Author: Yashu Gola, cointelegraph Translation: Shan Oppa, Golden Finance

Bitcoin prices are stuck in consolidation, and the market atmosphere is in a see-saw state. On the one hand, increased institutional investment has brought optimism, and on the other hand, concerns about potential sell-offs by miners have posed pressure.

Bitcoin (BTC) prices range-bound, reflecting market participants’ uncertainty and hesitancy following last week’s approval of a spot Bitcoin ETF Decide.

As of January 16, BTC prices have been hovering between $41,550 and $43,000. This stagnation has persisted, although it briefly topped $49,000 at the beginning of the month before falling back to the current range.

p>

The stability of Bitcoin price can be attributed to several factors discussed below.

Lukewarm reaction to Bitcoin ETF approval

Bitcoin breaks through $49,000 appears to be U.S. approval It emerged after listing 11 spot BTC ETFs, including BlackRock and Fidelity. However, prices have since fallen by about 10%, which is what some analysts expected.

This suggests that the market has largely priced in approvals. The lack of a significant rebound following the ETF's approval suggests investors have adjusted their expectations accordingly.

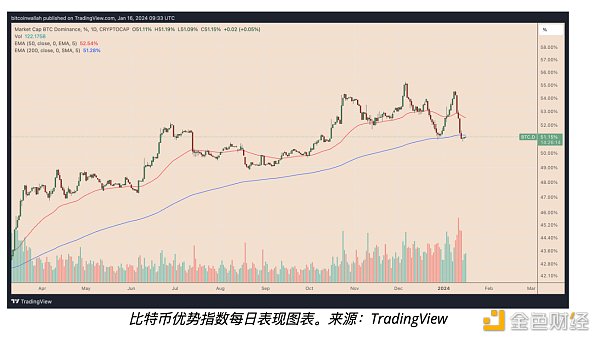

Bitcoin’s market dominance declines

Bitcoin’s market dominance index in a week It fell to 51.14% from the local high of 54.56%.

p>

Ethereum rises

The main reason for the decline in Bitcoin dominance is that ETH rose by 8.5%, and others Altcoins have seen similar gains. This suggests that traders may be moving funds away from Bitcoin and into the altcoin market following the ETF’s approval, believing the risk-reward ratio is higher elsewhere, especially with an Ethereum ETF on the way.

Fundamental outlook is mixed

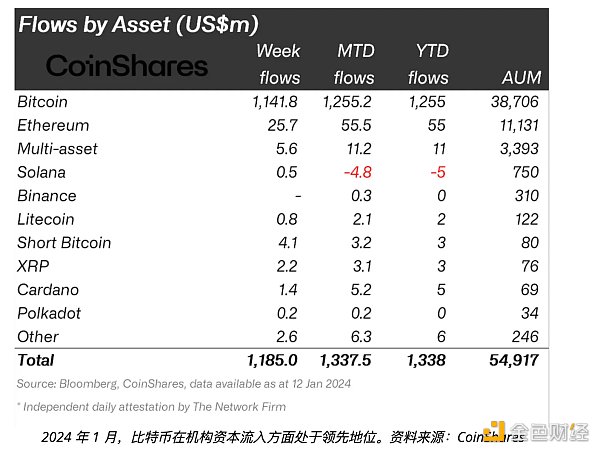

An important positive market indicator for Bitcoin is the inflow into Bitcoin Capital in cryptocurrency investment funds continues to increase, especially amid growing excitement about spot Bitcoin ETFs.

These Bitcoin funds attracted $1.25 billion from institutional investors in the first two weeks of 2024, almost 55% of what they did in all of the previous year. This influx highlights the strong confidence institutional players have in Bitcoin’s long-term value and potential.

p>

However, offsetting this bullish fundamental are miners.

There are growing concerns that increases in Bitcoin mining hash rates could cause miners to sell their Bitcoins faster. Some people predict that after the halving in April 2024, Bitcoin mining costs will rise significantly, which may put pressure on Bitcoin prices

Bitcoin miners have moved more than $1 billion worth of Bitcoin to cryptocurrency exchanges so far.

Koreans buy, Americans sell

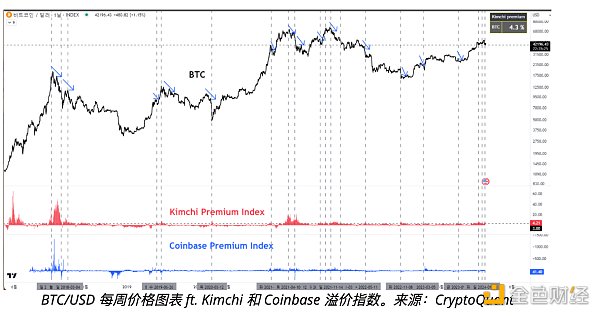

The current sideways trend of Bitcoin prices is in line with South Korea This coincides with a clear trend of increased buying to offset the US sell-off. The Kimchi Premium Index, a measure of the difference in Bitcoin prices between South Korea and global cryptocurrency exchanges, suggests Bitcoin trades at a premium of 3-4% in South Korea.

p>

Meanwhile, the Coinbase Premium Index, which compares the price of Bitcoin in USD on Coinbase Pro to the price of USDT on Binance, has turned negative, indicating There are more sellers than buyers in the United States.

Neutral Relative Strength Index

Bitcoin’s range from a technical perspective Price action is consistent with its daily relative strength index (RSI) returning to neutral territory.

When these two conditions are observed simultaneously, it usually indicates that market sentiment is reaching a balance and neither bulls (buyers) nor shorts (sellers) have control .

p>

Investors may wait for more information before making major moves, leading to lower volatility and less directional price moves.

JinseFinance

JinseFinance

JinseFinance

JinseFinance JinseFinance

JinseFinance Brian

Brian Kikyo

Kikyo Bitcoinworld

Bitcoinworld Darren

Darren Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Bitcoinist

Bitcoinist Cointelegraph

Cointelegraph