The RWA market has been around for so long, but only the track of issuing coins based on the RWA concept is relatively lively (there is Crypto Fund), and then there are the Bitcoin spot ETFs and money market funds tokenized by Wall Street financial institutions. In the final analysis, the market of T-RWA and Hong Kong compliant RWA lacks RWA guiding funds to promote development.

RWAguiding funds are the key to guiding old money, standardization and retailization

For Bitcoin and other token markets, including various memecoins, DePIN, AI and other tracks, CryptoFund has played a vital role in promoting, whether in primary, secondary, quantitative and arbitrage. The special feature of cryptocurrency is that it itself is like a special hedge asset class. For example, the high volatility of Bitcoin can be controlled through asset management: there are short-term fluctuations, and the band can be quantitatively arbitraged; there is no fluctuation in the long term, only appreciation, which hedges against inflation and recession.

Corresponding to the driving value of CryptoFund in the cryptocurrency market, the introduction of old money and funds into the RWA tokenization platform through RWA-guided private investment funds or short-term liquidity funds is crucial to the success of tokenized alternative assets.

We can look at traditional RWA products, such as BlackRock's BUIDL money fund tokenization, which directly tokenizes its own money market fund; there are also similar lending Defi products such as MakerDAO, Ondo, Ethena Labs, etc., which allocate part of the stablecoin holdings and reserve funds of the original underlying assets to RWA assets that can generate income. These assets are often US bonds or ETFs, and some high-quality corporate bonds or equity are in the form of private equity funds.

This trend means that Web3.0 products have also begun to use Web2.5's RWA assets with professional management capabilities and relatively stable returns as underlying pledged interest-bearing assets, and then design their own financial Lego on this basis. This is a two-way phenomenon.

A mainstream brokerage, FalconX, accepts BlackRock's USD RWA Fund (BUIDL) as collateral for client transactions and swap positions. This is a value increase for FalconX, investment clients and RWA platform Securitize. More FalconX clients may choose to exchange stablecoins and cash for BUIDL to obtain on-chain returns, which will drive more capital and participants into the RWA ecosystem. BlackRock's BUIDL tokenized fund is an RWA guidance fund.

In addition to standardized financial assets (FA), most other real-world assets (RA) are alternative assets. These non-standard alternative assets require a guidance fund to turn them into standardized investment products, such as shares, yields, asset packages, trading rules, and income rules; and the guidance fund is also equivalent to a distributed open platform that can be rolled out and fixed-increase, etc.

In addition, switching between the institutional market and the retail market of RWA also requires a guiding fund. The RWA guiding fund is similar to a virtual institutional client or trading seat, which brings together and entrusts more retail investors, so that they can participate in a good RWA product investment with a better price, share and scale effect. The manager of the guiding fund can also add more investment research capabilities, risk resistance and professional depth for retail investors.

A compliant RWA product is a fund

Referring to the relevant regulations of the Hong Kong SFC on funds and tokenized securities funds, securities tokens, especially simple products, need to be filed in the form of a fund product, and then further underwritten, tokenized and listed. Fund products involve Hong Kong's LPF, OFC, No. 9 asset management license, VA qualification uplift, etc.

In terms of funds in Hong Kong, there are generally LPF and OFC. The former is simple and similar to the limited partnership of the Cayman Fund, and the latter is more complex and similar to a private equity fund company. Generally speaking, it is enough for LPF to issue simple funds, and OFC can issue slightly more complex fund products, such as umbrella structure funds, or closed-end fund products or open-end fund products. If it is a No. 9 licensed asset management company, it can be more open and complex, similar to a public fund company, and can also issue investment portfolios and asset management products. The first two require a licensed asset management company to be affiliated with investment management, the fund manager's net value is updated, and then the fund needs to have a custodian bank, SFC filing, etc.

Currently, compliant RWA products are generally simple bonds or stocks, and bonds are a fixed income or floating fund. Complex products are similar to trust investment funds, ABS funds or fund bonds. First, the fund structure is designed, and then the No. 9 asset management company manages the issuance, SFC filing and communication, the brokerage channel connects the capital side and the underwriting channel, and then the fund is tokenized, and the licensed exchange and SFC continue to communicate about listing. After listing, underwriting and subscription transactions, PI customer investment, secondary market liquidity, and post-investment management of fund exit and redemption, etc.

Tokenized fund products are different from traditional funds in terms of asset target penetration, source of funds and market structure. For example, the underlying assets can be disclosed, and the information disclosure and net asset value data panel can be presented reliably through the form of specific products on the chain.

Guidance Fund is a Large Pool of Funds

The importance of a guidance fund to the capital side is also very critical. As a bridge between the real world and the crypto world, RWA requires a lot of capital and funds to promote development and improve liquidity. Corresponding to the Bitcoin spot ETF, Wall Street has introduced tens of billions of dollars of funds, which has led to a wave of bullish Bitcoin prices. The core of the current compliant RWA market is also the capital side. What is the demand for the capital side of the RWA market around the tokenization of real-world assets? What are the sources and classifications of its LPs? It needs to be well positioned and analyzed.

Global family offices, including Chinese family office funds overseas, have begun to allocate Bitcoin investments. Some of these funds invested in traditional physical assets have also begun to accept RWA products that invest in physical asset tokenization.

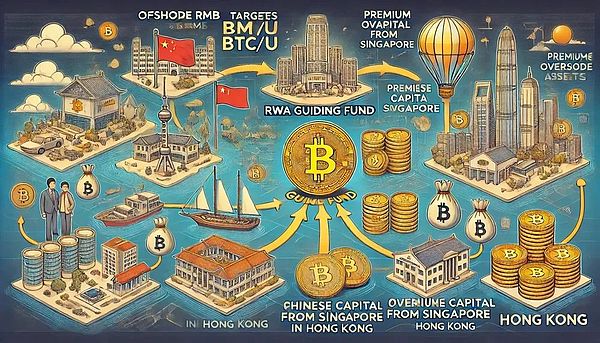

On this basis, it is completely feasible to attract offshore RMB and cryptocurrency funds in the Middle East, and Chinese family offices/family funds in Singapore and other places, which are large enough, to Hong Kong with RWA guidance funds. This is a good opportunity to promote the RWA market: part of the funds need to be traded and invested and then settled back to the mainland, and part of the funds are invested and traded in Hong Kong and hold overseas high-quality assets (Bitcoin mines or high-quality real estate, etc.), or hold high-quality assets or operating cash flow assets in the mainland. These are what an RWA guidance fund can do.

When the guidance fund introduces the capital side, it increases the liquidity of RWA products. At the same time, with the guidance of a sufficient scale of guidance funds, more main underwriters, angel early private equity, underwriting channels, arbitrage funds, PR traffic, etc. will participate.

For these Middle Eastern funds, family office funds, offshore RMB, etc., an RWA guidance fund is equivalent to a large capital pool that can continuously roll over investment, trading and holding RWA assets.

RWAFund is a potential ATS exchange

Hong Kong compliant RWA needs to be listed on a licensed exchange. Compliance communication and listing and the development of the secondary market are relatively complex and take a long time. If the RWA tokenization is designed in a non-securities model, it can be listed on an offshore exchange, but it lacks the advantages of compliance and access.

If designed properly, an RWA pilot fund can be a potential ATS exchange. It can be registered as a compliant RWA product and open a limited secondary market such as PI customer investment on a tokenized exchange. The subsequent liquidity, block trading, OTC and peer-to-peer trading can all be solved in an "ATS liquidity pool" infrastructure service corresponding to the fund.

At the same time, the RWA Guidance Fund is also a hedge arbitrage fund, which can achieve staggered arbitrage and Maker of RWA products through the investment bank's fundraising, investment, management and withdrawal models, thereby promoting the liquidity of RWA tokens. Because behind a guidance fund, there is often an investment bank company hidden, it needs to obtain higher overall returns through capital operations of the entire industrial chain, and at the same time it will have a good incubation and promotion of various links in the RWA field.

RWAFund is an RWA innovation incubation studio

Finally, the RWA Guidance Fund is actually an RWA innovation incubation studio and project training camp. Because the Guidance Foundation often has a good cooperative relationship with the head licensed financial institutions or licensed exchanges, it can discover and incubate good RWA assets and projects through incubation studios and training camps, promote RWA product construction and early share investment, and in order to discover and promote projects, the Guidance Fund will also organize various guiding RWA exchanges and seminars.

The most important thing is that the guiding foundation will deeply cooperate with the leading enterprises in different tracks to promote the RWA upgrade of the entire industry chain; or deeply cooperate with companies with deep resources and assets in the field suitable for RWA tokenization to innovate RWA protocols or platform products.

JinseFinance

JinseFinance

JinseFinance

JinseFinance Edmund

Edmund Kikyo

Kikyo Huang Bo

Huang Bo JinseFinance

JinseFinance Bitcoinist

Bitcoinist Coindesk

Coindesk Cointelegraph

Cointelegraph Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist