Author: Lucas Tcheyan, Research Assistant at Galaxy Digital; Translator: Jinse Finance xiaozou

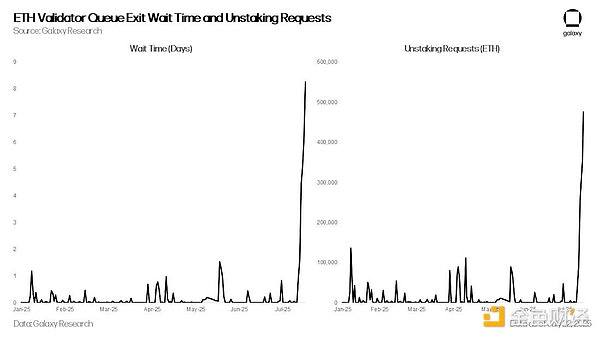

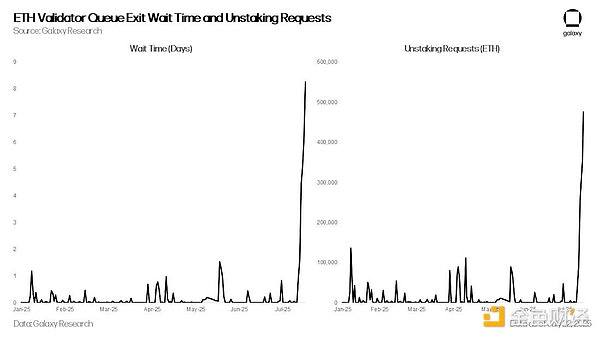

Since July 16, ETH unstacking requests have increased dramatically, with validator exit requests soaring from 1,920 to more than 475,000 on July 22, and waiting times extending from less than an hour to more than eight days. While ETH's recent strong price performance and the adjustment of validator staking requirements by the ETH Pectra upgrade are expected to bring an increase in unstacking activity, the surge was mainly driven by the surge in ETH lending rates that began on July 16. The surge in interest rates triggered widespread unwinding of ETH circular strategies, which in turn exacerbated the depegging pressure on ETH-based liquidity staking and re-staking tokens (LSTs and LRTs).

1. Ethereum Staking Queue

Ethereum's staking exit queue is a built-in mechanism designed to manage the orderly withdrawal of staked funds from the network by validators. In order to maintain network stability and prevent large-scale validator exits from jeopardizing consensus, Ethereum limits the number of validators that can exit during each epoch. This limit is called the "churn limit", and its size is related to the total number of active validators, allowing approximately 8 to 10 validators to exit per epoch (about 6.4 minutes). When validators initiate a voluntary exit, they enter the queue and wait for processing. After exiting, funds are subject to a mandatory delay (about 27 hours) before they can be withdrawn. During periods of high demand for exits, queues can backlog up significantly, leading to waiting times of days or even weeks.

This week is not the first time Ethereum has experienced a backlog in unstaking. In January 2024, the bankrupt crypto lending platform Celsius needed to withdraw 550,000 ETH during its reorganization, and the waiting time at that time reached six days.

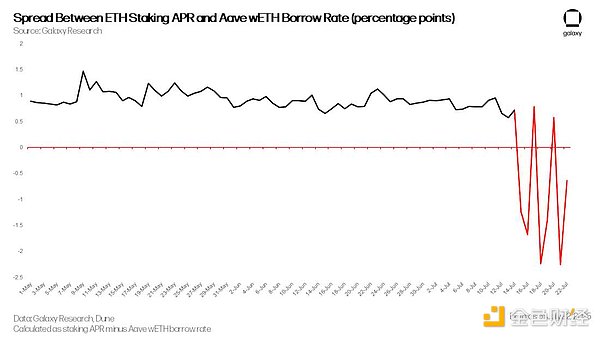

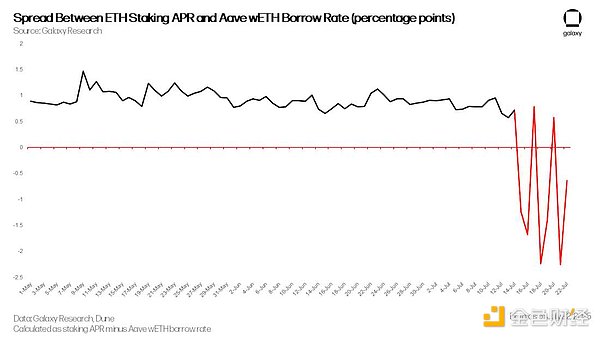

2. ETH Logging Strategy Liquidation Wave: Soaring Borrowing Rates Trigger a Chain Reaction

Since July 14, ETH lending rates in the Aave decentralized finance protocol have begun to surge periodically. Although lending rates usually remain in the 2% to 3% range, they soared to a high of 18% on July 16, 18, and 21. This dramatic fluctuation stems from the massive withdrawal of HTX exchange-related wallets, which has led to a sharp drop in the supply of ETH on the Aave platform. The wallet has withdrawn more than 167,000 ETH since June 18. The sudden reduction in available deposits has put pressure on users running ETH loop strategies on Aave, which is also part of the reason for the surge in unstacking requests.

The looping strategy is a widely used ETH staking yield amplification strategy by crypto traders. Its standard operating procedure is: users deposit Liquidity Staking Tokens (LST) or Liquidity Re-staking Tokens (LRT) as collateral on platforms such as Aave, borrow ETH and redeem it for more LST and re-deposit it, and establish a leveraged position through repeated operations. When the staking yield exceeds the ETH lending rate, users can earn a profit by earning the spread. This strategy can be operated manually or through automated vaults provided by protocols such as EtherFi and Instadapp.

However, with the tightening of ETH supply starting on July 16, the spread between staking yield and borrowing cost turned negative. As of July 21, the spread fell to as low as -2.25%, making the revolving strategy unprofitable. This triggered a massive liquidation wave, with users starting to withdraw deposited ETH, repay loans, and gradually reduce leverage. Since most traders use LST/LRT as collateral, they need to exchange these assets back to ETH or unstake them, which puts additional pressure on the LST/LRT secondary market and the Ethereum validator exit queue.

However, with the tightening of ETH supply starting on July 16, the spread between staking yield and borrowing cost turned negative. As of July 21, the spread fell to as low as -2.25%, making the revolving strategy unprofitable. This triggered a massive liquidation wave, with users starting to withdraw deposited ETH, repay loans, and gradually reduce leverage. Since most traders use LST/LRT as collateral, they need to exchange these assets back to ETH or unstake them, which puts additional pressure on the LST/LRT secondary market and the Ethereum validator exit queue.

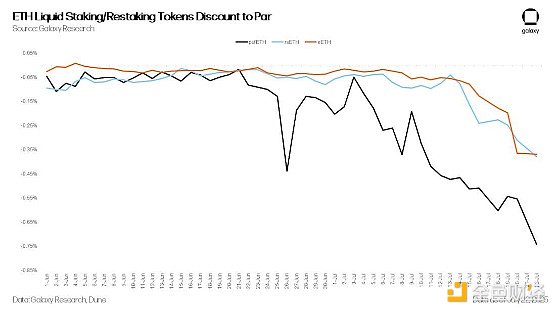

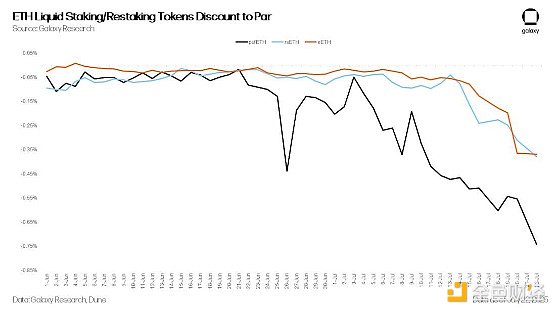

As lending rates climb, the decoupling of LST and LRT from ETH has further intensified. Typically, LST/LRT will maintain a small discount to ETH to compensate for redemption delays caused by the Ethereum exit queue, DEX liquidity restrictions, and protocol-specific risks (such as fines or smart contract risks). During forced deleveraging or redemption, this selling pressure will push the LST/LRT price further below par. In addition, automated revolving strategy vaults respond to market fluctuations in different ways - some choose to unstake, while others sell directly in the secondary market. For example, as of now, EtherFi's liquidity strategy still has about 20,000 ETH in the Ethereum exit queue.

As lending rates climb, the decoupling of LST and LRT from ETH has further intensified. Typically, LST/LRT will maintain a small discount to ETH to compensate for redemption delays caused by the Ethereum exit queue, DEX liquidity restrictions, and protocol-specific risks (such as fines or smart contract risks). During forced deleveraging or redemption, this selling pressure will push the LST/LRT price further below par. In addition, automated revolving strategy vaults respond to market fluctuations in different ways - some choose to unstake, while others sell directly in the secondary market. For example, as of now, EtherFi's liquidity strategy still has about 20,000 ETH in the Ethereum exit queue.

Another factor exacerbating queue congestion is that some market participants have begun to arbitrage the unpegging phenomenon of LST/LRT. By purchasing LST/LRT at a discount in the secondary market and then unstaking and redeeming the full ETH value, they can earn the difference between the two. This behavior further increases the number of ETH queue exit requests.

3. New staking demand surges simultaneously

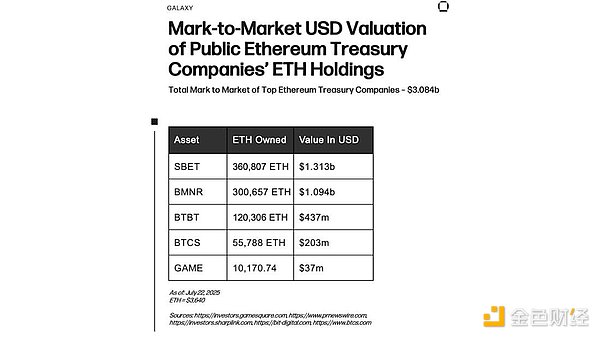

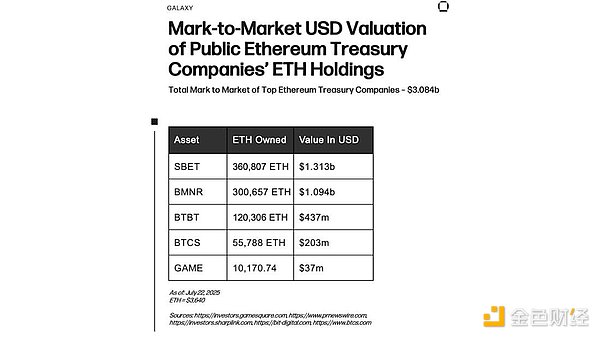

Offsetting the surge in unstaking requests is the significant increase in new staking demand. Since June, ETH staking applications and validator admission requests have climbed to their highest level since April 2024. This is mainly driven by two aspects: first, the excellent performance of ETH assets compared with Bitcoin has rekindled market enthusiasm; second, a number of digital asset treasury companies (DATCOs) have recently purchased more than US$2.5 billion in ETH.

4. Outlook

While headlines about ETH unstaked may have initially suggested a wave of profit-taking, a closer look reveals that much of the activity is actually driven by turmoil in the ETH lending market and a surge in lending rates starting on July 16. This view is supported by the continued strong demand for new staking, which almost offsets the current scale of withdrawals.

Despite the surge in demand, ETH's staking architecture is still operating as expected. While some may complain about the significant increase in waiting times, this is precisely a design feature of the network rather than a defect. The goal is to limit the rate at which validators can enter or exit, thereby protecting the stability and security of Ethereum's Proof of Stake (PoS) consensus mechanism.

However, this incident highlights the continued fragility of the ETH liquidity staking and re-staking ecosystem. These assets remain highly sensitive to leveraged strategies and are easily stressed under extreme market conditions. The widespread impact of LST/LRT depegging and redemption delays further highlights the importance of considering duration risk and liquidity bottlenecks.

Looking forward, protocols that rely entirely on Ethereum's native exit mechanism may face closer scrutiny. We expect the market to pay more attention to solutions that increase redemption flexibility - such as peer-to-peer exit markets, optimized LST/LRT automated market makers (AMMs), and protocol-native liquidity vaults specifically designed to ease exit queue congestion and smooth the flow of funds.

Catherine

Catherine

However, with the tightening of ETH supply starting on July 16, the spread between staking yield and borrowing cost turned negative. As of July 21, the spread fell to as low as -2.25%, making the revolving strategy unprofitable. This triggered a massive liquidation wave, with users starting to withdraw deposited ETH, repay loans, and gradually reduce leverage. Since most traders use LST/LRT as collateral, they need to exchange these assets back to ETH or unstake them, which puts additional pressure on the LST/LRT secondary market and the Ethereum validator exit queue.

However, with the tightening of ETH supply starting on July 16, the spread between staking yield and borrowing cost turned negative. As of July 21, the spread fell to as low as -2.25%, making the revolving strategy unprofitable. This triggered a massive liquidation wave, with users starting to withdraw deposited ETH, repay loans, and gradually reduce leverage. Since most traders use LST/LRT as collateral, they need to exchange these assets back to ETH or unstake them, which puts additional pressure on the LST/LRT secondary market and the Ethereum validator exit queue.  As lending rates climb, the decoupling of LST and LRT from ETH has further intensified. Typically, LST/LRT will maintain a small discount to ETH to compensate for redemption delays caused by the Ethereum exit queue, DEX liquidity restrictions, and protocol-specific risks (such as fines or smart contract risks). During forced deleveraging or redemption, this selling pressure will push the LST/LRT price further below par. In addition, automated revolving strategy vaults respond to market fluctuations in different ways - some choose to unstake, while others sell directly in the secondary market. For example, as of now, EtherFi's liquidity strategy still has about 20,000 ETH in the Ethereum exit queue.

As lending rates climb, the decoupling of LST and LRT from ETH has further intensified. Typically, LST/LRT will maintain a small discount to ETH to compensate for redemption delays caused by the Ethereum exit queue, DEX liquidity restrictions, and protocol-specific risks (such as fines or smart contract risks). During forced deleveraging or redemption, this selling pressure will push the LST/LRT price further below par. In addition, automated revolving strategy vaults respond to market fluctuations in different ways - some choose to unstake, while others sell directly in the secondary market. For example, as of now, EtherFi's liquidity strategy still has about 20,000 ETH in the Ethereum exit queue.