Author: Zoltan Vardai; Translated by: Baishui, Golden Finance

The global cryptocurrency industry is expected to gain mainstream and institutional recognition again in 2025 due to increasing regulatory clarity and soaring cryptocurrency valuations.

2024 hit a record high, and optimism among cryptocurrency investors is rising as the price of Bitcoin rose to a record high of $108,300 on December 17, more than a month after Donald Trump won the U.S. presidential election.

Industry experts point out that with expectations of greater regulatory clarity under the new Trump administration, the cryptocurrency industry may usher in another milestone year, including greater institutional adoption and a record number of global cryptocurrency investors.

Regulatory Clarity Will Drive Crypto Investor Numbers to All-Time Highs

The crypto industry has seen significant regulatory developments in some of the largest jurisdictions in 2024.

In Europe, the Markets in Crypto-Assets Act (MiCA) — the world’s first comprehensive crypto regulatory framework — came into full effect on December 30, providing comprehensive guidelines for crypto service providers.

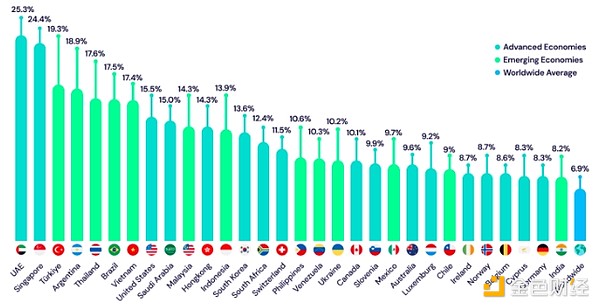

In Asia, Singapore is becoming the next crypto hub with its “risk-adjusted” regulation, which has helped the country double the number of digital asset licenses issued annually by 2024.

Singapore is home to 1,600 blockchain patents, 2,433 industry-related jobs, and 81 cryptocurrency exchanges. These are impressive numbers for a country with a population of less than 6 million.

Jonathan Levin, CEO of Chainalysis, said these global regulatory developments will usher in greater adoption from both retail and institutional investors.

“We can expect to see increased adoption from both institutional and retail investors next year, especially as these regulations bring greater transparency to the industry,” Levin said.

These new regulations will also enhance industry trust, market integrity, and consumer protection, “which will make the industry more attractive to retail investors,” he added.

Levin said regulatory transparency will drive the number of daily cryptocurrency users to record highs and spur growth in institutional products such as exchange-traded funds (ETFs).

According to Triple-A’s 2024 Crypto Ownership Report, there were an estimated 560 million cryptocurrency holders as of July 12, representing 6.8% of the global population.

There are 560 million cryptocurrency holders in countries around the world. Source: triple-a

Pavlo Denysiuk, CEO of crypto payment company Lunu, said that based on the current user growth, the number of cryptocurrency holders may triple in the next two years.

“That’s where we’re going to get more adoption everywhere and in payments,” Denysiuk said during a panel discussion at NFT Fest 2024.

ETFs and government BTC reserve programs will drive institutional adoption

U.S. spot Bitcoin exchange-traded funds have already led to more institutional adoption by making BTC investments more accessible to traditional financial institutions.

Bitcoin ETFs are approaching the $110 billion mark less than a year after their launch, supporting analysts’ predictions of a $200,000 peak in the Bitcoin cycle in 2025.

Chainalysis CEO Levin said this dynamic will pave the way for increasing institutional acceptance of Bitcoin as an asset class:

"This is likely to translate into continued institutional interest and efforts by financial institutions and cryptocurrency businesses to build the infrastructure and resiliency needed to support investor demand."

As an important sign of Bitcoin's popularity, Bitcoin's status as a savings technology is growing in the United States, thanks to the Bitcoin Act championed by Wyoming Senator Cynthia Lummis, which proposes the establishment of a strategic Bitcoin reserve.

Lummis Bitcoin Act. Source: Lummis.senate.gov

Fideum co-founder and CEO Anastasija Plotnikova said the Bitcoin Reserve proposal is gaining momentum due to U.S. President-elect Donald Trump’s victory in the November 2024 election and the Republican majority in the Senate.

Blockstream co-founder and CEO Adam Back, inventor of Hashcash and one of the industry’s most renowned cryptographers, said that if the Bitcoin Act is accepted by U.S. lawmakers, the price of Bitcoin could eventually exceed $1 million.

Cryptocurrency adoption in low-income countries is expected to continue to grow

According to Chainalysis’s Crypto Geography Report released in October 2024, cryptocurrency activity increased in 2024 and peaked at the high point of the 2021 bull run.

The Chainalysis Global Index, which measures the total value of global crypto activity, rose to a new high above 0.75 in the first quarter of 2024, the report said.

Global index measuring the global value of crypto activity. Source: Chainalysis

The report added that while cryptocurrency adoption in 2023 was driven primarily by low- and middle-income countries, the 2024 high was attributed to increased crypto activity in countries of all income levels, while high-income countries saw a decline in crypto activity in early 2024.

Levin noted that the increase in global activity is largely attributed to the growing real-world use cases for stablecoins and the debut of a Bitcoin ETF in the United States:

“There are a number of factors driving this trend, from the launch of a Bitcoin ETF in the United States to stablecoins supporting real-world use cases in low-income and lower-middle-income countries, and a significant increase in DeFi activity in Sub-Saharan Africa, Latin America, and Eastern Europe.”

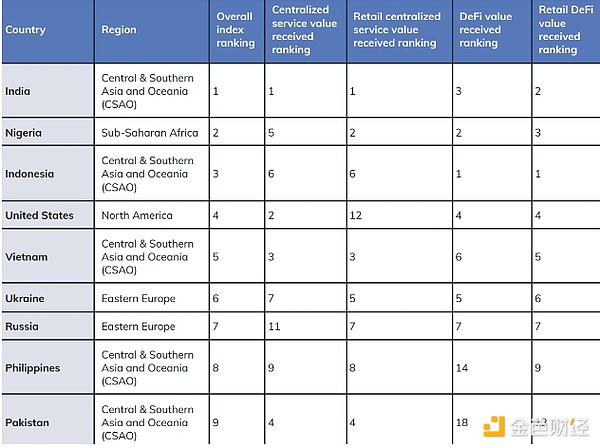

Global Cryptocurrency Adoption Index 2024. Source: Chainalysis

Low-middle-income countries such as India, Nigeria, and Indonesia lead the way in adoption, with India ranking first in the Chainalysis Global Cryptocurrency Adoption Index.

In Latin America, El Salvador has adopted Bitcoin as its legal tender on September 7, 2021, which has brought the country more than $31 million in profits in the first three years.

Despite the $31 million profit, President Nayib Bukele’s decision was widely criticized after Bitcoin fell from its all-time high of $69,000 in November 2021 following the collapse of the FTX exchange. Bitcoin holdings in El Salvador fell sharply after Bitcoin fell to $16,000 during the bear market.

Author and intergovernmental blockchain expert Anndy Lian said El Salvador’s decision to adopt Bitcoin is an important step in Bitcoin’s increasing integration into the global financial system.

Lian said similar government initiatives could boost bitcoin adoption in other countries:

“As more countries consider this path, we may see a gradual redefinition of ‘safe’ reserve assets. If bitcoin becomes the primary currency for national reserves, it could fundamentally change the global financial landscape, promoting a more decentralized and digital approach to economic stability.”

BTC and gold, 1-year chart. Source: Cointelegraph/TradingView

Bitcoin could even become the next reserve asset after gold. Over the past year, Bitcoin has risen more than 131%, while gold has risen about 30%, TradingView data shows.

Optimism remains high among crypto investors for 2025, especially after Bitcoin recaptured $100,000 on January 6, two weeks before Donald Trump’s January 20 inauguration — seen as a potential catalyst for cryptocurrency prices due to greater regulatory clarity.

Bitcoin’s 2025 rally is expected to attract more investor attention to the cryptocurrency sector, with price predictions ranging from $160,000 to more than $180,000.

Hui Xin

Hui Xin

Hui Xin

Hui Xin Kikyo

Kikyo Jixu

Jixu Jasper

Jasper Joy

Joy Jixu

Jixu Aaron

Aaron Catherine

Catherine Hui Xin

Hui Xin Aaron

Aaron