Circle sought to go public first, and then Pump.fun issued a coin on the chain.

In the past week, the TGE that the market has paid the most attention to is none other than Pump.fun. This coin issuance event started in June, and continued to ferment amid expectations and complaints. Until July 12, the coin was finally issued. Although the market has been questioning its valuation of $4 billion, it is very obvious from the data that investors used their heels to vote. The public offering was quickly sold out within 12 minutes, and some investors even swore on social media because they did not get a chance.

For now,Pump.fun has delivered a relatively satisfactory answer. After going online, the price has been rising steadily, and just today, Pump.fun also used the handling fee to realize the first token repurchase. But can the price of the currency really be maintained? In the minds of many people, this question is still in doubt.

Speaking of the king of applications in this round of bull market,Pump.fun is at the forefront even if it is not in the first place. It is no exaggeration to say that the emergence of Pump.fun has successfully brought MEME to a new height. Its concept of fair launch and convenient operation form have completely broken the high threshold of the traditional issuance model. The temptation to establish a token with only 3 US dollars is still very attractive even now that MEME is on the decline.

From the mechanism point of view, there is no pre-sale and private placement, the whole process is priced by smart contracts, and even a graduation mechanism is set. After the market value reaches 69,000 US dollars, a liquidity pool is automatically created on DEX. The fully automatic listing process is widely welcomed by the market, and it also makes Pump.fun the strongest money printing machine in this round of the market.

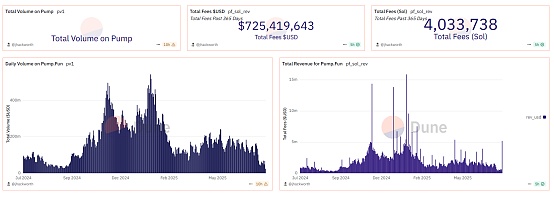

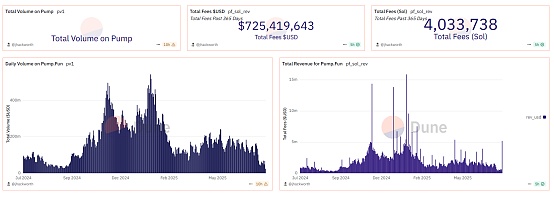

Since its launch in January 2024, Pump.fun has issued a total of 11.44 million tokens, with more than 22 million addresses, and has achieved a cumulative income of nearly 720 million US dollars, of which the highest single-day handling fee even reached 5.43 million US dollars, and the peak single-day income even reached a staggering 15.88 million US dollars. It can be basically considered that all the market dividends of this round of MEME have been pocketed by Pump.fun, and further promoted the development of the Solana ecosystem.

It is such a project that started with MEME, and suddenly wanted to issue coins, which triggered widespread heated discussions in the market. The rumors of Pump.fun's coin issuance began in February this year. At that time, Wu said that Pump.fun planned to issue coins on centralized exchanges and even prepared complete coin issuance documents, but later it was abandoned due to the frequent issuance of MEME by Trump's family, which led to the depletion of liquidity. In June, the coin issuance rumors made a comeback. Blockworks quoted several people familiar with the matter as saying that Pump.fun planned to raise $1 billion through token sales, with a valuation of $4 billion, and the tokens would be sold to the public and private investors.

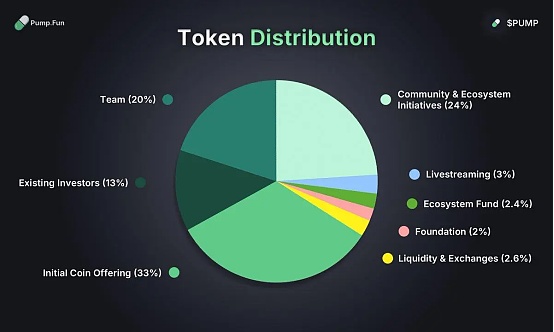

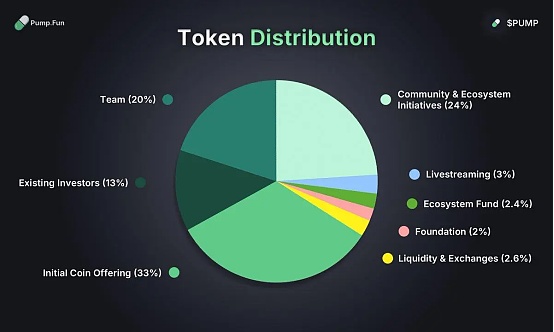

On July 10, Pump.fun finally released the news, announcing that it will officially launch the public sale of the native token PUMP at 22:00 on July 12, 2025, and the PUMP airdrop is coming soon. 150 billion tokens will be sold this time, with a unit price of 0.004 USDT, accounting for 15% of the total supply (1 trillion). At a valuation of US$4 billion, it raised US$600 million. Participants from the UK and the United States are not allowed to participate in this sale due to compliance reasons. In the PUMP token economics, 33% is used for public sale, 24% is used for community and ecological incentives, 20% is allocated to the team, 2.4% is used for ecological funds, 2% belongs to the foundation, 13% is allocated to existing investors, 3% is used for live broadcast related, and 2.6% is used for liquidity and exchanges.

However, compared with the previous expectations of issuing coins, when the coins were really issued, the market collectively sang badly. The controversy focused on the valuation of 4 billion US dollars. You should know that the first stablecoin stock Circle that rang the bell in New York was only valued at 7 billion US dollars. Even the regular army was like this, but an on-chain casino threatened to ask for 4 billion, and even the valuation exceeded most of the current DeFi blue-chip protocols, which made the market say that it overdrew liquidity.

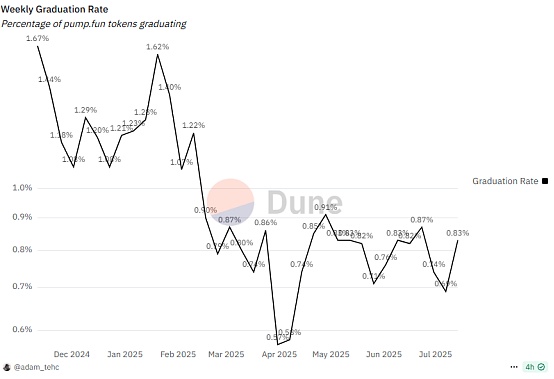

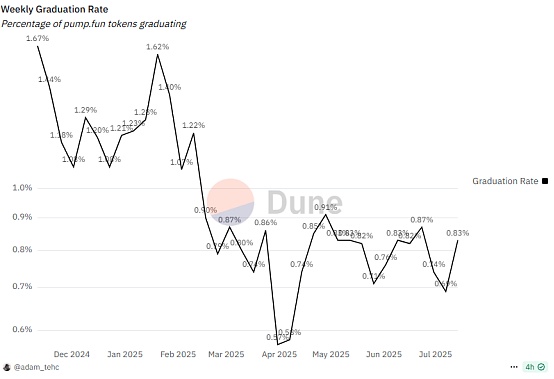

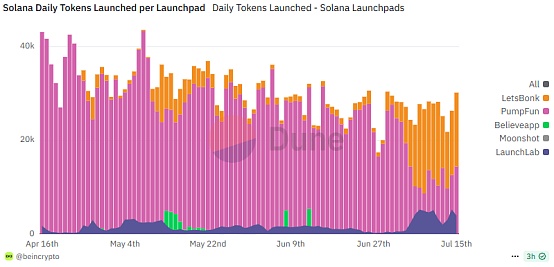

More importantly, today is different from the past. From the market point of view, looking at the current currency circle, except for the recent rise of the dragon, the trend of most altcoins and MEME coins can only be described as sluggish. This can be seen from the trading volume. According to Dune data, after reaching a peak of 5.44 million US dollars in trading volume on January 23, 2025, Pump.fun's trading volume basically showed a cliff-like downward trend. The daily trading volume has basically stabilized within 700,000 US dollars in recent days, and the decline from the high point is 87.2%. From the perspective of token creation, the daily token creation has dropped from a peak of 70,000 to 30,000, almost halved. The token graduation rate is even more shockingly low. In 2024, there was a graduation rate of 1.6%, but now it has dropped to less than 1%. It is enough to see that the benefit effect is weakening, the MEME market is becoming "cold", and the enthusiasm of users is also fading rapidly. However, no matter how powerful Pump.fun is, it is just a tool and needs to rely on the heat of the MEME market, which also makes the market question its valuation.

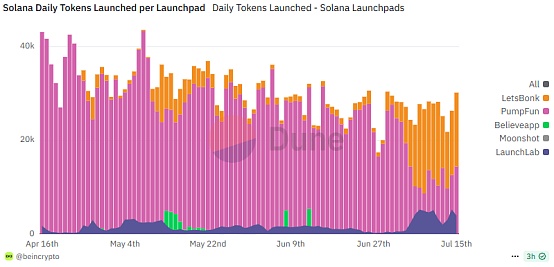

On the other hand, the market is shrinking, but competitors are rising. Pump.fun, which once had no rivals in the market, has also encountered pressure recently. Just recently, letsbonk.fun, a rival based on BONK, has developed rapidly. During this period, it has repeatedly ranked first in the number of token launches, and has surpassed Pump.fun to become the first in market share. Although Pump.fun quickly counterattacked, the competition between the two is still intense. It has to be admitted that Pump.fun's position as the first dragon is threatened.

It is for these reasons thatPump.fun's $4 billion valuation has been severely questioned. After the rumor of issuing coins in June, the market's risk aversion sentiment was once aroused. The popular MEME coin in the Solana ecosystem has been pulled back on a large scale, and funds have flowed out rapidly.IOSG Ventures partner Jocy even bluntly stated that this ICO is more like an exit from liquidity rather than a long-term development plan. Crypto researcher @rezxbt even pointed out that Pump.fun is staging a thorough "harvest operation."

Interestingly, in March 2024, Alon, the co-founder of Pump.fun, said on social media that every pre-sale was a scam. And what a coincidence, Pump.fun just happened to sell it in the form of pre-sale, performing a face-slapping operation on the spot. The token issuance raised 33% of the total supply, with 18% of the private round for institutions and 15% of the public round. All tokens were fully unlocked on the first day of listing.

From the final result, although industry insiders are not optimistic, supporters and institutions obviously do not think so. From the perspective of public offering, in just 12 minutes, PUMP tokens completed a public offering of 500 million US dollars, of which 6 large exchanges including Kraken, Bitget, and Bybit participated in the PUM public offering. According to Dune panel data, the number of wallet addresses participating in the Pump.fun official website pre-sale and completing KYC was 23,959, the number of wallet addresses that successfully bought was 10,145, and the average subscription amount was 44,209 US dollars. 89.7% of the PUMP token pre-sale was completed through the official website, and the total sales of each CEX accounted for only 10.3%. Among the official website pre-sale addresses, small users are the main group, with 5,758 users subscribing to PUMP within 1,000 US dollars, and the number of addresses with a subscription amount of more than one million US dollars is 202, which also shows the enthusiasm and preference of institutions.

The whole process perfectly illustrates the unique characteristic of the cryptocurrency circle. Due to some technical problems in the public sale of the exchange, it was difficult for users to complete the subscription, and even caused many users to express dissatisfaction on social media. At that time, there was also a lot of controversy in the community about the subsequent performance of Pump. On the one hand, it was believed that the valuation was too high and it would inevitably collapse after the spotlight effect ended. On the other hand, it was believed that Pump, as the most representative product in MEME, had a complete income logic and cognitive foundation and would not easily interfere.

From the current stage alone, the latter seems to have temporarily won. After the launch of GMGN on July 15, Pump briefly dropped from $0.0065 to $0.0042, but after the shock, it started an upward trend and is now at $0.0066, up 55% from the fundraising price of $0.004. The FDV price also rose from $4 billion to $6.6 billion, bringing a certain wealth effect to the subscribers. Of course, this part of the increase is also a performance component. According to @EmberCN's on-chain analysis, as of 8 a.m. this morning, pump.fun began to repurchase PUMP with the fee income after issuing the coin. In the past 7 hours, the fee income of 187770 SOL was transferred to the 3vkp...3WTi address, and after purchasing PUMP, the purchased tokens were transferred to the G8Cc...kqjm address for storage. Currently, 111,953 SOL (about 1.83 million US dollars) has been used to purchase 3.04 billion PUMPs, with an average price of 0.006 US dollars. Buybacks can support prices, but they can't escape the suspicion of transferring money from one hand to the other. Of course, for holders, no matter what the purpose is, as long as the market is pulled, it is a good thing.

Whether it is to withdraw liquidity or simply build benefits, the valuation dispute of Pump.fun reflects the current market situation. MEME, once known for its liquidity, is collectively in trouble, and the hot attention economy seems to have gradually become a false proposition. Today, even the most representative applications have to embark on the road of issuing coins, which subtly reveals the signal of the end of the narrative. Where will MEME go in the end? The token Pump is a weather vane, and the market's bet on it will be an effective observation of the market's value judgment on the attention economy. The rise of the token at least means that the market recognizes its pricing, and the fall of the token will make the public think about the true connotation of the MEME market, which will also generate more selling emotions. And this may be one of the reasons why Pump took the buyback.

Back to the question in the title, Pump.fun issued coins, who made money? There is no doubt that the project party made money, and the participants of public and private offerings also made money at present, and short-term long investors also made money, but when can they make money and to what extent can the project party maintain the price of the coin, it is still a big question mark. Some whales have begun to choose to take the money and take it home. According to Lookonchain monitoring, a whale 8a5nSU spent 5 million USDC through 5 wallets to participate in the public sale of PUMP and purchased 1.25 billion PUMP. Today, it sold all of them at an average price of US$0.0067, with a profit of US$3.416 million. On the other hand, returning to the reality, the current improvement of the macro market will also have an impact on MEME to a certain extent. Ethereum's narrative is strong, and mainstream tokens led by Ethereum have continued to rise. The direct result is the outbreak of Ethereum blue-chip cottages. Take ENS as an example. With today's increase of more than 18%, it has set a new high since February this year. In the long run, even if the market uncertainty is slightly stronger today, the foreseeable interest rate cut is already on the way, and the cottage market may also be expected to usher in a small climax. MEME reflects more of a bipolar trend. High-quality MEME is driven by the rotation of sectors, and the remaining MEME liquidity is siphoned, and most of them will present a situation where no one cares. If this path is interpreted, MEME, which is similar to the lipstick economy and the lottery economy, will exist forever, but it will no longer be able to stir up the money tide in the market like in 2024.

Kikyo

Kikyo