Source: chainfeeds

Last year, Friend.tech was once the leader in the SocialFi track, but then due to the uncertainty of the token launch and the unsustainability of its "Fi" attribute, Friend.tech was cold. Recently, it has once again led the market with its innovative V2 version. Can Friend.tech escape the Ponzi trap of SocialFi this time?

v1 Defect Analysis

Friend.tech's main function is to access exclusive content or interact through keys, where the price of keys is designed using the "bonding curve" mechanism, which increases exponentially with the increase in purchase volume. The specific calculation formula is a quadratic equation: the price of the next key = (the current number of keys) 2/ 16000 x 1 ETH.

The original intention of this model is to create a speculative environment, allowing early buyers to enter at a lower price, and gradually increase the price through the increase in the number of market participants, so as to encourage more early investment and active market. However, both buying and selling require a 10% tax, so new buyers are difficult to participate due to the high price. Especially when the market is close to saturation, the cost of new entrants is extremely high, and subsequent key prices need to increase by more than 20% to make a profit, which poses a challenge to the long-term sustainable development of the platform. At the same time, because the bonding curve of FT is too steep, it also brings significant risks, especially when user participation decreases, it is easy to cause the value of the key to drop rapidly, which in turn causes the market to collapse.

Image source: Mirror (Based on Toschi)

So, although the bonding curve model can encourage early market participation, it itself does not promote long-term stable or sustained user participation. At the beginning, community members formed (3,3) to support each other, and the spiral rose. However, once the market was turbulent or someone "secretly sold", the originally expected spiral quickly reversed, resulting in a decrease in community activities, which damaged the attractiveness and vitality of the entire platform. This is why the FT community later became deserted.

v2 Mechanism Analysis

Friend.tech v2 launched a number of innovative features and enhanced token models to improve user engagement and platform practicality. Among them, the "Money Club" feature is eye-catching. This is a space similar to a paid community, in which each new member entering the group needs to pay a gradually increasing price. This design not only increases the platform's monetization capabilities, but also promotes active interactions in the community and the value of content creators. The chairman of each club is elected by Key holders and is responsible for managing the club and appointing moderators, which enhances the autonomy and participation of the community.

To overcome the difficulties encountered in v1, v2 introduces a new points system and custom curve function, allowing users to create personalized mechanisms based on their participation. The flexibility of this design helps to meet the needs of different user groups and improve the overall satisfaction and activity of users.

In addition, Club transactions only support FRIEND tokens, and a 1.5% fee will be charged for each transaction. This fee mechanism creates an additional source of income for the platform, and may also help regulate trading activities and curb potential speculative behavior.

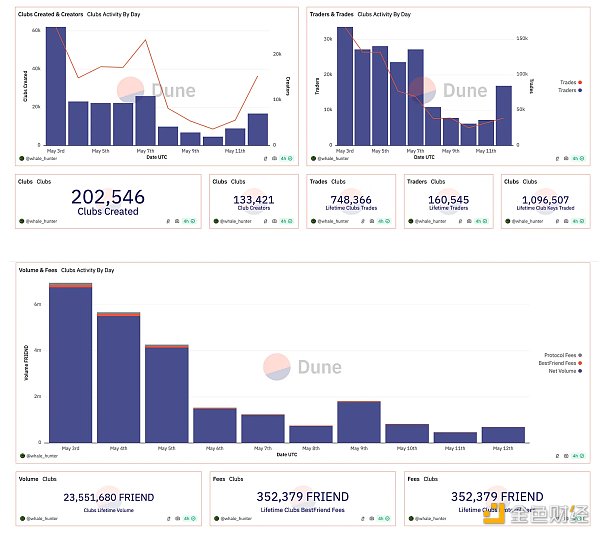

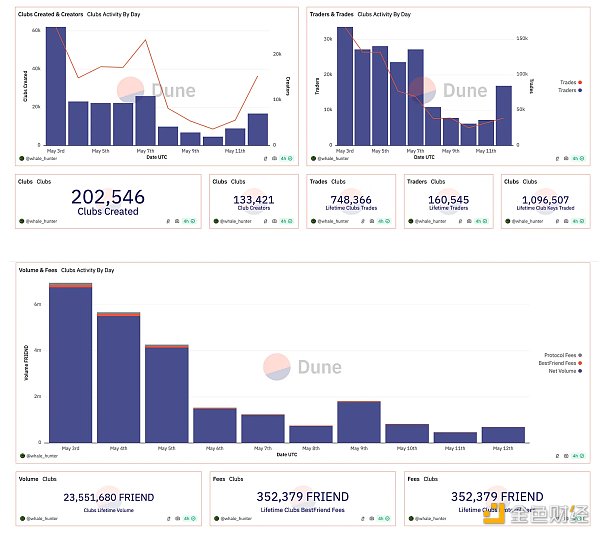

Image source: Dune (msilb7 & whale_hunter)

As of writing (May 13), Dune dashboard data shows that 202,000 Clubs have been created in Friend.tech, with 160,000 people trading in Clubs and a trading volume of 23.55 million FRIEND (market price of 51.10 100,000 US dollars). But it is worth noting that for the claim $FRIEND airdrop, users can only claim 10% of their shares at the beginning, and the remaining 90% needs to join at least one Club to claim. Therefore, the surge in Club trading activities is inseparable from this claim rule.

In general, the launch of v2 has brought a lot of incremental growth to FT. But observing the daily trading volume, Club transactions are decreasing.

What is the dilemma of SocialFi?

From Friend.tech's data and market reactions, it is not difficult to see that the market's expectations for its token airdrop in the early stage brought huge TVL and interactive activities. However, as the token went online, users claimed the airdrop, the trading volume decreased, and user loss became the biggest pain point of SocialFi.

SocialFi's dilemma can be broken down into two points:

1) User retention problem: For the SocialFi project, attracting and retaining users is a major challenge. These platforms often require users to understand and accept complex concepts such as blockchain technology and token economics, which is an entry barrier for users who are not familiar with encryption technology. But if only users in the circle are attracted, how to balance the "Fi" attribute and social gameplay is a big problem. In addition, the transition from traditional social media platforms with a large user base and mature network effects to new decentralized platforms may be slow and challenging.

2) Economic and tokenization model problems: SocialFi needs a sustainable economic model to develop. Traditional social media platforms rely heavily on advertising revenue, but SocialFi aims to redistribute value directly to users and creators through mechanisms such as social tokens and NFTs. It is crucial to develop and maintain a balanced token economics that provides real value without causing inflation or being exploited. The FT model shows that, despite the benefits of the steep bonding curve, it is almost impossible to achieve economic returns for high-value keys. Because as users and protocol data grow, if growth stagnates or declines, speculative purchases that rely on high-priced keys will no longer be feasible.

To ensure long-term success, the SocialFi project must innovate to solve these problems, provide a more user-friendly experience, and build an economic model that can continue to attract and incentivize user participation. Over time, only those platforms that can effectively integrate social functions with financial incentives will be able to stand out in the competitive market and achieve real growth and user loyalty.

Other SocialFi Projects' Innovative Attempts

Farcaster: More Focus on Social Attributes

Farcaster did not issue platform tokens, but memecoins frequently appeared in the ecosystem. Farcaster's mechanism design reflects its advantages, especially in building decentralized social networks. First, Farcaster allows users to maintain the consistency of social graphs between different applications, and to maintain identity and network connections even between different social applications. This approach greatly reduces the influence of centralized entities and ensures control of user data. In addition, Farcaster's open source and permission-free design encourage developers to innovate and integrate new features, providing social media applications with greater flexibility and user-driven experience. Users and developers can freely build and expand social networks, making Farcaster a highly modular and composable platform. In comparison, Friendtech's economic model shows some design flaws, such as the lack of value returns to coin holders and over-reliance on advertising revenue, which may limit its long-term development. Farcaster's design allows it to adapt to user needs and market changes more effectively, providing a more fair and sustainable social network environment.

Phaver: More emphasis on incentives for user contribution and participation

Phaver's mechanism allows users to share and integrate responses through cross-protocols such as Lens Protocol and Farcaster, which provides users with a wider range of interactions and stronger social network influence. In addition, the non-custodial and permissionless nature of the Phaver application allows users to control their social graphs and data more freely, rather than being restricted by centralized platforms.

Phaver has also launched $SOCIAL tokens to enhance the interactivity and reward mechanism of its ecosystem. Users can earn points by actively contributing to the platform and redeem these points for $SOCIAL tokens in specific activities. In addition, holding $SOCIAL tokens can also improve users' credit ratings and monthly withdrawal limits, thereby obtaining more platform benefits and early access to new features.

Compared to Friend.tech's economic model, Phaver's design emphasizes incentives for user contribution and participation, and through tokenization, it strengthens the activity of the community and user stickiness. These designs of Phaver give it a certain competitive advantage in the SocialFi market, especially in building decentralized and user-driven social networks.

Written in the end

While exploring the economic model sustainability and user retention dilemmas faced by Friend.tech and the entire SocialFi field, we also observed the innovative attempts of other platforms such as Farcaster and Phaver. These platforms try to solve the problems of insufficient user activity and unbalanced economic models through their unique mechanism design.

Although these designs are attractive in theory, it is still difficult to determine whether they are truly better than Friend.tech, or whether their designs can provide a more balanced combination of "Fi" and social attributes in the long run. Ultimately, which model can better balance the characteristics of finance and sociality and meet the needs of users remains an unanswered question.

JinseFinance

JinseFinance