Brian

BrianManta.Network introduces 'New Paradigm,' a Layer 2 blockchain solution with Zero-Knowledge tech, offering secure transactions and native yields for ETH and stablecoins.

Alex

AlexTether enhances market stability, minting 1 billion USDT on Ethereum, with CEO Paolo Ardoino ensuring transparency and earmarking funds for future demand.

Hui Xin

Hui XinDeFi Technologies acquires key Solana Trading System IP to bolster its DeFi initiatives, pending regulatory approval.

Kikyo

KikyoAlgosOne.ai transforms retail trading by making advanced AI accessible, simplifying trading, and offering strong potential returns.

Brian

Brian