Source: C Labs Crypto Observation

Three years ago, you entered Ethereum with more than 4,000 U

Then uninstalled the exchange

Worked diligently and lived seriously

You firmly believed in the future of encryption

These two days, I heard that Bitcoin has exceeded 90,000

I also heard that Ethereum has gone crazy

I couldn’t stop the tears flowing, you finally came back

Under the attention of the whole family, I opened the exchange

Looking at more than 3,000 Ethereum, I suddenly felt a little overwhelmed

Why is this happening? Why can’t Ethereum stand up?

In fact, from the perspective of currency price, Ethereum, which has been priced in Bitcoin, has maintained a stable downward trend:

Anyway, there are many different opinions, so what happened to Ethereum?

Today, Da Piaoliang will talk to you about what happened to Ethereum from the perspective of the rise and fall of dynasties.

Why use dynasties as a metaphor instead of commercial companies?

Because the survival of commercial companies is mainly supported by cash flow, which is either earned through business or VC investment.

Ethereum does not have this pressure. As the most complete crypto project at present, it is more like a regime.

A regime has many ways to survive. It can do business to earn cash flow, collect taxes like gas fees, and issue various new assets in the ecosystem.

At its peak, the Ethereum ecosystem was almost a must-have for all crypto projects. It is not an exaggeration to say that it is the Ethereum Dynasty.

And there are only three reasons for the death of dynasties in history:

Official rebellion, civil rebellion, and foreign invasion.

If we apply our Chinese history, about 40% of dynasties died from official rebellion, 40% died from civil rebellion, and 20% died from foreign invasion.

Official rebellion: Central governance is aging, and the princes are too powerful to be eliminated

Let's take a look at official rebellion first.

There are two forms of official rebellion. One is the internal division of the central government. For example, Wang Mang's usurpation of power in the Han Dynasty and Zhao Kuangyin's Chenqiao Mutiny in the Song Dynasty are both official rebellions.

In fact, the Ethereum central government has split many times.

Several of the early co-founders of Ethereum publicly rebelled

For example, Charles Hoskinson created the Pos public chain Cardano, and Gavin Wood launched Polkadot.

And both chains are known as Ethereum killers.

It’s just that the Zhou emperor was prosperous and had many supporters, so these early rebels hardly achieved anything.

The most successful official change in our crypto circle is Binance. CZ and Yijie, who were core members of OKX Central, left and now make Binance the first in the universe.

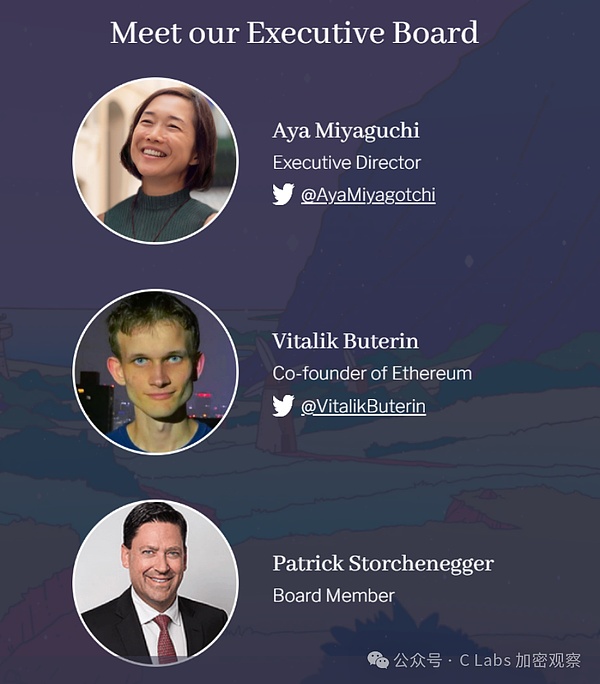

Before analyzing the situation of Ethereum Central, let’s take a look at the structure of Ethereum Central. The following are the three dukes and six ministers of Ethereum:

Many people think that Vitalik is the emperor of Ethereum, but he is not. As a decentralized organization, Ethereum does not have an emperor. It can be considered a dynasty with a constitutional monarch.

V God is currently ranked second among the three officials. From the perspective of his daily work, V God is more like a censor, who can influence public opinion.

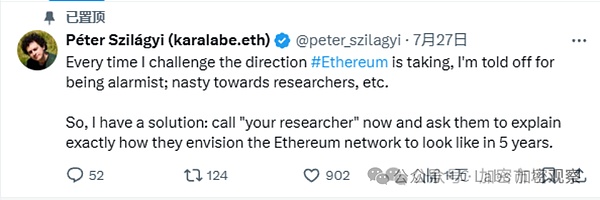

There are also some who openly disagree with V God among the six officials:

Developer Peter directly complained on Twitter that the Ethereum route is not clear

In fact, it is not a big deal to argue with others, but the most common complaint about the foundation is that they suspect that these people are eating from the inside and lining their own pockets.

For example, two of the six ministers, Justin Drake and Dankrad Feist, have disclosed that they have become consultants for EigenLayer and will receive EIGEN tokens as compensation that "may exceed the total wealth of their current wealth". In the eyes of the community, this "want both" behavior is really ugly, and some people even joked that EF researchers "are 're-staking' themselves."

Although it is mentioned above that the two researchers resigned as consultants of EigenLayer some time ago, it is obvious that the Ethereum Foundation has been ambushed by various hunting capitals, either entrusting them with consulting positions or directly sponsoring the personal research of researchers, and these foundation members themselves do not seem to be disgusted with this.

Of course, the most hunted is Vitalik, who has the greatest personal influence.

In the eyes of the market, Vitalik is the orthodoxy. As long as it is related to Vitalik, the market will recognize it. This recognition extends to all aspects of the ecosystem.

The most classic case is Scroll. During the period when the L2 narrative was popular, it rose from an inconspicuous "Chinese dog" to a mainstream L2 worth $1 billion such as Starktnet and z kSync. The reason for this is that an email written by the founder to EF received a reply from Vitalik.

It is precisely because the Ethereum Central Foundation has been hunted for a long time. Since you can make money lying down, why stand up?

What Ethereum really fears is the rebellion of the princes.

The current relationship between the Ethereum mainnet and L2 is actually very similar to the relationship between the Tang Dynasty and various Jiedushi, rather than the Spring and Autumn Period and the Warring States Period.

Because the various princes of the Spring and Autumn Period and the Warring States Period were fighting each other, there was no external pressure.

The Jiedushi in the middle and late Tang Dynasty was mainly to guard against foreign enemies.

And Ethereum vigorously promoted L2 in the past two years, which was also to defend against attacks from various performance chains, and it successfully disintegrated many performance chain ecosystems known as Ethereum killers.

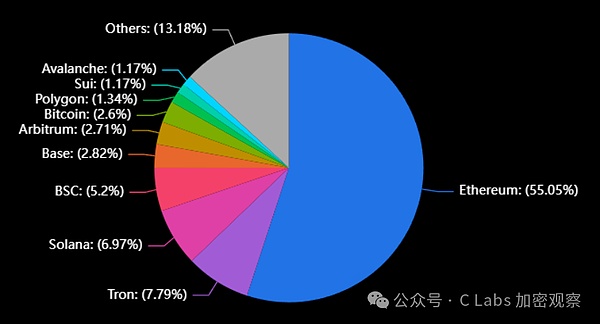

The current situation is: the Ethereum mainnet accounts for about 55% of the assets of various public chains, which can still be regarded as a majority position.

But Tron/Solana/BSC behind are no longer Ethereum's L2.

At this time, there are two options for Ethereum Central:

One is to expand and strengthen the main chain. The Song Dynasty chose this path when it fought against Liao, Jin and Mongolia.

The second path is to let L2 compete with other public chains. This is the path that the Tang Dynasty chose when it faced the Turks, and when Empress Dowager Cixi later suppressed the Taiping Heavenly Kingdom.

According to the roadmap released by Ethereum, facing an aggressive opponent like Solana, improving the performance of the main chain may be powerless, and the only way is to let L2 continue to roll up performance.

We will talk about the competition with other public chains such as Solana later, let's first look at the situation of L2 on Ethereum.

From the data, there are only two chains that can really help Ethereum resist foreign enemies: Base and Arbitrum.

This is actually very similar to the situation in the middle of the Tang Dynasty. There are mainly two groups that can fight: An Lushan in the east and Geshu Han in the west.

Moreover, each of these two L2s has its own calculations. Arbitrum blatantly develops Layer3 and even accepts USDC as gas fee, which shows that it wants to be the emperor itself; and the strategic choice of Base chain must give priority to the interests of Coinbase.

BNB was first issued on Ethereum in 2017, but Binance chose to rebel and build its own Binance Chain. It has to be said that Binance is really full of rebelliousness. It caused internal divisions in the central government in OKX and rebellions among the princes in Ethereum.

Most other L2 projects, let alone defending the central status of Ethereum, are almost all positioned to steal the wool and pry the wall.

On the one hand, these L2s raised a lot of funds from VCs, and on the other hand, they used airdrops as bait to attract a large number of users' Ethereum tokens.

As the saying goes, the front is tight, and the back is tight, which probably refers to these Layer2.

A lot of funds and development have been invested in a lot of ineffective duplicate infrastructure, so much so that V God also announced in the second half of this year that he would no longer support new L2 projects. After the airdrop of various Layer2s listed this year, the assets and users on the chain basically ran away.

Foreign invasion: other public chains are strong, and consensus is decentralized

After talking about the various lords of Ethereum, let's take a look at the foreign enemies faced by Ethereum.

The biggest worry of Ethereum now is Solana

In the past, several major innovations of CRPIO, including ICO in 2017, Defi Summer in 2020, Gamefi and NFT in 2021-22, all occurred on Ethereum, and on the Ethereum mainnet.

And the original market narrative, whether it is meme, AI/payment, etc., many projects have chosen Solana or other high-performance chains.

Specifically speaking, Solana and Base are competing in the AI and meme track.

Solana has directly created the new AI Meme track, which has also received explicit support from A16Z.

Base has previously completed the first AI-to-AI payment in history, and recently launched a new set of fully on-chain AI agents that can create an Al Agent with a built-in encrypted wallet in 3 minutes.

In the payment track, Ton is eyeing the market with Telegram approaching 1 billion users, and is definitely a small role that Ethereum cannot ignore.

And relying on the fission of Telegram this year, Ton has taken away a lot of market share from GameFi.

If three years ago, Ethereum could represent the development direction of innovation in encrypted applications.

But now, I believe that this consensus has been basically dispersed, and no one should be sure that the large-scale landing of encrypted applications will definitely happen in the Ethereum ecosystem.

At least Solana and Ton still have great opportunities.

Civil uprising: The industry has entered a period of disillusionment, and the landing scenarios are limited

The recent weakness of Ethereum's currency price, in addition to the internal and external troubles mentioned above, there is also the possibility that Ethereum's supporters may change their minds.

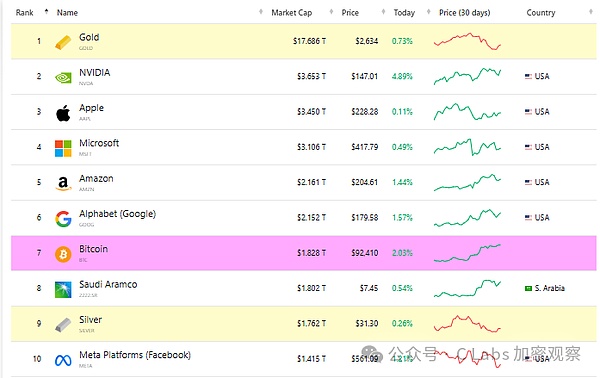

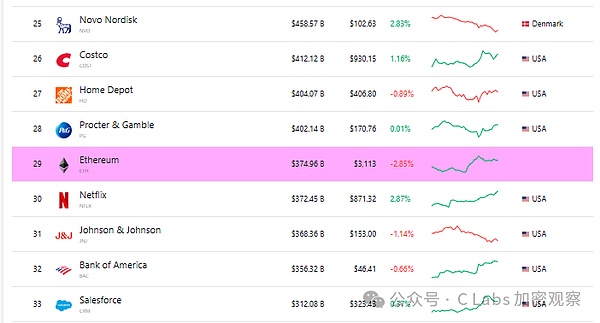

It has been nearly ten years since the release of Ethereum's main network, and the total market value has reached 300 billion US dollars, which is a behemoth among all kinds of assets in the world.

The largest asset in the world is gold, 18 trillion US dollars

Bitcoin now ranks higher than silver, 1.8 trillion, ranking seventh, ten times behind gold.

The market value of Ethereum ranks 29th in the world, which is not a low ranking. It is ahead of Procter & Gamble and Costco Bank, and behind it are Netflix and Bank of America.

There is a saying in the financial industry that after an asset reaches a market value of 300 billion US dollars, it is difficult to increase its valuation. To go up, it must rely on performance, and it is difficult for the original supporters to continue to maintain it.

Now Bitcoin is still advancing rapidly, but Ethereum is not strong enough. If this continues, Ethereum, which is denominated in Bitcoin, may reach 0.02 by this time next year.

Why is this?

There may be three types of Ethereum supporters.

The first category is miners. When Ethereum was still in the POW mode, there were many miners who supported Ethereum. Later, when Ethereum changed from POW to POS, the miners were completely offended.

The second category is various on-chain users. These users contribute most of the gas fees of the Ethereum ecosystem and can be said to be the real breadwinners. However, in the absence of landing application scenarios on the chain, there are almost only two things to do on the chain: hype memes and play with money.

In this round of meme wars, many users switched to solana; and the party that played with money was even more heartbroken. From zksync to scroll, the key projects of the Ethereum ecosystem acted like a dead pig that was not afraid of boiling water, and forced users to go to the ton chain to play with money in the game.

The third category is Ethereum investors. There are also some stubborn people who support Ethereum for a long time.

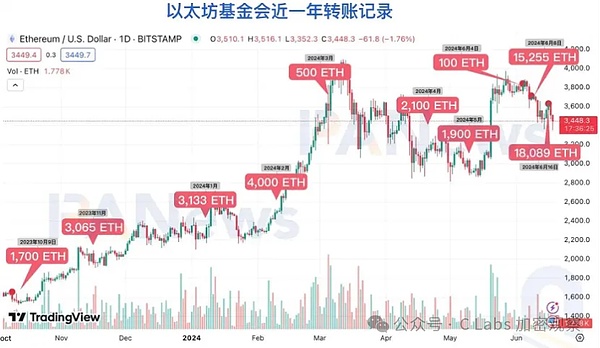

But what's interesting is that the Ethereum Foundation can always sell coins accurately when the price trend is good:

Especially the two sales in 2021, one was selling 35,000 Ethereum at $3,533.3 two days before 519;

The other was selling 20,000 Ethereum at $4,677.6 at Ethereum's historical high.

These two precise escapes established the reputation of the Ethereum Foundation as a signal of market crash.

In the past year, the Ethereum Foundation has made frequent moves, almost every month.

After such a wave of operations, it can almost be said that many investors have cooled down.

At the same time, if you look at Bitcoin, not only do miners continue to support it, but many big miners can also go public on Nasdaq to raise funds for computing power.

With the development of the Bitcoin ecosystem this year, there are also meme players and money-grabbing parties on the Bitcoin chain, and they have even contributed about 10% of the miners' income.

On the investor side, not only is there no so-called foundation selling coins, but also because the narrative of value storage continues to gain recognition from the mainstream market, maybe the United States will list Bitcoin as a federal reserve asset at some point.

It can be said that Bitcoin has more and more supporters, while Ethereum has fewer and fewer supporters.

Summary of the problem

Speaking of this, Da Piaoliang summarizes:

First of all, there are internal worries. The Ethereum Foundation is actually a bit strange now. It is almost hunted by capital. The members of the foundation have made a lot of money, but the foundation has to sell coins from time to time to maintain operations.

In addition, there is the development strategy of layer2. From the current situation, the only layer2 that Ethereum can compete with is Arbitrum and Base chain, and most of the other layer2s are lagging behind.

If this situation continues for a long time, as long as one of Arbitrum and Base rebels, the Ethereum ecosystem will exist in name only.

Against this background, Ethereum's external worries are also very serious.

In history, every crypto bull market has exploded in the Ethereum ecosystem, and almost 90% of VC investment is invested in projects in the Ethereum ecosystem.

But this year it is very likely to happen in Solana and Ton, and many VC investments have been dispersed to Solana and Ton ecosystems.

Since 2022, Ethereum has offended miners first, and this year it has offended the Mao Party. Under the sluggish price of the currency, the Ethereum Foundation is still selling the currency, and it seems that all investors will be offended.

It has to be said that this situation is really difficult to clean up.

It is generally difficult to reverse the situation at the end of a dynasty.

What can be done?

I will give you a random suggestion here~

For example, should the members of the Ethereum Foundation give part of the money they earn as consultants to the foundation? Because people originally came to you for your identity

Maybe in this way, the Ethereum Foundation will not only not have to sell coins, but also have extra profits to buy back Ethereum, right?

In the crypto circle outside, there are no contradictions that cannot be solved by pulling up the market. If there are, it is because the pull is not enough; if the pull is good, maybe Ethereum will usher in a revival like the Tongzhi period of the Qing Dynasty~

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance JinseFinance

JinseFinance Bankless

Bankless Coindesk

Coindesk Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph