Author: ignasdefi Translation: Shan Ouba, Golden Finance

I bet you have spent countless hours trying to figure out the next hot crypto narrative. If you are right, you can make a lot of money; but if you enter the market too late, you can only be a receiver.

The best investment returns come from:

Identifying narratives early

Planning the path of capital rotation before others

Exiting when market expectations are most inflated

Locking in profits

Then ask yourself: Is another narrative coming?Narratives come and go, but speculative money returns in waves, provided that:

• There is real technical innovation behind the narrative that can come back even after the first wave of hype;

• There is a new catalyst;

• There is a committed community that continues to build after the hype has faded.

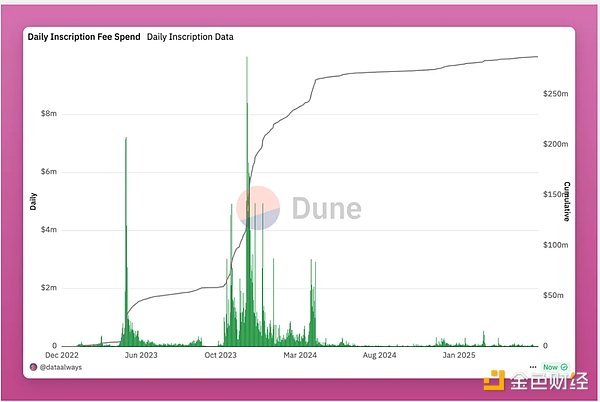

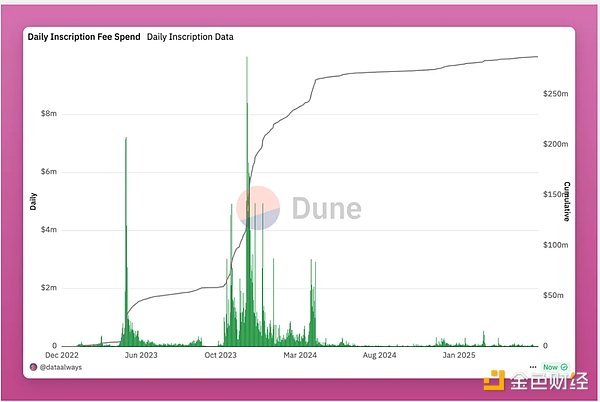

Ordinals on Bitcoin is an example. You can clearly see the four waves of speculation in the figure below.

December 2022: Ordinals theory is first released, with almost no activity on the chain.

March 2023: BRC-20 standard triggers the first wave, which gradually cools down in the next six months.

Late 2023 / early 2024: Continued development stimulates the second and third waves.

April 2024: Runes goes online and quickly rises, but the heat fades within a few weeks.

Ordinals gave several months of layout time and provided multiple exit opportunities. Runes only provided a short exit window. It's been over a year since it was announced. Will Ordinals (including Runes), NFTs, or some new format come back?

Maybe. Depends on their narrative score.

Formula

This is a formula for identifying emerging hot narratives and determining whether they are likely to spark subsequent speculative waves (and such waves tend to be more sustainable).

It’s still a work in progress, but here’s my current V1 formula:

Narrative Score = [(1.5 × Innovation × Simplicity) + (1.5 × Community × Simplicity) + (Liquidity × Token Economics) + Incentives] × Market Environment

It’s not mathematically elegant, but it makes it clear which levers are important and how much weight each has.

Let’s break it down:

Innovation

This is the technical level, native crypto innovation that I’m focusing on.

The strongest catalyst is the kind of “zero to one” innovation. This could be in a new field (like DeFi, NFT, RWA), a new token economic model (like veToken), or even a new way of issuing tokens (like fair issuance, Pump.fun).

I have written before: innovation from "zero to one" is unique enough to change the trajectory of the industry. Its originality can ignite a new crypto subfield. But it is difficult to identify such innovations because we always look at new things with prejudice.

When something new first appears, it may not attract attention at all (such as Ordinals) or even be considered noise. This is why keeping an open mind and daring to try every new trend (especially those controversial ones) is the key to preemptive layout.

Without real technological innovation, a narrative is just a short-lived speculative bubble. There is also a special feature of this cycle: the introduction of external innovation-AI.

Thanks to AI, we are seeing innovations like Kaito InfoFi and AI agents.

Some examples of this cycle:

Ordinals

Re-pledge

AI agents

InfoFi

SocialFi

ERC404

The purpose is not to list all examples, but to build a mental model to help you identify these innovations. You can use a score of 0 to 10 to measure the degree of innovation.

Simplicity & Memetic Potential

Not all innovations are easy to understand. Complex narratives (e.g. ZK proofs, restaking) spread slowly, while simple or memetic narratives (e.g. Dogecoin $WIF wearing a hat) spread quickly.

Can you explain this concept in 5 seconds? Does it have meme points?

Some examples:

Simplicity High (10/10) : AI, memecoin, XRP as a blockchain bank

Medium (5/10) : SocialFi, DeFi, NFTs, Ordinals

Low (3/10) : ZK proofs, modular blockchains, re-staking

Complex narratives take time to ferment and are slower to pull up. Simplicity also strengthens the cohesion of the community.

Community

Bitcoin is the purest "from zero to one" innovation. But without a community, it's just a piece of code. The value of BTC comes from the story we build for it.

Many people don't understand why projects like Cardano or XRP can perform well without innovation. The reason is: hardcore community.

Another more extreme example: memecoin.

They have almost no technical innovation, but memecoin has become a $66 billion track. This is all thanks to a group of people who decided to unite around a token.

The question is, how do you measure the size and strength of a community? Is it the number of followers on X (original Twitter)? The attention on X? Or the number of fans and posts on Reddit?

Some communities are hard to identify because they speak different languages or are active in different forums, such as Koreans who like to discuss XRP on local forums.

"Mindshare" is a great metric (popularized by Kaito), but Loudio's experiment also shows that just having a lot of mindshare doesn't mean you have a real community.

To identify a true community (especially in the early days), you need to be there. Buy a few tokens or NFTs, join a Discord or Telegram group, and see who is talking about X (not the paid posting kind). If you feel a real sense of belonging and connection, that's a strong positive sign.

In my opinion, Hyperliquid is the fastest growing community.

Binance and OKX's attack on HYPE has made us more united and given a sense of mission and purpose to supporting the team and the protocol. Hyperliquid is no longer just a project, it has become a movement.

I think innovation and community are the two most critical factors, which is why I give them 1.5 times weight respectively.

Just like innovation, I also added the variable "simplicity" to the factor of "community". Because: the simpler the narrative, the easier it is to spread.

For example, Memecoins (such as PEPE) are very easy to understand; and even relatively complex projects like Hyperliquid have successfully stimulated community enthusiasm.

Both Runes and Ordinals have brought technical innovations, realizing the ability to "issue homogeneous tokens on Bitcoin" that was once thought to be impossible, and they also have strong community support. So why did the price still fall?

That’s because there’s a third key factor to consider:

Liquidity

Innovation ignites inspiration, communities build narratives and beliefs, and liquidity is what helps you “ride the waves and get off safely at the high point.”

This is the difference between whether you can “successfully ride a sustainable wave” and “be the last person standing to take over.”

Casey Rodarmor, the founder of Runes, has built a very creative homogenous token model. But maybe he should also build an AMM liquidity pool like Uniswap for Runes on Bitcoin to continue the market enthusiasm.

Currently, memecoins on Runes have difficulty competing with memecoins on Solana or L2 chains due to the lack of passive liquidity pool support. In fact, Runes trades more like NFTs on Magic Eden - although there is decent buy-side liquidity, there is not enough sell-side liquidity to complete large exits. The trading volume is too low, and there is no motivation for the first-level CEX to go online.

NFTs also face similar liquidity issues. So I had high hopes for the ERC404 model (for NFT shard trading) - it could have brought passive selling liquidity and transaction fee APY returns.

But unfortunately, it failed.

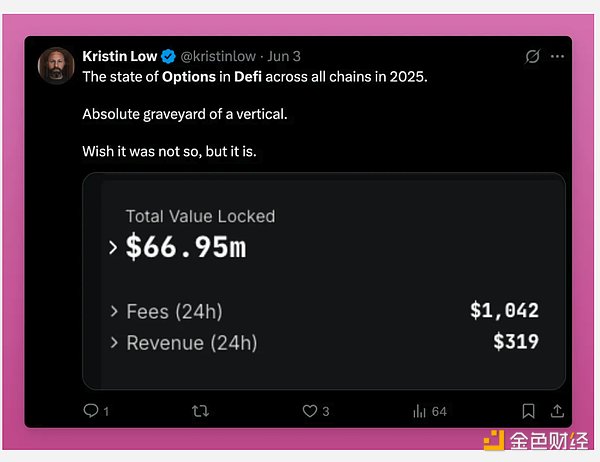

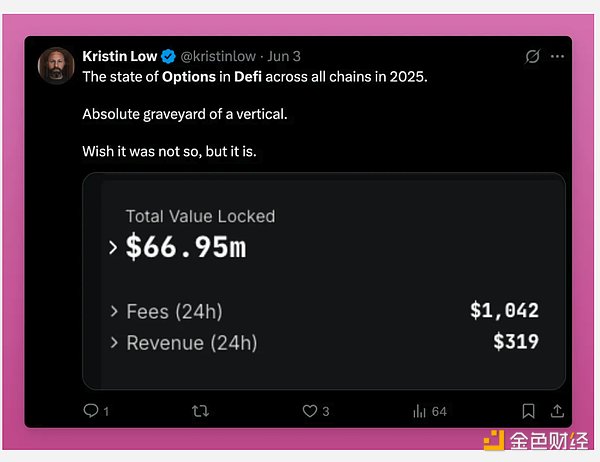

I think this is also one of the core reasons why DeFi options have not been able to rise in the past few years.

When the market was uncertain recently, I wanted to use options to hedge my portfolio, but the liquidity of on-chain options was very poor. I had high hopes for Derive, but its prospects are now unclear.

But the liquidity I want to emphasize is not just: having a large order book, a continuous inflow of new funds, a CEX listing, or a high TVL in the liquidity pool (although these are all important).

The "liquidity" I use in the formula refers to: protocols that can achieve exponential expansion after liquidity growth, or have native liquidity growth mechanisms.

Some examples include:

Hyperliquid: The higher the liquidity → the better the trading experience → attract more users → in turn promote liquidity improvement.

ve(3,3) model DEX, such as Velodrome: Bribery mechanism drives liquidity growth.

Olympus OHM: The protocol has liquidity (POL).

Virtuals DEX: New AI agent projects are directly bound to the native token VIRTUAL.

Token Economy

Token economics is as important as liquidity. A bad token economy will only lead to a crash. Even if liquidity is sufficient, the continued selling pressure from unlocking and releasing is extremely risky.

Advantages: high circulation, no large venture capital/team allocation, clear unlocking schedule, destruction (hype, well-designed fair launch), etc.

Disadvantages: hyperinflation, huge cliff unlocking, no income (L2).

Even a narrative with 10 points of innovation is a time bomb if the token economy is only 2 points.

Incentive Mechanism

Incentive mechanisms can make a protocol or destroy a narrative.

The concept of re-staking relies on Eigenlayer's performance. However, due to the failure of the token issuance (perhaps due to its complex narrative or insufficient community), this narrative was marginalized for a time.

It may be difficult to assess liquidity at the beginning of the narrative, but an innovative incentive mechanism can help liquidity be gradually established. I am particularly concerned about the "new token issuance model".

If you’ve read my previous posts, you’ll know that the market often changes due to new token issuance methods.

Historically we have seen:

BTC fork → Bitcoin Cash, Bitcoin Gold

ETH fork → ETC

ICO (Initial Coin Offering)

Liquidity Mining, Fair Launch, Low Circulation / High Valuation (Suitable for Airdrops, Not Conducive to the Secondary Market)

The recent trend is: Crypto Treasuries. Some listed companies have begun to buy BTC, ETH, and SOL, and these operations have made their stock prices outperform the actual value of the crypto assets they hold.

What is the incentive behind this phenomenon? It is very important to understand this, otherwise you can easily become someone else's buyer.

Market Environment

Even the best narratives, if born at the bottom of a bear market or during a period of macro risk aversion (such as the early US-China tariff war), will be drowned by the market. On the contrary, even ordinary narratives can soar in an accommodative bull market. This is the impact of the macro & regulatory tides. You can use the following multipliers to evaluate: 0.1 = Brutal bear market 0.5 = Shocking sideways 1.0 = Healthy bull market 2.0+ = Bull market, bubble period

Example: Runes (April 2024) has innovation, community, initial liquidity and partial incentives.

But it was launched at a time when the hype of BTC halving subsided and the market fell sharply (Market_Conditions ≈ 0.3).

Result: mediocre performance. If it had been launched three months earlier, the outcome might have been very different.

How to use this formula

Rate each factor from 1-10:

Innovation:From zero to one? (Ordinal: 9, Memecoin: 1-3)

Community:True believers or mercenaries? (Hyperliquid: 8, VC-chain: 3)

Liquidity: Deep market? (Fast tier 1 CEX listings: 9, Runes traded like NFTs: 2)

Incentives: Lucky and sticky? (Hyperliquid airdrops: 8, no incentives: 1)

Simple: Can it be a meme? ($WIF: 10, zkEVM: 3) Token Economics: Sustainable or Ponzi? ($BTC: 10, 90% premine: 2) Market Conditions: Bullish (2.0), Bearish (0.1), Neutral (0.5-1) Ratings are subjective! I gave Runes a 9 for innovation, but you might give it a 5. This formula is just a suggestion of what factors should be included.

Anyway, if we calculate the variables for Rune, it would be:

Innovation = 9 Community = 7 Liquidity = 3 Incentives = 3 Simplicity = 5 Token Economics = 5 Current Market Conditions = 0.5

Plugging in the numbers (thanks to chatGPT o3):

1.5 × Innovation × Simplicity = 1.5 × 9 × 5 = 67.5

1.5 × Community × Simplicity = 1.5 × 7 × 5 = 52.5

Liquidity × Token Economics = 3 × 5 = 15

Incentives = 3

Subtotal = 67.5 + 52.5 + 15 + 3 = 138

Applying Market Condition (0.5):

Rune Narrative Score = 138 × 0.5 = 69

Therefore, under this model, the Rune Score is 69.

In comparison, Memecoins' score will be higher, reaching 116 points, because my evaluation scores are more subjective:

Innovation = 3 (because Pumpfun adopted an innovative model to launch memecoin, it is not zero)

Community = 9

Liquidity = 9 (bound to AMM, high trading volume = high LP yield, CEX listing)

Summary

Early Scanning Narratives: Use tools such as Kaito and Dexuai to focus on "Innovation + Catalysts".

Rubly Scoring: Face the reality honestly. The token economy sucks? In a bear market? No incentive mechanism? These are all important. The market environment is changing all the time, and sometimes a native innovation (such as building an AMM for Runes) can revive the entire narrative.

Exit before incentives fade: Consider exiting when emissions peak or airdrops land.

Go with the flow: Don’t go against the macro environment. Save cash in a bear market and deploy in a bull market.

Keep an open mind: Try out the protocol, buy some popular tokens, join community chats…Learn from practice, not from fantasy.

Weatherly

Weatherly