After Bitcoin broke through $120,000, altcoins took over in full force, especially Ethereum, which soared 60% in July and broke through the $4,000 mark today!

Many people asked me: "Can I still get on the ETH train?"

Don't worry, let's first dig into the truth of this round of market - who is driving Ethereum's price up?

PART 01The fundamentals have not changed much, capital is the protagonist

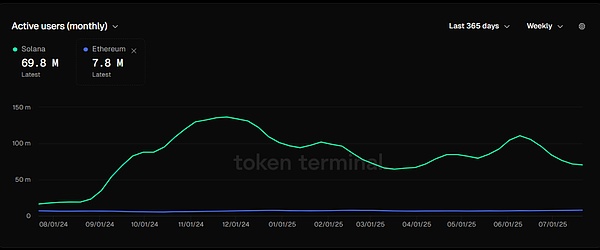

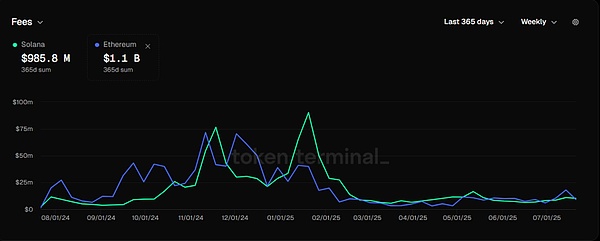

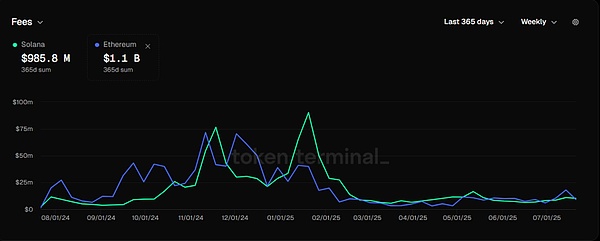

Compared with last year, fundamentals such as on-chain activity and revenue have not only not made any qualitative leap, but have also shown a downward trend.

The only change is that Ethereum changed its management a few months ago, claiming to improve efficiency.

Therefore, the engine of this wave of market is not business, but capital, and the capital is most likely from - US stock capital.

PART 02 Fund Disassembly - US Stock ETFs are Big Buyers

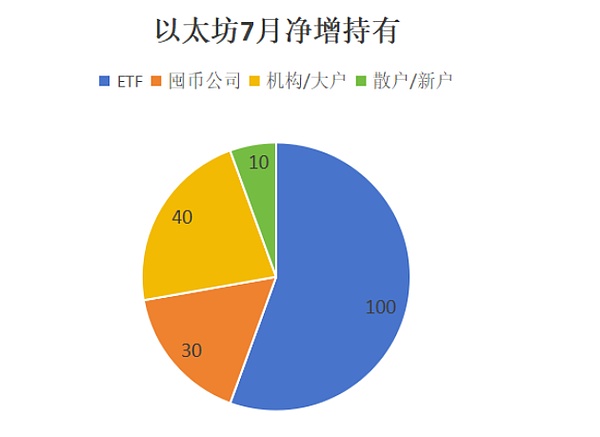

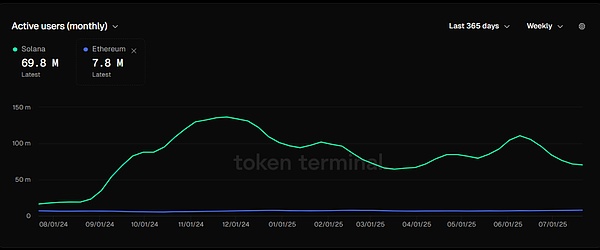

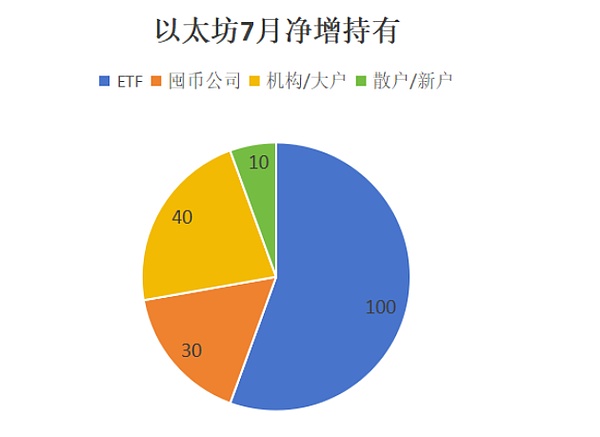

In July, ETH spot trading volume exceeded US$1.2 trillion, but the price soared by 60%, with only 1.8 million new ETH purchases.

Source | Newly Added ETH Amount | Representative Institution/Company |

|---|

US Ethereum Spot ETF | 1 million | BlackRock, Grayscale, Bitwise, etc. |

US stock currency hoarding company | 30 Thousands | SharpLink, BitMine, The Ether Machine |

Other institutions/whales | 400,000 pieces | —— |

Retail investors | 100,000 coins | —— |

Conclusion: U.S. stock ETFs + coin hoarding stocks bought more than 70% of the new ETH, a veritable feast for Wall Street capital.

PART 03 Coin-stock linkage: the advanced gameplay of capital giants

Since April, the inflow of ETFs has accelerated, accompanied by the linkage operation of coins and stocks~

First, SBET announced its transformation from a gambling company to an ETH hoarding company, and the platform’s supporters include: Joseph Lubin (ETH co-founder), Pantera Capital, Cantor Fitzgerald

Many people think that Ethereum co-founder

Not only can you see the Cantor + Pantera combination here, but there are also more hardcore bosses! PART 04 Future Outlook Short-term: Funds will continue to flow into mainstream public chains like ETH and SOL, and the capital market's amplification effect may continue to push up prices. Long-term: Ultimately, it depends on business implementation. The difference between ETH's ecosystem scale and SOL's high-performance approach will likely be determined in this round of market fluctuations.

Weatherly

Weatherly