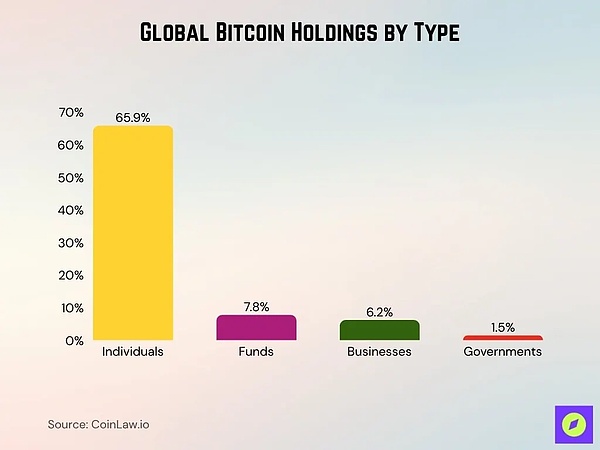

The question of "global Bitcoin holder size" lies at the intersection of finance, technology, and global adoption. It reveals both the extent of Bitcoin's penetration into the mainstream economy and its potential for future growth. Companies are shifting cash reserves into Bitcoin, while individuals in emerging markets are using it as an inflation hedge and cross-border remittance tool. This article uses the latest Bitcoin holdings data, distribution patterns, and key trends to deeply analyze the practical implications behind these figures. Recent Developments: By 2025, the surge in US spot Bitcoin ETFs and institutional inflows will significantly increase holdings transparency. Companies and funds will continue to expand their balance sheets, driving the disclosure of fiscal-level holdings information. Furthermore, regulatory clarity in many countries has lowered the barrier to entry for investors and reshaped the distribution of holdings. Bitcoin ownership has increased in developed markets, with the UK seeing an increase from 18% to 24%. However, this increase in ownership does not necessarily translate to widespread decentralization. On-chain data directly confirms the concentration of wealth, with whale addresses still holding a significant share.

Bitcoin Holdings of Institutions and Enterprises

Institutional holdings reached $414 billion in August 2025, primarily driven by ETF adoption and corporate treasury strategies.

Corporate reserves surged 40% in the third quarter, valued at $117 billion.

The number of publicly listed companies holding Bitcoin has expanded to 172, with a total holding of over 1 million BTC.

MicroStrategy leads corporate holdings with 640,000 bitcoins.

As of October 2025, U.S. spot Bitcoin ETFs managed $169.48 billion in assets (6.79% of market value)

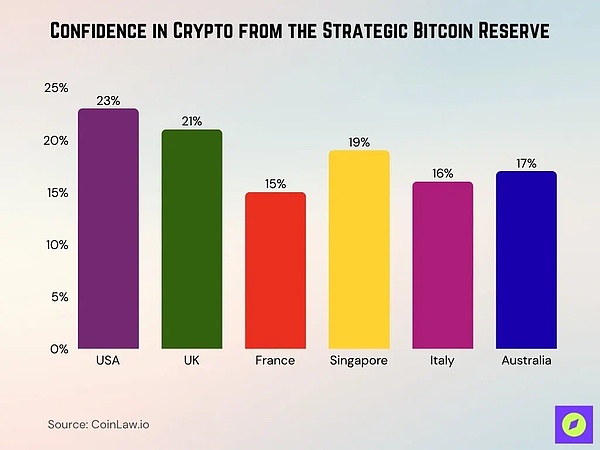

Strategic Bitcoin Reserve Confidence Index

United States:23% of non-holders said that strategic Bitcoin reserves increased their confidence in the value of cryptocurrencies.

UK: 21% of respondents felt more confident due to the existence of the reserve.

France: Only 15% of non-holders felt more confident, the lowest among the countries surveyed.

Singapore: 19% of participants expressed greater trust in the stability of crypto.

Italy: 16% of respondents said that the strategic Bitcoin reserve increased their confidence.

Australia:17% of non-owners became more optimistic about the value of crypto after the reserve program.

Bitcoin on-chain activity

The total number of global crypto users exceeded 716 million in 2025, a year-on-year increase of 16%, with Bitcoin accounting for the largest share of active network users.

As of October 2025, Bitcoin processed 504,508 transactions in 24 hours, equivalent to over 21,000 transactions per hour globally. The average daily transaction volume across the entire blockchain reached $28.46 billion. Despite a trend toward address centralization, network liquidity remained stable. The average daily active addresses for the year were 945,752, with the 30-day average decreasing slightly to 928,141 (a decrease of 1.86%). The crypto sector has approximately 181 million monthly active addresses, but only 40 to 70 million actual active users, an increase of approximately 10 million from 2024. Approximately 700,000 to 1 million Bitcoin addresses are active daily, equivalent to approximately 300,000 to 500,000 unique users conducting on-chain transfers daily.

Number of Sunken and Dormant Bitcoins

As of August 2025, approximately 19.88 million Bitcoins have been mined (approximately 94.8% of the 21 million cap); between 2.3 million and 4 million BTC (11%-18% of the maximum supply) are permanently lost.

Of these, approximately 62,800 Bitcoins over seven years old were activated between January and March 2025, a significant increase from 28,000 during the same period in 2024.

The continued accumulation of long-term dormant wallets (coins that have not been moved for several years) indicates a rising "dormant supply." Dormant whale addresses, which have remained stagnant since 2010, continue to attract attention, as any unusual movement could trigger market volatility. A significant number of mined Bitcoins may never enter circulation, materially altering the effective supply. The core drivers of Bitcoin adoption: As many as 65% of Millennials and Generation Z continue to favor cryptocurrencies over traditional equity assets.

14% of non-holdersplan to enter the market in 2025,

67% of existing holdersintend to increase their holdings.

India, the United States, Pakistan, the Philippines, and Brazilare leading the global wave of crypto adoption, with US market activity surging by approximately 50% year-on-year.

The usage rate of crypto payments will increase by approximately 45% in 2025, and half of small and medium-sized enterprises will already accept Bitcoin or stablecoins for payment.

Ninety percent of Fortune 500 executives are calling for improved US crypto regulations, and 60% are exploring the application of blockchain technology.

Furthermore, despite 72% of investors holding higher education, 40% remain skeptical about the security and practicality of cryptocurrencies.

The Impact of the Regulatory Environment on Portfolio Structure

By 2025, 64 jurisdictions worldwide will have advanced digital asset legislation, achieving a 43% year-over-year increase in regulatory clarity.

The institutional adoption rate in regulated markets, such as Singapore, Hong Kong, and the European Union, is 2.3 times higher than in less regulated markets. The United States has issued four executive orders (including the March 2025 Strategic Bitcoin Reserve), driving a 35% increase in Bitcoin since its inception. The GENIUS Act (July 2025) establishes the nation's first federal stablecoin framework, mandating 100% reserves and monthly audits. The CLARITY Act clarifies the regulatory responsibilities of the SEC and CFTC for digital assets, ending a long-standing jurisdictional dispute. The new SEC regulations (September 2025) will shorten the ETF approval cycle from 270 days to 75 days, improving approval efficiency by 72% and stimulating an accelerated inflow of institutional funds. By August 2025, US crypto ETFs had assets under management of $156 billion, with net inflows of $29.4 billion in the first eight months. There are 76 listed crypto ETPs in the US, a twelve-fold increase compared to 2021 due to the relaxation of ETF regulations. According to data from the Financial Stability Board, 58% of G20 member countries have fully implemented crypto regulation (compared to only 22% in 2023). At the same time, the G20 Risk Report warns that inconsistent regulatory frameworks pose a significant risk to global stability.

Future Outlook for Bitcoin Holdings

By 2030, Bitcoin's total market capitalization may exceed $15 trillion, with the unit price expected to reach a range of $829,000 to $999,000.

Due to increased holdings by institutions through compliant channels, the proportion of retail holdings may drop from 85% in 2024 to 60% in 2030. After the 2028 halving, 74% of the supply may be controlled by long-term holders who have held the currency for more than one year.

Kikyo

Kikyo