Author: Lugui Tillier, CoinTelegraph; Compiler: Baishui, Golden Finance

A major topic in the crypto space in 2024 is the number of second-layer (L2) blockchains created on the Ethereum network. The sudden surge in L2s, the main non-fungible tokens (NFTs), is seen as a joke by many, who believe it is just hype. Despite this, we are likely to have thousands of L2s next year. This will be a great help to the success of Ethereum.

Background: The Ethereum network is a first-layer blockchain (L1). Ethereum prioritizes decentralization and security, but lacks scalability - a problem known as the blockchain trilemma, that only two of these three things can be achieved.

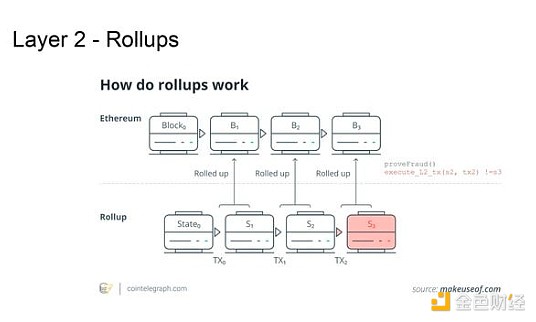

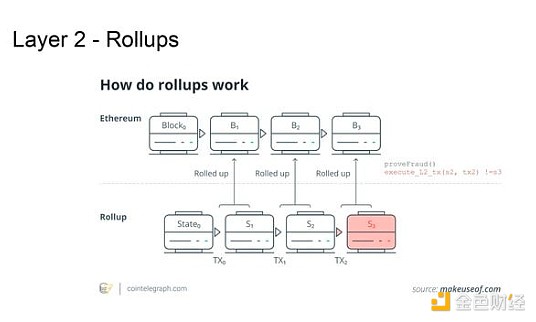

As a result, The Ethereum network eventually became less scalable and extremely expensive to execute on. To solve this problem, L2 (also known as Rollup) was created. They process transactions outside the Ethereum network in a cheaper way by combining transactions into batches and sending these batches to the Ethereum network.

How Layer 2 Rollup works. Source: Makeuseof.com

However, this model has two major pain points. The first is the fragmentation of the Ethereum ecosystem. Market liquidity is fragmented between L2s, which creates a poor user experience. Users need to constantly switch wallets between networks and "bridge" their assets. In addition, bridges and "wrapped" assets on different networks have been a major target for hackers in recent years.

The second pain point is that transaction costs on these L2s are unstable and unpredictable, which is terrible for the development of various applications. One day you might only spend a penny to perform an operation, and the next day that number might be 10x or 100x higher because some meme coin is popular and takes up all the block space.

The result is an ecosystem with fragmented liquidity, fragmented users, poor user experience, vulnerability to attacks, and an environment that is still not suitable for developing applications in a financially sustainable way.

Thousands of L2s to Solve the Problem

Despite seeming complexity, it is very quick and relatively cheap to launch and maintain an L2 today. Rollup-as-a-Service (RaaS) companies are in the business and can already launch and maintain a Rollup in up to six minutes for less than $1,000 per month, as is the case with RaaS Gateway.Fm.

These rollups are built using the Chain Development Kit (CDK) of a larger L2, such as Polygon.

Application chains are L2s created and customized to support one application, providing a controlled environment that is less expensive and more predictable than building on a public L2.

Industry chains are blockchains (usually permissioned) created and customized to serve a specific industry, such as gaming or real-world assets (RWAs).

These environments are inherently more suitable for economically sustainable on-chain development. But they have an added benefit: their customization for specific use cases allows for greater efficiency than public L2s built for general purpose.

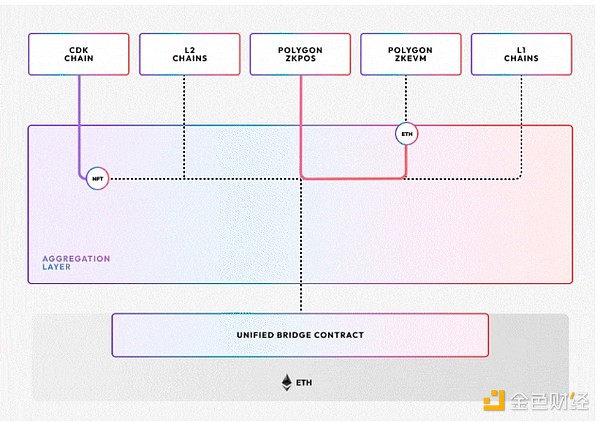

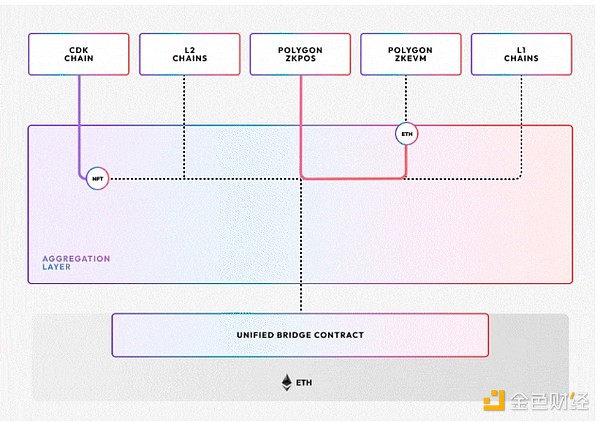

Of course, these new chains do lead to greater fragmentation. That problem is being partially addressed by the same L2s that provide CDKs to the rest of the market. Polygon, Optimism, and ZkSync are building liquidity aggregation layers that will make thousands of application and industry chains look like one.

One project that stands out in this space is AggLayer, the liquidity aggregation layer created by Polygon. It is at the forefront of developing an aggregation layer that uses zero-knowledge (ZK) proof technology. (ZK is key not only to enabling instant interoperability between chains connected to AggLayer, but also to reducing the costs of these chains in the future.)

Big companies including OKX, Ronin, ImmutableX, Telegram Open Network (TON), and Fox Corporation have or are connecting L2s to AggLayer.

Visualization of the AggLayer protocol. Source: Polygon Labs

Even Ronin (one of the world’s largest gaming blockchains) announced in June that it was considering the possibility of transitioning from L1 to L2 connected to AggLayer. This would add tremendous value to the Ethereum ecosystem and Ronin itself, as it could devote less energy to infrastructure and spend more time acquiring new games and ensuring their success.

It’s clear that thousands of application chains and industry chains are coming, and they are essential for financially sustainable on-chain development. The ZK aggregation layer will solve much of the fragmentation issues we have today. For other L1s, migrating to the Ethereum ecosystem to take advantage of increasingly unified liquidity is an enticing dynamic - enabling them to focus less on infrastructure and more on acquiring and retaining killer apps on their chain.

JinseFinance

JinseFinance