Author: Ignas Translator: Shan Ouba, Golden Finance

It’s surprising how little impact crypto has on the world outside of crypto. If you don’t actively engage with crypto, you can almost never interact with it in your daily life.

The problem is that those “minimal interactions” with crypto are often negative.You’re watching Squidward on Netflix, and a crypto influencer who’s deceiving his fans shows up. He can’t spend a minute without checking crypto prices and keeps asking for his phone back. Honestly, I understand that.

Look at the news again and you’ll often see headlines like these (almost always negative):

• North Korea steals $1.5 billion in world’s largest hack

• ‘Absolutely ridiculous’: Trump’s meme coin sparks crypto fury

• Man charged with fraud, woman loses £154,000 in Bitcoin scam

• Crypto trader livestreams suicide

Scam, fraud, pump-and-dump… you name it, cryptocurrencies have a reputation. To be fair, even those of us who work in crypto know that the industry is rife with abuse.

But we also know why we’re here: to get rich while disrupting an outdated financial system. Yes, we’re often criticized for getting rich quick, but it’s a fact. After all, anyone who invests wants to make money.

However, crypto is one of the few industries that still allows people to build wealth from scratch. In today’s economy, slowly building wealth on an average salary is almost impossible. Gen Z knows this and is quietly exiting the traditional job market.

It’s just that they don’t understand how crypto can change their lives…

I think the crypto industry has done a terrible job of communicating its mission, the necessity of crypto, and that “making money from crypto is not evil”. Here’s a highly-rated Financial Times comment that accurately summarizes the crypto-skeptics’ view:

When Bitcoin crashes, protests will break out in the streets because of the lack of regulation. “Investors” will demand their money back, and their lawyers will cite lies spread by entities that profited from their participation. It’s a pyramid scheme where participants get paid in fiat only if others put in fiat.

Bitcoin has no intrinsic value, and the computer power used to check the ledger is burdening the world’s electricity production and carbon emissions. Bitcoin is being used to launder criminal proceeds.

There is nothing redeeming about Bitcoin.

If you’ve ever scrolled through Reddit, you’ll know how much the average person dislikes cryptocurrencies. But I really wish the mainstream media would portray cryptocurrencies in a more positive light.

To be fair, the Financial Times has always been skeptical of cryptocurrencies, but Bloomberg’s coverage in recent years has changed and provided a lot of insight.

Interestingly, Bloomberg recently published a seemingly innocuous article, Meet the Seven Top Personal Finance Influencers in the United States, and one of them is a cryptocurrency influencer.

However, his main content is hyping up Meme Coins and promoting his own Meme Coin Telegram group in the article. Although I’m glad that Bloomberg is willing to include cryptocurrencies in the discussion, I didn’t expect them to pick this person to represent the crypto industry!

Yes, people really hate crypto

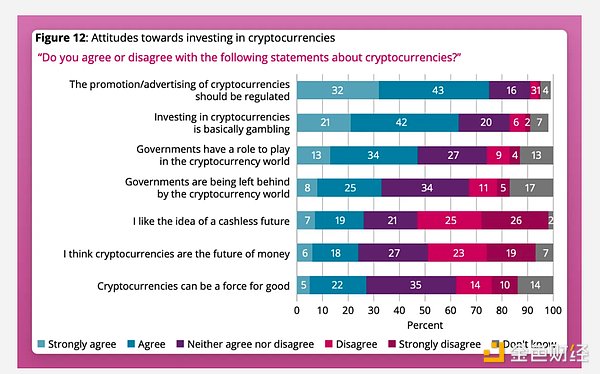

Since this is still a "research" blog, let's look at some research data on public sentiment towards cryptocurrencies. Multiple surveys have shown that non-investors are more likely to view cryptocurrencies as high-risk speculation rather than real financial instruments. In the UK, 64% of consumers who are aware of cryptocurrencies believe that "investing in cryptocurrencies is basically gambling".

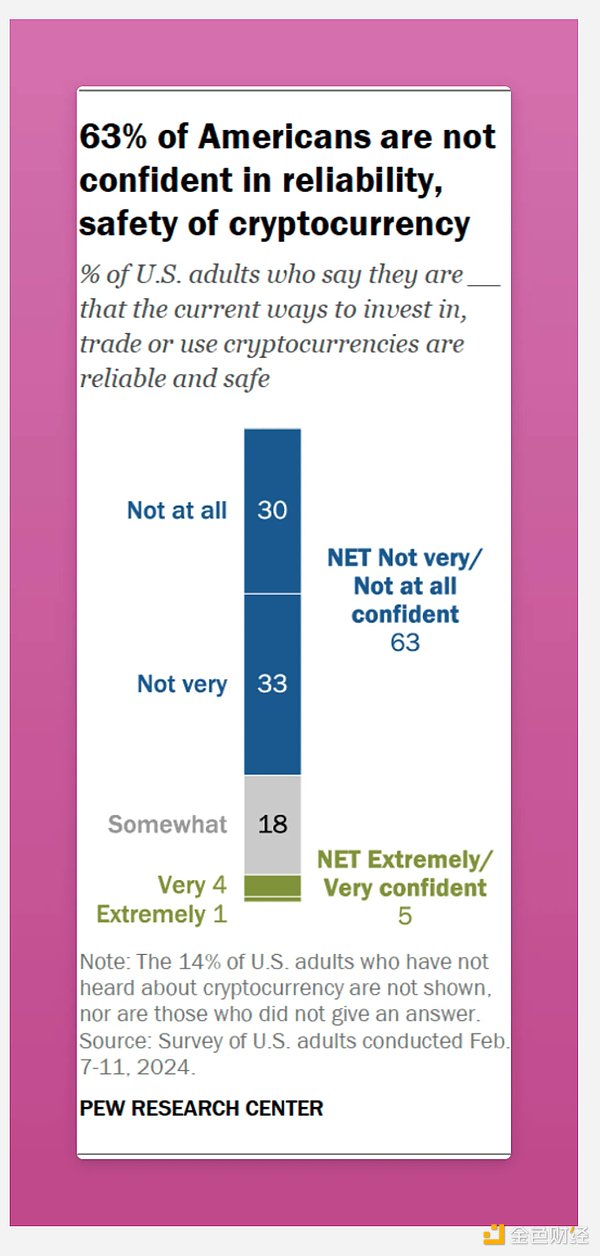

A 2024 Pew Research Center (Pew) survey showed that 75% of Americans do not trust the reliability and security of cryptocurrencies due to scams and market volatility.

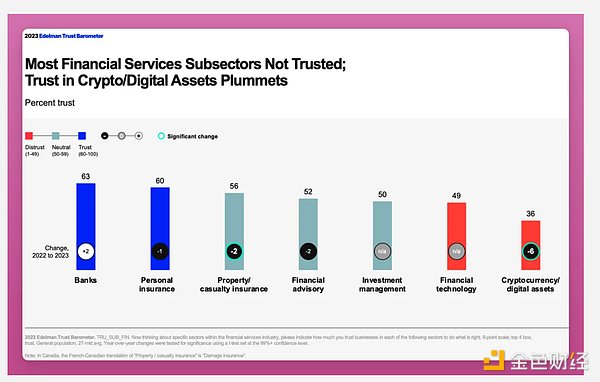

A 2023 Edelman global survey found that cryptocurrency has low trust among all respondents, even less trusted than the banks it is supposed to disrupt.

Of course, the FTX crash dealt a heavy blow to the reputation of cryptocurrencies in 2023, but the Meme coin craze in 2024 obviously didn't help us either.

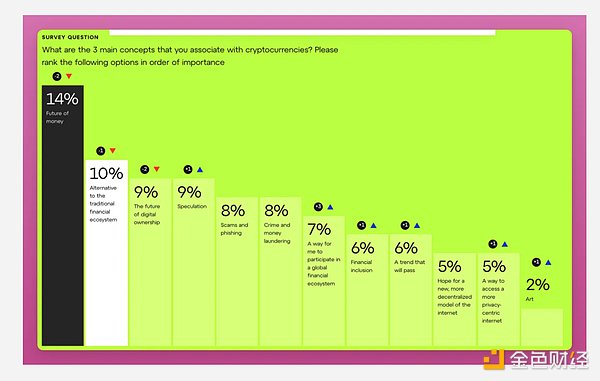

Consensys publishes high-quality industry research reports every year, and the 2024 report shows that the narrative of "cryptocurrency = future currency" is declining. At the same time, the popularity of negative labels such as "speculation, fraud and phishing, crime and money laundering" has been equal to that of "cryptocurrency is a substitute for traditional finance."

The conclusion is clear: outside the crypto community, most people still do not believe that digital assets can be a safe financial tool.

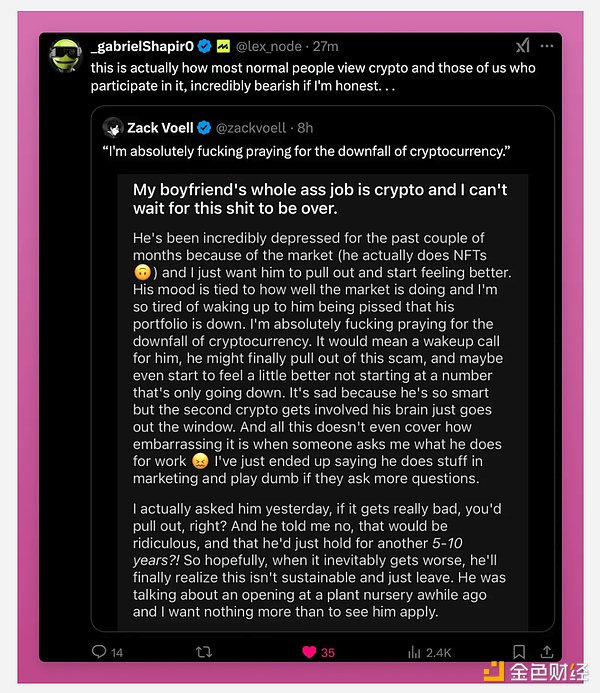

While writing this post, I came across a tweet that accurately sums up the public’s attitude towards cryptocurrencies:

Why Crypto Culture Matters

We may think that public image is unimportant because ordinary people “just don’t get it.” They’re afraid of being rescued from their 9-to-5 workplace prison and being influenced by the negative publicity about cryptocurrencies in the mainstream media.

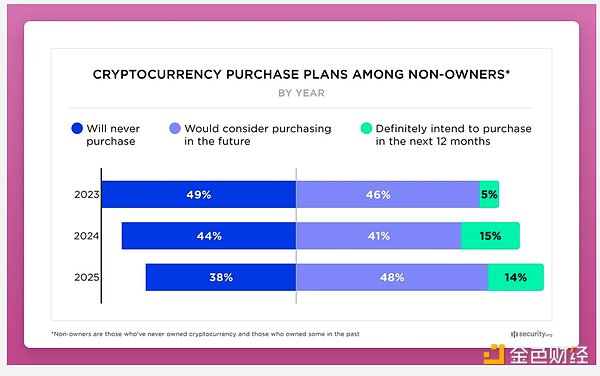

But the fact is that public perception is indeed changing - now, more people are willing to buy cryptocurrencies than ever before. If this trend continues, it can bring millions of new members to the crypto community.

I believe that we can and should do better. We need to convince people of the vision and mission of cryptocurrency.

The vision of cryptocurrency is to build a decentralized financial system that gives individuals full control over their assets without having to rely on intermediaries such as banks or governments. Its goal is to create a borderless, uncensorable, low-trust ecosystem where anyone can freely trade, store value, and build economic systems without relying on centralized power.

However, our vision is being obscured by the noise of meme coins and speculative frenzy.

To make matters worse, the public no longer sees cryptocurrency as a revolutionary tool for improving the financial system.

As one post put it:

“The Bitcoin ecosystem has become what you once hated.” Wealth and power are concentrated in the hands of a few who use cryptocurrency to extract wealth from the economically desperate.

In addition, due to Trump's public support, many people now associate cryptocurrency with the MAGA (Make America Great Again) movement, which is not popular outside the circle. No wonder the EU sees Trump's support for cryptocurrency as a threat to Europe's monetary sovereignty.

Don’t get me wrong, the previous US administration’s policy of slowing down regulation was good news for cryptocurrencies. However, the entire industry is now walking a delicate tightrope under the Trump administration.

How to change the perception of cryptocurrencies to make them more open and fair

Cryptocurrency’s reputation will not repair itself. If we want mainstream adoption, we need to reshape the narrative. It’s easier said than done, but it must start from within: even crypto natives have lost hope in cryptocurrencies.

I think we need to focus on three key points first:

1. Make Crypto Great Again

In previous cycles, newcomers to crypto could make money. However, the vicious exploitation of memecoins by small groups and the issuance of low circulation and high fully diluted valuations (FDV) backed by venture capital left new entrants with no room for upside.

We managed to resist the low circulation and high FDV of this cycle, but fell into the trap of the memecoin small group.

Legion and Echo are making progress by adopting fairer funding models, but they are still too exclusive. We need to create and promote games that create value rather than destroy value, so that early entrants can benefit together.

Kyle follows up the “first principles” with a more detailed plan on how to emerge stronger from this market chaos.

But due to extreme short-termism, a culture of maximum extraction, and people of low integrity, we have degenerated into this ouroboros state of perpetual financial nihilism that is almost collectively self-inflicted when everyone thinks it’s a good idea to keep throwing money at random scam coins because “I’ll get out before he scams me.”

We need to self-regulate the bad actors. The industry must do more to expose scams and hold influencers accountable for misleading campaigns. ZachXBT used to do this, but the level of crime got so out of control that even he ended up dumping a memecoin sent to him.

I need to do better on this and distance myself from value-extracting activities. People need to actually make money while growing the crypto pie. Right now, newcomers end up financially bankrupt. Or worse.

2. Shift the narrative from speculation to utility

Crypto is more than just gambling — it provides real-world benefits.

We need to focus on use cases like remittances, financial inclusion, and transparent governance, not memecoin culture.

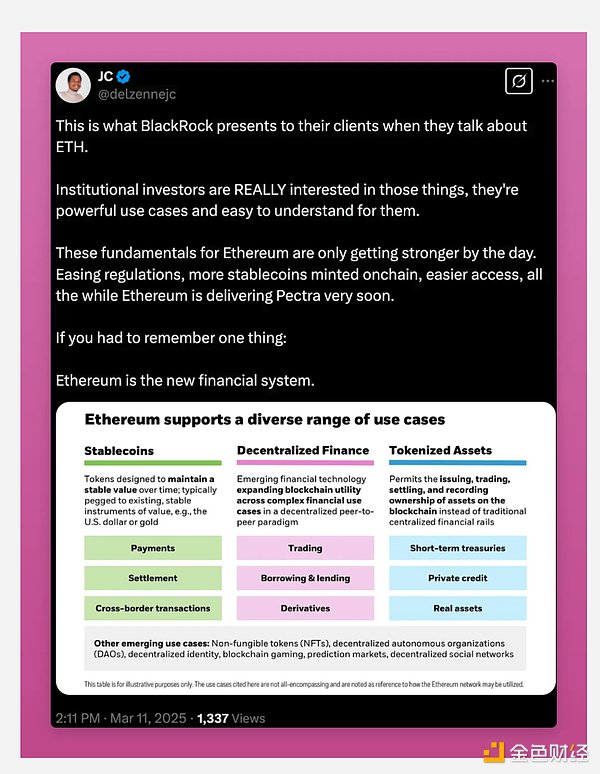

DeFi is expanding, and new social networks are emerging with innovative monetization models like Lens, Abstract, and Farcaster. Additionally, the growing popularity of stablecoins and RWAs (real world assets) helps preserve and increase value, not destroy it.

KOLs on CryptoX may not care, but CryptoX represents only a small part of the broader crypto culture.

I’m glad Bitcoin is doing well as “digital gold”, but Ethereum and Solana are seen as speculative chains, not foundational platforms for an open digital economy.

If we promote memecoins as crypto culture, I bet Pudgy Penguins will be the most powerful Web3 export to Web2, not Web2 memecoin input to Web3 (Doge, Pepe, etc.).

3. Reshaping the Bitcoin and Ethereum Narrative

Cryptocurrency is not a single unified culture; instead, it encompasses multiple subcultures. The most notable of these are Bitcoin and Ethereum.

The perception that “Bitcoin has become everything it was destined to destroy” annoys me. Only those who keep their BTC in cold wallets can truly understand the peace of mind that comes from self-custody and being outside the system.

ETFs are good for our wallets, but they are a double-edged sword because ETF buyers will not experience the same sense of freedom that comes with self-custody.

I also hope Bitcoin can distance itself from the MAGA movement. Bitcoin is global and should be neutral.

That's why I like Ethereum. Many have criticized the Ethereum Foundation for failing to approach Team Trump, but in the long run this will prove to be a successful strategy.

In a world where privacy and democracy are being eroded, AI blurs the line between reality and illusion, and digital ownership is not guaranteed, Ethereum offers a safe haven.

Ethereum is unabashedly:

Credibly Neutral

Apolitical

Decentralized

Global

People outside of crypto don’t know anything about this, so it’s our job to spread the word and build products that truly demonstrate Ethereum’s values.

Optimistic Future

Today, the total market cap of cryptocurrencies just passed $2.7 trillion. But the question is, do we really deserve this valuation?

Since Vitalik published that article in 2017, the cryptocurrency industry has changed a lot, and not everything is just speculation and negative games.

As I mentioned in my previous post, 1.4 billion people in the world do not have access to bank services. Even in the United States, this proportion is as high as 4.5%. A study by the Federal Reserve found that high-income people mainly view cryptocurrencies as investment tools, while low-income people are more inclined to use them for payment transactions. 60% of crypto traders earn less than $50,000 per year, and 13% of them are unbanked. Venezuela ranks 40th in the 2023 Chainalysis Crypto Adoption Index. Stablecoins have become a lifeline in an environment of hyperinflation. Similarly, in Argentina, stablecoin purchases surged when the national currency plummeted, another sign of widespread cryptocurrency adoption. Cryptocurrency is valuable not only as a hedge against inflation, but also as a tool to resist oppressive regimes. Cryptocurrency was used to send aid to doctors and nurses in Venezuela during the pandemic, bypassing the corrupt government. Ukraine raised $225 million in crypto donations after the outbreak of the Russian-Ukrainian war.

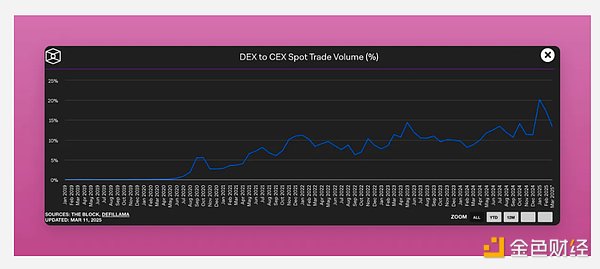

At the same time, the total locked value (TVL) of DeFi (decentralized finance) has reached 88 billion US dollars! Decentralized exchanges (DEX) are gradually challenging centralized exchanges (CEX); MakerDAO and other protocols are bringing real world assets (RWA) to the chain.

Decentralized social applications are also growing, with Farcaster and Polymarket having thousands of daily active users, and the number is still rising. Today, we finally have a batch of real dApps that are actually usable.

However, these real progress are completely drowned out by the discussion on X (Twitter), and we are doing a very poor job of promoting the real mission of cryptocurrency.

Despite this, I still believe that even though the market is falling at the moment, this market correction will help the crypto industry repair itself and continue to move forward. We must clean up the mess first and then focus on showing the positive value of cryptocurrency to the world.

Catherine

Catherine

Catherine

Catherine Jasper

Jasper Kikyo

Kikyo Jasper

Jasper Hui Xin

Hui Xin Brian

Brian Jasper

Jasper Catherine

Catherine Clement

Clement Joy

Joy