Author: TAIKI MAEDA, HFA Research Translator: Shan Oppa, Golden Finance

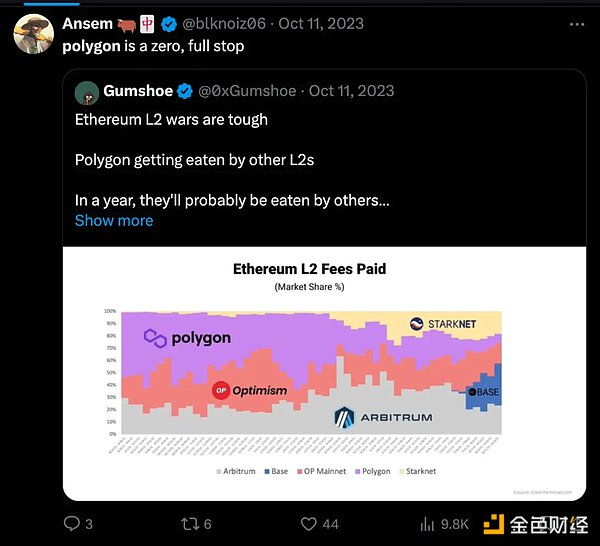

< p style="text-align: left;">If you regularly browse cryptocurrency Twitter, you will definitely see a lot of negative comments about Polygon and its token MATIC. They argue that Polygon spent tens of millions of dollars on ineffective BD collaborations, such as with DeGods/y00ts (a disappointment), Starbucks' Project Odyssey, and Nike's Swoosh project.

p>

These criticisms are not unreasonable, but whenever market sentiment becomes so negative, it is easy for market participants to overlook the positives that may serve as a "white swan" event for the native token MATIC catalyst. In this article, I will highlight 3 major catalysts that the market is ignoring and could lead to dramatic price re-ratings:

Polygon's new AggLayer: Compared with traditional Optimistic Rollup, AggLayer has significant improvements in scalability and security. If Polygon implements the technology, it could make its network truly competitive with Ethereum.

MATIC rebranded to POL & New token function: Upcoming rebranding and token function update possible Bringing new use cases and user groups to MATIC, further increasing its value.

POL airdrop narrative: The rumored POL airdrop may attract a large number of users to participate in the Polygon ecosystem and push up MATIC’s price.

Polygon's new AggLayer solves the ETH expansion Fragmentation problem

There are many problems with the ETH scaling roadmap, one of which is fragmented liquidity. As we've seen with projects like Blast, Manta, and Mode Network, it feels like there's a new Layer 2 project launching every two weeks. Since all of these Layer 2s use ETH as the settlement layer, the liquidity of each Layer 2 is decoupled from the other. This results in a poor user experience and makes us very bullish on Dymension, a RollApp settlement layer that leverages IBC to connect different execution layers as a key part of the modular stack.

If any social proof is needed, Bankless and Justin Drake recorded a two-hour podcast discussing issues in the Layer 2 ecosystem. Teams like Optimism are building Superchains with a similar vision to Dymension, but we think Polygon’s AggLayer will be faster to market.

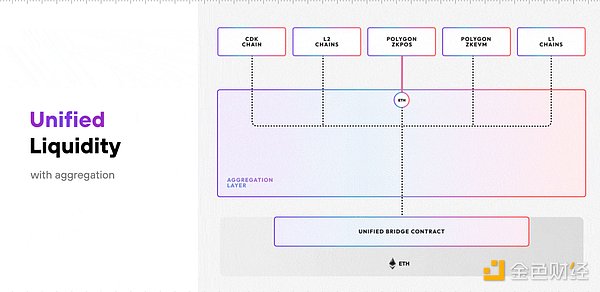

As shown above, Polygon aims to solve this problem by creating a new "aggregation layer". Currently, all zk-rollups must send proofs to ETH individually, making the bridging experience very cumbersome. However, with AggLayer, all Layer 2s can now send their proofs to AggLayer, which can "aggregate" these proofs into one and publish them all at once to a unified bridge contract.

Therefore, all Layer 2 can integrate AggLayer with other Layer 2 unified fluidity. This means that chains like Immutable X can share liquidity with the Manta Network. This unification will definitely bring more value accumulation to the application layer, because developers have more liquidity and can use this liquidity to create better products.

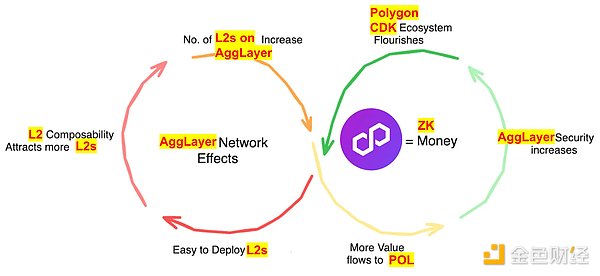

This type of solution does not currently exist on the market and we can expect the following flywheel effect:

Polygon CDK makes deploying zk-rollup simple

The composability of L2 attracts more Many L2s

Possible airdrops

AggLayer security increased (positive flow to $POL)

MATIC changed its name to POL

How is the value of tokens accumulated? What is the role of POL? MATIC can be exchanged for POL at a 1:1 ratio. Currently MATIC is used to protect the Polygon PoS chain, but once AggLayer is launched, POL can be used to protect AggLayer.

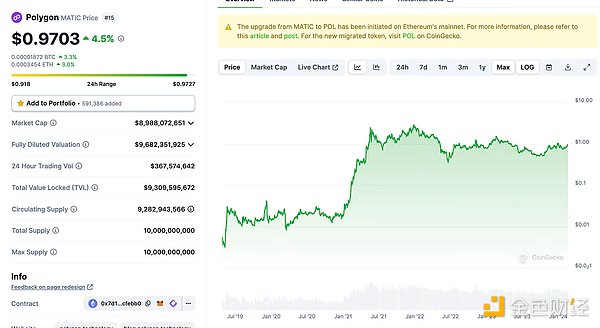

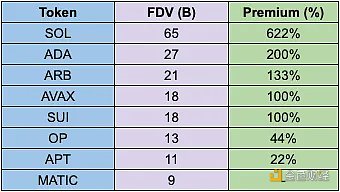

While the token doesn’t look cheap at a valuation of $9 billion, most of the lock-up period has ended, while other L2’s fully diluted market capitalization (FDV) transactions range from $10 billion to $20 billion Dollar. The following is an excerpt from the report written by thiccythot:

As more teams take advantage of AggLayer, demand for POL should rise due to economic security. MATIC may also benefit from the upcoming Dencun upgrade on March 13, which introduces EIP-4844. As AggLayer builds network effects, we should see more and more L2 launches on AggLayer, which presents another interesting bullish narrative.

POL airdrop narrative

In our articles, we like airdrop narratives. Our founder Taiki Maeda received a six-figure $DYM airdrop, and our analysts were also fortunate enough to receive a six-figure $JTO airdrop through active on-chain activity. As fear of regulation prevents teams from introducing direct revenue sharing, we see tokens introduce “indirect value accumulation” with airdrop narratives. Stake this token to receive that airdrop, stake this airdrop to receive more airdrops!

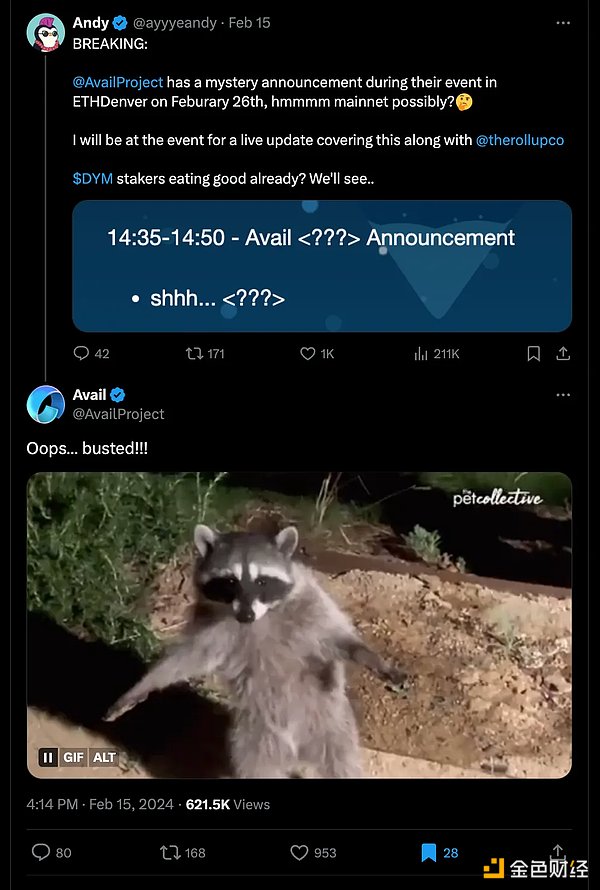

AVAIL previews an airdrop to $DYM holders. But we believe that the AVAIL airdrop is more likely to be issued to MATIC holders because Avail was separated from the Polygon brand and the co-founders of Polygon are responsible for the development of Avail. There are rumors that they will launch their mainnet on the 26th, just three days after Polygon’s AggLayer went live on the 23rd.

Is it possible to take a snapshot on the "aggregation day"? We wouldn't be surprised if Celestia's FDV is around $20 billion, and if AVAIL's FDV is over $10 billion as well. Indeed, this will be a great airdrop for holders of $DYM and $MATIC.

Trading

We believe staking MATIC has a disproportionate risk-reward ratio. Compared to other options, staking MATIC to validators can earn approximately 5% annual yield with an unlocking period of 3-4 days, making it a more attractive way to participate in the airdrop. Other options, such as staking TIA/DYM, have an unlocking period of 2-3 weeks and have higher inflation rates and VC lock-up periods.

Polygon's new AggLayer promises to solve the problem of fragmented liquidity in the L2 ecosystem. As more projects are built on AggLayer, we can expect POL stakers to receive more airdrop rewards in addition to inherent staking benefits.

Disadvantages of pledging MATIC:

Potential advantages of staking MATIC:

Bitcoinist

Bitcoinist

Bitcoinist

Bitcoinist Coinlive

Coinlive  Others

Others Tristan

Tristan Coinlive

Coinlive  Beincrypto

Beincrypto Coindesk

Coindesk Nulltx

Nulltx Cointelegraph

Cointelegraph Cointelegraph

Cointelegraph