Author: John Stec, CoinDesk; Compiled by: Songxue, Golden Finance

2024 has become a year of change for digital assets (especially Bitcoin). With the U.S. Securities and Exchange Commission (SEC) approving a spot Bitcoin ETF last week, and Bitcoin’s next halving event scheduled to take place in April, we expect significant changes in both supply and demand. Understanding these shifts is critical to understanding the role digital assets are likely to play in the coming years as they help promote financial accessibility around the world.

On the demand side, the SEC’s approval of a spot Bitcoin ETF will open the door to a flood of new investors seeking to invest in the price of Bitcoin directly within their traditional investment accounts. They can now forego the complexities of trading on cryptocurrency exchanges and use a familiar investment vehicle –ETFs . This will give Bitcoin greater liquidity and greater price stability. Just as importantly, the SEC’s approval is a major milestone in Bitcoin’s growing legitimacy among established financial institutions.

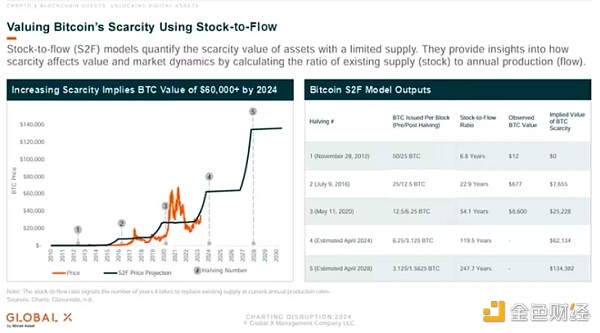

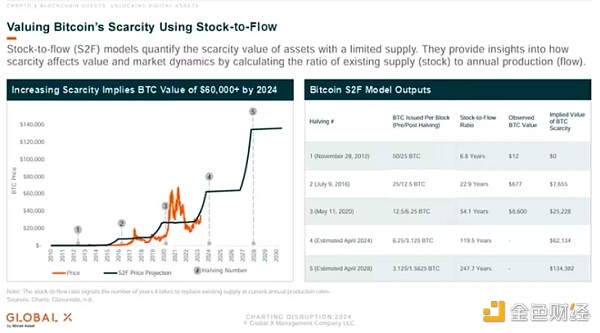

As for supply, Bitcoin’s scarcity increases approximately every four years with each halving event. Bitcoin halving refers to the process in which the rewards of Bitcoin miners are reduced by half and the issuance rate of new Bitcoins is reduced by 50%. The next halving is expected to take place in April 2024 and the block reward will be 3.125 compared to 6.25 today.

Historically, this has led to significant increases in Bitcoin prices in subsequent months and years (see chart). While the actual timing of this event is predictable, it will take time for the market to find a new price equilibrium. Looking at Bitcoin’s previous halvings, we see significant growth in the months and years following each halving.

bits The last halving of the coin occurred on May 11, 2020, when the block reward dropped from 12.5 BTC to 6.25 BTC. Since the event, Bitcoin has grown at a CAGR of 52%, with the fastest growth occurring in the first 9 to 12 months following the event. Previous halvings in 2020 produced a similar situation.

The combination of these factors makes a compelling investment case for Bitcoin and provides a potential entry point. Using a stock-to-flow model (which attempts to quantify the value of an asset with limited supply), we find that the implied value of each Bitcoin in April 2024 is approximately $62,000, which is approximately a 34% increase relative to current prices, as follows: 1 January 10th.

Digital assets (especially (is Bitcoin) the landscape will undergo major changes this year. The SEC’s approval of a spot Bitcoin ETF and the April halving event will reshape Bitcoin’s supply and demand dynamics.

Huang Bo

Huang Bo