Recently, the bidding war for USDH issuance rights set off by HyperLiquid once attracted players such as Circle, Paxos, Frax Finance, etc. to openly compete, and some giants even did not hesitate to use US$20 million in ecological incentives as gaming chips. This storm not only demonstrated the huge temptation of the native stablecoins of the DeFi protocol, but also gave us a glimpse of the stablecoin logic of the DeFi world.

Take this opportunity, we also hope to re-examine:What are DeFi protocol stablecoins and why are they so valued? And today, as the distribution mechanism becomes increasingly mature, where is the real fulcrum that determines its success or failure?

Source: Paxos

Why are DeFi stablecoins so popular?

Before discussing this issue, we must face the fact that the stablecoin market is still dominated by stablecoins issued by centralized institutions (such as USDT and USDC). With their strong compliance, liquidity and first-mover advantages, they have become the most important bridge between the crypto world and the real world.

But at the same time, a force pursuing purer decentralization, censorship resistance, and transparency has always been promoting the development of DeFi native stablecoins. For a decentralized protocol with a daily trading volume of billions of dollars, the value of native stablecoins is self-evident.

It is not onlythe core pricing and settlement unit within the platform, which can greatly reduce the dependence on external stablecoins, but also firmly lock the value of transactions, lending, clearing and other links within its own ecosystem. Take USDH to HyperLiquid as an example, its positioning is not simply copied Instead, USDT should become the “heart” of the protocol—operating as a margin, pricing unit, and liquidity center.

This means that whoever can hold the issuance rights of USDH can occupy a crucial strategic high ground in the future structure of HyperLiquid. This is the fundamental reason why the market responded quickly after HyperLiquid offered an olive branch. Even Paxos and PayPal did not hesitate to use US$20 million in ecological incentives as a bargaining chip.

In other words, for DeFi protocols that rely heavily on liquidity, stablecoins are not just a "tool", but a "fulcrum" of on-chain economic activities covering transactions and value cycles. Whether it is DEX, Lending, derivatives protocols, or on-chain payment applications, stablecoins play the core role of the dollar settlement layer.

Source: DeFi protocol stablecoin of imToken Web (web.token.im)

From the perspective of imToken, stablecoin is no longer a tool that can be summarized by a single narrative, but a multi-dimensional "asset collection" - different users and different needs will correspond to different stablecoin choices (extended reading: "Stablecoin World View: How to build a stablecoin classification framework from the user's perspective?").

In this set of classifications, "DeFi protocol stablecoins" (DAI, GHO, crvUSD, FRAX, etc.) are an independent category. Compared with centralized stablecoins, they emphasize decentralization attributes and protocol autonomy - anchored by the protocol's own mechanism design and mortgage assets, trying to get rid of dependence on a single institution. This is why even if the market fluctuates repeatedly, there are still a large number of protocols that are constantly trying.

The "paradigm battle" started with DAI

The evolution of the DeFi protocol's native stablecoin is essentially a paradigm battle surrounding scenarios, mechanisms and efficiency.

1. MakerDAO (Sky) DAI (USDS)

As the originator of decentralized stablecoins, the DAI launched by MakerDAO created a paradigm of over-collateralized minting, allowing users to deposit ETH and other collateral into the vault for minting DAI has withstood the test of many extreme market conditions.

But what is less known is that DAI is also the first DeFi protocol stablecoin to embrace RWA (real world assets). As early as 2022, MakerDAO began to try to enable asset sponsors to convert real-world assets into tokens for loan financing, trying to find larger asset support and demand scenarios for DAI.

After the latest name change from MakerDAO to Sky and the launch of USDS as part of the final plan, the MakerDAO plan is to attract a different user group from DAI based on the new stable currency and further expand the adoption of DeFi to off-chain scenarios.

2. Aave's GHO

Interestingly, Aave, which is based on lending, is moving closer to MakerDAO and launched GHO, a decentralized, collateral-backed, DeFi native stablecoin pegged to the US dollar.

It has much the same logic as DAI - it is an over-collateralized stablecoin minted using aTokens as collateral. Users can use assets in Aave V3 as collateral for over-collateralized minting. The only difference is that since all collateral is productive capital, a certain amount of interest (aTokens) will be generated, depending on the borrowing demand.

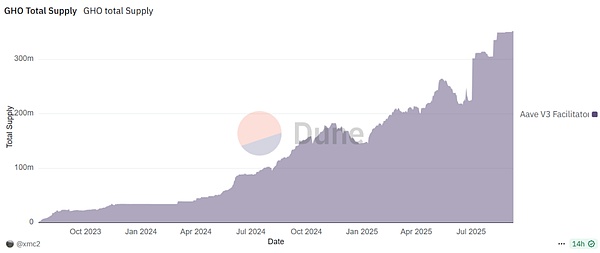

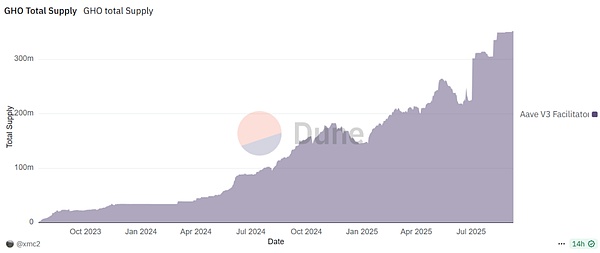

Source: Dune

From the perspective of experimental comparison, MakerDAO relies on minting rights to expand the ecosystem, while Aave derives stablecoins in its mature lending scenarios. The two can be regarded as providing development templates for DeFi protocol stablecoins under different paths.

As of the time of publication, the minting volume of GHO has exceeded 350 million. It has been basically growing steadily in the past two years, and market recognition and user acceptance have steadily increased.

3. Curve’s crvUSD

crvUSD has supported sfrxETH, wstETH, WBTC, WETH and ETH since its launch in 2023 A variety of mainstream assets, including LSD, are used as collateral, and cover the main LSD (liquidity pledged assets) categories. Its unique LLAMMA clearing mechanism also makes it easier for users to understand and use.

As of the time of publication, the number of crvUSD minted has exceeded 230 million. It is worth mentioning that wstETH alone accounts for about half of the total crvUSD minted amount, highlighting its deep binding and market advantages in the LSDfi field.

4. Frax Finance’s frxUSD

Frax Finance’s story is the most dramatic. During the 2022 stabilization crisis, Frax quickly adjusted its strategy and completely transformed into a fully collateralized stablecoin by adding sufficient reserves to stabilize its position.

A more critical step is that it has accurately entered the LSD track in the past two years, using its ecological product frxETH and the governance resources accumulated in its hands to create extremely attractive yields on platforms such as Curve, and successfully achieved the second growth curve.

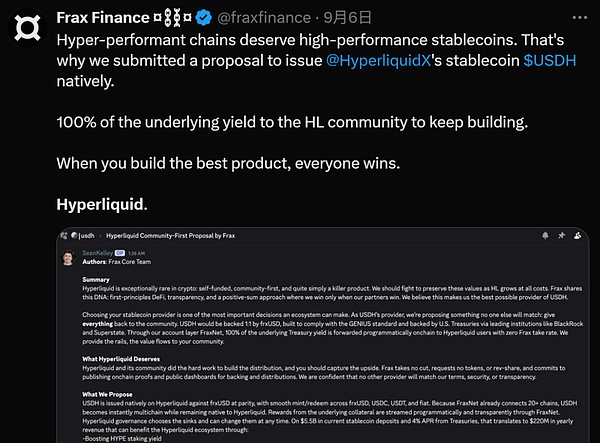

In the latest USDH bidding competition, Frax has put forward a "community first" proposal and plans to link USDH to frxUSD 1:1. frxUSD is supported by BlackRock's income-based BUIDL on-chain treasury bond fund. "100% of the underlying treasury bond income will be directly allocated to Hyperliquid through on-chain programming." Users, Frax does not charge any fees."

From "issuance" to "transaction", what is the fulcrum?

As can be seen from the above cases, to a certain extent, stablecoins are the only way for DeFi protocols to move from "tools" to "systems".

In fact, as a forgotten narrative after the midsummer of 2020-2021, DeFi protocol stablecoins have been on a path of continuous evolution. From MakerDAO, Aave, Curve to today's HyperLiquid, we find that the focus of this war has quietly changed.

The key is not the ability to issue, but the transaction and application scenarios. To put it bluntly, whether it is over-collateralized or fully reserved, issuing a stablecoin linked to the US dollar is no longer a problem. The real key is "What can it be used for? Who will use it? Where can it circulate?"

Just as HyperLiquid emphasized when bidding for USDH issuance rights - serving the HyperLiquid ecosystem first and compliance as the standard, this is DeFi The real fulcrum of stablecoins:

First of all, it is naturally the endogenous scenario for the widespread implementation of this stablecoin, which is also the "base" of stablecoins, for example - For Aave, it is lending; for Curve, it is trading; for Curve, it is trading; HyperLiquid, will be derivatives trading (margin assets), 可以说一个强大的内生场景可以为稳定币提供最原始、最忠实的需求;

其次是流动性深度,毕竟稳定币的生命线在于其与其他主流资产(如 ETH, WBTC)以及其他稳定币(如 USDC, USDT)的交易对,拥有一个或多个深度流动性池,是其保持价格稳定和满足大规模交易需求的基础,这也是为什么 Curve 至今仍是所有稳定币的必争之地;

然后还有可组合性与扩展性,一个稳定币能否被其他 DeFi 协议轻松集成,作为抵押品、借贷资产或收益聚合器的基础资产,决定了其价值网络的天花板;

最后则是「锦上添花」的收益驱动——在存量博弈的 DeFi In the market, yield is the most effective way to attract liquidity, and stablecoins that "make money for users" are more attractive;

In a word, centralized stablecoins are still the underlying liquidity of DeFi, and for all DeFi As far as the protocol is concerned, the issuance of native stablecoins is no longer a simple technical selection, but a strategic layout related to a closed loop of ecological value. Its real fulcrum has already shifted from "how to issue" to "how to let it be traded and used at high frequency."

This is also destined that the DeFi stablecoins that can win in the future will definitely be those "super assets" that can provide their holders with the most solid application scenarios, the deepest liquidity and the most sustainable returns, not just a "currency".

Weatherly

Weatherly