We may not realize that the investment methods we have are about to become outdated. Why? Because the high threshold of the traditional financial market is limiting our investment potential. But BlackRock (BlackRock) is launching a financial revolution, and the core of this revolution is asset tokenization.

Do you feel that assets are difficult to flow freely, investment channels are limited, and are restricted by the high threshold and opaque traditional financial system? The asset tokenization that BlackRock focuses on can help you solve these problems. It provides you with unprecedented investment freedom through technological innovation.

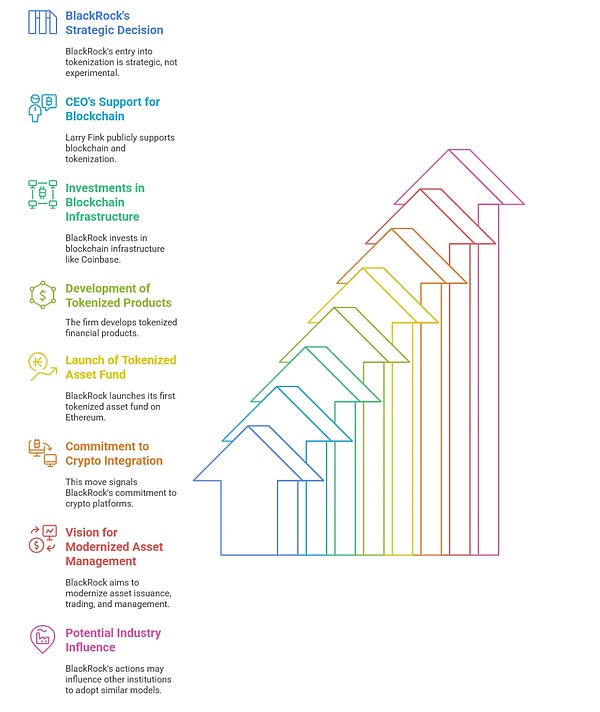

(Net picture BlackRock's asset tokenization strategy)

Why does BlackRock bet on asset tokenization?

1. BlackRock's asset tokenization strategy

BlackRock's comprehensive layout in the field of asset tokenization is not only due to the trend, but also stems from its clear strategic vision. CEO Larry Fink publicly and strongly supports tokenization, emphasizing thatTokenizationwill profoundly change the infrastructure of the financial world. As part of its strategic layout, BlackRock actively invests inCoinbaseand other leading blockchain infrastructure companies to consolidate its foundation in the field of digital assets.

In terms of financial products, BlackRock has launched Bitcoin spot ETF, and actively promoted the money market fund tokenization (BUIDL) project. In addition, it has also actively explored the field of US stock tokenization and plans to launch a dedicated stable currency USDB, further consolidating its leading position in the field of digital finance. BlackRock has always emphasized the full integration of cryptocurrency into the traditional financial management system, and its vision is to achieve full tokenization of asset issuance, trading and management. BlackRock's asset tokenization strategy embodies three core features: 1. Reconstruction of infrastructure: BlackRock invests in blockchain infrastructure and cooperates with Coinbase to launch institutional-grade crypto asset custody services, seamlessly connecting traditional asset management with real-time management of on-chain assets.

2, Global compliance layout: BlackRock has obtained crypto asset licenses in Europe and other relevant regions, and cooperated with Middle Eastern sovereign wealth funds to build a private equity investment platform, establish a global compliance network, and ensure the legality and global circulation of asset tokenization.

3, Scenario-based innovative products: By tokenizing traditional high-threshold private equity assets (such as government bonds, funds, infrastructure, etc.), breaking them down into digital tokens that are easier to trade, reaching the vast retail and pension account markets, and achieving true investment democratization.

2. Larry Fink'sCEO Larry Fink

More importantly, Larrypointed out that asset tokenization can build a more inclusive financial ecosystem, allowing ordinary investors to participate in high-value investment areas that were previously exclusive to institutions with a low threshold. At the same time, smart contract technology will also improve governance transparency. Larrycalled on the world to establish an efficient digital identity system to release a trillion-dollar potential market.

If we look at the other content in this letter, it is not difficult to see that BlackRock has a very clear understanding and strategic intention of Tokenization, which is all about tokenization and asset redistribution.

Third, the strategic layout from institutional hegemony to retail democratization

As an asset management giant that manages more than 10trillion US dollars in assets, BlackRock has always occupied the dominant position in the institutional market. But now, it hopes to achieve strategic transformation through tokenization technology and become a leader in the global retail market. Starting from the tens of billions of dollars of Bitcoin spotETF, to the10multi-billion dollar money market fund tokenizationBUIDL, and also with multipleDefiplatform docking, while actively promoting the tokenization of US stocks, and planning to issue at least one trillion dollars of BlackRock stablecoins based on the pledge of asset management productsUSDB. All of this is a clear route and a firm strategic goal.

Through asset tokenization, BlackRock can democratize institutional market assets and enable retail investors to directly participate in the market that was originally monopolized by institutions. “Tokenization is democratization”This statement is essentially an important strategy for BlackRock to attract retail investors. At the same time, through the launch of the digital identity system and stable currencyUSDB, BlackRock's ambition to completely change the global investment landscape has been demonstrated.

Four. RWAWithAIThe revolution

Real-world asset tokenization (RWA

Web3.0

Web2.5

Web3.0

Web2.5

1. Reconstruction of production relations: The essence of RWA is the digital asset redistribution of production relations, and with the help of AI technology, the issuance, pricing and trading of real-world assets can be fully automated. For example, through DePIN and AI technologies, a distributed underlying asset pool can be formed, and smart contracts can generate instant risk ratings, replacing traditional manual due diligence and greatly improving efficiency.

2、Decentralized Infrastructure:DepinThe network connects the world's green electricity and computing power, and connects all people, equipment and physical assetsAI Agent

Its processing power far exceeds that of the traditional SWIFT system, enabling instant settlement of high-frequency transactions. 3、Closed-loop liquidity ecology: ThroughAIintelligent agents to achieve full-process integration of asset tokenization, in decentralized exchanges (

DEX) and centralized exchanges (CEX) to achieve 24-hour asset liquidity and directly reach retail users. Traditional financial institutions with a keen eye on innovation, represented by BlackRock, are like a awakened powerful family in the RWA game of power. Relying on their deep accumulation and huge assets and resources, they intend to incorporate RWA technology into their own ecosystem. The future competition will revolve around digital identity standards, asset tokenization standards and on-chain data sovereignty.

RWA: The inevitable trend of the next generation of digital financial market system

BlackRock represents the rule makers in asset tokenization, and they are committed to consolidating the existing financial order through technological upgrades. But at the same time, there are also a large number of underlying technology innovators who are trying to completely reconstruct the financial infrastructure through disruptive technological innovation. In the RWA's game of power, there will be powerful family forces that turn their guns around, and there will also be grassroots rebels. The two are intertwined, driving the RWA to grow in a spiral.

In the future, the development of asset tokenization will present a dual-track competition pattern of “traditional financial institutions dominate the compliance ecosystem, and technological innovation companies control the underlying infrastructure

”. This financial revolution driven by technology and capital will determine the power structure of the global financial market in the next decade. Conclusion: Investment Democratization/Inclusiveness is just around the corner. Are you ready? BlackRock's asset tokenization strategy is providing you with a gateway to global investment opportunities. Don't miss the wave of this investment revolution. Take action to make your investment freer and more potential!

Hui Xin

Hui Xin

Hui Xin

Hui Xin Hui Xin

Hui Xin Brian

Brian Brian

Brian Hui Xin

Hui Xin Brian

Brian Hui Xin

Hui Xin Joy

Joy Joy

Joy Joy

Joy